- Home

- »

- Healthcare IT

- »

-

U.S. Retail Clinics Market Size, Industry Research Report, 2014-2025GVR Report cover

![U.S. Retail Clinics Market Size, Share & Trends Report]()

U.S. Retail Clinics Market Size, Share & Trends Analysis Report By Ownership Type (Retail-Owned, Hospital-Owned), Competitive Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-615-8

- Number of Pages: 45

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Industry Insights

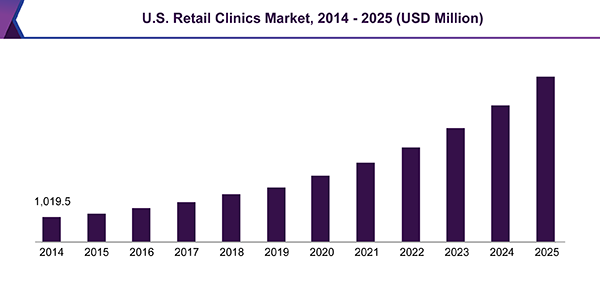

The U.S. retail clinics market size was valued at USD 1.4 billion in 2016 and is projected to grow at a CAGR of 20% over the forecast period. Retail clinics, also termed as “walk-in medical facilities”, "retail-based clinics", or "convenient care clinics”, offer healthcare services in retail outlets, such as supermarkets & department stores. These act as a substitute for traditional primary care.

These walk-in medical facilities are easily accessible as they are conveniently located and the cost of services is usually lower as compared to an emergency department. They are connected to legacy healthcare providers such as physicians and hospitals that provide them with trained staff & personnel who can operate in any clinical setting. Besides, they maintain patient records in an electronic format and assist in data sharing.

The growth of the market can be attributed to various factors such as their affordable prices, ease of inconvenience & accessibility, and the ability to expand healthcare services while containing costs. However, perception about the quality of care provided in these settings is expected to hinder growth.

Ownership Insights

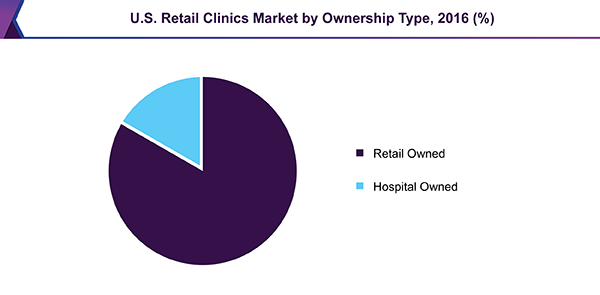

Based on ownership, the market is segmented into hospital-owned and retail clinic-owned. Many retail clinic owners have transferred ownership and management of these settings to hospitals or healthcare systems. This is a strategy employed by the owners, wherein they lease space to the hospitals to manage their facilities by utilizing their staff. This helps retailers improve their brand visibility and benefits the health system, which results in an increased number of referrals.

For instance, Walgreens Boots has shifted ownership & management of approximately 56 clinics operating in Chicago, to Advocate Health Care, which was rebranded as “Advocate Clinic at Walgreens.” Partnerships with hospital systems enable these settings to provide coordinated care rather than offering fragmented medical services.

However, retail-owned settings accounted for the largest share in 2016. Companies such as CVS Health, own, operate, or provide management for its MinuteClinic clinics. CVS has clinical affiliations with leading health systems such as Baptist Health System in Alabama. These health systems provide clinical support, chronic disease monitoring, wellness programs, and medication counseling to the customers of CVS.

Regional Insights

These walk-in medical facilities are witnessing exponential growth owing to the increasing utilization of accessible & non-emergency healthcare services in the region. They can help provide treatment options for some acute conditions and provide additional preventive services. Convenient location, ease in accessibility (even during late evenings & weekends), and fixed prices are the primary benefits of these settings.

Since the inception of the first retail clinic in the year 2000, the number has reached more than 2,000 in the U.S., in 2016 as they help curb issues of the increasing shortage of primary care providers, rising demand for value-based healthcare, and the emphasis to contain rising healthcare costs in the U.S.

It is a cost-saving alternative to physician offices and hospital emergency departments at a relatively lower price and reduced wait times. Furthermore, it has become easier for these settings to implement a population health management strategy due to the maintenance of patient records, which is expected to cut down costs and improve patient outcomes.

U.S. Retail Clinics Market Share Insights

The market is consolidated in nature, with a few companies currently dominating the market. The market is a characteristic of well-established players such as CVS Health, Walgreens, and Walmart, who are currently dominating the market in the U.S.

Some of the major players in the market are CVS Health (MinuteClinic), Walgreens, Walmart, Bellin Health (FastCare), Rediclinic (Rite Aid), Kroger (The Little Clinic), and Aurora Health Care (QuickCare Clinic). CVS’s retail clinic brand MinuteClinic has more than 1,000 retail clinics and is the largest operator in the U.S.

In June 2017, Walgreens announced a collaboration with LabCorp. According to the collaboration agreement, LabCorp will establish and operate service centers for patients located within Walgreens stores. These centers will be branded as “LabCorp at Walgreens.”

In January 2017, Kaiser Permanente launched its brand of convenient care clinic located in the Park building in Pearl District in Portland, Oregon. These settings will provide convenient medical services to members of Kaiser as well as nonmembers and will also provide services for minor health issues and routine everyday care such as flu shots, and health specialist consultations using phone and video. They will operate from 9 a.m. to 7 p.m during the weekdays and will function between 11 a.m. and 4 p.m. during the weekends.

Report Scope

Attribute

Details

The base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Country scope

The U.S.

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the U.S. retail clinics market based on ownership type:

-

Ownership Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Retail-Owned

-

Hospital-Owned

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."