- Home

- »

- Clinical Diagnostics

- »

-

U.S. Pharmaceutical Sterility Testing Market Report, 2033GVR Report cover

![U.S. Pharmaceutical Sterility Testing Market Size, Share & Trends Report]()

U.S. Pharmaceutical Sterility Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Outsourcing, In-house), By Product, By Test (Sterility Testing, Bioburden Testing), By Sample (Pharmaceuticals, Medical Devices), By End-use, And Segment Forecasts

- Report ID: GVR-2-68038-403-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pharmaceutical Sterility Testing Market Summary

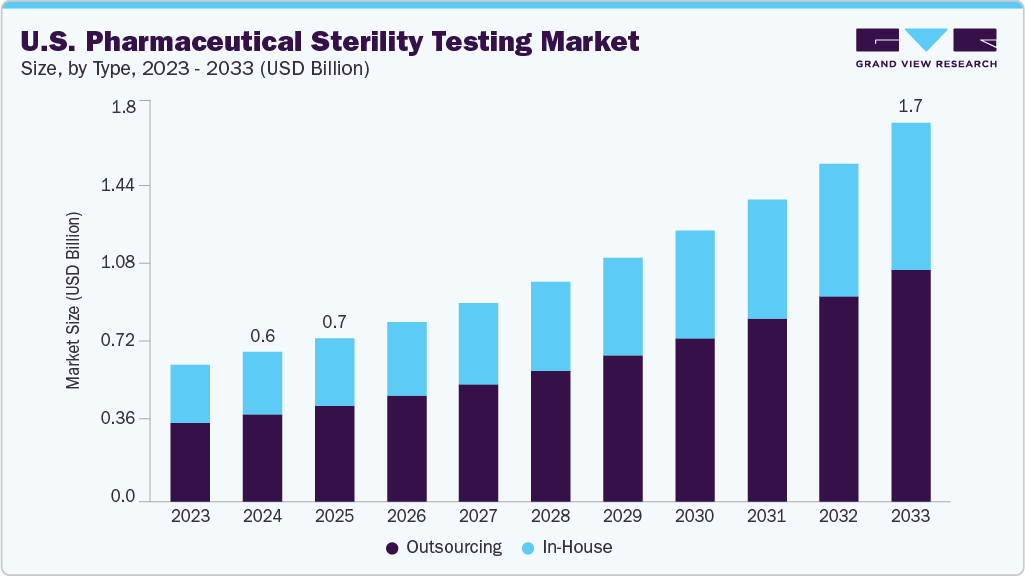

The U.S. pharmaceutical sterility testing market size was estimated at USD 0.67 billion in 2024 and is projected to reach USD 1.70 billion by 2033, growing at a CAGR of 11.04% from 2025 to 2033. The market is driven by increasing R&D activities, growing drug innovations, rising focus on quality & sterility, and rising government investments in healthcare.

Key Market Trends & Insights

- The U.S. pharmaceutical sterility testing industry is driven by rising demand for sterile injectables, biologics, and advanced therapies like cell and gene therapies.

- By type, the outsourcing segment led the market with the largest revenue share of 58.25% in 2024.

- By test, the bioburden testing segment led the market with the largest revenue share of 41.52% in 2024.

