- Home

- »

- Medical Devices

- »

-

U.S. Patient Positioning Systems Market Size Report, 2030GVR Report cover

![U.S. Patient Positioning Systems Market Size, Share & Trends Report]()

U.S. Patient Positioning Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Tables, Accessories), By Application (Surgery, Diagnostics), By End-use (Hospitals, Ambulatory Surgical Centers), And Segment Forecasts

- Report ID: GVR-4-68039-646-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

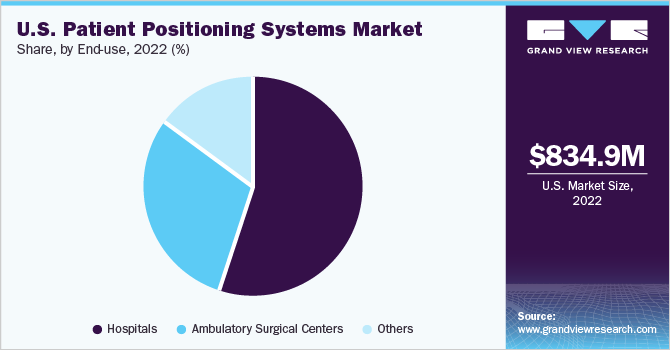

The U.S. patient positioning systems market size was valued at USD 834.9 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Growing need to maximize access and minimize risks in general surgery, advancements in technology, prevalence of chronic diseases, and number of surgeries are some of the key drivers of this market. Patient positioning players key role in performing effective and safe surgical procedures. Improper patient positioning can lead to numerous complications, such as risk of developing pressure sores, muscle stress, joint damage, longer recovery time, and post-procedure complications. This has led to arise in need for optimal patient positioning systems that keep the patient's body as naturally aligned as possible, offering maximum access to the surgical site.

The growing number of surgical and diagnostic/imaging procedures is expected to increase demand for better patient positioning systems in coming years. The COVID-19 pandemic had a significant impact on the U.S. patient positioning systems market. Delay in elective surgical procedures, capital projects, and installations, and hospital access restrictions negatively impacted demand and sales. For example, in its 2020 Annual report, Hill-rom reported decline in revenue across its global businesses and portfolio due to COVID-19 outbreak including its surgical solutions portfolio. However, the company reported that the decrease was partially offset during the first 6 months of fiscal 2020, by high demand for Hill-rom’s integrated operating tables. The demand is estimated to increase over time, especially for contactless patient positioning systems.

The number of surgeries performed in the U.S. is increasing, due to growing prevalence of chronic diseases and a rapidly aging population. According to the U.S. Census Bureau, of the 328 million U.S. population in 2019, an estimated 75 million were aged 60 years and older. The proportion of geriatric population is expected to increase over time. This implies that a significant number of populations will be vulnerable to chronic and acute conditions, leading to a growth in demand for surgical interventions. The increasing number of surgeries has prompted end users, such as hospitals, to buy more specialty tables and accessories to improve patient outcomes. The growing preference for minimally invasive procedures is another factor fueling the market for U.S. patient positioning systems.

Hospitals and ambulatory centers generally look to obtain both, general and specialty tables, due to newer features and capabilities such as higher weight limit of up to 1,000 pounds. Such features can prove useful during bariatric procedures for obese patients. These factors are expected to propel market growth. Development of innovative positioning equipment will further contribute to market growth. Integrated patient positioning and usage of artificial intelligence and robotics are key trends that are expected to be major impact creator in coming years. For instance, GE Healthcare established and commercialized the Auto Positioning function, using artificial intelligence technology and a 3D camera. Companies are investing in R&D efforts for development of novel technologies. These include hybrid surgical tables, powered and integrated patient positioning systems, and smart equipment.

In addition, market players are involved in competitive strategies such as merger and acquisitions collaborative agreements to gain competitive advantages. For instance, Stryker strengthened its portfolio and position in medical equipment markets through complementary business acquisitions. Its revenue is driven by sales from the U.S. market and is dominated by its medsurgical segment, followed by orthopedics and neurotechnology and spine. The company makes significant R&D investments; its R&D budget for 2020 was USD 984 million. It invests in developing a wider portfolio of products, including its Operon surgical tables and Sage Prevalon accessories.

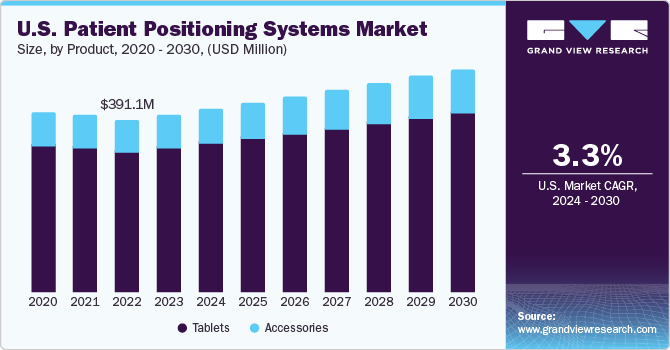

Product Insights

The tables dominated the market for U.S. patient positioning systems in 2022. Rising adoption of automated technology such as integrated robotic systems and the need to enable better control and precision during treatments and diagnostic procedures are the key drivers anticipated to contribute to the growth of the market for U.S. patient positioning systems. SchureMed, for instance, is a U.S.-based manufacturer of a range of procedure tables, including Endrest Major Procedure Table, Rectangle Minor and Major Procedure Table, and Hourglass Major Procedure Table. The company also provides supporting accessories in addition to its table lineup.

