- Home

- »

- Automotive & Transportation

- »

-

U.S. Rooftop Tent Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Rooftop Tent Market Size, Share & Trends Report]()

U.S. Rooftop Tent Market (2024 - 2030) Size, Share & Trends Analysis Report By Tent Type (Hard-shell, Soft-shell), By Capacity (2 Person, 3 Person), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-030-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rooftop Tent Market Size & Trends

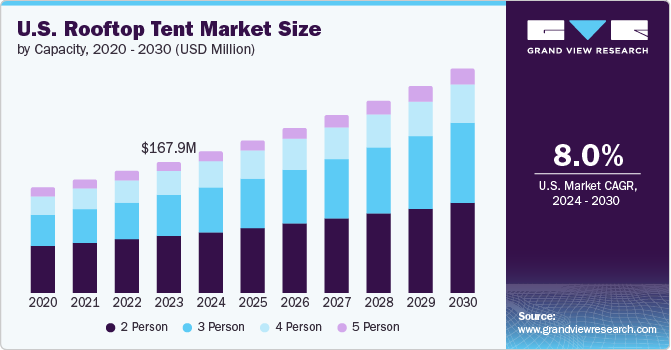

The U.S. rooftop tent market size was estimated at USD 167.88 million in 2023 and is expected to grow at a CAGR of 8.0% from 2024 to 2030. Automotive rooftop tents have grown in popularity as a low-cost alternative to RVing and as a slightly more elegant way to camp. The most appealing aspects of rooftop tents are their ease of erecting and the way they support their inhabitants off the ground. The rooftop tents are popular among over-landers and off-road enthusiasts; the tent allows 4WD'ers to discover backcountry routes that would be impassable for a motorhome or trailer while still getting a good night's sleep. The rooftop tent market in the U.S is growing as camping and traveling with own vehicles is gaining more popularity rather than going outside for holidays and staying at hotels.

Users can sleep above the car with a certain level of safety and comfort due to a rooftop tent, which is a roof-mountable attachment that frees up the inside load space. The growth of the market is driven by the growing prominence of off-road camping and trekking. The upward trend in camping is fueling the market growth. People in the U.S. are finding the benefits of spending time for outdoor and recreational activities where people carry rooftop tents of their own as it is more sanitized and secure for them. Rooftop tent facilitates people with hassle-free carrying and easy-to-install features.

Adventure tourism has grown dramatically in recent years, particularly in the U.S., benefiting product demand. Increased interest in outdoor activities drives the U.S. market and is expected to rise throughout the forecast period. Camping is usually done outside of cities where basic amenities such as internet, electricity, and other amenities are in short supply, increasing the demand for comfortable and luxury rooftop tents. Rooftop tents are safe, comfortable, dry, and easy to use. It becomes a simple task to unzip the cover, take it off, and untie the straps that hold it in place, enabling the tent to be opened quickly. Rooftop tents are fantastic for campers looking for a straightforward and cozy substitute for a standard tent.

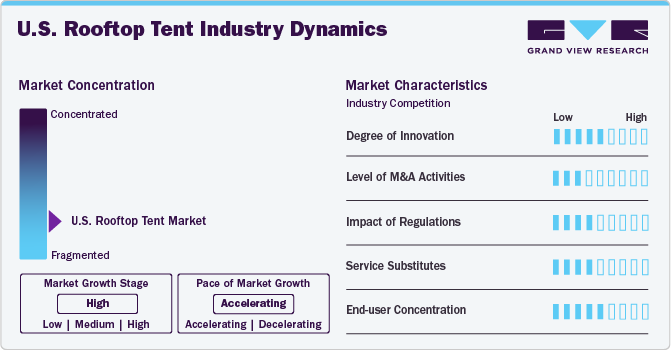

Industry Dynamics

Innovation in the U.S. rooftop tent industry is focused on enhancing the user experience rather than revolutionary changes to the core concept. We see new features like annex rooms that expand the living space, awnings that provide shade and shelter, and even hard-shell tents with better insulation for colder climates. Manufacturers are also looking at ways to improve tent materials for weight reduction and durability.

The market is still experiencing steady growth, creating opportunities for existing players to expand organically. In addition, the market encompasses a diverse range of products at various price points, which can accommodate a variety of manufacturers without significant consolidation needs.