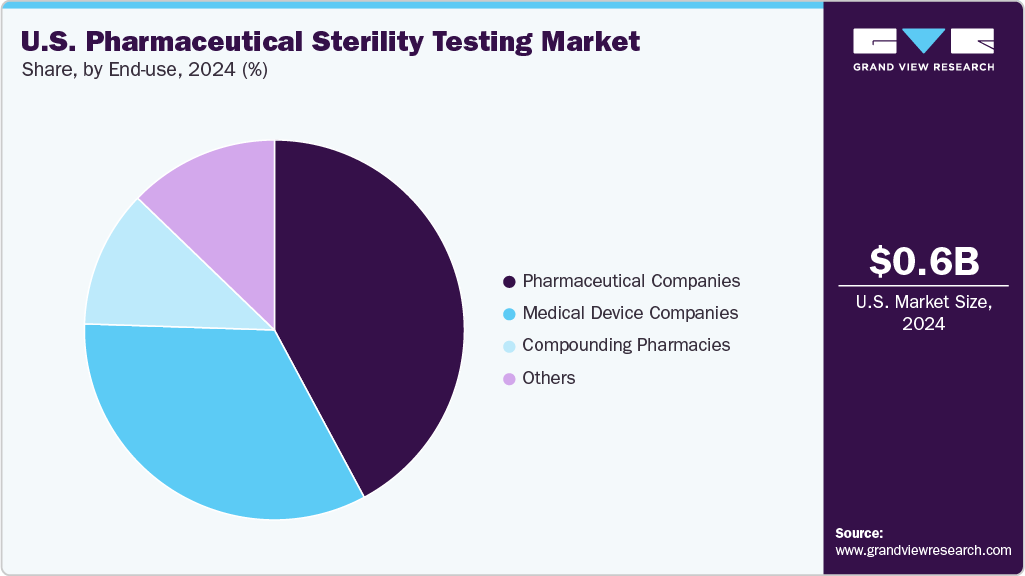

- By end-use, the medical device companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 0.67 Billion

- 2033 Projected Market Size: USD 1.70 Billion

- CAGR (2025-2033): 11.04%

Besides, rising demand for biologics, personalized medicines, and stringent regulatory requirements from the FDA and USP is expected to support the market growth. In addition, the adoption of rapid microbiological methods (such as PCR and ATP bioluminescence), increased automation to minimize errors, and the use of AI-driven analytics for improved data interpretation is contributing to growing trends toward outsourcing and managing costs effectively. Also, the market is shifting towards faster and more reliable testing solutions that ensure product safety and compliance, especially as the complexity of pharmaceutical manufacturing increases and there is an increased focus on patient safety.

Moreover, the rising number of drug launches globally continues to be a significant growth driver for the pharmaceutical sterility testing industry. According to the U.S. FDA, 50 new molecular entities (NMEs) and biologics were approved by Center for Drug Evaluation and Research (CDER) in 2024 alone, the trend is expected to accelerate in 2025 due to advancements in personalized medicine, gene therapies, and novel biologics. Each newly launched sterile drug, including injectables, vaccines, and advanced therapy medicinal products (ATMPs), requires stringent sterility testing to comply with rigorous regulatory frameworks such as those from the FDA, EMA, and WHO.

The growing complexity and diversity of sterile formulations, driven by innovations in drug delivery systems and biologics, further intensify sterility testing demands. As per the research study, the pipeline of sterile injectable drugs expanded by over 15% year-on-year in 2024, reflecting sustained R&D investment and market entry of novel therapies targeting unmet medical needs. This expansion requires enhanced sterility testing capacity, adoption of rapid microbiological methods, and tailored testing protocols to ensure safety and efficacy.