The accessories segment is anticipated to be the fastest-growing segment in the market for U.S. patient positioning systems over the forecast period. This growth is owing to increasing initiatives by market players. For instance, in July 2020, Hill-Rom launched a range of lithotomy positioning devices (Yellofins Apex) in the U.S. to expand its product portfolio. Yellofins Stirrups product line from the company is designed to provide elevated performance in the OR while offering greater ease of use. Besides, Getinge also offers a complete range of accessories for patient positioning. There are a variety of appropriate accessories for diverse needs and types of surgery, be it metal-free or infusion stands, and radiolucent multi-purpose plates.

Application Insights

The surgery application dominated the market for U.S. patient positioning systems and accounted for the largest revenue share of over 45.0% in 2022. Aging population in the U.S. coupled with prevalence of chronic diseases is increasing the number of surgeries performed in the country. The presence of key players and availability of insurance coverage are other factors expected to contribute to the high number of treatment procedures and surgeries, thereby contributing to market growth. Moreover, increasing use of the equipment post-surgery to provide comfort to the patient is driving the segment. It stimulates the healing process and reduces pain, which further drives the demand for the system post-surgeries.

The others segment consisting of radiotherapy treatments such as cancer therapies is expected to witness the highest CAGR of over 5.0% over the forecast period Technological advancements are estimated to propel the demand owing to increasing use of robotics and automated patient positioning systems to deliver therapies to cancer patients. As per the CDC, cancer is the second leading cause of death in the U.S. and accounts for 1 of every 4 deaths in the country. This key factor is estimated to contribute to the growth of the market for U.S. patient positioning systems.

End-use Insights

The hospitals segment dominated the market U.S. patient positioning systems and accounted for the largest revenue share of over 50.0% in 2022. The segment held the largest market share owing to greatest number of treatments and surgical and diagnostic procedures conducted within hospital settings. Increasing awareness pertinent to disease treatments and prevalence of chronic diseases, leading to rising number of diagnostic and surgical procedures being performed annually in the U.S., is propelling segment growth.

The ambulatory surgical centers segment is estimated to witness the highest CAGR of over 6.0% in the market U.S. patient positioning systems over the forecast period. According to Definitive Healthcare, there are over 9,000 active ambulatory surgery centers in the U.S. Rising number of ambulatory surgery centers, initiatives by market players, investments, and preference for outpatient surgeries is anticipated to increase the number of procedures performed in ambulatory surgery centers, thereby fueling segment growth.

Key Companies & Market Share Insights

The market is competitive in nature and market players are undertaking strategic initiatives to maintain market leadership or increase their market share. These include partnerships, mergers and acquisitions, R&D, and product launches. The Hip Positioning System by Hillrom, for example, can be customized for use in lateral and supine arthroscopic procedures by enabling adduction, flexion, abduction, and distraction of the patient’s leg. Hillrom also launched a precision surgical table, the PST 500, and lithotomy positioning devices to expand its product offerings in July 2020. Mizuho OSI on the other hand, offers a lineup of surgery tables specific to different specialties. Its Insite table, for example, is a radiolucent cantilevered surgery table intended for spinal and imaging procedures. Some of the prominent players in the U.S. patient positioning systems market include:

-

Medtronic

-

Stryker

-

Steris

-

Hill-Rom Services, Inc.

-

SchureMed

-

Skytron LLC

-

Smith & Nephew

-

Leoni AG

-

Schaerer Medical AG

-

Mizuho OSI

U.S. Patient Positioning Systems Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 878.3 million

Revenue forecast in 2030

USD 1,273.5 million

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country Scope

U.S.

Key companies profiled

Medtronic; Stryker; Steris; Hill-Rom Services, Inc.; SchureMed; Skytron LLC; Smith & Nephew; Leoni AG; Schaerer Medical AG; Mizuho OSI

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

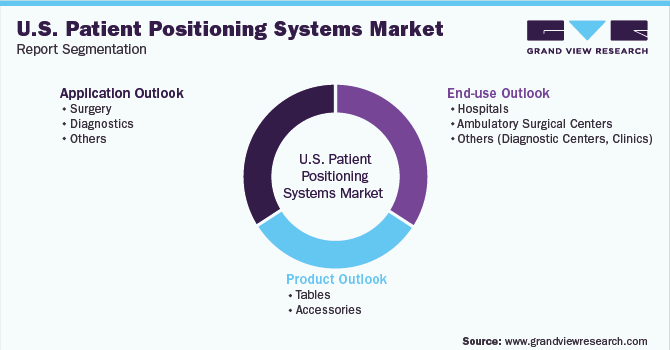

U.S. Patient Positioning Systems Market Report SegmentationThis report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. patient positioning systems market report on the basis of product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Tables

-

Surgical Tables

-

Examination Tables

-

Radiolucent Imaging Tables

-

-

Accessories

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Surgery

-

Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others (Diagnostic Centers, Clinics)

-

Frequently Asked Questions About This Report

b. The U.S. patient positioning systems market size was estimated at USD 834.9 million in 2022 and is expected to reach USD 878.3 million in 2023.

b. The U.S. patient positioning systems market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 1,273.5 million by 2030

b. The tables dominated the market for U.S. patient positioning systems in 2022. This is attributable to the rising adoption of automated technology such as integrated robotic systems and the need to enable better control & precision during treatments and diagnostic procedures.

b. Some key players operating in the U.S. patient positioning systems market include Medtronic, Stryker, Steris, Hill-Rom Services, Inc., SchureMed, Skytron LLC, Smith & Nephew, Leoni AG, Schaerer Medical AG, and Mizuho OSI.

b. Key factors that are driving the U.S. patient positioning systems market growth include the increasing number of diagnostic procedures, technological advancements such as automated powered systems, and a growing number of surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.