- Home

- »

- Electronic & Electrical

- »

-

U.S. Residential Washing Machine Market Size Report, 2030GVR Report cover

![U.S. Residential Washing Machine Market Size, Share & Trends Report]()

U.S. Residential Washing Machine Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Fully Automatic, Semi-automatic), By Capacity, By Technology (Top Load, Front Load), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-057-5

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

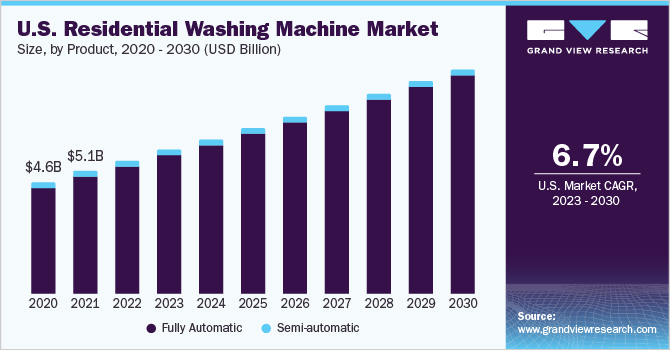

The U.S. residential washing machine market size was estimated at a value of USD 5,504.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. The growing number of households in the U.S. significantly contributes to the rising demand for residential washing machines in the country. According to estimates released by the U.S. Census Bureau and the Department of Housing and Urban Development, the sales of new single‐family houses in August 2022 were at a seasonally adjusted annual rate of 685,000, 28.8% above the revised rate of 532,000 in July 2022.

The introduction of innovative technologies has changed the consumer perception of home appliances; these machines are no longer just utility products but a modern-day necessity. The washing machine is one of the most prevalent home appliances in every household due to increasingly hectic work lives. This shift in consumer preferences is expected to drive product demand in the coming years.

In July 2022, Samsung Electronics Co. Ltd. announced the expansion of its bespoke lineup with new AI-powered washers and dryers in the U.S. The Samsung Bespoke AI Laundry pair combines design-forward innovation with intelligent washing capabilities to fit consumers’ styles and simplify their cleaning routines.

Product Insights

The full automatic segment dominated the market with a share of over 95% in 2022 and is expected to register a CAGR of 6.9% during the forecast period. The demand for fully automatic washing machines is expected to grow in the U.S. during the forecast period. A fully automatic washing machine allows users to select programs and reduce manpower and supervision. Lifestyle changes, hectic routines, and urbanization coupled with technological advancements have increased the need to save time while washing clothes, an attribute provided by fully automatic machines.

The market is expected to maintain its upward momentum due to strategic initiatives in product development and mergers and acquisitions. For instance, in December 2021, Whirlpool launched its product Whirlpool top load washer with the industry’s first 2-in-1 removable agitator. It is designed to give consumers the flexibility to customize their washing machines to meet their needs and provide the best care for their clothes. The smart washing machine also can be connected to the Whirlpool App to streamline laundry routines.

Similarly, in 2021, Miele launched the newly updated W1 washing machine and T1 dryers. The washing machine provides ultimate cleaning performance, fabric care, and convenience to use for consumers. The product has upgraded with Wi-Fi access and can be connected to the Miele Mobile app to allow users to monitor and control their machines on smartphones.

Technology Insights

The top-load segment held the largest share of 54.14% in 2022. Top-load washing machines have gained popularity among U.S.-based consumers, owing to their low cost and ease of usage as compared to front-load washing machines. Moreover, these washing machines have vertical gaskets and dryers that help excess water evaporate, which reduces the chances of mold formation or mildew around the edge of the gasket. This aspect makes top-load washers generate more sales in the country.

Additionally, older people who have chronic back pains and joint issues prefer the ease of usage of household devices. Top load washers are ideal for clothes loading and unloading without having to bend and therefore are suitable for people of specific age categories. In February 2022, researchers from Brigham and Women's Hospital and Harvard Medical School examined the 2019 National Health Interview Survey and discovered that one in every five Americans (20.5%) reported experiencing chronic back pain in the U.S.

Distribution Channel Insights

The offline segment held the largest revenue share of 63.60% in 2022. Consumers in the U.S. primarily look for product life cycle and price/value factor while purchasing a washing machine or a consumer appliance and find retail shops the most convenient place to try and check products and accordingly make a buying decision. In December 2021, Whirlpool Corporation announced the expansion of top-load washing machines with 2-in-1 removable agitators to major retailers in the U.S. and across the globe. The company focuses on targeting consumers and providing them with various options for choosing upgraded products in the top-load washers category.