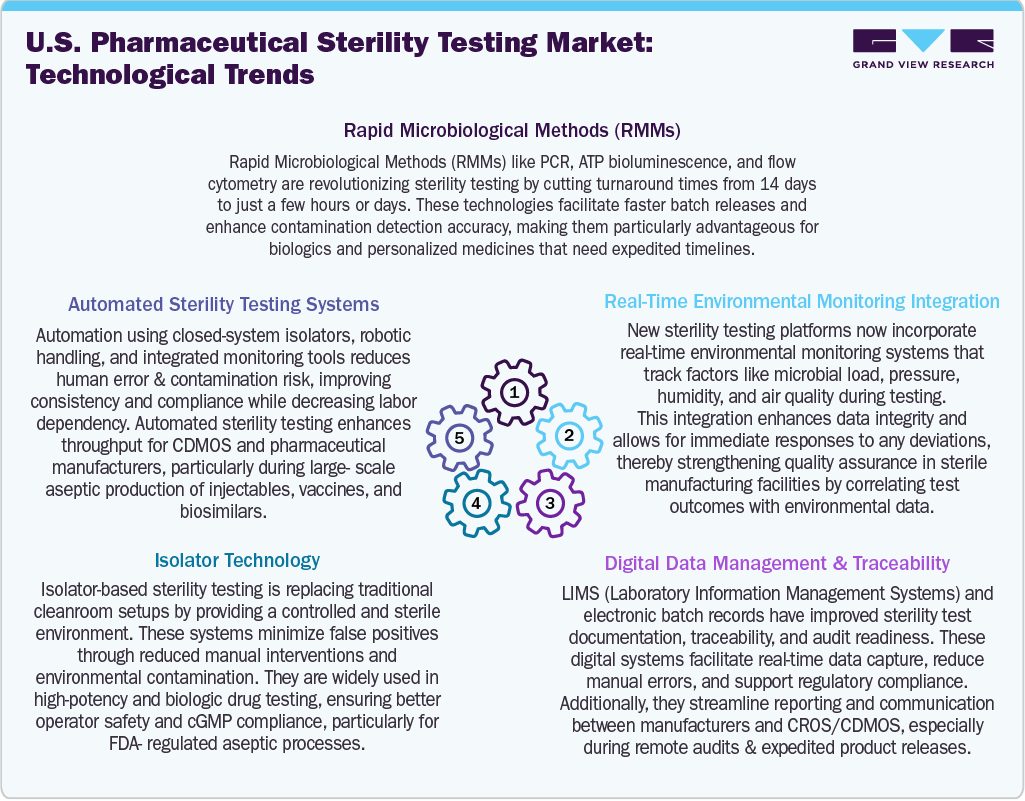

Furthermore, the U.S. pharmaceutical sterility testing sector is evolving rapidly due to the adoption of innovative technologies. Emerging rapid microbiological methods, such as ATP bioluminescence and PCR, are accelerating contamination detection and shortening product release times. The increased use of automation and robotics enhances testing accuracy while reducing manual errors. In addition, artificial intelligence aids in data analysis and provides predictive insights, improving decision-making processes. These advancements align with stricter FDA and USP requirements, ensuring enhanced safety standards for complex biologics and personalized therapies.

Opportunity Analysis

The U.S. pharmaceutical sterility testing industry is experiencing growth driven by a rising demand for sterile injectable medications, complex biologics, and advancements in cell and gene therapies. The market is also influenced by increasing regulatory scrutiny from the FDA, particularly regarding current Good Manufacturing Practices (cGMP), which require stringent sterility assurance throughout the pharmaceutical value chain. In addition, there is a growing trend of outsourcing among pharmaceutical and biopharmaceutical companies due to capacity challenges and the necessity for specialized testing facilities. This shift is enhancing the demand for contract sterility testing services.

Moreover, the expansion of aseptic manufacturing facilities, in conjunction with the increasing number of approvals for prefilled syringes and parenteral drugs, contributes to the consistent market demand. In addition, advanced rapid microbiological methods (RMMs) and automation are coming to the fore, enabling quicker testing cycles, and reducing the risk of contamination. The potential for sterility testing is further enhanced by the rise in personalized therapies and small batch production, particularly in oncology and rare disease treatments. Thus, the market is expected to witness emerging new opportunities for comprehensive sterility solutions.

Impact of U.S. Tariffs on the U.S. Small Molecule Drug Discovery Outsourcing Market

U.S. tariffs on imported pharmaceutical ingredients, equipment, and testing supplies are increasingly impacting sterility testing operations. Many laboratories depend on imported items such as culture media, sterilizers, isolators, and rapid microbiological testing kits, which have become more expensive due to tariffs imposed on countries such as China and those in the EU. As a result, both in-house pharmaceutical labs and contract testing organizations (CTOs) are facing higher operating costs. Some facilities have postponed equipment upgrades or are experiencing extended lead times stemming from supply chain disruptions. In addition, tariffs on imported active pharmaceutical ingredients (APIs) and drug products have prompted many U.S.-based companies to move manufacturing and testing back to domestic locations, thereby increasing demand for local sterility testing services.

