- Home

- »

- Advanced Interior Materials

- »

-

U.S. Steel Rebar Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Steel Rebar Market Size, Share & Trends Report]()

U.S. Steel Rebar Market Size, Share & Trends Analysis Report By Application (Construction, Infrastructure, Industrial), By Region (Northeast, Midwest, West), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-720-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

U.S. Steel Rebar Market Size & Trends

“2030 U.S. steel rebar market value to reach USD 8.32 billion.”

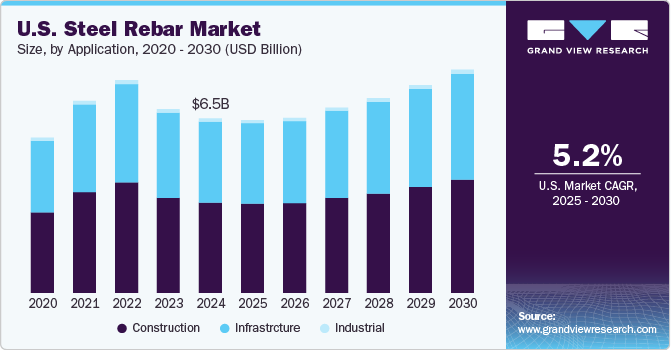

The U.S. steel rebar market size was estimated at USD 6.50 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. The market growth is anticipated to be driven by the increasing investments in residential development projects across the U.S.

Increasing demand for affordable houses has pushed state and local governments to invest in affordable housing in the country. For instance, in October 2024, The U.S. Department of the Treasury announced funding of USD 246.4 million for the development of affordable housing and community infrastructure for low-income communities and families.

Drivers, Opportunities & Restraints

The expansion of the construction industry in the U.S. is expected to positively influence steel rebar demand. For instance, value of construction put in place in the U.S. increased to USD 2,131,936 million in August 2024 from USD 2,047,414 million in August, 2023, with year-on-year increase of around 4.1%.

U.S. steel rebar manufacturers are expected to benefit from increased infrastructure spending under government initiatives. Demand is likely to rise with ongoing urbanization and construction projects. The market is likely to benefit from exports as global infrastructure needs expand. In addition, manufacturers are expected to capitalize on advancements in sustainable steel production methods.

Increasing demand from the construction and infrastructure industries has forced manufacturers to expand their manufacturing capacity. For instance, in June 2024, Nucor Rebar Fabrication announced investment of USD 20 million for its new rebar fabrication operations in Davidson County, North Carolina.

The availability of substitutes such as glass fiber reinforced polymer, plastic fiber, and stainless steel concrete reinforcements is a key market restraint for the steel rebar industry. However, the product is the first choice for new construction owing to its lower cost as compared to its counterparts.

Pricing Trend

The steel rebar prices in the U.S. has seen significant fluctuations in recent years, driven by supply chain disruptions, raw material costs, and global demand. In 2021, the average price of steel rebar surged to around USD 1,000 per ton due to pandemic-induced shortages and increased construction activity. This represented a sharp increase compared to the pre-pandemic level of approximately USD 600 per ton. By mid-2023, prices stabilized somewhat, hovering around USD 800 per ton, although still above historical averages. The volatility in scrap metal prices, a key input for rebar, continues to influence market pricing.

Application Insights

“Construction segment held the revenue share of over 51% in 2024.”

Rise in public construction is projected to fuel market growth in the country during the forecast period. For instance, value of public construction put in place reached USD 489,772 million in August 2024 from USD 454,126 million in August 2023, with year-on-year increase of 7.8%.

The infrastructure segment is anticipated to register the fastest CAGR of 5.6% in terms of revenue across the forecast period. Rising investments by state governments toward infrastructural developments are expected to boost the consumption of steel rebars.

The ongoing infrastructure investment, encouraged by the Infrastructure Investment and Jobs Act (IIJA), is driving higher demand for rebar. With $110 billion allocated for roads and bridges alone, rebar demand is expected to rise. Steel rebar is essential in projects like the Interstate Bridge Replacement and repairs to aging highways. In addition, new advancements in high-strength and corrosion-resistant rebar are being applied in coastal and high-moisture areas, where traditional materials would deteriorate more quickly, thereby extending the life of infrastructure

Industrial is another vital application segment of the market. The product is used in the construction of industrial facilities such as processing plants, mining structures, factories, warehouses, and others. Rising investment in the construction of new industrial facilities is expected to propel the demand for rebar in the country over the coming years.