Rooftop tents do not have many direct service substitutes. Traditional ground tents offer a more affordable entry point to camping, but require finding suitable flat ground and lack the elevated sleeping position and potential animal protection benefits of rooftop tents. Recreational Vehicles (RVs) provide a more luxurious camping experience with built-in amenities but come with a significantly higher cost, size limitations, and potentially lower fuel efficiency compared to car camping with a rooftop tent.

The rooftop tent market in the U.S. is not likely concentrated on a small user base. There is certainly overlap with off-road enthusiasts who value the all-terrain access rooftop tents. However, the market is expanding to encompass a broader audience interested in car camping adventures, including families and those seeking a more comfortable and convenient alternative to traditional ground tents. The rise of adventure van conversions and overlanding trends is also contributing to the growing popularity of rooftop tents.

Post COVID-19 Outlook

The rooftop market emerged more after the COVID-19 pandemic. During the pandemic, people were instructed to maintain social distancing. The pandemic has changed the attitude of people toward the hospitality industry for luxury. The constantly evolving hotel rules by the governments have also affected the people's mindset about their independency; therefore, the consumers have shifted their preference towards car rooftop tents, which give them freedom and a good camping experience. The main drivers of a rooftop tent are its quick setup, the ability to sleep above the ground, and the protection it provides from potential threats like animals or water.

Government rules for social distancing have boosted the market for 2- and 3-person rooftop tents. The constantly evolving hotel rules by the governments have also affected people's mindsets about their independence; therefore, consumers have shifted their preference towards car rooftop tents, which give them freedom and a good camping experience.

Tent Type Insights

Hard-shell rooftop tents dominate the market with more than 53.21% of the revenue share in 2023. Hard shell tents have upper and lower solid, rigid sections that, when the tent is closed, encase the tent walls, a full mattress, bedding, etc., between them to protect everything within (often aluminum or ABS plastic is chosen over fiberglass). The hard lid forms a roof when elevated, with a full-size bed resting in the bottom shell. Automated or gas strut systems are frequently used to assist in setup. There are two primary styles. The popup's entire top cover rises, revealing a box-shaped tent below, and the wedge, which is the top cover of the tent hinged on one end or side, unfolds to form an angled roof.

There are two distinct types of soft-shell tents. A bi-fold design is the most typical. These tents have a hinge on one side and two-floor portions that are the same size. The factor propelling the growth is Softshell rooftop tents are frequently folded, giving customers a little bit more material to work with. Some of these tents are foldable, and when they are expanded, they are larger than the car. Softshell rooftop tents typically provide more space for furniture like mattresses and more comfort, and many of them are known to accommodate 3-4 persons comfortably.

Capacity Insights

The 2-person segment dominated the market by capacity type in terms of revenue. Government rules for social distancing have boosted the market for 2- and 3-person rooftop tents. The constantly evolving hotel rules by the governments have also affected people's mindsets about their independence; therefore, consumers have shifted their preference towards car rooftop tents, which give them freedom and a good camping experience.

Moreover, 2, and 3-person tent are usually hard-shell tents; with the growing demand for hard-shell tents, the demand for smaller tents are also expected to grow. The market is also emerging due to the rise in the e-commerce industry, where people can easily choose and buy rooftop tents from Amazon, E-bay, etc., which saves the customer's time and allows them to avail of various offers and save costs.

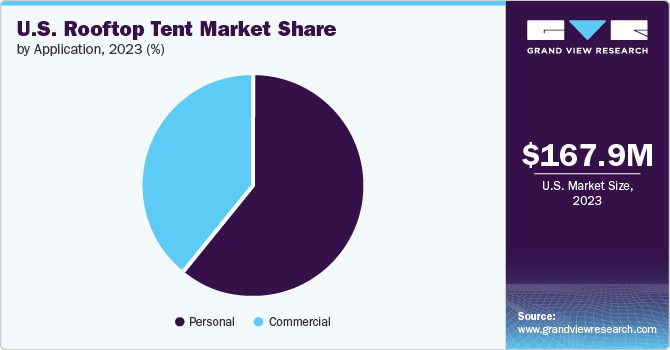

Application Insights

The personal segment dominated the market with the largest revenue share in 2023. Personal application is estimated to witness significant growth owing to the popular trend of solo traveling.