In addition, this shift has created new business opportunities for U.S.-based testing laboratories, particularly for those capable of testing sterile injectables, biologics, and complex formulations. However, smaller labs with tighter budgets are more significantly affected by these rising input costs. Overall, while tariffs have contributed to cost and supply challenges, they have also paved the way for greater investment in U.S.-based sterilization testing capabilities and collaborations with domestic Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs) that include sterility testing in their quality control processes.

Technological Advancements

Technological advancements are increasingly changing the landscape of pharmaceutical sterility testing in the U.S., driving improvements in speed, precision, and compliance with regulations. Besides, the integration of Artificial Intelligence (AI) and Machine Learning (ML) allows for sophisticated analysis of sterility test data, helping predict contamination risks and aiding decision-making through trend analysis. In addition, the rapid Microbiological Methods (RMMs), such as PCR and ATP bioluminescence, are now often preferred over traditional culture-based methods, significantly reducing testing times from 14 days to just a few hours.

Moreover, automated sterility testing systems equipped with robotic arms and closed-loop isolators minimize the need for manual intervention, which enhances consistency and lowers the risks of contamination. Isolator technology has become standard practice for handling high-potency or sensitive biologics, providing a controlled, sterile environment that improves operator safety. In addition, real-time environmental monitoring systems track essential variables such as particulate matter, humidity, and air pressure, which allows for immediate alerts and corrective actions when necessary. Moreover, digital data management tools such as Laboratory Information Management Systems (LIMS) and electronic batch records play a crucial role in ensuring traceability, regulatory readiness, and seamless data sharing. Thus, these innovations are expected to boost the testing throughput, quality, and reliability, positioning the pharmaceutical and biopharmaceutical market growth.

