- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Rigid Thermoform Plastic Packaging Market Report, 2030GVR Report cover

![U.S. Rigid Thermoform Plastic Packaging Market Size, Share & Trends Report]()

U.S. Rigid Thermoform Plastic Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PET, PVC, PS, PP, PE), By Product (Blister Pack, Clamshells, Trays & Lids), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-908-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

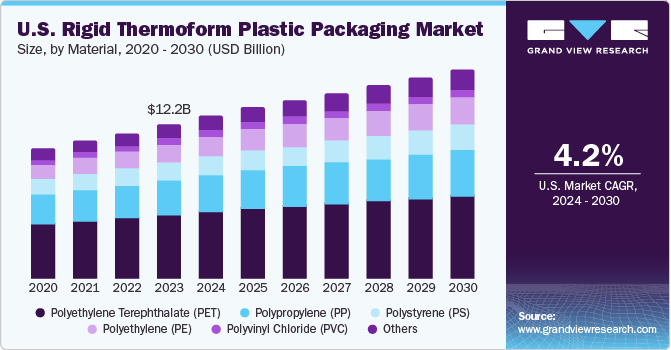

The U.S. rigid thermoform plastic packaging market size was valued at USD 12.2 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The market growth is attributed to the rising utility of plastics in many industries across the region; however, rigid thermoform packaging is versatile, durable, strong, and tamper-resistant, comprising excellent physical and mechanical properties implemented for a wide range of end-use applications. Moreover, the growing demand for various goods in the pharmaceutical sector, consumer goods packaging, personal care & cosmetics, and the increasing adoption in manufacturing of electronic goods such as vehicle batteries, headphones, and mobile components are contributing factors to market expansion of rigid thermoform plastic packaging.

In addition, the significant properties of rigid thermoform plastic packaging make it ideal for several applications in different industries, and it continues to evolve in the modern industrial landscape with innovative solutions. Rigid thermoform plastic materials are affordable packaging options for businesses, are lightweight and require lower transportation costs than any other material. In the U.S., rigid thermoform plastic packaging is utilized for many companies, including food, electronics, toys, personal care & cosmetics items, tools and components of manufacturing industries, covering premium or expensive products, pharmaceuticals, and much more.

However, industries aim to ensure product safety and a growing preference for sustainable packaging alternatives with extended shelf life, as rigid thermoform plastics could be recycled, making them more sustainable than flexible packaging. Stimulates the market in the country. It helps the healthcare industry protect medicines from impurities and externalities for medical kits, specialty food products, electronic & electrical items, and other products. Government regulations affect the use of plastic in the region, with variations in raw material prices influencing the shift towards bio-based plastic packaging options for sustainability in the U.S., which is anticipated to propel the market of rigid thermoform plastic packaging.

Material Insights

Polyethylene terephthalate (PET) dominated the market and accounted for the largest revenue share of 41.3% in 2023. Polyethylene terephthalate is in huge demand in the packaging industry, dominating the bottle market for beverages and plastic consumption in the packaging industry. Moreover, the development of technology is aligned with the increasing demand for consumer electronics products, such as smart TVs, refrigerators, air conditioners, and other products. In addition, the rise of electronic technological innovation is driving the demand for newer electronic products. Furthermore, the growing implementation of high-quality packaging in the medical and food & beverage industries boosts product adoption. Hence, the ongoing research & development practices and plastic advancements propel the rigid thermoform plastic market growth throughout the forecast period.

Polyethylene (PE) is expected to grow at a CAGR of 5.8% over the forecast period. This growth is attributed to the high demand for lightweight plastic from the automotive, consumer goods, and electronics sectors. In addition, some emerging polypropylene applications include medicine bottles and syrup bottles, as well as bottle caps and closures, as chemical resistance, high stiffness, and low-density qualities make polypropylene a suitable material for several packaging applications. The market for rigid thermoform plastic packaging thus continues to grow over the forecast period due to the increasing demand for polypropylene material.

Product Insights

Containers led the market and accounted for the largest revenue share of 32.5% in 2023, primarily due to their widespread use in the food and beverage sector. Companies respond to fluctuating consumer demands by developing innovative and sustainable packaging solutions. The demand for injection molding machines for various packaging components, including food and beverage containers, is increasing. Rigid thermoform plastic containers are gaining popularity for their durability and protective qualities, particularly in healthcare, where they safeguard product integrity against external contaminants.

Blister packs are projected to grow at a compound annual growth rate of 5.1% during the forecast period. Various blister packs, such as face seals and trap blisters, are commonly used for single-dose medications. Their appeal lies in their cost-effectiveness, durability, and transparency, making them ideal for pharmaceuticals, cosmetics, and small consumer goods. The pharmaceutical industry extensively utilizes blister packs, driven by their practicality and the increasing demand for efficient packaging solutions.

