- Home

- »

- Medical Devices

- »

-

U.S. Physical Therapy Services Market Size Report, 2033GVR Report cover

![U.S. Physical Therapy Services Market Size, Share & Trends Report]()

U.S. Physical Therapy Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Orthopedic Therapy, Neurological Therapy), By Settings (Outpatient Clinics, Hospitals), By Payer (Public Insurance, Private Insurance), And Segment Forecasts

- Report ID: GVR-4-68040-022-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Physical Therapy Services Market Summary

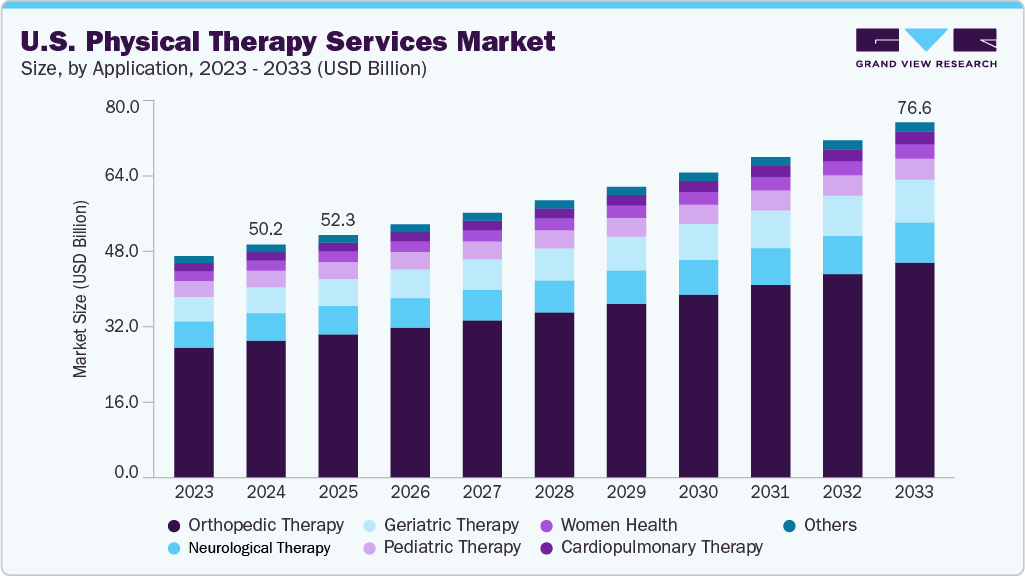

The U.S. physical therapy services market size was valued at USD 50.23 billion in 2024 and is projected to reach USD 76.61 billion by 2033 growing at a CAGR of 4.88% from 2025 to 2033. The market is driven by several factors such as aging population, increased prevalence of chronic conditions, increased awareness of preventive care, and technological advancements. These drivers are expected to increase the demand for these services, by changing both patient behavior and the strategic direction of healthcare providers.

Rising Prevalence of Sports Injuries and Chronic Pain:

Increasing global sports participation has intensified competition within the sports industry, creating significant financial opportunities, particularly for athletes pursuing elite professional status. Hence, injured athletes frequently encounter considerable pressure from personal expectations and team management to resume competition quickly, as extended recovery periods can risk their position within the team. In October 2024, Project Play released its State of Play 2024 report, highlighting youth sports trends in the U.S., noting that in 2023, approximately 27.3 million children aged 6-17 participated in organized sports, representing 55.4% of that age group. The report emphasized the rising incidence of serious knee injuries among teen athletes and called for increased awareness and preventive measures. Early intervention, personalized care, and prevention-focused strategies are essential to facilitating effective recovery and a safe return to competition.

Physical therapy is critical in sports medicine, particularly in managing injuries during major international events. Sports physiotherapists' primary responsibilities include injury treatment, rehabilitation, and performance support through injury prevention, maintenance, and recovery strategies. Athletes value sports physiotherapists who demonstrate expertise, possess strong personal attributes, communicate effectively, and show genuine interest in their well-being. In 2024, according to the National Safety Council, sports and recreational injuries in the U.S. increased by 17%, with 4.4 million people treated in emergency departments, primarily from exercise, cycling, and basketball. The highest injury rates were observed among 15- to 24-year-olds, with males affected more than females, and most patients (90%) were treated and released.

