- Home

- »

- Advanced Interior Materials

- »

-

U.S. Recreational Vehicle Awnings Market, Industry Report, 2019-2025GVR Report cover

![U.S. Recreational Vehicle (RV) Awnings Market Size, Share & Trends Report]()

U.S. Recreational Vehicle (RV) Awnings Market Size, Share & Trends Analysis Report By Product (Electric, Manual), Distribution Analysis, Competitive Landscape, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-2-68038-770-4

- Number of Report Pages: 62

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2018 - 2025

- Industry: Advanced Materials

Industry Insights

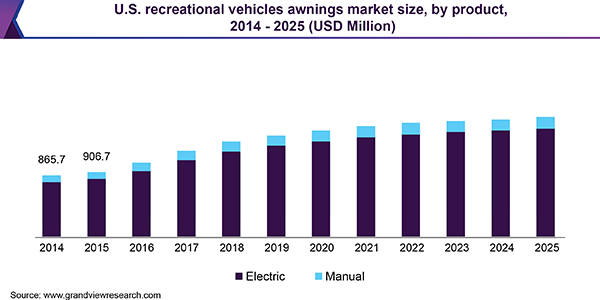

The U.S. recreational vehicle awnings market size was estimated at USD 1.20 billion in 2017 and is expected to register a CAGR of 4.2% from 2018 to 2025. Increasing demand for and sale of the product on account of the rising affinity of U.S. consumers for outdoor recreational activities, including camping, is expected to boost market growth over the forecast period. The market has been witnessing several technological innovations pertaining to retraction and expansion mechanisms, the technology of operation, and the type of installation. Growing demand for and usage of advanced products is expected to drive the market.

Manufacturers in the U.S. operate their businesses through sales to OEMs. This supply chain results in the possibility of extensive customization of awnings pertaining to product length. It also increases the functionality of awnings through the installation of components such as speakers, LED lights, and fans in order to increase product sales.

The price of electric awnings is likely to dip on account of an increase in competition amongst manufacturers. Price reduction and discounts are key tactics adopted by manufacturers in a bid to attract consumers. Lowering product differentiation in the industry is also expected to bring the price of the product down.

The U.S. aftermarket is characterized by the presence of a number of dealers, OEMs, awnings manufacturers, and localized repair centers that are involved in the sale of components and accessories. High fabric sales increased overall market revenue.

Product distribution through dealers accounts for a significant share of the revenue earned by companies in the industry. Major manufacturers in the region operate through a network of dealers spread across the U.S. These dealers are either involved in the sales of the product to leading RV manufacturers (OEMs) or directly to consumers.

Product Insights

The U.S. recreational vehicle awnings market can be bifurcated on the basis of product into manual and electric variants. The market for manual awnings is expected to exhibit a CAGR of 3.2% from 2018 to 2025 in terms of revenue, on account of demand for low-cost products, primarily for use in lower-priced RVs. However, the growing substitution of the product with electrically operated alternatives on account of ease of usage is expected to hinder segment growth over the coming years.

The market for electric variants of the product is expected to witness substantial growth in the U.S. on account of longer operational lifetime. Demand for automated systems, coupled with improvement in retraction mechanism, is likely to drive the segment over the forecast period.

The growing establishment of RV parks and grounds have increased the affinity of consumers towards the use of recreational vehicles, which in turn, drives demand for awning installations. In addition, a rise in demand for medium-to-high priced recreational vehicles due to an increase in consumer spending is expected to promote market growth.

The surge in the introduction of advanced products in both electric and manual categories in a bid to increase sales is expected to fuel the market. In addition, ease of product customization to suit the designs and requirements of various recreational vehicles is expected to drive the market over the forecast period.

U.S. Recreational Vehicle Awnings Market Share Insights

Manufacturers operate their businesses through a number of product and technology patents and charge a premium for patented products. However, the price charged is expected to decline on account of high competition among players, coupled with the production of technologically advanced products by competitors.

Companies in the region are also involved in research and development activities pertaining to awning retraction and expansion in order to attract more consumers. In addition, major manufacturers in the region are involved in the incorporation of high technology speakers and lighting systems in awnings.

Players in the industry position their products as technologically advanced systems with improved functionalities. They project patented products and operating technologies as their unique selling point and charge high prices for such products. Price differentiation and discounts are some of the major features of the industry in the U.S.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2016

Forecast period

2018 - 2025

Market representation

Volume in Thousand Units, Revenue in USD Million and CAGR from 2018 to 2025

Country scope

The U.S.

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at country level and provides an analysis on latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. recreational vehicle (RV) awnings market report on the basis of product:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2014 - 2025)

-

Electric

-

Manual

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."