Pricing Model Analysis

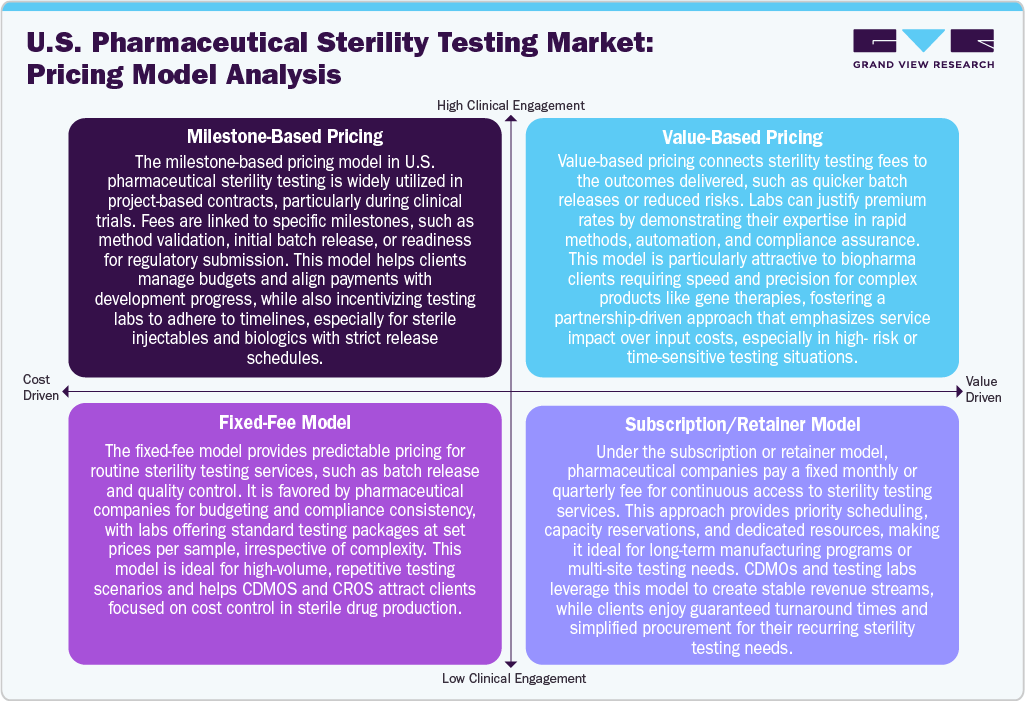

The U.S. pharmaceutical sterility testing industry employs a variety of pricing models tailored to meet the diverse needs of clients throughout both development and commercial phases. One prevalent model is milestone-based pricing, often seen in clinical and project-based work, where fees are correlated with specific deliverables such as method validation, batch release, or regulatory submission. This model offers flexibility and ensures that payments are aligned with project progress. Besides, the fixed-fee models are commonly utilized for routine testing, providing clients with predictable costs per test or sample, which is particularly beneficial for batch release in high-volume manufacturing settings. In addition, the value-based pricing is also emerging, especially for complex biologics and advanced therapies. In this scenario, pricing is determined by service quality, speed, and regulatory outcomes, especially when rapid microbiological methods or automated systems are implemented. Furthermore, the subscription or retainer models are gaining popularity among companies that require ongoing sterility testing. Under these arrangements, clients pay a set fee, which ensures guaranteed capacity, priority scheduling, and long-term support. These pricing models not only help laboratories maintain stable revenue streams but also offer clients advantages such as faster turnaround times, reduced administrative burdens, and a consistent quality assurance partner.

Market Concentration & Characteristics

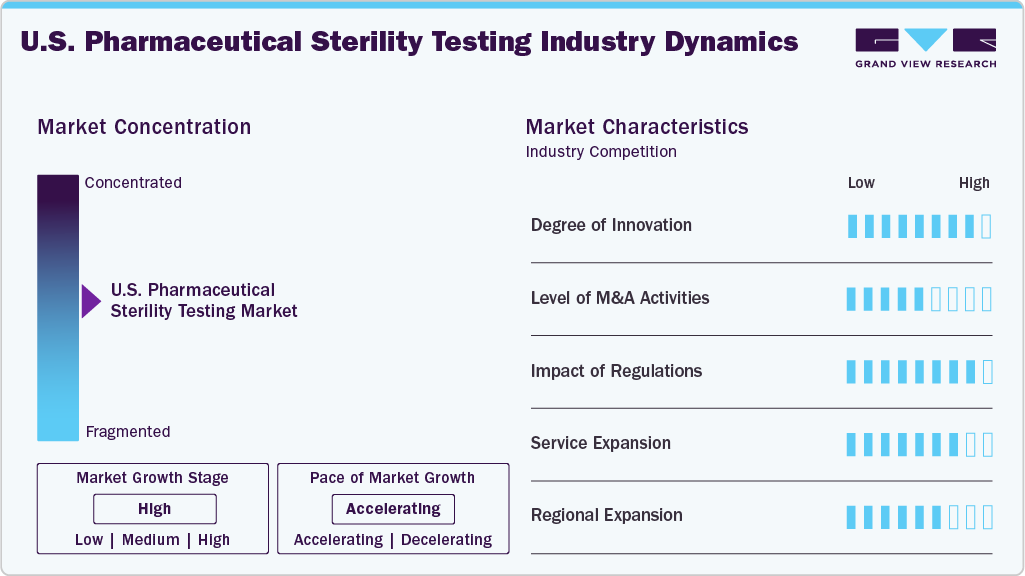

The U.S. pharmaceutical sterility testing industry growth stage is moderate, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

The U.S. sterility testing market is experiencing significant innovation, propelled by the adoption of rapid microbiological methods, AI-driven data analytics, automated isolators, and real-time monitoring systems. These advancements are not only enhancing testing accuracy but also reducing contamination risks and speeding up batch release processes, particularly for biologics and sterile injectables. As these technologies continue to evolve, they are reshaping the landscape of sterility testing, allowing for more efficient operations and improved overall product safety.