Athletes often have a narrow understanding of the responsibilities of sports physiotherapists, primarily viewing them as injury-focused. The four key themes regarding the role of sports physiotherapists are:

-

Treatment of injuries

-

Injury prevention

-

Rehabilitation

-

Enhancement of athletic performance

Favorable Reimbursement Policies:

In the U.S. physical therapy services market, reimbursement policies significantly influence the accessibility and affordability of care. Government programs such as Medicare and Medicaid play a major role in setting reimbursement standards. Medicare Part B covers outpatient physical therapy, with payment determined by the Physician Fee Schedule (PFS), which is updated annually to reflect changes in healthcare costs and practices. In November 2025, APTA reported that advocacy efforts led to updates in Aetna’s physical therapy policy, improving alignment with PT practice and CPT code definitions. Key changes include recognition of telehealth services, removal of homebound requirements for home-based PT, elimination of direct supervision requirements for PTAs, and enhanced descriptions of gait training and neuromuscular reeducation. These updates expand access for over 26 million Aetna beneficiaries and reflect APTA’s ongoing success in shaping payer policies to better support physical therapists and patient care.

Recent legislative initiatives have also influenced reimbursement policies. In August 2025, the American Physical Therapy Association (APTA) highlighted ongoing advocacy efforts to reform Medicare payment policies affecting physical therapists. Key initiatives include pushing for annual inflation-based payment updates, repeal of the Multiple Procedure Payment Reduction (MPPR), expanded options for PTs to privately contract or “opt out” under Medicare Part B, and adjustments to the budget-neutrality threshold from USD 20 million to USD 53 million. These efforts aim to stabilize practice finances, reduce administrative burdens, and improve patient access to therapy services across the U.S.

Growing Number of Physical Therapists:

The U.S. physical therapy services market has experienced a notable increase in the number of physical therapists in recent years. This growth can be attributed to various factors, including increased demand for rehabilitation services, an aging population, and a growing emphasis on preventive healthcare. With a growing aging population, the prevalence of musculoskeletal disorders, chronic pain, and mobility issues has increased, creating a greater need for physical therapy services. This demand has prompted an expansion in educational programs and training opportunities, leading to more physical therapists entering the workforce.

The increased emphasis on preventive care in the U.S. healthcare system has contributed to the growing number of physical therapists. As insurers and healthcare providers shift their focus toward preventing chronic conditions and reducing the need for surgery or long-term medication use, physical therapy has become a key part of preventive health strategies. This trend has led to greater demand for physical therapists in outpatient clinics, hospitals, and wellness centers, further driving growth in the workforce. In February 2025, Tufts University School of Medicine and ATI Physical Therapy unveiled a unique partnership to broaden access to physical therapy education and workforce development in the U.S. The collaboration seeks to meet the rising demand for physical therapists by providing scholarships, advanced training pathways, and expanded clinical placement opportunities across ATI’s nationwide network of over 850 outpatient clinics.

Expansion of Outpatient and Home Based Therapy Models:

The expansion of outpatient and home-based physical therapy models is a key growth driver in the U.S. physical therapy services market. With rising healthcare costs and a shift toward patient-centered care, these settings offer a cost-effective and convenient alternative to inpatient rehabilitation. Patients are increasingly preferring outpatient and home-based therapy due to its flexibility, accessibility, and lower expenses. This shift is supported by the growing number of independent therapy centers, franchise clinics, and home health agencies offering specialized musculoskeletal and post-operative rehabilitation programs. In March 2024, SportsMed Physical Therapy launched its HomeCare division to provide in-home outpatient physical, occupational, and speech therapy services across New Jersey and Connecticut. The move expands its rehabilitation network as the company marks its 20th anniversary and continues growth following its partnership with Hildred Capital Management.

Shift Toward Value-Based and Preventive Care:

The physical therapy sector is increasingly driven by value-based and preventive care models, which prioritize patient outcomes, functional improvement, and overall wellness. Health systems and payers are adopting reimbursement strategies that reward efficient, high-quality, and outcome-focused care, encouraging physical therapists to reduce chronic conditions and improve mobility. In October 2025, Sword Health reported that its U.S. physical therapy programs, delivered via a value-based care model, achieved high clinical and financial impact. The outcomes included an 81% completion rate for physical therapy programs, 69% of members pain-free at discharge, and a 50% reduction in avoidable MSK surgeries through early and guided PT interventions. On average, employers and health plans saved approximately USD 3,177 per member per year, highlighting how outcome-focused physical therapy improves recovery, reduces unnecessary procedures, and drives measurable return on investment.

