- Home

- »

- Pharmaceuticals

- »

-

U.S. Platelet Rich Plasma Market Size & Share Report, 2030GVR Report cover

![U.S. Platelet Rich Plasma Market Size, Share & Trend Report]()

U.S. Platelet Rich Plasma Market (2023 - 2030) Size, Share & Trend Analysis By Type (Pure PRP, Leukocyte Rich PRP), By Application (Sports Medicine, Orthopedics, Dermatology, Cosmetic Surgery), By End-use, And Segment Forecasts

- Report ID: 978-1-68038-384-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

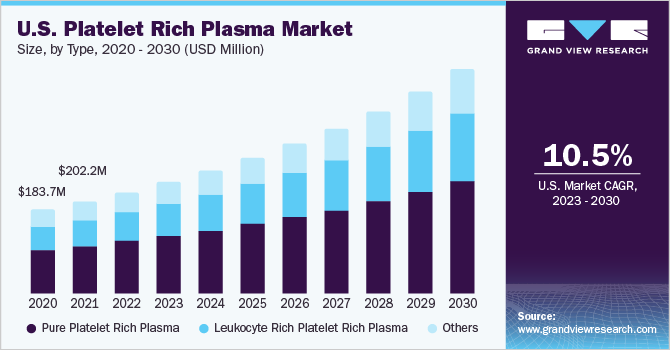

The U.S. platelet rich plasma market size was valued at USD 222.73 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.5% from 2023 to 2030. Platelet-rich Plasma (PRP) therapy has proven effective and safe in various medical applications, offering benefits such as accelerated healing, enhanced wound closure, reduced swelling and inflammation, and stabilization of bone or soft tissue. These advantages expand the use of PRP in treating chronic ailments, leading to boost market revenue. Platelets play a critical role in wound healing due to their hemostatic function and the presence of growth factors and cytokines. Research studies confirm the safety and affordability of platelet-rich plasma as a regenerative therapy for cutaneous wound healing, improving patient care.

While increased acceptability of PRP in dental and oral surgical procedures, such as managing bisphosphonate-related osteonecrosis of the jaw to enhance wound healing, have also yielded promising results. In the past few years, platelet rich plasma injections have gained significant traction among popular sports professionals, including Jermaine Defoe, Rafael Nadal, Alex Rodriguez, Tiger Woods, and many more. Furthermore, the World Anti-doping Association (WADA) removed the PRP from the prohibited substances list in 2011. Wide application of these products by high profile athletes in the U.S. for early osteoarthritis (OA) and chronic injuries significantly contribute to market growth.

PRP and stem cell-based biological interventions have been proven to accelerate recovery while maintaining the performance of athletes. Moreover, research studies have demonstrated that PRP can be used successfully in combination with other treatments to ensure rapid healing. The effects of PRP therapy combined with 70% glycolic acid effectively manage acne scars. Similarly, PRP along with hyaluronic acid significantly improves skin general appearance, firmness, and texture.

High costs associated with platelet rich plasma products make it difficult for clinicians to deploy this therapy on a large scale, which impedes market growth to some extent. Conversely, insurance firms cover few PRP therapy costs, including diagnostic tests, consultation fees, and other medical expenses. The CMS covers autologous PRP only for patients with chronic non-healing diabetic, venous wounds, or when enrolled in a clinical research study, thus reducing the amount of out-of-pocket charges.

Type Insights

Pure platelet rich plasma dominated the market with a revenue share of 51.8% in 2022. Certain benefits associated with this PRP type, including tissue generation & repair, rapid healing, and enhancement in overall function, have raised the demand for pure PRP across different therapeutic applications. In addition, effective elimination of adverse effects, such as an allergic or immune reaction, with this therapeutic approach has considerably benefitted the segment growth.

