- Home

- »

- Consumer F&B

- »

-

U.S. Soft Drinks Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Soft Drinks Market Size, Share & Trends Report]()

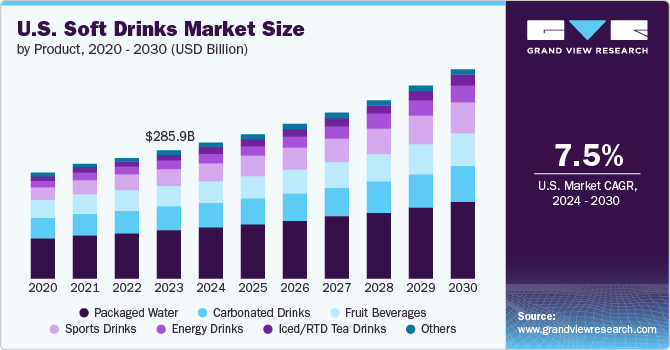

U.S. Soft Drinks Market Size, Share & Trends Analysis Report By Product (Carbonated Drinks, Packaged Water, Iced/RTD Tea Drinks, Fruit Beverages, Energy Drinks), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-406-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Soft Drinks Market Size & Trends

The U.S. soft drinks market size was valued at USD 285.93 billion in 2023 and is projected to grow at a CAGR 7.5% from 2024 to 2030. Increasing awareness about the adverse health effects of excessive sugar intake has led many consumers to seek healthier beverage alternatives. This shift has driven the demand for low-calorie, zero-sugar, and functional beverages with vitamins, minerals, and other beneficial ingredients. The growing shift towards a healthier lifestyle among consumers drives the need for soft drinks.

Companies continuously invest in research and development to create unique products in a competitive market. This includes introducing new flavors, packaging innovations, and functional beverages that offer additional health benefits, such as enhanced hydration, energy boosts, or probiotic support. These new launches emphasize quality ingredients and unique production, driving consumers' demand for premium, distinctive drinks. For instance, in December 2023, PepsiCo launched Starry, a lemon and lime carbonated soft drink. It includes regular and zero-sugar versions in several sizes at U.S. retailers.

Fast food chains around the U.S. offer milkshakes and soft drinks with their food, making it a perfect meal for consumers. The rising number of fast-food outlets has led to a rise in the demand for carbonated soft drinks. For instance, in June 2024, McDonald's launched a "$5 Meal Deal" to win back price-conscious customers. The $5 meal includes a four-piece Chicken McNuggets, McDouble or McChicken sandwich, small fries, and a small soft drink.

Companies leverage digital marketing, social media campaigns, influencer partnerships, and experiential marketing to engage with consumers and build brand loyalty. By creating effective narratives and leveraging consumer insights, brands can connect with their target audiences and differentiate themselves in a competitive market. Seasonal and limited-edition products and collaborations with popular cultural icons or trends generate buzz and drive sales. These strategies are essential for capturing consumer attention and driving the demand for soft drinks in the market.

Busy lifestyles and the increasing need for quick, portable beverage options have led to a surge in single-serve and ready-to-drink formats. Soft drink manufacturers offer a wide variety of convenient packaging solutions, such as cans, bottles, and pouches, that cater to the needs of consumers requiring easy and quick refreshments. The expansion of vending machines, convenience stores, and online delivery services makes it easier for consumers to access their favorite beverages.

Product Insights

The packaged water segment accounted for the largest market revenue share of 38.0% in 2023. Consumers are increasingly aware of the health benefits of staying hydrated and are shifting away from sugar-containing beverages for healthier options such as bottled water. Brands are responding to this trend by offering enhanced water options, such as those infused with vitamins, electrolytes, and other beneficial ingredients, further appealing to health-conscious consumers. Additionally, companies are investing in sustainable packaging solutions, such as recyclable, biodegradable, and reusable bottles, to reduce their environmental footprint. For instance, in October 2023, Chlorophyll Water introduced bottles made from 100% recycled plastic (rPET) with CleanFlake technology. It is the first bottled water in the U.S. to pass Clean Label Project certification.

The iced RTD tea and coffee segment is expected to register the fastest CAGR during the forecast period. Rising consumer awareness is growing the demand for beverages that offer functional benefits and lower sugar content. Iced RTD tea and coffee often contain antioxidants, vitamins, and other health-promoting ingredients, making them demanding alternatives to traditional sugary soft drinks. Brands are capitalizing on this trend by developing products with added health benefits, such as organic and natural ingredients, reduced calories, and functional additives such as probiotics, fulfilling the demands of lifestyles of modern consumers. Companies continuously invest in introducing new flavors, functional benefits, and premium options.

