- Home

- »

- Healthcare IT

- »

-

U.S. Revenue Cycle Management for Oncology And Urology Market Report, 2030GVR Report cover

![U.S. Revenue Cycle Management for Oncology And Urology Market Size, Share & Trends Report]()

U.S. Revenue Cycle Management for Oncology And Urology Market Size, Share & Trends Analysis Report By Sourcing (In-house, External RCM Apps/ Software, Outsourced RCM Services), By End Use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-999-5

- Number of Report Pages: 68

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

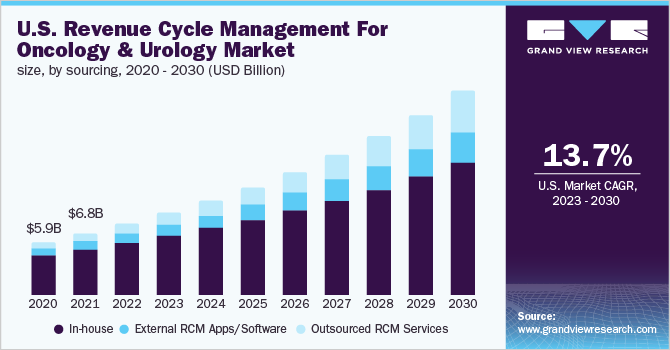

The U.S. revenue cycle management for oncology and urology market size was valued at USD 7.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 13.7% from 2023 to 2030. Growing instances of RCM outsourcing by healthcare facilities, technological advancements, and growing awareness about software among healthcare professionals are expected to contribute to the growth of the market during the forecast period.

Revenue Cycle Management (RCM) includes a combination of third-party payers, payment models, guidelines, and codes. The market is estimated to witness considerable growth during the forecast period owing to efforts to increase the adoption of Electronic Health Records (EHRs) by healthcare delivery networks are projected to drive the RCM market. Moreover, reducing healthcare expenditure, emphasis on providing value-based care & technological advancements, and outsourcing health information technology services are the major factors boosting overall growth. Stage three of Medicare and Medicaid EHR Incentive Programs focus on improving the use of Certified EHR Technology (CEHRT) to enhance health outcomes. This is likely to drive the demand for RCM systems, which can be integrated with EHR systems to streamline workflow and curb rising healthcare costs.

Moreover, the market is also anticipated to witness considerable growth due to the increasing adoption of mHealth applications which help patients to track their health condition with the help of mobile technology such as wearables and health-tracking applications. The rising penetration of the internet and smartphones in the region is attributed to positively contribute to the growth of the market. For instance, 90% of physicians in the U.S. use smartphones to access patient electronic medical records and communicate with patients at work. Furthermore, most of the applications are free to use and provide benefits such as enhanced accessibility, cost reduction & communication services between remote patients and healthcare providers.

Despite several advantages, the adoption of these solutions is expected to be restrained by the shortage of skilled professionals with technical knowledge. Health Information Technology (HIT) systems deployed at healthcare facilities that are required for managing the complex functions of the software required skilled professionals and hence, the lack of professionals hampers the market growth. However, the growing adoption of technologically advanced solutions for streamlining revenue management is anticipated to reduce the hurdles and aid in the market growth over the forecast period. As per a Black Book survey, over one-third of the hospitals based in the U.S. are focusing on incorporating integrated digital health solutions comprising EHR, RCM, and practice management solutions. The survey further stated that 40% of the large-sized hospitals are devising strategies to either incorporate or replace existing platforms with integrated technologies by 2020-2021.

The COVID-19 pandemic had a positive impact on the growth of the market. Due to the sudden spike in patient volume, there was a considerable increase in healthcare expenses and medical billing complications, which directly contributed to an upsurge in the demand for outsourced RCM solutions across the U.S. Some of the challenges faced by key healthcare RCM vendors were new billing guidelines & codes laid down in response to the COVID-19 pandemic and revised ICD-10 Codes, with several other CPT & HCPCS Codes specific to COVID-19 testing being revised. The increasing demand for RCM services and systems drove market players to integrate value-added features, such as remote payer connect, coding services, audit, reporting, and analytics, to meet the growing demand.

Sourcing Insights

The in-house segment held the largest share of 72.9% in 2022. The increasing use of in-house RCM solutions to manage the financials of healthcare facilities contributed to market growth. The in-house solutions offer advantages such as flexibility over functioning, direct control of the platform, and high return on investments which increased the adoption of the in-house RCM solutions. Furthermore, the availability of players providing the solutions such as Flatiron, Connect LLC; Gentem Health, Inc., and BillingParadise has increased the demand for the solutions.