Pure platelet rich plasma is considered to be more suitable for application for bone regeneration than leukocyte platelet rich plasma. The combined use of this therapy with β-tricalcium phosphate is reflected to be an effective and safe alternative for the treatment of bone defects. Key players are also providing advanced products in this segment. Pure Spin PRP, a U.S.-based firm, is one such player offering an advanced PRP system for centrifugation with maximum platelet recovery.

Leukocyte-rich PRP (LR-PRP) is anticipated to grow at a CAGR of around 11% during the forecast period. LR-PRP promotes bone regeneration by improved viability, proliferation, migration of cells in vitro, osteogenesis, and angiogenesis in vitro & in vivo, however, these products produce harmful effects as compared to pure type. Conversely, these are powerful tools for soft tissue reconstruction with a reduction in operating time, postoperative pain, and risk of complications in wound healing.

Application Insights

In terms of revenue, the orthopedics held the maximum share of 26.7% in 2022 in the U.S. PRP market. Platelet rich plasma injections in orthopedic therapeutics have been recognized to be more convenient as compared to conventional therapeutics as the former stimulates healing and causes degenerative tissue to repair & regenerate itself. Long-lasting relief and optimized healing after surgery are certain advantages associated with this therapy that have supplemented the demand for PRP in soft tissue reconstruction and bone reconstruction.

Furthermore, an increase in the prevalence of OA in the U.S. boosts the demand for this regenerative therapy in orthopedics. As per the Centers for Disease Control and Prevention (CDC), there were 54 million cases of arthritis, and it is estimated that 78.0 million U.S. adults aged 18 years or older would have arthritis by 2040. Moreover, an increase in the number of research studies constantly illustrating the benefits of isolated PRP usage in combination with surgical treatments in the management of OA is set to propel the market growth.

An increase in cosmetic surgeries is set to boost the cosmetic surgery and dermatology segment, poised to grow at the highest CAGR through 2023-2030. As per the American Society of Plastic Surgeons, there were nearly 5.9 million reconstructive procedures in 2019 in the U.S. The rise in the adoption of PRP treatments by plastic surgeons & dermatologists to improve the volume, tone, and texture of the skin also drives segment growth. It reduces the appearance of wrinkles and offers positive aesthetic results when combined with fat grafting procedures.

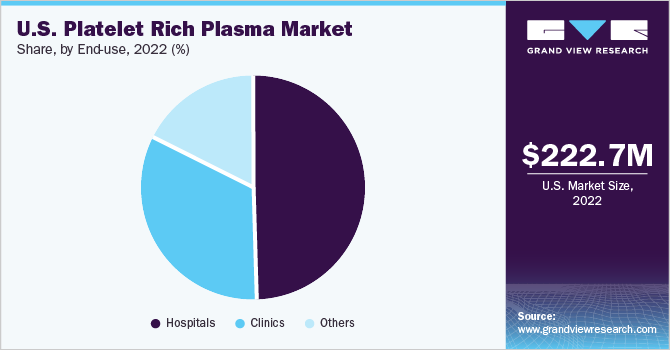

End-use Insights

The hospital segment accounted for the largest revenue share of 49.5% in 2022 with a substantial number of hospitals in the U.S. that provide PRP-based therapies. In addition, the growth in the knee OA cases is a major health concern in the U.S. As there are limited or no definitive curative therapies for osteoarthritis, it creates a major opportunity for these therapies to be highly adopted by hospitals for the treatment of knee OA. This factor contributes to the segment’s dominance in the market.

Others end-use segment includes academic institutes, research institutes, and Point-of-care (POC) settings and is estimated to witness the fastest growth rate of 11.3% over the forecast period. Recent product approval for the rapid and safe preparation of this therapy at PoC settings in the U.S. is one of the major factors responsible for high growth. For instance, in September 2021, Royal Biologics recently received FDA 510K approval for their Maxx™-PRP concentration system. This patented next-generation device enables the safe and rapid preparation of platelet-rich plasma (PRP) by concentrating autologous whole blood.