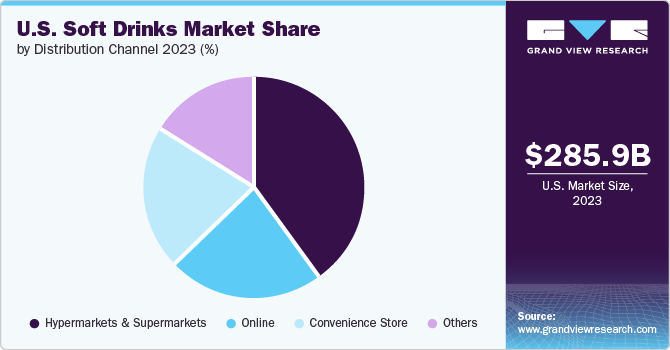

Distribution Channel Insights

The hypermarkets and supermarkets segment accounted for the largest market revenue share in 2023. Retailers provide easy access to various soft drink options, catering to diverse consumer preferences under one roof. These retailers are in densely populated urban and suburban areas, which makes them easily accessible to a large consumer base. The convenience of one-stop shopping allows customers to purchase their favorite soft drinks alongside other groceries, household items, and personal care products, enabling more discount shopping. For instance, in April 2024, Cove Soda launched zero-sugar soda made with one billion probiotics and organic ingredients. Initially, it was available at 140 Fresh Market locations and has now launched nationally across Costco stores. The soda is available in Classic Cola, Dr Cove, Root Beer, Cream Soda, Grape, Orange, Lemon Lime, and Ice Pop flavors.

The online distribution segment is expected to register the fastest CAGR during the forecast period. Online distribution enables consumers to access soft drinks from the comfort of their homes and workplaces from smartphones and computers. It offers a variety of soft drink options with various brands, flavors, and specialty beverages, catering to diverse consumer preferences. Online platforms allow 24/7 shopping and eliminate the need to visit physical stores, benefiting consumers with busy lifestyles, limited mobility, or in remote locations. Additionally, scheduling deliveries and subscription services ensures a steady supply of soft drinks, enhancing consumer satisfaction and loyalty.

Key U.S. Soft Drinks Company Insights

The key companies focus on providing consumers with creative, cost-effective, and innovative marketing strategies. They are increasing their R&D expenditures to develop unique-tasting products with health benefits and gain a strategic advantage over competitors. Dominant market players have adopted mergers and acquisitions as their primary strategies to strengthen their market position, develop new products, and form partnerships.

-

The Coca-Cola Company offers a wide range of beverages, including soft drinks, juices, and teas. Its strategy focuses on global market expansion, brands, and sustainable practices. Innovation and marketing are key success factors, driving brand recognition and consumer engagement worldwide.

-

Monster Energy Company offers a range of energy drinks, including Zero Ultra, Monster Hydro, and Java Monster, targeting different consumer preferences. Its market strategies focus on strong branding, including sports and music support, and global market expansion to strengthen its presence and attract youth demographics.

Key U.S. Soft Drinks Companies:

- AriZona Beverages USA

- BlueTriton Brands, Inc.

- CAROLINA BEVERAGE GROUP, LLC

- DS Services of America, Inc.

- Keurig Dr Pepper

- Monster Energy Company

- National Beverage Corp.

- PepsiCo

- The Coca‑Cola Company

- The Kraft Heinz Company

Recent Development

-

In April 2024, Sprite has introduced a new flavor called Sprite Chill, featuring a refreshing blend of cherry and lime. Sprite Chill and Sprite Chill Zero Sugar will be offered in North America from February to July while stock last.

-

In June 2024, Sonic launched Flavorista Favorites, a lineup of six curated drinks focused on customization. The lineup includes slushies, lemonades, and classic soft drinks. It will debut on Friday at X Games Ventura 2024 and will be available to Sonic application users from 1 July 2024.

-

In February 2022, PepsiCo launched Nitro Pepsi, a nitrogen-infused cola in the United States. By infusing nitrogen into the beverage, Nitro Pepsi creates smaller bubbles and a smoother, creamier texture, similar to the effect seen in nitrogen-infused beers and coffees. Nitro Pepsi is sweetened with high fructose corn and contains phosphoric acid, caramel, and citric acid. It has 230 calories and 73 mg of caffeine.

U.S. Soft DrinksMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 303.11 billion

Revenue forecast in 2030

USD 467.18 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

The Coca‑Cola Company.; PepsiCo; Keurig Dr Pepper; National Beverage Corp.,; Carolina Beverage Corp.; BlueTriton; The Kraft Heinz Company; DS Services of America, Inc.,; Monster Energy Company; AriZona Beverages USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Soft Drinks Market Report Segmentation

This report forecasts revenue growth on a country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. soft drink market report by product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbonated Drinks

-

Packaged Water

-

Fruit Beverages

-

Iced/RTD Tea Drinks

-

Energy Drinks

-

Sports Drinks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets and Supermarkets

-

Convenience Store

-

Online

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."