- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Ready-To-Drink Cocktails Market, Industry Report, 2030GVR Report cover

![U.S. Ready-To-Drink Cocktails Market Size, Share & Trends Report]()

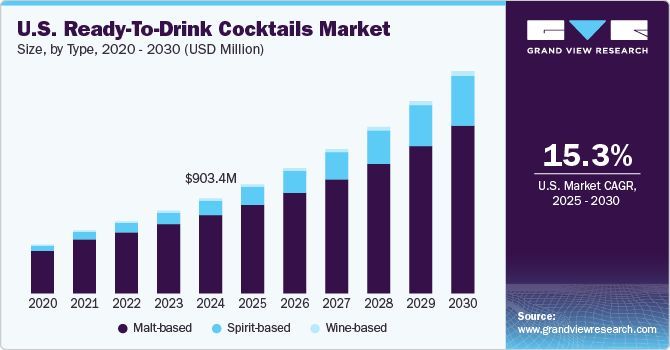

U.S. Ready-To-Drink Cocktails Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Malt-based, Spirit-based, Wine-based), By Packaging, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-215-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ready-To-Drink Cocktails Market Trends

The U.S. ready-to-drink cocktails market size was valued at USD 903.4 million in 2024 and is anticipated to grow at a CAGR of 15.3% from 2025 to 2030. A key trend is the increasing demand for convenience and portability. Consumers, especially millennials and Gen Z, are drawn to RTDs as an easy-to-enjoy option for social gatherings, outdoor activities, and at-home consumption. This convenience factor, coupled with the perception that RTDs offer a consistent and pre-mixed cocktail experience, is fueling a shift away from traditional mixing and towards ready-to-enjoy alternatives. This preference for ease and on-the-go consumption positions RTDs as a versatile choice for meeting diverse needs.

While convenience remains a core driver, consumers are increasingly seeking higher-quality ingredients, unique flavor profiles, and sophisticated packaging, driving demand for premium RTD options. This includes cocktails made with real spirits, high-quality juices, and natural flavors, often mirroring the experience of ordering a handcrafted cocktail at a bar. Moreover, the use of innovative packaging formats, such as sleek cans, resealable pouches, and even sustainable materials, also plays a key role in attracting consumers and differentiating products on the shelf. Besides, R&D efforts are focused on refining production processes to ensure consistent quality and shelf stability while preserving the integrity of the ingredients and flavor profiles.

Consumers are becoming more conscious of their health and are seeking low-calorie, low-sugar, and gluten-free alcoholic beverage options. This has led to the emergence of RTDs made with lighter spirits, natural sweeteners, and innovative flavor combinations that appeal to health-conscious consumers. Moreover, the growing demand for healthier options is driving innovation in the ready-to-drink cocktails market, leading to the development of new products that cater to specific dietary needs and preferences. This includes exploring globally inspired flavors, such as Japanese Highballs or South American caipirinhas, and incorporating unique ingredients sourced from around the world.

The growth of e-commerce, direct-to-consumer channels, and the increasing availability of RTDs in various retail outlets are contributing to the market's growth. RTDs are now readily available in supermarkets, liquor stores, convenience stores, and even online platforms, making them easily accessible to a wider range of consumers. This increased availability, coupled with effective marketing and promotional campaigns, is further driving demand and contributing to the continued expansion of the U.S. ready-to-drink cocktails industry.

Formulating RTDs that accurately replicate the taste of freshly made cocktails requires significant expertise in flavor chemistry and ingredient interactions. Companies are investing in research to optimize blending techniques, preservation methods, and packaging solutions that minimize flavor degradation over time. This includes exploring techniques such as retort processing, tunnel pasteurization, and modified atmosphere packaging to extend shelf life without compromising on the taste and aroma of the final product. Furthermore, R&D is also focused on developing new and innovative ingredients, such as natural preservatives and flavor enhancers, that can enhance the overall quality and appeal of RTD cocktails.

Type Insights

The U.S. malt-based RTD cocktails market accounted for a revenue share of 82.5% in 2024, driven by consumer demand for convenient and sessionable alcoholic beverages. A key trend is the focus on lower alcohol content (ABV) options that appeal to health-conscious consumers and those seeking a lighter drinking experience. Moreover, the versatility of flavors within the malt-based RTD segment, ranging from classic cocktails like margaritas and Moscow mules to innovative fruit-infused blends, also contributes to their expanding appeal. Besides, the demand is further fueled by the ease of distribution and availability of malt-based RTDs, as they often face less stringent regulatory hurdles compared to spirit-based counterparts.

