- Home

- »

- Medical Devices

- »

-

U.S. Skilled Nursing Facility And Rehabilitation Market Report, 2030GVR Report cover

![U.S. Skilled Nursing Facility And Rehabilitation Market Size, Share & Trends Report]()

U.S. Skilled Nursing Facility And Rehabilitation Market Size, Share & Trends Analysis Report By Type Of Facility (Freestanding, Hospital), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-400-4

- Number of Report Pages: 66

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

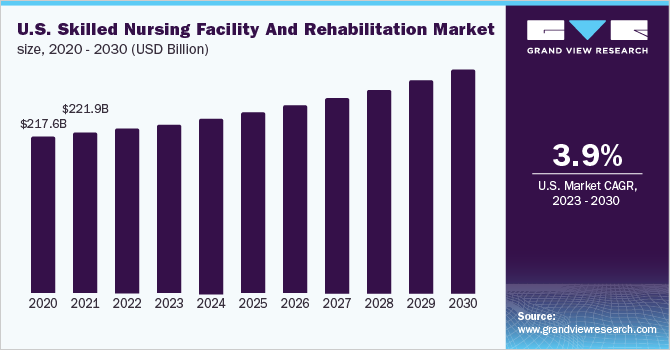

The U.S. skilled nursing facility and rehabilitation market size was valued at USD 227.5 billion in 2022 and is expected to expand at a CAGR of 3.99% from 2023 to 2030. The rise in the geriatric population and the growing prevalence of chronic diseases is key drivers for the U.S. market. The recent advancements in technology and easier availability of Medicare and Medicaid and private insurance are likely to drive the market during the forecast period.

The skilled nursing and rehabilitation services in the U.S. have a lot of regulations by the government. Skilled nursing and rehabilitation services have to comply with the Code of Federal Regulations (CFR). Code 42 CFR subpart B gives all the requirements for these nursing facilities to comply for receiving payment under Medicare and Medicaid programs.

COVID-19 U.S. skilled nursing facility and rehabilitation market impact: 2% decline from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The Covid-19 pandemic negatively impacted the market for U.S skilled nursing facility and rehabilitation. The nursing and rehabilitation facilities faced a big crisis that the residents in the facilities were at a high risk of Covid-19 infections and as the pandemic progressed many of such facilities became Covid-19 transmission hotspot and thus had to be closed.

To avoid the risk of infection, SNFs are installing wireless videoconferencing technologies. These systems provide patients with internet access in their rooms and facilitate easy communication with friends and family.

The economic downturn owing to the ongoing COVID-19 pandemic is putting publicly funded elderly care and long-term care facilities at risk. Medicaid reimbursements have declined and many SNFs operate on thin financial margins. The COVID-19 pandemic has resulted in a steep decline in occupancy of the SNFs and individuals visiting the rehabilitation centers, leading to a loss of revenue and disruption of care required by patients.

Providing software-based rehabilitation to assess aspects such as motor skills of the patient need to be employed on a large scale, given the difficulty to visit the facilities due to the pandemic situation. Such initiatives are expected to reduce the fear and increase occupancy in SNFs and rehabilitation facilities.

The reimbursement at skill nursing and rehabilitation facilities is based on Medicare part A & B. Medicare part A gives reimbursement based on inpatient and hospital. According to part A, the prospective payment system is followed where these therapy facilities are paid on the daily basis covering the patient-associated services that include therapy services calculated in minutes nursing along with daily room services. Medicare part B pays for all therapy services given using the CPR codes.

