- Home

- »

- Electronic Devices

- »

-

U.S. Self-checkout Systems Market, Industry Report, 2030GVR Report cover

![U.S. Self-checkout Systems Market Size, Share and Trends Report]()

U.S. Self-checkout Systems Market (2025 - 2030) Size, Share and Trends Analysis Report By Component (Systems, Services), By Type (Cash-based, Cashless-based), By Application, And Segment Forecasts

- Report ID: GVR-4-68038-363-8

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Self-checkout Systems Market Trends

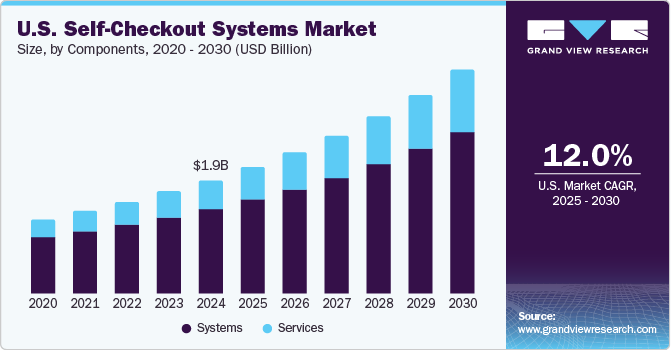

The U.S. self-checkout systems market size was valued at USD 1.91 billion in 2024 and is projected to grow at a CAGR of 12.0% from 2025 to 2030. The need for automation and efficiency in retail operations is a major factor driving market growth. Retailers are looking to simplify the checkout process and lower labor costs due to ongoing labor shortages. In addition, the shift towards cashless payments has made self-checkout systems more feasible, allowing consumers to complete transactions quickly and conveniently.

Technological advancements play a crucial role in enhancing the functionality of self-checkout systems, with innovations such as artificial intelligence and touchless payment options leading the way. For instance, Diebold Nixdorf's "Vynamic Smart Vision | Shrink Reduction" is powered by SeeChange's AI and machine learning cloud platform to help retailers easily implement advanced technologies across multiple locations. These improvements streamline the checkout process and provide consumers with a more secure and user-friendly experience. AI-driven systems can quickly identify items without the need for barcodes, significantly speeding up transactions and reducing wait times. In addition, touchless payment options cater to the increasing demand for contactless transactions, further improving customer satisfaction.

Furthermore, an increasing consumer preference for convenience drives the adoption of self-checkout systems. Shoppers appreciate the ability to control their checkout experience, allowing them to avoid long lines and complete purchases at their own pace. As more consumers seek quick and efficient shopping solutions, retailers are responding by expanding their self-checkout offerings. This trend is evident in various retail environments, from grocery stores to pharmacies, where self-checkout systems are becoming standard.

Components Insights

The systems segment dominated the market with a 74.8% revenue share in 2024. Hardware includes specialized self-checkout kiosks equipped with multi-touch screens, barcode scanners, integrated payment terminals for credit and cash transactions, and receipt printers. These components enable customers to scan items, select payment methods, and receive receipts without needing assistance from staff. Moreover, software plays a critical role, providing the necessary interface for customers to navigate the checkout process. This includes features for item recognition, price calculation, and support options for assistance.

The services segment is expected to grow at the fastest CAGR over the forecast period, reflecting the rising demand for ongoing support and maintenance of self-checkout systems. As retailers increasingly implement these technologies, they require reliable service solutions to ensure optimal performance and address any technical issues that may arise. This growing need for comprehensive service packages, including software updates and technical support, positions the services segment for significant growth within the U.S. self-checkout systems industry.

Type Insights

The cash-based segment dominated the market with the highest revenue share in 2024, driven by consumer preference for traditional payment methods among certain demographics. Many shoppers still favor cash transactions, particularly in environments where they may be making smaller purchases or prefer to use something other than digital payments. This preference compels retailers to maintain cash-based self-checkout options alongside newer technologies, ensuring they cater to a broad range of customer preferences within the U.S. self-checkout systems industry. Moreover, cash-based systems provide flexibility for consumers who may not access digital payment methods or prefer the anonymity of cash transactions.

The cashless segment is anticipated to grow at the fastest CAGR over the forecast period as more consumers embrace digital payment methods. The increasing prevalence of mobile wallets and contactless payment options has shifted consumer behavior toward cashless transactions, especially among younger demographics prioritizing convenience and speed. Retailers are responding by integrating cashless self-checkout solutions that facilitate seamless transactions, further driving this segment's expansion within the U.S. self-checkout systems industry. The rise of technologies such as Apple Pay and Google Wallet has made it easier for consumers to make quick payments without physical cash, improving their overall shopping experience and encouraging retailers to adopt these advanced systems.