The U.S. spirit-based RTD cocktails market is anticipated to witness a CAGR of 22.6% from 2025 to 2030, fueled by a desire for premium, authentic cocktail experiences without the hassle of mixing. Brands are focusing on replicating bar-quality cocktails in a convenient format, often featuring well-known spirit brands or crafting unique, in-house spirit blends. Direct-to-consumer (DTC) sales channels and sophisticated packaging are also increasingly important for differentiation and reaching target audiences. The rise of premiumization and a growing appreciation for authentic cocktails is also a key driver, with consumers willing to pay more for RTDs made with genuine spirits and high-quality ingredients. Furthermore, the increasing popularity of outdoor activities and social gatherings is boosting demand for portable and convenient cocktail options.

Packaging Insights

The U.S. canned RTD cocktails market accounted for a revenue share of 80.4% in 2024. Cans are lightweight, durable, and easily recyclable, making them a preferred choice for outdoor activities, concerts, and on-the-go consumption. Their compact size also allows for easier storage and chilling, appealing to consumers with limited fridge space. Furthermore, aluminum cans offer superior protection against light and oxygen, preserving the flavor and freshness of the cocktail for a longer shelf life. The visual appeal of cans is also a factor; manufacturers are leveraging creative designs and branding to attract consumers, creating visually appealing and attention-grabbing packaging that stands out on shelves. The lower cost of aluminum compared to glass contributes to competitive pricing, making canned RTDs attractive to price-conscious consumers.

The U.S. bottled RTD cocktails market is anticipated to witness a growth rate of 15.8% from 2025 to 2030, offering perceived premiumization and a more traditional cocktail experience. Glass bottles evoke a sense of sophistication and craftsmanship, appealing to consumers who are seeking a higher-end, bar-quality cocktail. Many premium brands opt for glass bottles to differentiate themselves and convey a sense of authenticity and luxury. The transparency of the glass allows consumers to see the color and clarity of the cocktail, enhancing the visual appeal and perceived quality of the product. While bottles may be less portable than cans, they remain a popular choice for at-home consumption, dinner parties, and gifting occasions, appealing to consumers who prioritize the aesthetic and sensory experience of enjoying a cocktail.

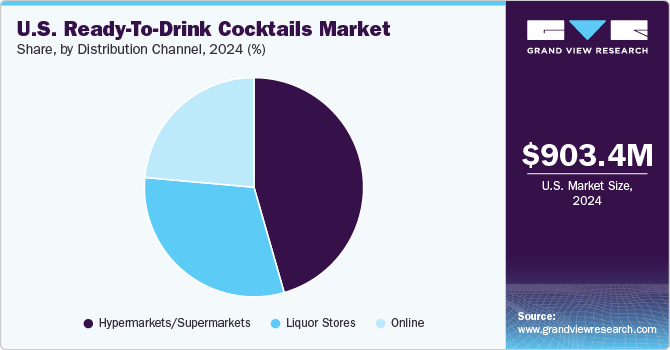

Distribution Channel Insights

The sales of ready-to-drink cocktails through hypermarkets/supermarket channels accounted for a revenue share of 45.6% in 2024. Hypermarkets and supermarkets are pivotal channels for RTD cocktail distribution, leveraging their wide reach and established customer base. These retailers offer a convenient one-stop shopping experience, allowing consumers to purchase RTDs alongside their regular groceries and household items. The availability of RTDs in supermarkets is particularly appealing for planned purchases and social gatherings, where consumers are looking for convenient beverage options for a group. Strategic placement within the store, such as near the beer and wine sections or in dedicated RTD displays, can significantly impact sales. Furthermore, promotional activities like in-store sampling, discounts, and bundle deals drive trial and repeat purchases.

The online segment of the U.S. ready-to-drink cocktails industry is estimated to grow at a CAGR of 17.5% from 2025 to 2030, offering consumers unparalleled convenience, selection, and access. Direct-to-consumer (DTC) sales are witnessing significant growth, driven by factors like ease of browsing, personalized recommendations, and home delivery. Online platforms provide a valuable opportunity for brands, especially smaller and craft producers, to reach a wider audience beyond their immediate geographic area. Moreover, some consumers appreciate the discrete shopping experience that many online retailers provide, allowing them to easily browse and purchase products at their leisure. Besides, online retailers often offer unique product bundles, subscription services, and personalized recommendations, creating a more tailored shopping experience.

Key U.S. Ready-To-Drink Cocktails Company Insights

Key companies operating in the U.S. ready-to-drink cocktails industry including Ranch Rider Spirits Co., House of Delola, LLC, Diageo plc, Brown-Forman, Bacardi Limited, Asahi Group Holdings, Ltd., Pernod Ricard, Halewood Wines & Spirits, White Claw, Suntory Holdings Limited, High Noon Spirits Company and Anheuser-Busch InBev hold significant positions in the U.S. RTD cocktails market, through their established distribution networks, strong brand recognition, and diversified product portfolios. These companies leverage their existing resources to launch innovative RTD variations of classic cocktails, experiment with unique flavor combinations, and cater to specific consumer preferences, such as low-calorie or organic options.