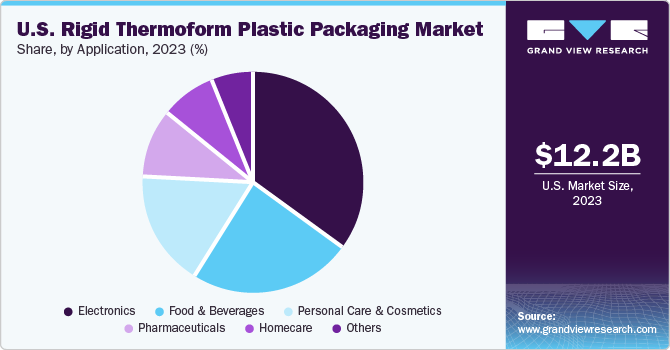

Application Insights

Electronics led the market and accounted for the largest revenue share of 34.7% in 2023 attributed to the widespread use of rigid thermoform plastics in packaging electronic components, devices, and accessories. The electronics industry's requirement for high-precision, damage-resistant, and electrostatic discharge (ESD) protective packaging solutions has driven the adoption of rigid thermoform plastics. The growing demand for consumer electronics, such as smartphones, tablets, and laptops, which rely heavily on rigid thermoform plastics for packaging and protection, has fueled segment growth.

Personal care & cosmetics is expected to grow at a CAGR of 5.2% over the forecast period. This is due to the increasing demand for premium and innovative packaging solutions in the personal care and cosmetics industry, driven by evolving consumer preferences and trends. The segment's high growth rate can be linked to the rising popularity of skincare and beauty products, which require high-quality, visually appealing, and functional packaging. Rigid thermoform plastics have become the material of choice for packaging a wide range of personal care and cosmetic products, including creams, serums, and fragrances, due to their excellent protection, aesthetics, and convenience. Furthermore, the growing focus on sustainability and eco-friendliness in the personal care and cosmetics industry has driven the adoption of rigid thermoform plastics, which offer a more environmentally friendly alternative to traditional packaging materials.

U.S. Rigid Thermoform Plastic Packaging Market Trends

The growth of the U.S. rigid thermoform plastic packaging market is driven by its strong construction sector, which is used for pipes and roofing materials, and the automotive industry, which demands impact modifiers. Government regulations promoting natural-based plastics enhance performance stability and environmental sustainability. The rise of single-serve and on-the-go food products also boosts demand for clamshells, trays, and containers. Rigid thermoform packaging is durable, resilient, and tamper-resistant, protecting products during transit and offering various seal options to extend shelf life or allow easy access. Furthermore, key demand drivers include the growing food and beverage industry, which benefits from secure seals and enhanced shelf life, and the medical sector, which requires compartmentalization and cleanliness.

Key U.S. Rigid Thermoform Plastic Packaging Company Insights

Some of the key companies in the U.S. rigid thermoform plastic packaging market include Sonoco Products Company, Constantia Flexibles, Pactiv Evergreen Inc., D&W Fine Pack LLC, Sabert Corporation, Genpak LLC, Anchor Packaging LLC in the market focusing on development & to gain a competitive edge in the market.

-

Constantia Flexibles provides flexible packaging solutions to food & beverage, pharmaceuticals, and other industries. The company manufactures a broad range of plastic, metal, and paper packaging products, including aluminum foils and container systems, pouches, bags, lidding films & laminates, blister packaging, cup sealing systems, capsule systems, among others.

-

Anchor Packaging LLC manufactures and distributes rigid packaging products completely in the U.S., making containers using polypropylene (PP) and PET, the most recycled plastic for food industries such as packaging materials, food containers, reusable containers, foam alternatives mainly for non-cyclical food service, food manufacturing markets, and retail supermarkets.

Key U.S. Rigid Thermoform Plastic Packaging Companies:

- Sonoco Products Company

- Sealed Air

- Pactiv Evergreen Inc.

- D&W Fine Pack LLC

- Sabert Corporation

- Genpak LLC

- Anchor Packaging LLC

- Placon.

- WINPAK LTD.

- Display Pack.

- EasyPak.

- Huhtamaki Group

- Amcor plc

- Constantia Flexibles

Recent Developments

-

In May 2024, Anchor Packaging LLC completed a collaboration with Cyclyx, a post-use plastic innovation company. This collaboration aims to build recycling ways and change the possibilities for recycling food-grade plastic. Cyclyx will further assist Anchor in reaching a wide range of clients across the value chain and in securing the increased volume of #5 PP material.

-

In September 2023, Pactive Evergreen Inc. had a collaboration with ExxonMobil. This collaboration was about providing certified circular packaging solutions to prominent food brands and food service providers by fulfilling all regulatory requirements for food contact applications with advanced products.

U.S. Rigid Thermoform Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.9 billion

Revenue forecast in 2030

USD 16.6 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America

Country scope

U.S.

Key companies profiled

Sonoco Products Company; Sealed Air; Pactiv Evergreen Inc.; D&W Fine Pack LLC; Sabert Corporation; Genpak LLC; Anchor Packaging LLC; Placon.; WINPAK LTD.; Display Pack.; EasyPak.; Huhtamaki Group; Amcor plc; Constantia Flexibles

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rigid Thermoform Plastic Packaging Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. rigid thermoform plastic packaging market report based on material, product, and application.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene Terephthalate (PET)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Blister Pack

-

Clamshells

-

Trays & Lids

-

Containers

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Electronics

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Homecare

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.