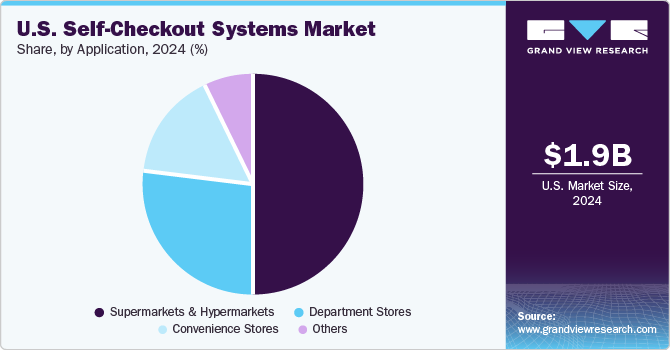

Application Insights

The supermarkets & hypermarkets segment dominated the market with the highest revenue share in 2024 due to its expansive customer base and high transaction volumes. These retail formats benefit significantly from self-checkout systems as they can accommodate large numbers of shoppers while reducing wait times at checkout. The ability to efficiently manage high traffic during peak shopping hours makes self-checkout systems beneficial for supermarkets & hypermarkets looking to enhance customer satisfaction. For instance, Kroger has introduced smart cart technology to enhance the shopping experience for its customers. These digital carts, known as KroGO, are equipped with AI and computer vision capabilities that allow shoppers to scan items as they shop and pay directly through the cart, eliminating the need to wait in line at checkout.

The convenience stores segment is expected to grow at the fastest CAGR over the forecast period. As consumer lifestyles become increasingly fast-paced, convenience stores adopt self-checkout systems that allow quick transactions. The demand for rapid service in these settings aligns perfectly with self-checkout technology, enabling customers to make purchases swiftly. This trend is likely to continue as more convenience stores recognize the benefits of adopting self-checkout solutions to meet evolving consumer expectations within the U.S. self-checkout systems industry. The ability to offer quick service enhances customer satisfaction and helps convenience stores maintain competitiveness in a crowded market where speed and efficiency are paramount.

Key U.S. Self-Checkout Systems Company Insights

The U.S. self-checkout systems market features several notable companies. NCR Voyix Corporation offers user-friendly solutions that enhance customer experience and streamline transactions. Diebold Nixdorf, Incorporated provides AI-powered systems for improved item recognition and security. Fujitsu combines robust hardware with advanced software to support various payment methods. Toshiba Global Commerce Solutions focuses on adaptability, equipping its systems with customizable interfaces and touchless payment options to meet evolving retail demands within the U.S. self-checkout systems industry.

-

Fujitsu Frontech North America Inc. specializes in innovative technology solutions for the retail sector, particularly self-checkout systems. Fujitsu is known for its RFID-enabled self-checkout solutions, which significantly reduce checkout time and enhance customer convenience. Fujitsu's U-SCAN software technology is hardware-agnostic, allowing it to integrate seamlessly with various self-checkout hardware, including NCR. This flexibility enables retailers to optimize their operations and improve the shopping experience by offering faster, more secure transactions while maintaining effective inventory management.

-

Toshiba Global Commerce Solutions provides comprehensive self-checkout solutions to enhance retail efficiency and customer satisfaction. Their systems are equipped with advanced features such as customizable interfaces and touchless payment options, catering to the diverse needs of modern consumers. Toshiba focuses on creating flexible solutions that allow retailers to adapt their self-checkout offerings based on customer preferences and store layouts. By integrating innovative technology with user-friendly designs, Toshiba aims to streamline the checkout process and support retailers in delivering a seamless shopping experience.

Key U.S. Self-Checkout Systems Companies:

- NCR Voyix Corporation

- Diebold Nixdorf, Incorporated

- Fujitsu

- Gilbarco Veeder-Root Company.

- MetroClick

- Toshiba Global Commerce Solutions

- Pyramid Computer Ltd.

- Posiflex

- Invenco Group Ltd.

- ECR Software Corporation

Recent Development

-

In May 2024, Mashgin announced a partnership with payments solution provider Verifone to enhance its touchless self-checkout technology. This integration allows Mashgin to deploy its computer vision self-checkout system through Verifone’s Commander solution, which is currently utilized in 40% of convenience stores across the U.S. The collaboration aims to streamline the checkout process, enabling retailers to offer faster transactions while managing payments and loyalty programs through a centralized commander site controller.

-

In February 2024, Aldi introduced its first fully automated checkout system in the U.S. at a suburban Chicago store, partnering with technology firm Grabango. This innovative system allows shoppers to leave the store without scanning their items. It utilizes computer vision-based cameras and sensors mounted on the ceiling to monitor customers and record their selections as they shop. The technology enhances convenience by eliminating traditional checkout lines while offering customers the option to use a cashier if preferred.

U.S. Self-Checkout Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.13 billion

Revenue forecast in 2030

USD 3.75 billion

Growth Rate

CAGR of 12.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Components, type, application

Key companies profiled

NCR Voyix Corporation; Diebold Nixdorf; Incorporated; Fujitsu; Gilbarco Veeder-Root Company.; MetroClick; Toshiba Global Commerce Solutions; Pyramid Computer Ltd.INC.; Posiflex; Invenco Group Ltd.; ECR Software Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Self-Checkout Systems Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. self-checkout systems market report based on components, type, and application.

-

Components Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems

-

Hardware

-

Software

-

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cash-based

-

Cashless-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Department Stores

-

Convenience Stores

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.