- Home

- »

- Homecare & Decor

- »

-

U.S. River Cruise Market Size, Share & Trends Report, 2030GVR Report cover

![U.S. River Cruise Market Size, Share & Trends Report]()

U.S. River Cruise Market (2025 - 2030) Size, Share & Trends Analysis Report By Region (Mississippi, Colombia & Snake River, Alaska, Great Lakes), And Segment Forecasts

- Report ID: GVR-4-68040-055-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. River Cruise Market Size & Trends

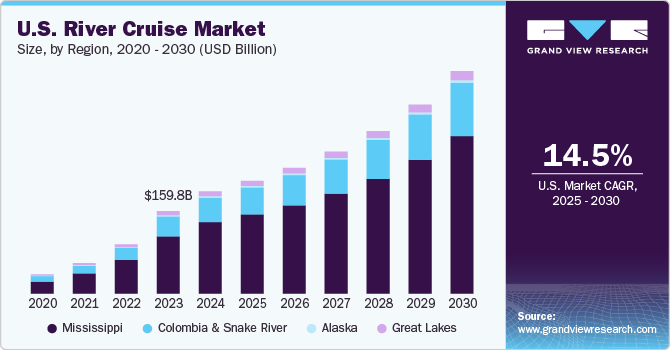

The U.S. river cruise market size was estimated at USD 197.9 million in 2024 and is projected to grow at a CAGR of 14.5% from 2025 to 2030. The growing popularity of river tourism in the U.S. has spurred increased demand for river cruise services. Unlike ocean cruises, river cruises offer a distinctly different experience-characterized by smaller vessels, proximity to shorelines, and a more intimate, tailored journey. Typically, river cruises transition from one destination to the next overnight, arriving by morning to provide travelers with ample opportunity to explore new locations. However, certain itineraries also include daytime sailing, allowing guests to enjoy scenic landscapes and evolving views along the route. These unique aspects are anticipated to enhance the appeal of river cruises and attract a broader traveler base.

According to a report by the Cruise Lines International Association (CLIA), U.S. cruise passenger volume rose from 14.2 million in 2019 to 16.9 million in 2023, reflecting notable growth within the sector. This upward trend underscores a strengthening demand for cruise experiences and suggests positive momentum for the U.S. market. As passenger volume continues to expand, the market is likely to benefit from increased revenue streams, enhanced brand loyalty, and expanded route and service offerings to meet diverse traveler preferences. This growth trajectory highlights the industry’s resilience and adaptability, positioning it to capture an even broader market share in the coming years.

The rising popularity of cruise vacations can be attributed to the unique, customizable amenities they offer, making them a compelling alternative to traditional land-based vacations. Unlike typical vacation packages, which combine transportation, lodging, meals, and entertainment, cruises often provide a more cost-effective option. According to estimates from the Cruise Lines International Association (CLIA), 58.0% of international tourists are first-time cruisers-a promising indicator of future demand in the cruise industry.

In the U.S., the market is broadly divided into key regions, including the Mississippi River, Columbia & Snake Rivers, Alaska, and the Great Lakes. The Mississippi River segment leads the market, with high penetration rates and promising growth potential. The river’s appeal is bolstered by iconic ports and attractions, such as Baton Rouge’s Cajun culture, St. Louis's Gateway Arch, Vicksburg's Civil War history, Memphis's music and barbecue scene, as well as charming small towns and picturesque landscapes along the river’s course. Travelers can choose from cruises spanning the full length from New Orleans to St. Paul or Minneapolis or shorter routes covering selected sections.

Alaska and the Great Lakes, though still largely untapped, are gaining interest due to their dramatic natural beauty, including snow-capped mountains, glaciers, abundant wildlife, and rich indigenous cultures. However, Alaska’s market remains constrained by seasonality, operating primarily in the summer when conditions are favorable for tourism. Columbia and Snake Rivers are also poised for strong growth, with rising numbers of river cruise operators expected to drive demand in the coming years.

River cruising is rapidly emerging as a preferred way to explore diverse destinations, positioning it as one of the fastest-growing segments in tourism. Data from AAA Travel indicate that domestic river cruise bookings in 2022 exceeded pre-pandemic levels, rising by 25% over 2019. This trend is particularly pronounced among baby boomers, who value the ability to visit multiple locations within a single trip. River cruising, viewed as a more affordable and eco-friendly alternative to ocean cruising, is gaining traction among this demographic, which appreciates the slower pace and cultural immersion of river cruises. These factors present lucrative opportunities for river cruise operators to expand their offerings and capture a growing market.

Regional Insights

The U.S. river cruise market in the Mississippi region accounted for the largest revenue share of 69.98% in 2024. In the Mississippi region, iconic American landmarks, diverse local cultures, and famous destinations, such as St. Louis and Memphis, offer travelers a compelling and immersive journey that connects them to the region’s storied past and vibrant present. This river’s numerous accessible ports also provide flexible itinerary options, making it an attractive choice for a range of travelers seeking deeper cultural experiences.

