U.S. Soup Market Size & Trends

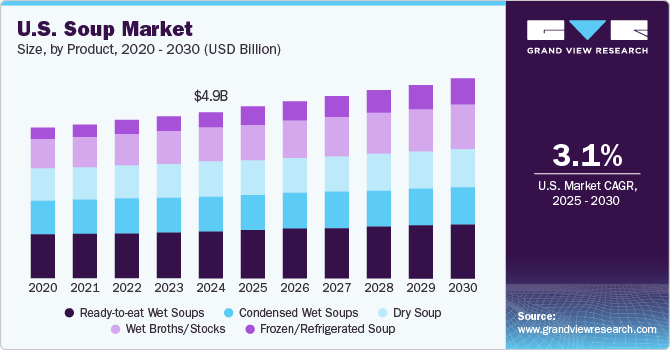

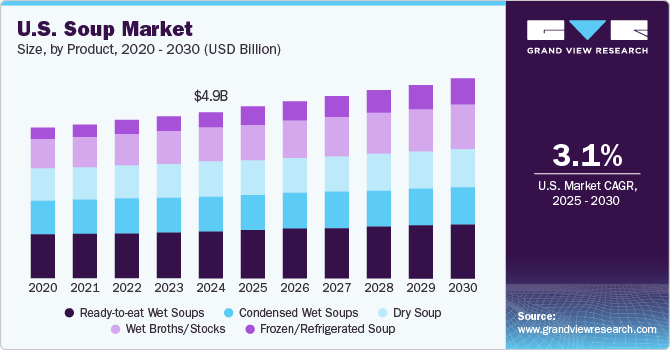

The U.S. soup market size was valued at USD 4.95 billion in 2024 and is expected to expand at a CAGR of 3.1% from 2025 to 2030. The market growth is attributed to the increasing health consciousness among consumers which has led to a higher demand for nutritious and convenient meal options, with soups being a popular choice. The busy lifestyles of many Americans also contribute to the growth of the soup market, as soups offer a quick and easy meal solution.

Rising disposable income, coupled with an extended life of the product, is expected to drive market growth. Burgeoning demand for products with natural and fresh ingredients coupled with the introduction of customized products as per the consumers’ demand is expected to drive the growth of the market.

Additionally, the rising trend of ready-to-eat and instant soups caters to the need for time-saving meal options. The variety of flavors and types of soups available, including traditional favorites and innovative new offerings, appeals to a wide range of consumer preferences. In addition, the seasonal demand for soups, particularly during colder months, supports the market's growth.

Consumers are seeking solutions that allow them to maximize their free time and disposable income. Strong wish to have more free time is driving the convenience trend in consumers. The majority of consumers find it difficult to manage their daily obligations and have time to relax. This trend is having a major impact on food preparation and consumption. Due to changing lifestyles and busy schedules, consumers are spending less time planning and preparation of meals. The majority of the urban population considers cooking a chore and meal preparation is seen as time-consuming. As a result of busy lifestyles and changed eating habits, convenience food is preferred by the majority of consumers.

Convenience foods are generally easy-to-prepare and easy to take away. Consumers also prefer healthy convenience products, with additional attributes. Changing consumer demographics also contributes greatly to the growth of convenience food. Despite the cooking skills, the older population is seeking convenience in food options to have more free time. The younger generation is looking for convenient meal solutions to have more time for academic work. Whereas mid-lifers are looking for convenience food to have more work-life balance due to the increasing pressure of parenthood and other factors. Due to the decreasing average size of households in the U.S., with a household consisting of just one or two people, families are opting for a blend of convenience, health, and comfort in meal solutions.

The aging population in the U.S., coupled with the growth agenda of adopting individual ownership of self-health and wellness owing to the increasing cost of medical care, is expected to increase the demand for healthier and natural plant-based foods. In addition, growing consumer awareness & understanding of the link between exercise, health, and a healthy diet, across genders and generations will be a major contributing factor toward the growth of the U.S. soups market. Moreover, advances in nutrition & technology, growing consumer desire for improved health & longevity, and increasing frequency of exercising in modern lifestyles will contribute to the increasing consumption of fiber-rich food and organic and gluten-free foods, thereby driving the U.S. soups market.

Product Insights

RTE wet soups dominated the market with the largest revenue share of 28.8% in 2024. The convenience of RTE wet soups, which require minimal preparation and can be consumed directly from the packaging, appeals to consumers with busy lifestyles. Additionally, the increasing demand for healthy and nutritious meal options has led to a surge in the popularity of soups that are rich in vegetables, lean proteins, and whole grains. The variety of flavors and types available in the RTE wet soup category, including traditional favorites and innovative new recipes, further enhances their appeal. Furthermore, the trend towards premiumization in the food industry has seen consumers willing to pay more for high-quality, gourmet soups.

Refrigerated/frozen soup is expected to grow at the fastest CAGR of 8.9% over the forecast period. The increasing demand for convenient and high-quality meal options is a major driver, as consumers seek out soups that offer fresh ingredients and superior taste. Refrigerated and frozen soups often have a perception of being more wholesome and closer to homemade, which appeals to health-conscious consumers. Additionally, the growing variety of flavors and innovative recipes in this segment, including options that cater to dietary preferences such as vegan, gluten-free, and low-sodium, attract a broad range of customers. The advancements in packaging technologies that preserve the freshness and nutritional value of refrigerated and frozen soups further enhance their appeal.

