- Home

- »

- Healthcare IT

- »

-

U.S. Pharmacy Benefit Management Market Size Report, 2030GVR Report cover

![U.S. Pharmacy Benefit Management Market Size, Share & Trends Report]()

U.S. Pharmacy Benefit Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Business Model (Standalone, Health Insurance Providers, Retail Pharmacy), By End Use (Commercial, Federal), And Segment Forecasts

- Report ID: GVR-2-68038-826-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

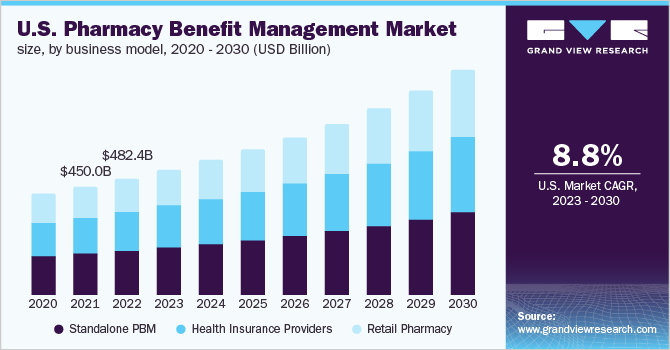

The U.S. pharmacy benefit management market size was valued at USD 482.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.77% from 2023 to 2030. The increase in healthcare expenditure has played a pivotal role in the development of the market. Besides this, the rising prevalence of chronic conditions and growing preference for vertical integration within pharmaceutical distribution systems have been augmenting the market in the country.

Pharmacy benefit managers function as intermediaries between insurance providers and pharmaceutical manufacturers. As per the National Association of Insurance Commissioners, around 66 PBM companies are operating in the U.S., controlling the pharmacy benefit of more than 266 million Americans. The demand for PBM (pharmacy benefit management) services is on the rise owing to an increase in the number of insurance providers with in-house pharmacy benefit groups to manage the covered population. PBM systems lower the overall costs by combining health plan customers to form bigger networks that enable negotiations and discounts.

The growth of the market is being driven by vertical integration, especially post two major alliances of CVS-Aetna and Cigna-Express Scripts. The supply chain dynamics are predicted to change considerably in the coming years, especially post these mergers. Partnerships of PBM organizations with health insurance companies are estimated to further benefit the growth of the market and the role of PBMs in the decision-making process. Such alliances in the market will improve the affordability and personalization of health insurance plans and provide more alternatives through better alignment with healthcare professionals.

The majority of drugs in the market offer similar mechanisms of action resulting in a minimal difference between APIs, ultimately increasing the price sensitivity of these drugs. PBMs release drug formularies that include all drugs covered under their benefit plans, wherein manufacturers are receptive to offering discounts. Manufacturers who add their drugs under the PBM formulary list significantly remunerate PBMs. This provides PBMs with an additional influence over prescribing decisions in the form of prior-authorization requirements, even allowing them to interrupt patient treatments.

COVID-19 U.S. pharmacy benefit management market impact: 6.5% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic positively impacted market growth. The spread of infection increased the demand for COVID-19 drugs. This resulted in high demand for PBM in the U.S.

COVID-19 caused an increase in healthcare expenditure due to the introduction of new drugs. This has propelled the demand for PBM. In December 2021, the Centers for Medicare & Medicaid Services reported that total U.S. national healthcare spending rose to USD 4.1 trillion in 2020, a 9.7% year-over-year growth rate.

Key providers such as Cigna, Optum, Inc., and Cigna reported positive growth in 2020. Furthermore, the initiation of vaccination drives by employers boosted the adoption of PBM.

The increasing cost of healthcare is anticipated to drive growth post-pandemic. For instance, CVS Health’s pharmacy services segment reported a growth of 7.2% in 2021

The increasing prevalence of chronic diseases has increased the demand for treatment options. Therefore, some large pharmaceutical companies are focusing on producing expensive branded drugs. This has led to a significant increase in drug costs in recent years. For instance, a study published in Pharmaceutical Technology found that U.S. drug prices were raised by 4.0% in 2021, breaking the previous modest upward pattern. Further, according to SingleCare Administrators, single-prescription medicine prices were also raised by 5% in 2021.