The Colombia & Snake River region of the U.S. river cruise market is anticipated to grow at the fastest CAGR of 14.5% from 2025 to 2030. The Columbia & Snake Rivers appeal to tourists with their spectacular natural landscapes, including dramatic canyons, waterfalls, and lush vineyards, combined with historical attractions tied to the Lewis and Clark expedition. This region’s rising number of operators has enhanced the range of available itineraries and service levels, accommodating a broader spectrum of traveler preferences. Together, these factors contribute to the growing appeal of river cruises in these areas, meeting the demand for experiential travel with distinct, memorable offerings in the U.S.

The Pacific Northwest Waterways Association reports a substantial rise in demand for river cruises over the past decade, establishing the Columbia and Snake Rivers as an expanding market. In 2019 alone, over 25,000 passengers and crew visited the region, generating more than USD 15 million in economic benefits for communities along these rivers. This growth underscores the increasing impact of river cruising on the local economy and highlights the region’s appeal as a prime destination within the U.S. market.

Key U.S. River Cruise Company Insights

The U.S. market is characterized by a dynamic competitive landscape, with several established operators vying for market share across distinct regional routes. Key players differentiate themselves through varied itineraries, exclusive shore excursions, and high-quality onboard experiences tailored to cater to a discerning traveler base seeking cultural immersion and scenic exploration. Major operators are investing in fleet expansion, enhanced amenities, and sustainable practices to appeal to the growing demand for environmentally conscious travel.

Emerging operators are intensifying competition by introducing specialized, niche offerings aimed at unique traveler interests, such as culinary or historical-themed cruises. This competitive environment is driving innovation and elevating standards across the sector, with companies leveraging strategic partnerships with local businesses and cultural institutions to provide enriched, location-specific experiences. As a result, the U.S. market is poised for sustained growth, supported by a diverse array of premium and specialized cruise options.

Key U.S. River Cruise Companies:

- American Cruise Lines, Inc.

- American Queen Voyages

- Viking River Cruises

- UnCruise Adventures

- Celebrity Cruises, Inc. (Royal Caribbean Group)

- Lindblad Expeditions LLC

- Pearl Seas Cruises

- Ponant

- Hapag-Lloyd Cruises (TUI Cruises GmbH)

- Alaskan Dream Cruises

Recent Developments

-

In October 2024, American Cruise Lines, a leading riverboat and small ship operator, announced plans for two new vessels-American Maverick and American Ranger-anticipated to launch in 2026. American Cruise Lines disclosed that these 125-passenger Patriot-class ships will feature full stabilization for enhanced coastal navigation along the Eastern Seaboard. This expansion will extend the line’s itinerary offerings from Maine to Florida and increase its national fleet to 24 small ships, underscoring American Cruise Lines’ commitment to providing diverse and seamless cruising experiences across the U.S.

-

In February 2024, American Cruise Lines launched its largest-ever Mississippi River season, marking a significant milestone in its nationwide expansion. The season featured new riverboats sailing over 16 distinct itineraries throughout the region, including explorations of key tributaries such as the Tennessee, Ohio, and Cumberland Rivers. In total, the company operated 19 ships in 2024, each with a capacity of 90 to 180 passengers, offering more than 50 unique domestic itineraries across the country.

U.S. River Cruise Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 218.7 million

Revenue forecast in 2030

USD 431.1 million

Growth rate

CAGR of 14.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Region

Country scope

U.S.

Regional Scope

Mississippi; Colombia & Snake River; Alaska, and Great Lakes

Key companies profiled

American Cruise Lines, Inc.; American Queen Voyages; Viking River Cruises; UnCruise Adventures; Celebrity Cruises, Inc. (Royal Caribbean Group); Lindblad Expeditions LLC; Pearl Seas Cruises; Ponant; Hapag-Lloyd Cruises (TUI cruises GmbH); Alaskan Dream Cruises

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. River Cruise Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. river cruise market report based on the region.

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Booking

-

Online Travel Agents and Travel Agencies (OTAs)

-

Marketplace Booking

-

Frequently Asked Questions About This Report

b. The U.S. river cruise market was estimated at USD 197.9 million in 2024 and is expected to reach USD 218.7 million in 2025.

b. The U.S. river cruise market is expected to grow at a compound annual growth rate of 14.5% from 2025 to 2030 to reach USD 431.1 million by 2030.

b. Mississippi region of the U.S. dominated the U.S. river cruise market with a share of around 69.98% in 2024. The local players in the region are offering river and ocean expedition cruises with destination-focused travel experiences

b. Some of the key players operating in the U.S. river cruise market include American Cruise Lines, Inc.; American Queen Voyages; Viking River Cruises; UnCruise Adventures; Celebrity Cruises, Inc. (Royal Caribbean Group); Lindblad Expeditions LLC; Pearl Seas Cruises; Ponant; Hapag-Lloyd Cruises (TUI cruises GmbH); Alaskan Dream Cruises.

b. Key factors that are driving the U.S. river cruise market growth include the most recent cutting-edge ships are creating new technical improvements and a variety of onboard entertainment alternatives for passengers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.