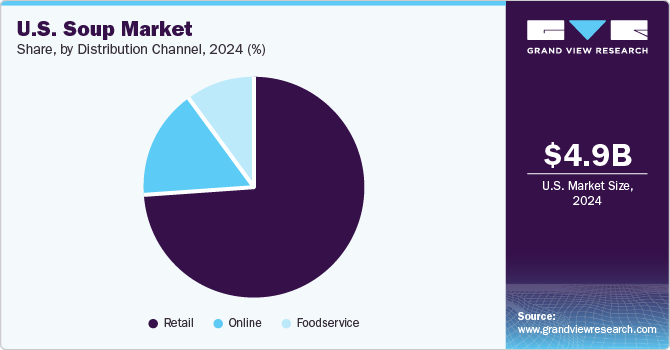

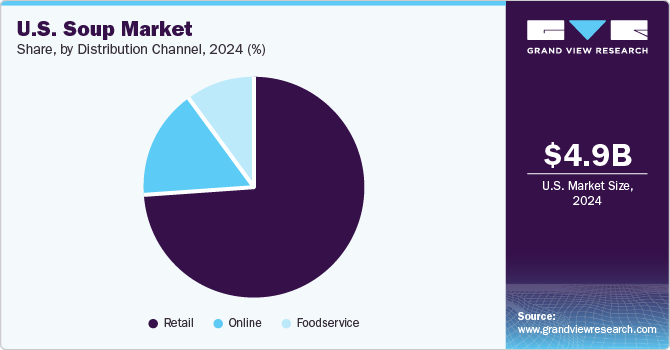

Distribution Channel Insights

The retail channel dominated the market with the largest revenue share in 2024. Retail stores, including supermarkets, hypermarkets, and grocery stores, are the primary points of purchase for soups, offering consumers a wide variety of options in terms of brands, flavors, and types. The convenience of being able to browse and select products in person enhances the shopping experience and drives sales. Additionally, retail stores often run promotions and discounts, making soups more affordable and attractive to consumers. The strategic placement of soup products within stores, effective marketing, and in-store displays further boosts visibility and sales.

The online channel is expected to grow at the fastest CAGR over the forecast period. The increasing adoption of e-commerce platforms and the convenience of online shopping play a significant role, allowing consumers to browse, compare, and purchase soup products from the comfort of their homes. The wide variety of soup options available online, including specialty and niche products that may not be readily available in physical stores, attracts a diverse range of customers. Additionally, the growing trend of subscription services and direct-to-consumer sales models provides consumers with personalized and convenient purchasing options. Digital marketing and social media influence also drive online sales, as brands leverage these platforms to engage with consumers and promote their products.

Key U.S. Soup Company Insights

Some key companies in the U.S. soup market The Campbell's Company, Kellanova, PepsiCo, Nestlé, General Mills Inc., The Kraft Heinz Company, and others.

-

The Campbell Soup Company is a leading player in the U.S. soup market. Founded in 1922, Campbell's is renowned for its wide range of soup products, including iconic brands like Campbell's Tomato Soup, Cream of Mushroom Soup, and Chicken Noodle Soup. The company's portfolio also includes other well-known brands such as Pace, Pepperidge Farm, Prego, Swanson, V8, Plum Organics, and Bolthouse Farms.

Key U.S. Soup Companies:

- The Campbell's Company

- Kellanova

- PepsiCo

- Nestlé

- General Mills Inc.

- The Kraft Heinz Company

- Hain Celestial Group

- Cargill, Incorporated

- Con Agra Brands, Inc.

- Greencore

Recent Developments

-

In December 2024, Panera Bread, the U.S.-based bakery-café chain, launched its limited-edition holiday soup cup collection, coinciding with the increased popularity of its soups during the winter season. With over 140 million servings sold annually, the collection features two new offerings for Autumn 2024: Hearty Fireside Chili and Rustic Baked Potato Soup, alongside classic favorites.

-

In September 2024, Campbell Soup Co. announced significant expansion opportunities for its Goldfish snack brand, which recently became a billion-dollar entity. At the annual Investor Day, CEO Mark Clouse emphasized that Goldfish is a cornerstone in their snack portfolio, contributing 50% net sales growth from fiscal 2019 to 2024.

U.S. Soup Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 5.09 billion

|

|

Revenue forecast in 2030

|

USD 5.93 billion

|

|

Growth Rate

|

CAGR of 3.1% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, distribution channel

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

The Campbell's Company; Kellanova; PepsiCo; Nestlé; General Mills Inc.; The Kraft Heinz Company; Hain Celestial Group; Cargill, Incorporated; Con Agra Brands, Inc.; Greencore

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Soup Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. soup market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ready-to-eat Wet Soups

-

Condensed Wet Soups

-

Dry Soup

-

Frozen/Refrigerated Soup

-

Wet Broths/Stocks

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

Online

-

Foodservice