Regional Insights

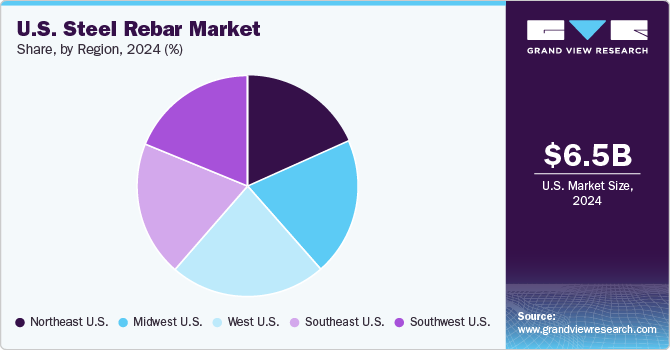

“Northeast U.S. held the revenue share of almost 18.0% in 2024.”

Northeast U.S. Steel Rebar Market Trends

In the Northeast U.S., the demand for steel rebar is primarily driven by urban infrastructure needs, especially in densely populated areas like New York City and Boston. With significant ongoing investments in bridge repairs and subway expansions, this region accounted for about 17.7% of national rebar consumption in 2024, in terms of volume. The need for corrosion-resistant rebar is particularly high due to the coastal environment, which accelerates wear in traditional steel applications.

Midwest U.S. Steel Rebar Market Trends

In the Midwest U.S., steel rebar demand is tied closely to industrial infrastructure, highways, and agricultural buildings. The region benefits from major infrastructure projects and the need to reinforce grain silos, warehouses, and distribution centers. The Midwestern states also prioritize cost-effective rebar for highway and interstate improvements, often incorporating recycled steel to support sustainability goals.

West U.S. Steel Rebar Market Trends

West U.S. steel rebar market is the largest in the country. In the Western U.S., seismic requirements shape the demand for high-quality steel rebar, especially in California. Earthquake-resistant rebar is heavily used in high-rise buildings, bridges, and public transit systems to withstand tectonic activity. Other states in the West, such as Arizona and Nevada, are also seeing increased demand due to rapid urbanization and residential construction.

Key U.S. Steel Rebar Company Insights

Some key players operating in the market include CMC Steel, Nucor, and Steel Dynamics, Inc.

-

Commercial Metals Company (CMC) is a one of the leading manufacturer and recycler of steel and metal products. The company is headquartered in Irving, Texas, and operates a network of mini-mills, fabricating facilities, and recycling centers across the U.S. and Europe. The company specializes in producing rebar, steel wire, and other long steel products.

-

Steel Dynamics, Inc. (SDI) is one of the largest steel manufacturers and metal recyclers in the U.S. With operations spanning flat-rolled steel, structural steel, and rebar production, SDI focuses on innovative steelmaking processes and has integrated recycling as a core part of its operations.

Key U.S. Steel Rebar Companies:

- Acerinox S.A

- ArcelorMittal

- CMC Steel

- EVRAZ U.S., Inc

- Gerdau S.A

- Liberty Steel USA

- Nucor

- OutoKumpu

- Schnitzer Steel Industries, Inc

- Steel Dynamics, Inc

Recent Developments

-

In February 2024, Nucor announced an investment of USD 860 million for the construction of 650 kilotons per year steel rebar factory in the Pacific Northwest. This is Nucor’s fourth largest steel rebar mill and is expected to take two years to construct. This mill is expected to produce the rebar from 100% recycled scrap.

-

In February 2024, Acerinox announced its plans to acquire Haynes, a nickel and cobalt specialist manufacturer in the U.S. With this acquisition, the company plans to expand its footprint in the North American stainless steel industry.

U.S. Steel Rebar Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.45 billion

Revenue forecast in 2030

USD 8.32 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

Northeast U.S.; West U.S.; Midwest U.S.; Southeast U.S.; Southwest U.S.

Key companies profiled

Acerinox S.A; ArcelorMittal; CMC Steel; EVRAZ U.S., Inc;, Gerdau S.A;, Liberty Steel USA; Nucor; OutoKumpu; Schnitzer Steel Industries, Inc; Steel Dynamics, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Steel Rebar Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. steel rebar market report based on the application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Infrastructure

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast U.S.

-

Midwest U.S.

-

West U.S.

-

Southeast U.S.

-

Southwest U.S.

-

-

Frequently Asked Questions About This Report

b. The U.S. steel rebar market size was estimated at USD 6.50 billion in 2024 and is expected to reach USD 6.45 billion in 2025.

b. The U.S. steel rebar market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 8.32 billion by 2030.

b. Based on application segment, construction held the largest revenue share of more than 51.0% in 2024 owing to rising investments in infrastructure

b. Some of the key vendors of the U.S. steel rebar market are Acerinox S.A, ArcelorMittal, CMC Steel, EVRAZ U.S., Inc, Gerdau S.A, Liberty Steel USA, Nucor, OutoKumpu, Schnitzer Steel Industries, Inc, and Steel Dynamics, Inc.

b. Growing investment in residential and commercial building construction is the key growth driver for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."