Report Overview

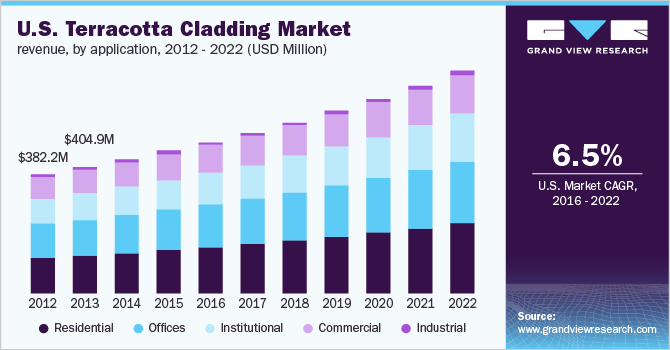

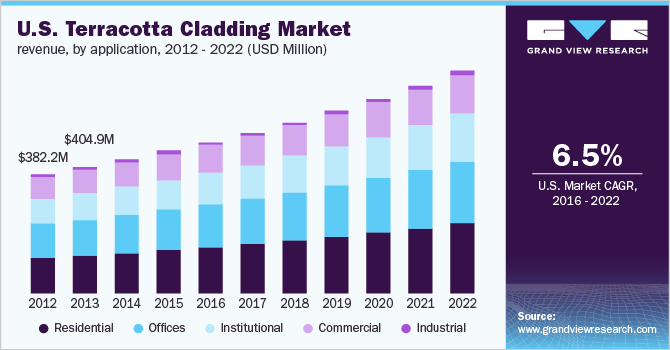

The U.S. terracotta cladding market size to be valued at USD 711.1 million by 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% during the forecast period. Economic revival in the U.S., coupled with high construction spending in the residential & commercial sectors is expected to show a positive influence on overall industry growth. Growing refurbishment and redevelopment activities, coupled with the introduction of luxury buildings under sustainable norms are anticipated to drive the industry. Terracotta, a glazed or unglazed ceramic, provides a natural look with an attractive clay finish and is widely used for surface decoration in commercial buildings such as museums and even heritage sites.

Infrastructure & commercial construction activities are witnessing a substantial rise in the U.S. owing to economic recovery and growing consumer confidence. Surging demand for enhanced moisture & energy management solutions is expected to fuel product demand. Strict government policies, along with rising environmental awareness are the factors contributing to industry growth.

The shift in trend towards the development of innovative ‘green buildings’ with high energy efficiency, has boosted the popularity of low-maintenance building materials. Rising demand for lightweight and durable composite panels with protective cladding is also anticipated to fuel industry growth over the forecast period.

High initial installation costs and complex maintenance issues are expected to restrain industry growth over the projected period. However, lightweight and recyclability of these products are anticipated to offer lucrative growth opportunities to key industry participants over the next six years.

Increasing construction spending, particularly for non-residential applications such as commercial spaces, educational institutions, and others is expected to boost the terracotta market. These cladding systems also have the advantage of greater ventilation, resistance to grout & mildew, with high-energy savings, which makes them ideal for several constructions & building applications.

U.S. Terracotta Cladding Market Trends

Terracotta is recyclable which makes it environment-friendly. In addition, long bricks made of terracotta absorb heat during the day and release it slowly during the night. Therefore, cooling the structure during hot weather and heating it during cold weather costs less. These are extensively used in places where the supply of electricity is limited as well as in hot and humid regions across the globe. These factors are expected to propel the market forward during the forecast period.

Terracotta is extensively used in the construction of buildings and houses. Owing to its high corrosion resistance and the ability to withstand exposure to the sun and UV rays, it prevents the structure from corrosion and increases its life. In addition, terracotta cladding is good for noise reduction as it helps in reducing the echoes inside a building. Moreover, these are resistant to heat as the clay is already exposed to high temperatures during the process of making bricks. Hence it can withstand fires more than its substitutes. These are expected to aid in the market growth.

However, the installation of terracotta cladding is a time-consuming process as well as it demands a skilled workforce. In addition, terracotta has a propensity to oxidize if left in the open air, which leaves it susceptible to stains and color change. These factors are expected to hinder the market growth.