M&A activity in the sterility testing sector remains moderate, with larger Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) acquiring specialized sterility testing labs. This effort is driven by the desire to expand aseptic testing capabilities and strengthen integrated quality control offerings. By acquiring these specialized labs, companies can effectively address capacity constraints and better meet the growing demand for services related to biologics, gene therapies, and complex sterile formulations. This strategic approach not only enhances operational efficiency but supports these organizations to respond more effectively to the evolving market needs.

FDA and USP regulations, especially USP <71> and cGMP guidelines, heavily influence sterility testing practices. Stricter compliance and data integrity requirements are motivating labs to adopt advanced systems and validated technologies, ensuring safety and efficiency in aseptic pharmaceutical manufacturing.

Labs are broadening their services to offer rapid sterility testing, container closure integrity testing, environmental monitoring, and endotoxin testing. The growth of biologics, cell and gene therapies, and personalized medicine is driving the demand for customized sterility testing packages from early-phase development to commercial production.

Leading sterility testing providers are expanding into biotech hubs like Boston, California, and North Carolina. Regional labs are scaling up to support rising local manufacturing demands and some are extending their capabilities near CDMO hubs to provide faster turnaround times and localized regulatory support.

Type Insights

In 2024, the outsourcing segment dominated the market, accounting for a revenue share of 58.25%. Outsourcing sterility testing is increasingly trending in the U.S. pharmaceutical industry driven by the rising demand for sterile products, regulatory complexities, and the requirement for specialized infrastructure. Besides, pharmaceutical and biotech companies are opting for qualified contract testing organizations (CTOs) and contract development and manufacturing organizations (CDMOs) to leverage expertise, reduce operational costs, and ensure adherence to FDA and USP guidelines. This approach allows for quicker turnaround times, especially for biologics, cell and gene therapies, and parenteral drugs. Moreover, with advancements in rapid microbiological methods & automation, external laboratories provide high-quality, scalable testing solutions. Such factors are expected to drive efficient drug development, facilitating timely market entry, and mitigating the risks in aseptic manufacturing environments.

Besides, the in-house pharmaceutical sterility testing segment is anticipated to grow at a lucrative CAGR during the forecast period. In-house pharmaceutical sterility testing is essential for companies engaged in large-scale sterile manufacturing. By maintaining internal testing capabilities, these companies benefit from tighter process control, expedited batch release, and secure management of high-potency or proprietary products. This setup also facilitates seamless integration with quality assurance and environmental monitoring systems, which is expected to drive segment growth over the estimated time period.

Product Insights

On the basis of product segment, the kits & reagents segment dominated the market in 2024. Kits and reagents used in pharmaceutical sterility testing are crucial for ensuring accuracy, consistency, and regulatory compliance. These kits & reagents include culture media, bioburden test kits, rapid microbiological detection reagents, and sterility indicators. Besides, the growing demand for ready-to-use, validated kits aligns with the industry's shift toward rapid testing and automated platforms is anticipated to drive the market growth over the estimated time period. Moreover, high-quality reagents support to reduce variability, streamline workflows, and ensure compliance with FDA and USP <71> standards. Thus, with the growing need for kits & reagents many companies are focusing on innovating reagents and indicators that are contamination-resistant, user-friendly kits specifically designed for testing biologics, injectables, and advanced therapy products.