Moreover, Abercrombie & Kent USA, one of the world’s foremost luxury travel companies, reported that there is a rise of 15% in solo travelers. Moreover, the rising popularity of extreme sports and adventure tourism has propelled the demand for the commercial tent.

Key U.S. Rooftop Tent Company Insights

To have a competitive edge, market vendors concentrate on growing their clientele. As a result, leading businesses undertake a range of strategic activities, such as joint ventures, mergers and acquisitions, collaborations, and the creation of new products and technologies. Market environment is dynamic based on a detailed inspection of the significant strategic decisions taken by the leading market participants in the U.S. rooftop tent industry during the preceding four years. The key players profiled in the U.S. market are: 23Zero, Alu-Cab, Body Armor 4x4, Cascadia Vehicle Tents, Freespirit Recreation, Front Runner Outfitters, iKamper USA, Inc., Smittybilt Inc., Roofnest Ltd, Tuff Stuff Overland, Thule Group, Overland Vehicle Systems, James Baroud. The major acquisitions augmented the growth of the market. For instance, In January 2022, Gathr Outdoors, a worldwide manufacturer of sporting goods and outdoor products, announced the purchase of Cascadia Vehicle Tents. Gathr promises to provide products that meet multiple consumer needs for multiple outdoor usage occasions through this accusation.

Key U.S. Rooftop Tent Companies:

- 23Zero

- Alu-Cab

- Body Armor 4x4

- Cascadia Vehicle Tents

- Freespirit Recreation

- Front Runner Outfitters

- iKamper USA, Inc.

- Smittybilt Inc.

- Roofnest Ltd

- Tuff Stuff Overland

- Thule Group

- Overland Vehicle Systems

- James Baroud

Recent Developments

-

In February 2023, Tuff Stuff Overland unveiled its newest innovation, the Alpine Aluminum Shell Roof Top Tent. This versatile tent caters to a wider audience and is offered in 51-inch and 61-inch models to comfortably accommodate up to three people.

-

In June 2022, Thule group announced the launch of their first soft-sided rooftop tents. The rooftop tents of the Thule Approach range have a spacious, comfortable interior, a panoramic ceiling, and substantial skylights for sightseeing.

-

In June 2022, 23Zero organized the Summer Solstice Campout, the first campout at Manti-La Sal National Forest, U.S., in the Twelve Mile Flat Campground. The campout has a small selection of 23ZERO Products for Sale at The Camp Store.

U.S. Rooftop Tent Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 180.97 million

Revenue forecast in 2030

USD 286.71 million

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Tent type, capacity, application

Key companies profiled

23Zero, Alu-Cab, Body Armor 4x4, Cascadia Vehicle Tents, Freespirit Recreation, Front Runner Outfitters, iKamper USA, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rooftop Tent Market Report Segmentation

This report offers revenue & volume growth forecasts in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. rooftop tent market report based on tent type, capacity, and application.

-

Tent Type Outlook (Volume, Units; Revenue, USD Million, 2017 - 2030)

-

Hard-shell

-

Soft-shell

-

-

Capacity Outlook (Volume, Units; Revenue, USD Million, 2017 - 2030)

-

2 person

-

3 person

-

4 person

-

5 person

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2017 - 2030)

-

Personal

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. rooftop tent market size was estimated at USD 167.88 million in 2023 and is expected to reach USD 180.97 million in 2024.

b. The U.S. rooftop tent market is expected to grow at a compound annual growth rate of 8.0% from 2024 to 2030 to reach USD 286.71 million by 2030.

b. 2-person segment dominated the U.S. rooftop tent market in 2023. This is attributable to the factors including ease of transportation, less setup times and improved comfortability.

b. Some key players operating in the U.S. rooftop tent market include 23Zero, Alu-Cab, Body Armor 4x4, Cascadia Vehicle Tents, Freespirit Recreation, Front Runner Outfitters, iKamper USA, Inc.

b. Key factors that are driving the U.S. rooftop tent market growth include rising demand for adventure tourism & easy setup, and growing prominence in off-road camping and treks

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.