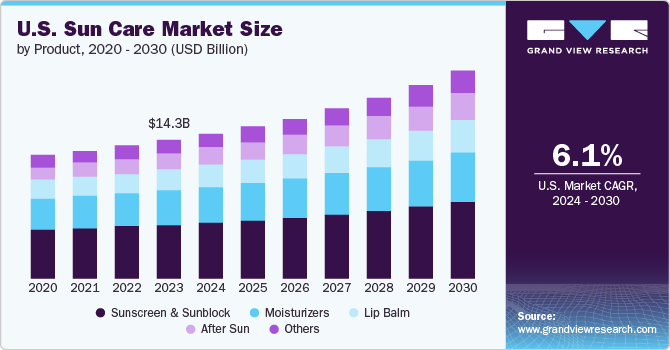

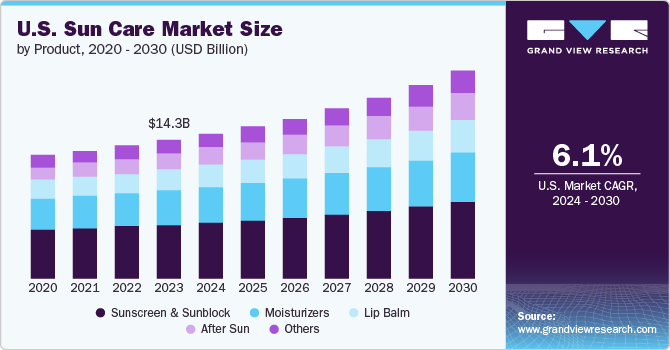

U.S. Sun Care Market Size & Trends

The U.S. sun care market size was valued at USD 14.35 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. This is attributed growing awareness among consumers about the importance of protecting skin from harmful UV rays to prevent skin damage, premature aging, and skin cancer. The increasing demand for organic and natural personal care products due to rising health concerns is expected to boost the sun care products market during the forecast period.

Consumers are seeking products that offer protection against both UVA and UVB rays. Rising incidence of skin cancer, including melanoma, has significantly boosted awareness about the harmful effects of UV radiation. Consumers in the U.S. are increasingly seeking natural and organic sun care products due to concerns about the potential side effects of chemical ingredients in traditional products. The shift towards green labels and organic sunscreens is driving market growth.

Increased participation in outdoor recreational activities such as hiking, camping, swimming, and beach vacations, are driving the demand for effective sun care products to safeguard against harmful rays during these activities. With an increasing focus on health and wellness, consumers are paying more attention to skincare routines and sun protection practices.

Product Insights

The sunscreen & sunblock segment dominated the market and accounted for the largest revenue share of 38.8% in 2023. There is a growing understanding that prolonged exposure to the sun can lead to premature aging, wrinkles, and age spots. The surge in outdoor activities, coupled with the rising prevalence of skin cancer, has driven the market growth. According to the American Cancer Society (ACS), over 5 million cases of skin cancer are diagnosed each year in the U.S.

The after sun segment is expected to grow at the fastest CAGR of 8.8% from 2024 to 2030. After-sun products are used to soothe and treat sunburns, which are common among fair-skinned individuals who spend time outdoors during peak sunlight hours. Consumers are recognizing the importance of soothing and hydrating their skin after sun exposure to prevent peeling, dryness, and premature aging.

Type Insights

The lotions segment dominated the market and accounted for a share of 42.7% in 2023. Consumers favor lotions for their ease of application, moisturizing properties, and ability to cater to various skin types. Furthermore, advancements in formulation technology have led to the development of lightweight, non-greasy, and fast-absorbing lotions that provide broad-spectrum protection without leaving a heavy residue on the skin.

The gels segment is expected to grow at a fastest CAGR of 8.6% during the forecast period due to their lightweight texture and quick absorption into the skin. Gels are preferred by consumers who have oily or acne-prone skin as they tend to be lighter in texture and less likely to clog pores compared to traditional lotions. The cooling sensation provided by gel formulations makes them appealing for use during hot weather, making them a popular choice for outdoor activities.

End Use Insights

The adult segment dominated the market and accounted for a share of 60.8% in 2023 due to increased awareness of the long-term consequences of sun exposure, including premature aging and skin cancer. According to the American Academy of Dermatology, one in five Americans is expected to develop skin cancer in their lifetime, making it the most common type of cancer in the country. In Addition, the rise in outdoor activities among adults, such as hiking, golfing, and beach vacations, has fueled the demand for effective sun care products.

The kids’ segment is projected to grow at the fastest CAGR of 6.9% over the forecast period due to heightened parental concern about protecting their child’s delicate skin from harmful UV rays. As per the study published on the American Academy of Pediatrics (AAP), exposure of early childhood to UV light radiation (UVR) has shown to be associated with the development of melanoma in later life.Pediatricians and dermatologists are emphasizing the importance of early sun protection habits, leading to increased demand for child-friendly sunscreens.