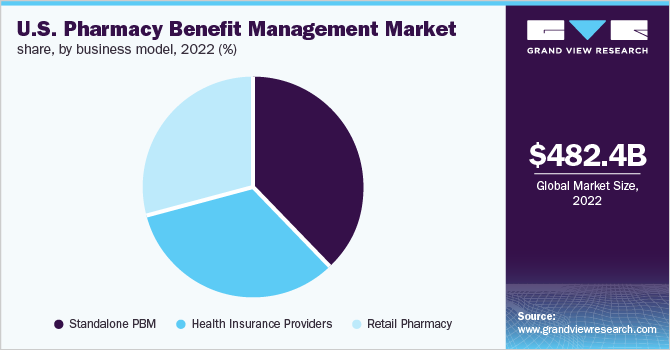

Business Model Insights

The standalone PBM segment held the largest revenue share of 37.9% in 2022. Major players such as CVS Health and Express Scripts who underwent major mergers cater to this segment. Such mergers are anticipated to allow drug manufacturers to manage pricing policies and understand the pricing information of competitors. The market experienced consolidations between PBMs and health insurers leading to the strengthening of key players in the market.

PBM uses its scale to negotiate contracts between manufacturers and retailers, secure drug discounts, and determine which drugs qualify for various health care plans. Retail pharmacies are undertaking various strategic initiatives to include PBM services. For instance, in October 2019, Centene Corporation, Walgreens, and RxAdvance announced a strategic partnership to implement an innovative pharmacy management model aimed at increasing transparency, improving the customer experience, and ultimately delivering better healthcare outcomes at lower costs.

The health insurance providers segment is anticipated to expand owing to the increasing access to public health insurance and the rising number of people insured under commercial insurance. Due to the increasing number of beneficiaries, many payers prefer to have in-house PBM, which is driving segment growth. Furthermore, many insurers are acquiring PBMs or partnering with them to develop their own PBM platform. For instance, in December 2019, Humana announced the acquisition of Enclara Healthcare, a hospice PBM provider.

End-use Insights

The commercial segment held the maximum revenue and is estimated to dominate the market throughout the forecast period. The majority of U.S. employees are enrolled under commercial private insurance plans to benefit from the copay system for high-cost drugs. According to the Congressional Research Service, around 211 million people were covered by private insurance in 2020, combining group and non-group insurance.

Federal support is significant for government employees wherein premiums vary for different health plans and are paid in part by employers and employees. Employers usually pay up to 72.0% of the total amount in an average plan for self-only or family coverage while employees pay the rest. As per the Congressional Research Service, Medicaid covered 58 million people, Medicare covered 60 million people, and 12 million were covered under military insurance in 2020.

Key Companies & Market Share Insights

Some of the strategies undertaken by the market players to strengthen their market presence include mergers and acquisitions. A number of market participants are striving to implement strategic plans that are favoring demand. For instance, in October 2021, a nonprofit partnership of about 40 companies, including U.S. retailers Walmart (WMT.N) and Costco (COST.O), was created, forming a new company to provide pharmacy benefit management services for employers. Some of the prominent players in the U.S. pharmacy benefit management market include:

-

CVS Health

-

Cigna

-

Optum, Inc.

-

MedImpact

-

Anthem

-

Change Healthcare

-

Prime Therapeutics LLC

-

HUB International Limited.

-

Elixir Rx Solutions LLC

U.S. Pharmacy Benefit Management Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 518.6 billion

The revenue forecast in 2030

USD 934.0 billion

Growth Rate

CAGR of 8.77% from 2023 to 2030

The base year for estimation

2022

Historical data

2017 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Business model, end-use

Country scope

U.S.

Key companies profiled

CVS Health; Cigna; Optum, Inc.; MedImpact; Anthem; Change Healthcare; Prime Therapeutics LLC; HUB International Limited; Elixir Rx Solutions LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmacy Benefit Management Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. pharmacy benefit management market based on business model and end-use:

-

Business Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Standalone PBM

-

Health Insurance Providers

-

Retail Pharmacy

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Federal

-

Frequently Asked Questions About This Report

b. The U.S. pharmacy benefit management market size was estimated at USD 482.4 billion in 2022 and is expected to reach USD 518.6 billion in 2023.

b. The U.S. pharmacy benefit management market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 934.0 billion by 2030.

b. Standalone PBM segment held the leading revenue share in the market in 2022. It included major players such as CVS Health and Express Scripts who underwent major mergers by the end of 2018.

b. Some of the key players in the U.S. pharmacy benefits management (PBM) market are CVS Health; Cigna; Optum, Inc.; MedImpact; Anthem; Change Healthcare; Prime Therapeutics LLC; HUB International Limited; Elixir Rx Solutions LLC.

b. Increase in healthcare expenditure has played a pivotal role in the development of the market. Besides this, rising prevalence of chronic conditions and growing preference for vertical integration within pharmaceutical distribution systems have been augmenting the market in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.