The online segment is expected to grow at the fastest CAGR of 9.5% during the forecast period. Many leading companies are entering the e-commerce marketplace to increase their customer base, streamline their revenues, and decrease operational costs. For example, Whirlpool Corporation, Panasonic Corporation, and General Electric have a significant online and offline presence worldwide and are the leading manufacturers of washing machines and other electronic products.

Capacity Insights

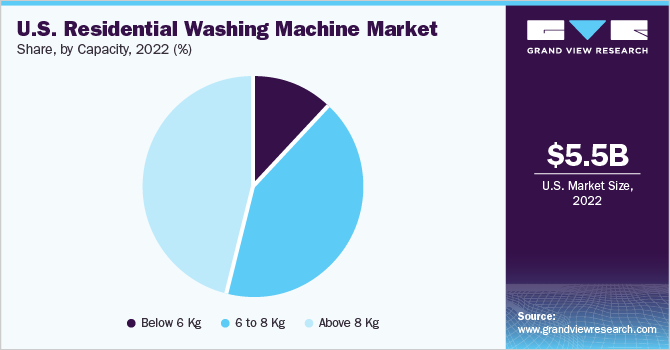

The above 8 kg segment dominated the market with a share of over 45% in 2022. The demand for the above 8 kg washing machine is expected to grow in the U.S. Households with more than eight people and frequent laundry cleaning prefer the above 8kg washing machine. Large families require the above 8kg capacity washing machines. Players such as Samsung, LG, and Haier have launched dual load/hybrid washing machines to enable two washes in a single machine. Usually, dual washing machines come in capacities of 10Kgs and above.

The 6kg to 8 kg segment is expected to grow at a CAGR of 6.9% over the forecast period from 2023 to 2030. The demand for 6kg to 8kg washing machines is growing in the U.S. Post-COVID trends such as families living together, work-from-home culture, technological upgrades, and a focus on hygiene are expected to fuel the market growth. In addition, the 6kg to 8kg machines have better efficiency in terms of power and water usage.

Higher-capacity washing machines have more intuitive features such as AI and IoT. For instance, in January 2022, LG launched a new FX washer and dryer with a dual heat pump dryer. The new FX laundry pair delivers customized performance that can sense load size, fabric type, and level of soiling and then automatically adds the recommended amount of detergent and adjusts the wash cycle for optimized cleaning.

Key Companies & Market Share Insights

Whirlpool Corporation; Samsung Electronics Co. Ltd.; LG Electronics Inc.; and GE Appliances are the leading manufacturers. The large players are also setting the trend of acquiring regional brands that serve multiple states. Players are recognizing the importance and dominance of regional brands, not just in terms of scaling their businesses but also in terms of the positive impact of consistent service on customers. Some prominent players in the U.S. residential washing machine market include:

-

Whirlpool Corporation

-

Samsung Electronics Co. Ltd.

-

LG Electronics Inc.

-

AB Electrolux

-

GE Appliances

-

BSH Hausgeräte GmbH

-

IFB Industries Ltd.

-

Panasonic Corporation

-

Midea Group Co. Ltd.

-

Hitachi, Ltd.

U.S. Residential Washing Machine Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 9,246.5 million

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, capacity, technology, distribution channel

Regional scope

United States

Key companies profiled

Whirlpool Corporation; Samsung Electronics Co. Ltd.; LG Electronics Inc.; AB Electrolux; GE Appliances; BSH Hausgeräte GmbH; IFB Industries Ltd.; Panasonic Corporation; Midea Group Co. Ltd.;

Hitachi, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Residential Washing Machine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. residential washing machine market report based on product, capacity, technology, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Fully Automatic

-

Semi-automatic

-

-

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 6 Kg

-

6 Kg to 8 Kg

-

Above 8 Kg

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Top Load

-

Front Load

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. residential washing machine market size was estimated at USD 5,504.0 million in 2022 and is expected to reach USD 5,938.2 million in 2023.

b. The U.S. residential washing machine market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 9,246.5 million in 2030.

b. The fully automatic segment dominated the market with a share of 95.8% in 2022. This is attributed to their adoption as fully automatic washing machine allows users to select programs and reduce manpower and supervision.

b. Some of the key players operating in the U.S. residential washing machine market include Whirlpool Corporation, Samsung Electronics Co. Ltd., LG Electronics Inc., AB Electrolux, GE Appliances, BSH Hausgeräte GmbH, IFB Industries Ltd., Panasonic Corporation, Midea Group Co. Ltd., Hitachi, Ltd.

b. The growing number of households in the U.S. significantly contributes to the rising demand for residential washing machines in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.