This shift creates opportunities for physical therapy providers to innovate care delivery, adopt outcome-based metrics, and expand services that emphasize prevention and long-term patient health. Providers focusing on evidence-based interventions and measurable results are better positioned to align with evolving healthcare priorities and demonstrate the economic and clinical value of physical therapy.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The market is fragmented, with many small players entering the market and launching new innovative services. The degree of innovation is low, the level of M&A activities is high, the impact of regulations is medium, service expansion is medium, and impact of partnerships & collaborations is medium.

Innovation in the U.S. market needs to improve, with many practices relying on established treatment methods rather than introducing groundbreaking technologies or techniques. There are some advancements in telehealth and digital health platforms, while the core practices of physical therapy remain relatively unchanged. For instance, traditional modalities such as manual therapy and exercise-based rehabilitation continue to dominate treatment plans.

Level of M&A activities in the U.S. market is high, driven by the need for provider consolidation and expansion. Many companies seek to acquire smaller practices to enhance their market presence and diversify their service offerings. For instance, in September 2024, U.S. Physical Therapy, Inc. acquired a majority 70% stake in an eight-clinic physical and hand therapy practice in Pennsylvania, enhancing its presence in the Northeast and expanding the portfolio with local expertise.

The impact of regulations on the U.S. market is medium, as regulatory frameworks facilitate and constrain growth. Medicare reimbursement policies are essential to determine the financial viability of physical therapy, affecting how services are delivered and compensated. However, the regulatory environment remains stable, with periodic adjustments rather than extensive reforms, allowing providers to operate within established guidelines while seeking compliance.

Service expansion within the market is medium, with many providers exploring opportunities to broaden their offerings beyond traditional physical therapy. This includes developing specialized programs targeting pediatrics, geriatrics, or sports rehabilitation populations. For instance, in July 2024, Select Medical and Cedars-Sinai launched a specialized spine care initiative in Greater Los Angeles.

The impact of partnerships and collaborations within the market is medium, as many physical therapy providers team up with healthcare systems, fitness organizations, and technology firms to enhance their service delivery. These collaborations often aim to improve patient outcomes and streamline care pathways. For instance, in September 2024, Athletico Physical Therapy partnered with Ballet Des Moines, Iowa’s only resident ballet company, to become the Official Physical Therapy Provider for the 2024-2025 season.

Application Insights

The orthopedic therapy segment held the largest revenue share of 58.89% in 2024 due to its widespread appeal and functionality. Several key factors, including a rise in Musculoskeletal (MSK) disorders, such as arthritis, and an increasing emphasis on nonsurgical treatments for injury rehabilitation, drive the orthopedic physical therapy market. For instance, according to CDC, in 2022, 18.9% of individuals aged above 18 years had arthritis. In addition, the growing awareness of the benefits of physical therapy in improving mobility, managing pain, and accelerating recovery from orthopedic surgeries is fueling demand. Advances in treatment techniques and increased sports-related injuries is expected to expand orthopedic physical treatment services as more individuals seek targeted, non-invasive rehabilitation options.

The geriatric therapy segment is expected to grow at the fastest CAGR over the forecast period. Growth of the segment can be attributed to the growing elderly population and the rising incidence of age-related conditions, such as arthritis, osteoporosis, Alzheimer’s disease, cancer, balance & gait disorders, neurological disorders, and mobility impairments. Moreover, technological advancements and the trend toward preventive healthcare & nonsurgical interventions have increased the demand for physical therapy as a preferred approach to managing age-related health decline. For instance, in March 2024, FOX Rehabilitation, a senior in-home care provider, partnered with a digital care technology company-OneStep-to incorporate Remote Therapeutic Monitoring (RTM) into its services.