Strategic activities like new product launches, mergers, acquisitions, and partnerships further shape the competitive landscape. Major players continuously innovate to stay ahead of evolving consumer trends, often focusing on sustainable packaging and collaborations with celebrity endorsements. For example, acquisitions of smaller, innovative RTD brands allow larger companies to quickly tap into emerging market segments. Partnerships with established beverage companies or retailers enable broader distribution reach and increased market penetration. These strategies are crucial for expanding market share, optimizing production capabilities, and ultimately, capturing a larger slice of the rapidly growing U.S. ready-to-drink cocktails industry.

Key U.S. Ready-To-Drink Cocktails Companies:

- Ranch Rider Spirits Co.

- House of Delola, LLC

- Diageo plc

- Brown-Forman

- Bacardi Limited

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Halewood Wines & Spirits

- White Claw

- Suntory Holdings Limited

- High Noon Spirits Company

- Anheuser-Busch InBev

Recent Developments

-

In September 2024, Molson Coors made a significant move towards expanding its presence in the burgeoning non-alcoholic beverage market by announcing a strategic partnership with Naked Life, an Australian brand specializing in ready-to-drink (RTD) non-alcoholic cocktails. This collaboration aims to introduce Naked Life's innovative canned cocktails to the U.S. market, allowing Molson Coors to tap into the increasing demand for sophisticated, alcohol-free alternatives.

-

In September 2024, Bacardi Limited announced the form of a strategic partnership with The Coca-Cola Company to launch BACARDÍ rum and Coca-Cola as a ready-to-drink (RTD) cocktail, signaling a strategic move to capitalize on the burgeoning RTD market and leverage the iconic brand recognition of both powerhouse companies. This collaboration aims to provide consumers with a convenient and consistently high-quality version of a classic cocktail. The initial launch targeting select European markets and Mexico in 2025 indicates a phased rollout, allowing for market testing, refinement of the product based on consumer feedback, and optimization of supply chain logistics before a wider global expansion.

U.S. Ready-To-Drink Cocktails Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.03 billion

Revenue forecast in 2030

USD 2.11 billion

Growth rate

CAGR of 15.3% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Quantitative units

Volume in thousand 9-liter cases and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, distribution channel

Key companies profiled

Ranch Rider Spirits Co.; House of Delola, LLC; Diageo plc; Brown-Forman; Bacardi Limited; Asahi Group Holdings, Ltd.; Pernod Ricard; Halewood Wines & Spirits; White Claw; Suntory Holdings Limited; High Noon Spirits Company; and Anheuser-Busch InBev

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Ready-To-Drink Cocktails Market Report Segmentation

This report forecasts volume and revenue growth on the country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ready-to-drink cocktails market report based on type, packaging, and distribution channel:

-

Type Outlook (Volume, Thousand 9-Liter Cases; Revenue, USD Million, 2018 - 2030)

-

Malt-based

-

Spirit-based

-

Wine-based

-

-

Packaging Outlook (Volume, Thousand 9-Liter Cases; Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Volume, Thousand 9-Liter Cases; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Online

-

Liquor Stores

-

Frequently Asked Questions About This Report

b. The U.S. ready-to-drink cocktails market size was estimated at USD 903.4 million in 2024 and is expected to reach USD 1.03 billion in 2025.

b. The U.S. ready-to-drink cocktails market is expected to grow at a compound annual growth rate of 15.4% from 2025 to 2030 to reach USD 2.11 billion by 2030.

b. The U.S. malt-based RTD cocktails market accounted for a revenue share of 82.5% in 2024, driven by consumer demand for convenient and sessionable alcoholic beverages. A key trend is the focus on lower alcohol content (ABV) options that appeal to health-conscious consumers and those seeking a lighter drinking experience.

b. Some of the key market players in the U.S. ready-to-drink cocktails market are Ranch Rider Spirits Co., House of Delola, LLC, Diageo plc, Brown-Forman, Bacardi Limited, Asahi Group Holdings, Ltd., Pernod Ricard, Halewood Wines & Spirits, White Claw, Suntory Holdings Limited, High Noon Spirits Company and Anheuser-Busch InBev.

b. A key trend is the increasing demand for convenience and portability. Consumers, especially millennials and Gen Z, are drawn to RTDs as an easy-to-enjoy option for social gatherings, outdoor activities, and at-home consumption. This convenience factor, coupled with the perception that RTDs offer a consistent and pre-mixed cocktail experience, is fueling a shift away from traditional mixing and towards ready-to-enjoy alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.