The service segment is expected to grow at a CAGR of 10.89% during the forecast period. Sterility testing services are critical for ensuring the safety of pharmaceutical products, especially injectables, biologics, and cell and gene therapies. Contract testing organizations (CTOs) and Contract development and manufacturing organizations (CDMOs) provide specialized services, including USP <71> testing, rapid microbiological methods, and isolator-based testing. These services enable manufacturers to comply with regulatory standards, minimize contamination risks, and expedite batch release. Moreover, with the rising outsourcing trends, the service providers are enhancing their capabilities, automating processes, and implementing real-time monitoring to facilitate high-throughput, compliance, and efficient sterility testing throughout both clinical and commercial production stages.

Test Insights

The bioburden testing segment held a market share of more than 41.52% in 2024. Bioburden testing measures the number of viable microorganisms present on pharmaceutical products or components before sterilization. It is essential for ensuring product safety, validating sterilization processes, and meeting regulatory standards such as USP <61> and <62>. Besides, it is widely used in the manufacturing of injectables, biologics, and medical devices, bioburden testing helps identify contamination risks early. Moreover, advances in automation & rapid detection methods have improved testing speed & accuracy, supporting efficient quality control in aseptic manufacturing and reducing time to market for sterile products.

In addition, the sterility testing market is anticipated to witness growth at a rapid pace during the forecast period. Sterility testing is critical for quality control process designed to verify that pharmaceutical products are free from viable microorganisms. It is essential for sterile injectables, biologics, and medical devices, ensuring both patient safety and regulatory compliance with USP <71> and FDA cGMP guidelines. While traditional culture-based methods remain in use, they are increasingly supplemented by rapid microbiological methods, automation, and isolator systems, which enhance accuracy and efficiency. Sterility testing can be conducted in-house or through outsourcing partners, facilitating product release in both clinical and commercial manufacturing settings.

Sample Insights

Pharmaceuticals held the largest market share in 2024. Pharmaceutical sterility testing is crucial for verifying that sterile drugs, including injectables and biologics, are free from microbial contamination. This testing is vital for safeguarding patient safety and ensuring product quality. Besides, traditional culture-based methods are commonly employed alongside advanced rapid microbiological techniques that provide quicker and more precise results. As the need for complex sterile therapies rises, both in-house and outsourced testing services are increasingly utilized to ensure regulatory compliance, minimize contamination risks, and facilitate efficient product release.

The biopharmaceuticals segment is expected to grow at fastest CAGR of 12.57% over the forecast period. Sterility testing in biopharmaceuticals is essential for ensuring that products such as monoclonal antibodies, vaccines, and cell and gene therapies are free from viable microorganisms. Given the complexity and sensitivity of these products, advanced testing methods such as rapid microbiological techniques, automation, and isolator systems are increasingly in demand, which is expected to drive market growth. These approaches enhance accuracy, minimize contamination risks, and expedite batch release. As biopharmaceutical manufacturing continues to grow, sterility testing remains a critical component of quality assurance, regulatory compliance, and the safety of high-value, life-saving therapies. Such factors support the segment growth.

End-use Insights

In terms of end use, the market is segregated into compounding pharmacies, medical devices companies, pharmaceutical companies, and others.The medical device companies held a significant market share in 2024. Medical device companies depend on sterility testing to confirm that their products are free from viable microorganisms, thereby ensuring patient safety and regulatory compliance. This critical quality control process validates manufacturing cleanliness and packaging integrity across a variety of devices, including implants, surgical tools, and disposables. Advanced sterility testing methods, such as direct inoculation and membrane filtration, are utilized to identify contamination risks. With increased regulatory scrutiny and the increasing complexity of devices, rigorous sterility testing is essential for securing market approval and maintaining clinical efficacy on a global scale.

The compounding pharmacies are expected to grow at a CAGR of 12.76% over the forecast period. Compounding pharmacies conduct sterility testing to ensure that customized sterile medications are free from microbial contamination, thereby safeguarding patient safety and adhering to strict regulatory standards. This testing verifies the aseptic preparation processes for injectable drugs, ophthalmic solutions, and other sterile formulations. Common methods, such as membrane filtration and direct inoculation, are employed to detect potential contaminants. As the demand for personalized therapies continues to grow, rigorous sterility testing in compounding pharmacies becomes vital to prevent infections, ensure product quality, and comply with guidelines from agencies such as USP <797> and the FDA.