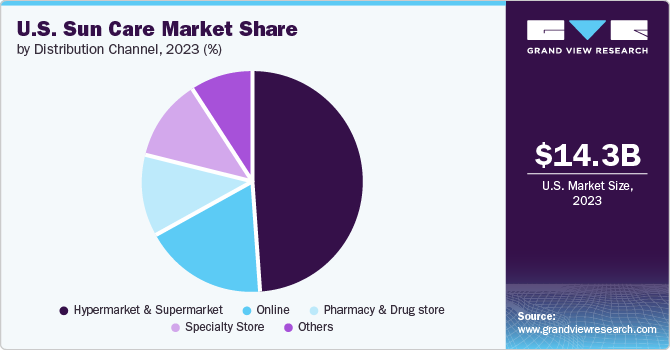

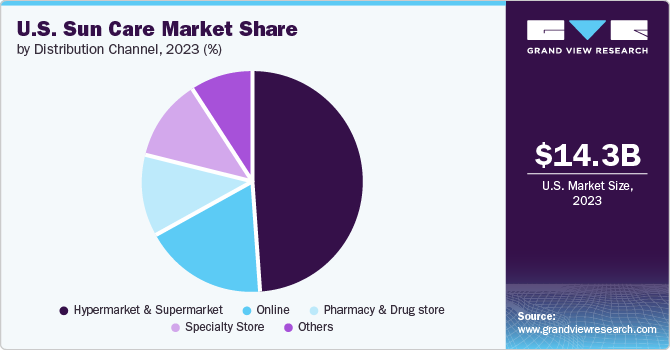

Distribution Channel Insights

Hypermarkets & supermarkets held the largest revenue share of 48.5% in 2023 due to the convenience and accessibility they offer to consumers. These retail giants offer a broad range of sun care options, catering to diverse consumer needs and budgets. The convenience of purchasing sun care products alongside other household items encourages impulse buying, especially during peak sun season. Furthermore, hypermarkets and supermarkets often carry a wide range of sun care brands, providing consumers with various options to choose from.

The online segment is expected to grow at the fastest CAGR of 7.9% during the forecast period. Online shopping allows customers to browse and purchase products at their convenience, without having to visit a physical store. Online platforms offer a vast selection of sun care products from various brands, allowing consumers to compare prices, read reviews, and make informed purchasing decisions easily.

Key U.S. Sun Care Company Insights

Some of the key companies in the U.S. sun care market include Johnson & Johnson Services, Inc., L'Oréal Group, The Clorox Company, and others. The key players focus on introducing new products and offering cheaper alternatives of existing products to gain market share.

- Johnson & Johnson offers a wide range of consumer healthcare products globally. The company’s product portfolio includes products in various categories such as feminine hygiene, baby care, facial skincare, beauty, etc. The company provides a variety of sun protection products, including sunscreen lotions, sprays, and gels.

Key U.S. Sun Care Companies:

- Johnson & Johnson Services, Inc.

- Beiersdorf

- EDGEWELL

- L'Oréal Group

- The Clorox Company

- W. S. Badger Company

- Groupe Clarins

- Shiseido Company, Limited

- Coty Inc

- The Estee Lauder Companies Inc.

Recent Developments

-

In April 2024, Image Skincare launched an anti-aging sun care collection, with 6 products that retail for USD 25- USD 70. The collection includes Sheer Matte Moisturizer, Advanced Smartblend Mineral Moisturizer, Ultra Defense Moisturizer, Pure Mineral-Tinted Moisturizer, Pure Mineral Hydrating Moisturizer, and the Protect and Refresh Mist. The collection is launched in the U.S., Hungary, Germany, the U.K., the Benelux region, Canada, Ireland, and Italy.

-

In May 2019, Eucerin announced the expansion in the U.S. sun protection market by introducing its new Eucerin Sun line. The Eucerin Sun line is formulated with 5 AOX Shield, which is a complex of 5 antioxidants that guards skin from free radicals and helps in supporting skin health.

U.S. Sun Care Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 15.01 billion

|

|

Revenue forecast in 2030

|

USD 21.44 billion

|

|

Growth Rate

|

CAGR of 6.1% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, type, end use, distribution channel, region

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Johnson & Johnson Services, Inc. , Beiersdorf , EDGEWELL , L'Oréal Group , The Clorox Company , W. S. Badger Company, Groupe Clarins, Shiseido Company, Limited, Coty Inc, The Estee Lauder Companies Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Sun Care Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sun care market report based on product,distribution channel, type, end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sunscreen & Sunblock

-

After Sun

-

Moisturizers

-

Lip Balm

-

Others

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lotions

-

Cream

-

Spray

-

Gels

-

Sticks

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)