Settings Insights

The outpatient clinics segment held the largest revenue share of 50.99% in 2024.Outpatient clinics are preferred for their flexibility, allowing patients to receive therapy without needing hospitalization. This setting caters to various conditions, from post-surgical rehabilitation to chronic pain management. It is a vital resource for individuals looking to improve their mobility and quality of life. In addition, the launch of new settings is expected to drive the segment growth during the forecast period. In November 2022, Physical Rehabilitation Network, a company with over 200 clinics, launched its first outpatient PT clinic in Escondido, California.

The home healthcare segment is expected to witness significant growth over the forecast period, driven by an increasing preference for receiving care in the comfort of one’s home, especially among aging populations and individuals with chronic conditions. This segment gained significant attention due to the increasing demand for personalized care, advances in telehealth technologies, and the need for cost-effective healthcare solutions. As patients increasingly seek alternatives to traditional hospital settings, home healthcare services are becoming a vital option for physical therapy.

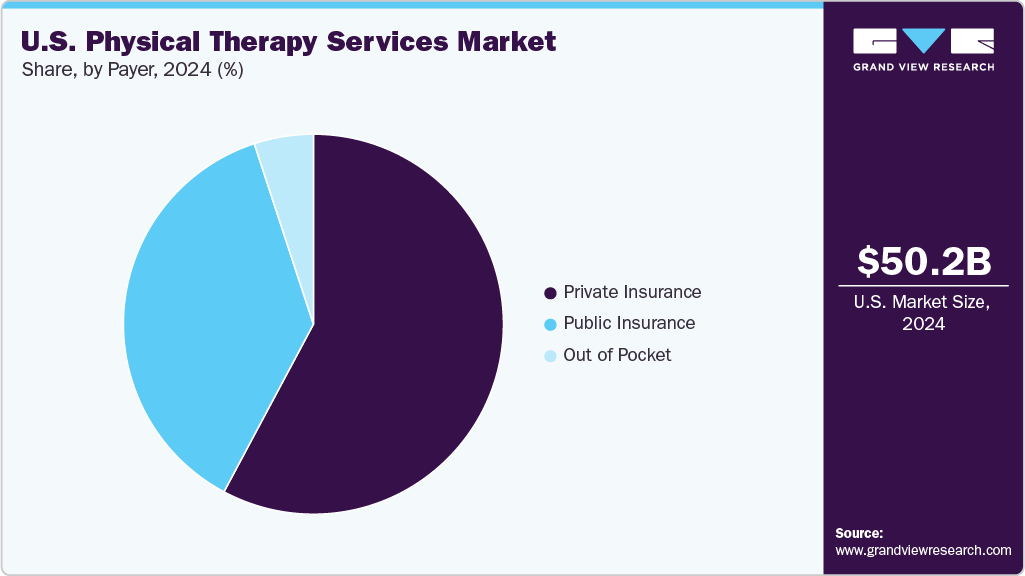

Payer Insights

The private insurance segment held the largest revenue share of 57.81% in 2024. The segment's growth can be attributed to the increasing collaboration between private health insurers, employers, and healthcare facilities. Many employers offer comprehensive health insurance plans that include coverage for physical therapy services as part of their employee benefits packages. According to a report published by the U.S. Census Bureau in September 2021, private insurance plans covered approximately 66.5% of insured individuals in the U.S. in 2020. This trend enhances access to physical therapy services and promotes preventive care, as patients are more likely to seek treatment early on when covered by their insurance.

The public insurance segment represented a significant market share over the forecast period. One of the primary drivers of the segment's growth is the rising incidence of chronic conditions, such as obesity, diabetes, and cardiovascular diseases. According to the U.S. CDC, approximately 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 have two or more. These conditions require long-term management and rehabilitation, typically covered by public insurance programs (Medicare and Medicaid). For instance, Medicare covers physical therapy services for beneficiaries diagnosed with certain chronic conditions, such as Parkinson's disease or multiple sclerosis, to help improve their quality of life and maintain independence.

Key U.S. Physical Therapy Services Company Insights

Facility expansion, strategic partnerships, and increased emphasis on inorganic growth initiatives are critical strategies followed by these players to strengthen their market position. In addition, other competitors are continually engaging in strategic expansion projects to build their footholds in new markets. Some of the notable emerging players are Ivy Rehab, CORA Health Services, Inc., and Enhabit Home Health & Hospice.

Key U.S. Physical Therapy Services Companies:

- Select Physical Therapy

- U.S. Physical Therapy, Inc.

