- Home

- »

- Beauty & Personal Care

- »

-

U.S. Skin Care Products Market Size & Share, Report, 2030GVR Report cover

![U.S. Skin Care Products Market Size, Share & Trends Report]()

U.S. Skin Care Products Market Size, Share & Trends Analysis Report By Product (Face Creams & Moisturizers, Sunscreen), By Gender (Male, Female), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-204-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Skin Care Products Market Trends

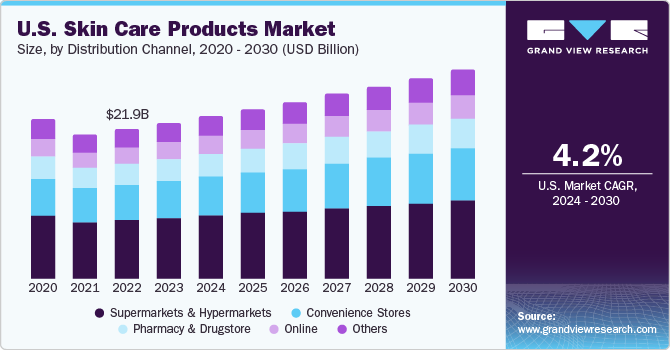

The U.S. skin care products market size was estimated at USD 22.90 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. The market growth is attributed to the large number of individuals spend a considerable amount on skin care and personal grooming in the country.Growing awareness regarding one’s physical appearance is expected to spur the demand for various skin care products such as face creams, face washes, and cleansers over the forecast period.

U.S. skin care products market accounted for the share of 16.10% of the global skin care products market in 2023. Consumers in the region prefer prominent e-commerce players such as Amazon and Walmart to buy most of their daily use items, including skin care and beauty products, as they offer various benefits like the convenience of free home delivery, easy return policies, and cashless payments. In addition, social media marketing by new companies through popular platforms like Instagram, Twitter, and Facebook have been influencing consumer purchasing decisions to buy products available on sale or discount, which is expected to favor the growth of the online segment.

Personalized products have been gaining traction among consumers in the U.S. The rising consumer demand for specific skin care solutions and increasing consciousness regarding specific ingredients are expected to boost the demand for personalized beauty products. Proven, a personalized beauty and skin care brand headquartered in California, creates consumer-specific skin care products based on the questionnaire provided and adapts to unique product requirements and ingredient allergies. This trend is particularly true for the millennial population, which is fueled by a focus on personal representation.

The rising desire among men and women to retain a youthful appearance and obtain clean and clear skin is the key factor driving the skin care products market. According to a 2021 survey by PowerReviews, 87% of consumers have been spending more on beauty and skin care products since the pandemic than pre-Covid-19 times, with growing interest among men. Consumer preference for high-quality products has led to an increase in the willingness to spend more on skin care products. This has driven the market for daily-use personal care and beauty products, including skin lightening creams, masks, and serums.

The rising spending on skin care products has also driven product launches catering to specific consumer needs. For instance, Brickell, a leading manufacturer and distributor of skin care products made from natural and organic ingredients, offers a daily essential face moisturizer with aloe vera, jojoba oil, and vitamin E.

Market Concentration & Characteristics

The U.S. skin care market is characterized by high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings.Increasing investments in the research & development of products, coupled with the rising trend of natural ingredient-based skin care products, have encouraged manufacturers to launch new products. For instance, in June 2021, Hale Cosmeceuticals, a well-established skin care manufacturer in the U.S., launched two natural ingredient products-Natural AZA Cleanser and Date Palm Deep Moisturizer-for the U.S. market.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players.For instance, Unilever has been the most acquisitive of the large companies in terms of the number of skin care acquisitions, acquiring Murad Skin care, Dermalogica, Kate Somerville Skin care, and REN Skin care, for building a better brand portfolio. Furthermore, players are focus to increase their product line and effective products for the consumers. Collaboration with beauty influencers to promote products for higher revenue.

End-user concentration is a significant factor in the U.S. skin care products market. The rising desire among men and women to retain a youthful appearance and obtain healthy skin is the key factor driving the global skin care products market. Rise in disposable income and high spending capacity of population in this region. Key players are focusing on creative budget-friendly skin care products along with the presence of offline and online modes of purchase is creating a great opportunity for the market.

Gender Insights

The demand for skin care products from female accounted for the revenue share of 62.84% in 2023 owing to rise in consciousness about personal grooming among the population. High purchasing power of the women population due to growing number of female workforce is anticipated to boost the product’s demand in the near future. Furthermore, the importance of self-care in recent years has encouraged women to proactively create relaxing self-care experiences through complex skin care routines at home.

The demand for skin care products from male is projected to grow at a CAGR of 4.6% from 2024 to 2030.Increasing awareness regarding men’s grooming and hygiene is expected to increase the demand for men’s skin care products over the forecast period. Growing aesthetic concerns among men, as well as an increase in the number of companies venturing into e-commerce, is propelling the expansion of cosmetic products in the U.S. Men's advertising campaigns are being developed at a much more prominent rate and more companies are likely to develop products to meet this demand.

Product Insights

The face creams and moisturizers segment held the largest revenue share of 43.71% in 2023. With growing consumer inclination for natural beauty products, the concept of creams, serums, and moisturizers infused with natural ingredients is expected to witness significant demand over the forecast period. Such products are considered to be more effective and have few or no side effects, which, in turn, is expected to increase their application among consumers.