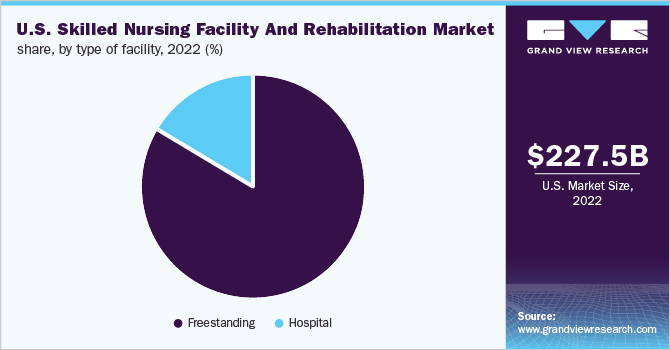

Type Of Facility Insights

The freestanding segment dominated the market for U.S. skilled nursing facility and rehabilitation held the largest revenue share of 83.68% in 2022 and is expected to register the fastest CAGR of 4.03% during the forecast period. The freestanding facilities offer skilled nursing and personalized care for 24 hrs. Rehabilitation services like physical and occupational therapy and speech-language, pathology services are also provided at these facilities. The freestanding facilities are the dominating segment because of their lower cost than that of hospital-based facilities.

Hospital-based facilities are having services after the stay in the hospital like wound care, post-acute care and rehabilitation. These facilities boost hospital performance by reducing the length of hospital stay which creates more room for new patients as the older patients are transferred to these facilities. High injuries in the workplace, chronic diseases and an increasing no of accidents boost the market for these hospital-based facilities.

Key Companies & Market Share Insights

The market for U.S. skilled nursing facility and rehabilitation has a lot of big and small players making it very competitive. Brookdale senior living is one of the top players in the market with 72,267 units.For instance, in 2019, Brookdale senior living acquired ownership 0f an 18-property leased portfolio for 405 million USD. Some of the prominent players in the U.S. skilled nursing facility and rehabilitation market include:

-

Brookdale Senior Living, Inc

-

The Ensign Group, Inc

-

Genesis Healthcare, Inc

-

Extendicare

-

Sunrise Senior Living, LLC

-

ProMedica

-

Golden Living Centers

-

Life Care Centers of America

U.S. Skilled Nursing Facility And Rehabilitation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 234.8 billion

Revenue forecast in 2030

USD 308.8 billion

Growth Rate

CAGR of 3.99% from 2023 to 2030

The base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type of Facility

Country scope

The U.S.

Key companies profiled

The Ensign Group, Inc; Brookdale Senior Living, Inc; Genesis Healthcare, Inc; Extendicare; Sunrise Senior Living, LLC; ProMedica; Golden Living Centers; Life Care Centers of America

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Skilled Nursing Facility And Rehabilitation Market SegmentationThis report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. skilled nursing facility and rehabilitation market based on type of facility:

-

Type of Facility Outlook (Revenue, USD Billion, 2017 - 2030)

-

Freestanding

-

Hospital

-

Frequently Asked Questions About This Report

b. The U.S. skilled nursing facility and rehabilitation market size was estimated at USD 221.9 billion in 2021 and is expected to reach USD 227.5 billion in 2022.

b. The U.S. skilled nursing facility and rehabilitation market is expected to grow at a compound annual growth rate of 4.46% from 2022 to 2030 to reach USD 308.8 billion by 2030.

b. Freestanding dominated the U.S. skilled nursing facility and rehabilitation market with a share of 84% in 2021. This is attributable to the availability of reimbursements, greater adoption of freestanding facilities, and a large number of patient visits.

b. Some key players operating in the U.S. skilled nursing facility and rehabilitation market are Brookdale Senior Living Solutions; Genesis HealthCare; The Ensign Group, Inc.; EXTENDICARE; Sunrise Senior Living, LLC; Life Care Services; HCR ManorCare; Golden LivingCenters; Life Care Centers of America Corporate; and SavaSeniorCare Administrative Services LLC.

b. Key factors that are driving the U.S. skilled nursing facility and rehabilitation market growth include the increasing geriatric population, growing prevalence of chronic diseases, rising healthcare cost, rapid technological advancements, and easy availability of Medicare and Medicaid & private insurance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."