- ATI Physical Therapy

- Athletico Physical Therapy

- Drayer Physical Therapy Institute

- Professional Physical Therapy

- CORA

- PT SOLUTIONS

- Boston Children's Hospital

- ApexNetwork Physical Therapy

- Hinge Health, Inc.

- Sword Health, Inc.

- Kaia Health

- Limber Health, Inc.(Net Health)

- Kins Health Inc (Wysa Ltd.)

- BetterPT (HealthBus)

- Omada Health Inc.

Recent Developments

-

In September 2024, Athletico Physical Therapy partnered with Limber Health to enhance hybrid musculoskeletal care. This collaboration integrates Limber’s technology in over 900 clinics across 24 states and D.C., aiming to improve patient outcomes in orthopedic rehabilitation.

-

In September 2024, NextGen Healthcare, Inc. renewed its partnership with Athletico Physical Therapy to implement NextGen Enterprise EHR and PM systems, enhancing clinical and financial efficiency across Athletico’s expanded service areas.

-

For instance, in July 2024, Select Medical and Cedars-Sinai introduced a specialized spine care initiative in Greater Los Angeles.

-

In March 2024, ATI Physical Therapy, Inc. formed a two-year exclusive partnership with the McDonald’s All-American Games, becoming the Official Physical Therapy Partner for this annual event in March, which showcases top high school basketball talent.

-

In June 2024, Select Medical donates USD 5 million over five years to Harrisburg University to establish the Select Medical Physical Therapy and Movement Institute.

U.S. Physical Therapy Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 52.31 billion

Revenue Forecast in 2033

USD 76.61 billion

Growth rate

CAGR of 4.88% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, settings, payer

Country scope

U.S.

Key companies profiled

Select Physical Therapy; U.S. Physical Therapy, Inc.; ATI Physical Therapy; Athletico Physical Therapy; Drayer Physical Therapy Institute; Professional Physical Therapy; CORA; PT SOLUTIONS; Boston Children's Hospital; ApexNetwork Physical Therapy; Hinge Health, Inc.; Sword Health, Inc.; Kaia Health; Limber Health, Inc. (Net Health); Kins Health Inc (Wysa Ltd.); BetterPT (HealthBus); Omada Health Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Physical Therapy Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. physical therapy services market report based on application, settings, and payer:

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Orthopedic Therapy

-

Neurological Therapy

-

Geriatric Therapy

-

Pediatric Therapy

-

Women Health

-

Cardiopulmonary Therapy

-

Others

-

-

Settings Outlook (Revenue, USD Billion, 2021 - 2033)

-

Outpatient Clinics

-

Hospitals

-

Home Healthcare

-

Others

-

-

Payer Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Insurance

-

Private Insurance

-

Out of Pocket

-

Frequently Asked Questions About This Report

b. The U.S. physical therapy services market size was estimated at USD 50.23 billion in 2024 and is expected to reach USD 52.31 billion in 2025.

b. The U.S. physical therapy services market is expected to grow at a compound annual growth rate of 4.88% from 2025 to 2033 to reach USD 76.61 billion by 2033.

b. The orthopedic therapy segment held the largest revenue share of 58.89% in 2024 due to its widespread appeal and functionality. Several key factors, including a rise in Musculoskeletal (MSK) disorders, such as arthritis, and an increasing emphasis on nonsurgical treatments for injury rehabilitation, drive the orthopedic physical therapy market

b. Some prominent players in the U.S. physical therapy services market includes Select Physical Therapy; U.S. Physical Therapy, Inc.; ATI Physical Therapy; Athletico Physical Therapy; Drayer Physical Therapy Institute; Professional Physical Therapy; CORA; PT SOLUTIONS; Boston Children's Hospital; ApexNetwork Physical Therapy; Hinge Health, Inc.; Sword Health, Inc.; Kaia Health; Limber Health, Inc. (Net Health); Kins Health Inc (Wysa Ltd.); BetterPT (HealthBus); Omada Health Inc.

b. Key factors that are driving the U.S. physical therapy services market growth attributed to the market is driven by several factors such as, including the aging population, increased prevalence of chronic conditions, increased awareness of preventive care, and technological advancements. These drivers will increase the demand for these services, by changing both patient behavior and the strategic direction of healthcare providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.