The shaving lotions and creams segment is projected to grow at a CAGR of 6.3% from 2024 to 2030. The rising popularity of grooming products for men coupled with the increasing spending of men on personal care products has contributed to various product launches.The growing male awareness of grooming and cleanliness is a major factor driving the demand for shaving lotions and creams.

Distribution Channel Insights

The supermarkets and hypermarkets segment held the largest revenue share of 39.12% in 2023. The presence of established supermarkets & hypermarkets and departmental stores in the U.S. has been encouraging beauty and skin care product manufacturers to distribute their products through these channels. Hypermarkets and supermarkets sell a variety of cosmetic and beauty care products for both men and women.

Demand from online retailers is set to expand at a CAGR of about of 4.7% from 2023 to 2030. The increasing online presence of beauty & personal care products has led to considerable digital investment. In 2018, L’Oréal Group acquired Modiface, a company that has had a hand in the creation of many custom augmented reality beauty apps, including those from Sephora and Estée Lauder. Modiface has developed advanced technologies for 3D virtual make-up and color and skin diagnostic services using proprietary know-how, which track facial features and color and are used by nearly all the major beauty brands. Such efforts are projected to result in ample growth opportunities for the online skin care products market in the U.S.

Key U.S. Skin Care Products Company Insights

Some of the key players operating in the market include Revlon, Colgate-Palmolive Company, and L’Oréal S.A.

-

Revlon designs, manufactures, and distributes cosmetic, skin care, fragrance, and personal care products.The company offers its products under brands such as Revlon, Revlon Professional, Elizabeth Arden, American Crew, Almay, Cutex, Mitchum, Elizabeth Taylor, Christina Aguilera, Britney Spears, Juicy Couture, Curve, Shawn Mendes, and John Varvatos.

-

Colgate-Palmolive Company offers skin care products under the brands Palmolive Naturals, PCA Skin, EltaMD Skin care, and Filorga. Palmolive Naturals offers a wide range of essential skin care products such as moisturizers, body wash, face wash, and others. PCA Skin offers products such as moisturizers, serums, retinol, cleansers/toners, exfoliants, and sunscreens. EltaMD Skin care offers products such as cleansers, moisturizers, serum, and anti-aging skin care products.

Coty Inc.,Johnson & Johnson Services, Inc., and Procter & Gamble (P&G) are some of the other participants in the U.S. skin care products market,

-

Coty Inc. was founded in 1904 and is headquartered in New York, U.S. The company is a manufacturer, designer, distributor, and retailer of fragrances, cosmetics, skin care, nail care, and hair care products. The company sells a wide range of products under 77 brands, which are segmented into Coty Luxury, Coty Consumer Beauty, and Coty Professionals.

-

Johnson & Johnson Services, Inc mainly offers skin care products under brands like Neutrogena, Aveeno, Dr. CI:Labo, NeoStrata, Dabao, and others. It is a multinational company founded in 1979 and headquartered in New Jersey, U.S.

Key U.S. Skin Care Products Companies:

- Revlon

- Colgate-Palmolive Company

- Coty Inc.

- Johnson & Johnson Services, Inc.

- Procter & Gamble (P&G)

- L’Oréal S.A.

- CeraVe

- Cetaphil

- The Ordinary

- Estée Lauder

Recent Developments

-

In August, 2023, L’Oréal S.A. announced a complete acquisition of distinctive luxury beauty brand, Aesop. This acquisition will help the companies’ to grow and expand their product line.

U.S. Skin Care Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.85 billion

Revenue forecast in 2030

USD 30.60 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender, product, distribution channel, region

Country scope

U.S

Key companies profiled

Revlon; Colgate-Palmolive Company; Estée Lauder; Coty Inc.; Johnson & Johnson Services, Inc.; Procter & Gamble (P&G); L’Oréal S.A.; CeraVe; Cetaphil; The Ordinary

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Skin Care Products Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis on the latest trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global U.S. skin care products market report based on gender, product, distribution channel, and region.

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Face Creams & Moisturizers

-

Cleansers & Face Wash

-

Sunscreen

-

Body Creams & Moisturizers

-

Shaving Lotions & Creams

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Pharmacy & drugstore

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. skin care products market size was estimated at USD 22.90 billion in 2023 and is expected to reach USD 23.85 billion in 2024.

b. The U.S. skin care products market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 30.60 billion by 2030.

b. Face creams & moisturizers dominated the U.S. skin care products market with a share of more than 43.71% in 2023. With growing consumer inclination for natural beauty products, the concept of creams, serums, and moisturizers infused with natural ingredients is expected to witness significant demand over the forecast period

b. Some key players operating in the U.S. skin care products include Revlon; Colgate-Palmolive Company; Estée Lauder; Coty Inc.; Johnson & Johnson Services, Inc.; Procter & Gamble (P&G); L’Oréal S.A.; CeraVe; Cetaphil; The Ordinary

b. Key factors that are driving the U.S. skin care products market growth include the growing awareness regarding one’s physical appearance is expected to spur the demand for various skin care products such as face creams, face washes, and cleansers over the forecast period

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."