The outsourced RCM services segment is anticipated to witness lucrative growth during the forecast period due to the increased number of healthcare facilities outsourcing RCM services to the market players due to the reduced costs and higher efficiency. Moreover, the incorporation of the ICD-10 coding structure, the shortage of healthcare staff, and the growing expansion of outpatient services boosted the demand for outsourced RCM services. Furthermore, outsourcing RCM lowers staff responsibility and improves collection level & pace by decreasing denials, thereby aiding the segment growth.

End-Use Insights

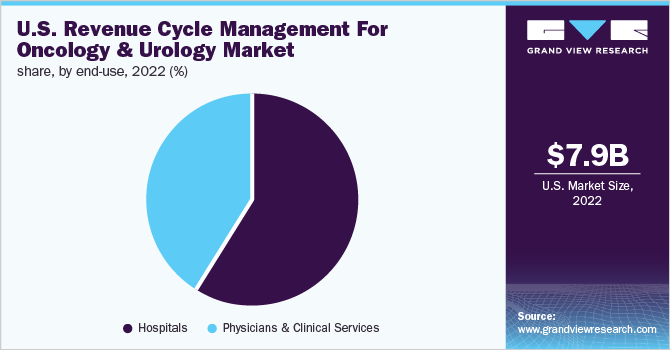

The hospitals segment accounted for the largest share of 58.6% in 2022. The RCM solutions help healthcare facilities to manage clinical and administrative functions associated with payment, claims processing, and revenue generation which is expected to contribute to the growth of the segment. Moreover, increasing collaborations of the hospitals with RCM providers in order to implement innovative solutions for effective management of reimbursements and related claims is expected to boost the adoption of RCM solutions in the facilities.

The physicians and clinical services segment is anticipated to witness the fastest growth during the forecast period owing to the increasing adoption of RCM solutions by private physicians in order to manage the medical and financial results. Moreover, the incorporation of RCM helps to reduce operational costs, manage reimbursements and boost patient and provider revenue which is expected to drive the adoption by physicians.

Key Companies & Market Share Insights

The key players in the market have been involved in mergers and acquisitions to increase their share in the market and provide innovative solutions to the end-users which is anticipated to boost the market growth during the forecast period. In June 2022, R1RCM, Inc. acquired Cloudmed, wherein both companies would focus on developing and delivering innovative revenue cycle management platforms for healthcare providers to boost digital transformation in the form of Artificial Intelligence (AI) & automation across the healthcare industry. Some of the key players operating in the U.S. revenue cycle management for oncology and urology market are:

-

United Urology Group

-

Cardinal Health

-

Flatiron

-

Oncospark.com

-

Fedora Solutions

-

BillingParadise

-

Gentem

-

Integra Connect, LLC

-

R1 RCM Inc.

U.S. Revenue Cycle Management for Oncology And Urology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.0 billion

Revenue forecast in 2030

USD 22.3 billion

Growth Rate

CAGR of 13.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sourcing, end-use

Country scope

U.S.

Key companies profiled

United Urology Group; Cardinal Health; Flatiron; Oncospark.com; Fedora Solutions; BillingParadise; Gentem; Integra Connect LLC; R1 RCM Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Revenue Cycle Management for Oncology And Urology Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the U.S. revenue cycle management for oncology and urology market report based on sourcing and end-use:

-

Sourcing Outlook (Revenue, USD Billion, 2016 - 2030)

-

In-house

-

External RCM Apps/ Software

-

Outsourced RCM Services

-

-

End-use Outlook (Revenue, USD Billion, 2016 - 2030)

-

Physicians & Clinical Services

-

Hospitals

-

Frequently Asked Questions About This Report

b. The U.S. revenue cycle management for oncology and urology market size was valued at USD 7.9 billion in 2022 and is expected to reach USD 9.0 billion in 2023

b. The U.S. Revenue Cycle Management for Oncology and Urology market is expected to grow at a compound annual growth rate of 13.7% from 2022 to 2030 to reach USD 22.3 billion by 2030.

b. The in-house segment held the largest share of 72.9% in 2022. Increasing use of in-house RCM solutions to manage the financials of the healthcare facilities contributed to the market growth.

b. Some of the key platers operating in the market are United Urology Group, Cardinal Health, Flatiron, Oncospark.com, Fedora Solutions, BillingParadise, Gentem, Integra Connect, LLC, R1 RCM Inc.

b. Growing instances of RCM outsourcing by healthcare facilities, technological advancements and growing awareness about the software among the healthcare professionals are some of the key factors driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."