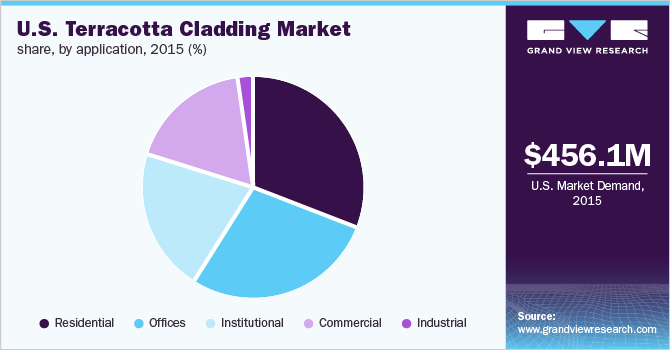

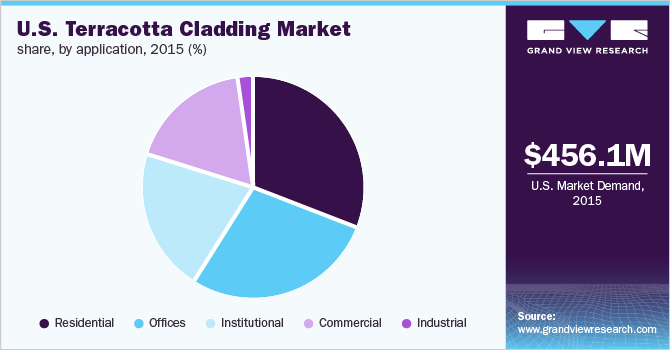

Application Insights

Residential was the largest application segment in 2015 and accounted for 30.9% of the total revenue share. Recovery of residential construction across the country along with increasing migration in urban cities is anticipated to fuel segment growth over the forecast period. The residential segment is anticipated to grow at a significant CAGR in the estimated timeframe.

Additionally, redevelopment & refurbishment of old residential buildings are expected to play a key role in raising the demand for terracotta cladding. High urbanization and LEED programs promoting ‘green buildings’ are expected to fuel the green construction materials, thus, supporting the growth of terracotta cladding in the projected period.

Increasing rentals for commercial office spaces and growing employment rates are anticipated to fuel private office construction projects. New start-up ventures, growing business enterprises coupled with increasing construction spending in Arizona and California are expected to drive product demand for office applications in the U.S.

Growing investments in education, healthcare, infrastructure, and promotion of medical tourism are anticipated to boost product consumption in institutional applications. Stringent government policies regarding energy consumption are likely to support the demand for sustainable building materials such as terracotta.

Regional Insights

The western region accounted for 24.2% of the total revenue share in 2015 and is anticipated to continue this trend in the forecast period. Increasing construction projects in the region to cater to the rising demands from a growing population are expected to drive the demand for terracotta cladding in the forecast period.

South Atlantic was the second largest regional market owing to strong GDP growth. Development of the manufacturing sector in this region is expected to boost terracotta consumption in states such as Delaware, Florida, Georgia, and Maryland. Increasing government investments in public infrastructure to support economic growth are anticipated to be a key driver for growth in the East North Central region.

West South Central is expected to grow at the fastest rate over the projected period on account of the rising number of public-private partnership (PPP) projects. In addition, increasing non-residential construction such as offices, hospitals, and commercial construction in the region owing to escalated investments is anticipated to drive industry growth over the forecast period.

Mid-Atlantic region accounted for 13% of the total revenue share in 2015 on account of increasing non-residential construction spending due to stabilization in the overall U.S. economy. Offices construction is expected to exhibit a high growth rate in the future. Additionally, single-family housing is projected to grow significantly owing to finance availability for long-term mortgage loans.

Key Companies & Market Share Insights

Key companies operating in the market include Terreal North America, M.F. Murray Company, Carea Ltd., Elite Cladding Systems Ltd., Pace Representatives, Inc., R.A.M. Inc., Shildan, Celotex Ltd., CGL Facades Co., Hunter Doulas, Cladding Corp., Palagio Engineering, Avenere Cladding LLC, James & Taylor Co., Boston Valley Terracotta.

Market entry strategies adopted by the prominent players include mergers & acquisitions, joint ventures, agreements & contracts, and others. Moreover, these players are investing in R&D in order to enhance their product portfolio and to establish a wide distribution network.

Recent Developments

-

In April 2022, The Saint Marks Place apartment complex in Brooklyn, New York, was created by NC Architecture & Design using terracotta-clad facades.

-

In May 2022, Lulu Harrison, a postgraduate student from Central Saints Martin, collaborated with Bureau de Change, and used mussel shells to make a series of glass cladding tiles.

U.S. Terracotta Cladding Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2022

|

USD 711.1 million

|

|

Growth rate

|

CAGR of 6.5% from 2016 to 2022

|

|

Base year for estimation

|

2015

|

|

Historical data

|

2012 - 2014

|

|

Forecast period

|

2016 - 2022

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2016 to 2022

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Key companies profiled

|

Terreal North America; M.F. Murray Company; Carea Ltd.; Elite Cladding Systems Ltd.; Pace Representatives, Inc.; R.A.M. Inc.; Shildan, Celotex Ltd.; CGL Facades Co.; Hunter Doulas; Cladding Corp.; Palagio Engineering; Avenere Cladding LLC; James & Taylor Co.; Boston Valley Terracotta.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Terracotta Cladding Market Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2012 to 2022. For the purpose of this study, Grand View Research, Inc. has segmented the U.S. medical device outsourcing market report on the basis of application, and region:

-

Application Outlook (Volume, Thousand Sq. Feet; Revenue, USD Million; 2012 - 2022)

-

Residential

-

Commercial

-

Offices

-

Institutional

-

Industrial

-

Regional Outlook (Volume, Thousand Sq. Feet; Revenue, USD Million; 2012 - 2022)

-

New England

-

Mid-Atlantic

-

East North Central

-

West North Central

-

South Atlantic

-

East South Central

-

West South Central

-

West