Similarly, the Fidia PRP Kit of the Fidia Farmaceutici s.p.a., an Italy-based company with operations in the U.S., received FDA approval in November 2019 for rapid and safe preparation of autologous platelet rich plasma at the patient’s PoC. Apex Biologix’s XCELL PRP Platelet Concentrating System 60ml was granted approval in April 2019. The availability of these systems and kits for PRP preparation to be used at POC settings is likely to drive the segment at a lucrative pace.

Key Companies & Market Share Insights

The market participants have manufactured and commercialized several products to cater to the demands for platelet rich plasma-based therapies across a broad range of medical ailments. Technological advancements in the development of novel and innovative products to facilitate rapid and safe preparation of autologous platelet rich plasma reinforce the company’s market share and overcome the limitations of the market. For instance, in February 2023, Royal Biologics has launched BIOINCYTE™ PRFM, an advanced PRP system. This innovative system has the capability to transform conventional PRP into Platelet Rich Fibrin Matrix (PRFM) formulations.

Moreover, companies are adopting profitable strategic initiatives, such as mergers and acquisitions, to attain a competitive edge in the marketplace. In regard to this fact, EmCyte completed the acquisition of all the assets of the U.S.-based Cellmedix Holdings LLC coupled with the latter’s Centrepid Platelet Concentrator system in February 2020. This acquisition is expected to propel EmCyte’s intellectual property profile and strengthen its product development capabilities. Some of the key players in the U.S. platelet rich plasma market include:

-

Johnson & Johnson Services, Inc.

-

Arthrex, Inc.

-

EmCyte Corporation

-

Dr PRP USA LLC

-

Juventix Regenerative Medical, LLC.

-

Terumo Corporation

-

Zimmer Biomet

-

Stryker

-

Apex Biologix

-

Celling Biosciences, Inc.

U.S. Platelet Rich Plasma Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 493.79 million

Growth rate

CAGR of 10.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use

Country scope

The U.S.

Key companies profiled

Johnson & Johnson Services, Inc; Arthrex, Inc.; EmCyte Corporation; Dr PRP USA LLC; Juventix Regenerative Medical, LLC; Terumo Corporation; Zimmer Biomet; Stryker; Apex Biologix; Celling Biosciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Platelet Rich Plasma Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. platelet rich plasma market report on the basis of type, application, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pure Platelet Rich Plasma

-

Leukocyte Rich Platelet Rich Plasma

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Sports Medicine

-

Cosmetic Surgery

-

Dermatology

-

Ulcer Healing

-

Venous Ulcer

-

Traumatic Ulcer

-

Diabetic Ulcer

-

Pyoderma Gangrenosum Ulcer

-

Trophic Ulcer

-

Vasculitic Ulcer

-

Others

-

-

Others

-

-

Ophthalmic Surgery

-

Neurosurgery

-

General Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. platelet-rich plasma market size was estimated at USD 222.73 million in 2022 and is expected to reach USD 245.47 million in 2023.

b. The U.S. platelet-rich plasma market is expected to grow at a compound annual growth rate of 10.5% from 2023 to 2030 to reach USD 493.79 million by 2030.

b. Certain benefits associated with pure PRPs such as tissue generation and repair, accelerated healing process, and improvement in overall function has increased their demand, contributing to the dominance of the segment in the U.S. platelet-rich plasma market.

b. Some of the well-established players operating in the U.S. platelet-rich plasma market include DePuy Synthes (Johnson & Johnson); Stryker; Zimmer Biomet; Terumo BCT, Inc.; EmCyte Corporation; and Arthrex, Inc. On the other hand, Dr. PRP America; Juventix; APEX Biologix; and PureSpin PRP are among some of the emerging companies operating in the market space.

b. Key factors that are driving the U.S. platelet-rich plasma market growth include a growing geriatric population, rising incidence of orthopedic diseases, increasing healthcare expenditure & patient awareness, and the introduction of advanced PRP products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.