Country Insights

U.S. Pharmaceutical Sterility Testing Market Trends

The U.S. pharmaceutical sterility testing industry is driven by rising demand for sterile injectables, biologics, and advanced therapies like cell and gene therapies. Besides, an increase in R&D activities and a rise in the number of drug approvals in the country are among the major factors supporting market growth. Moreover, the demand for medicines and effective treatment options is constantly growing due to the high prevalence of arthritis, asthma, diabetes, & other chronic diseases in the country, which is contributing to the growth of the U.S. pharmaceutical sterility testing industry. Furthermore, strict FDA regulations and the rising trend of outsourcing among pharmaceutical and biotech companies are expected to drive the need for compliant and high-quality sterility testing. In addition, technological advancements such as rapid microbiological methods, automation, and AI-driven analytics are expected to drive accuracy and reduce turnaround times. In addition, the investments in regional lab expansions and integrated service offerings ensure GMP compliance and expedite product releases. Such factors are expected to drive market growth.

Key U.S. Pharmaceutical Sterility Testing Company Insights

The key players operating across the market are adopting strategic initiatives such as service launches, mergers & acquisitions, partnerships & agreements, and expansions to gain a competitive edge in the market. For instance, in April 2025, DDL company launch a new GMP laboratory specifically focused on testing drug-device combination products. This expansion will improve the company’s ability to provide robust, regulatory-compliant testing solutions for the pharmaceutical, biotech, and combination product sectors.

Key U.S. Pharmaceutical Sterility Testing Companies:

- Pacific Biolabs

- Steris Plc

- Boston Analytical

- Sotera Health Company (Nelson Labs)

- Sartorius Ag

- Solvias Ag

- SGS SA

- Labcorp

- Pace Analytical

- Charles River Laboratories

- Thermo Fisher Scientific, Inc.

- Rapid Micro Biosystems, Inc.

- Almac Group

Recent Developments

-

In May 2025, Nelson Labs, a Sotera Health company mentioned that the company performs product sterility testing using rapid microbiological methods at three laboratory facilities in the U.S. and Europe. This approach provides sterility assurance for a range of medical devices and pharmaceuticals. In contrast to conventional rapid sterility testing, which typically targets biological products or those with short shelf-lives, this solution is crafted for a variety of applications.

-

In July 2024, SGS North America company mentioned the enhancements in its capacity and capabilities aimed at strengthening its biologics testing services for the U.S. biopharmaceutical market.

U.S. Pharmaceutical Sterility Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.74 billion

Revenue forecast in 2033

USD 1.70 billion

Growth rate

CAGR of 11.04% from 2025 to 2033

Historical Year

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, test, sample, end-use

Country scope

U.S.

Key companies profiled

Pacific Biolabs; Steris Plc; Boston Analytical; Nelson Laboratories, LLC (Sotera Health); Sartorius AG; SOLVIAS AG; SGS SA; Labcorp; Pace Analytical; Charles River Laboratories; Thermo Fisher Scientific, Inc.; Rapid Micro Biosystems; Almac Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Sterility Testing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. pharmaceutical sterility testing market report based on type, product, test, sample, and end-use.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In-House

-

Outsourcing

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits and Reagents

-

Instruments

-

Services

-

-

Test Outlook (Revenue, USD Million, 2021 - 2033)

-

Sterility Testing

-

Membrane Filtration

-

Direct Inoculation

-

Product Flush

-

-

Bioburden Testing

-

Bacterial Endotoxin Testing

-

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Medical Devices

-

Biopharmaceuticals

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Compounding Pharmacies

-

Medical Device Companies

-

Pharmaceutical Companies

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.