- Home

- »

- Automotive & Transportation

- »

-

U.S. Third-party Logistics Market Size & Share Report, 2030GVR Report cover

![U.S. Third-party Logistics Market Size, Share & Trends Report]()

U.S. Third-party Logistics Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (DCC, DTM, ITM, VALs), By Transport (Roadways, Airways), By End-use (Manufacturing, Retail & E-commerce, Healthcare, Automotive), By Region, And Segmentation Forecasts

- Report ID: GVR-4-68040-187-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Third-party Logistics Market Trends

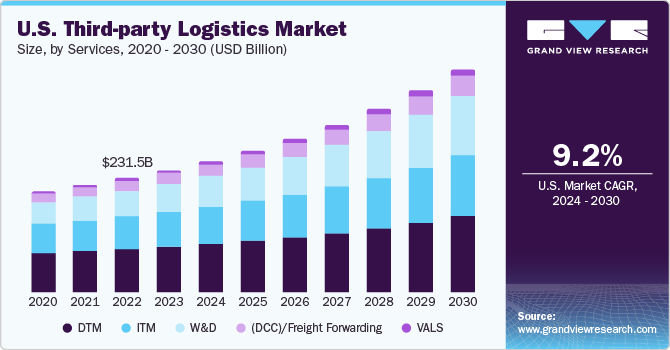

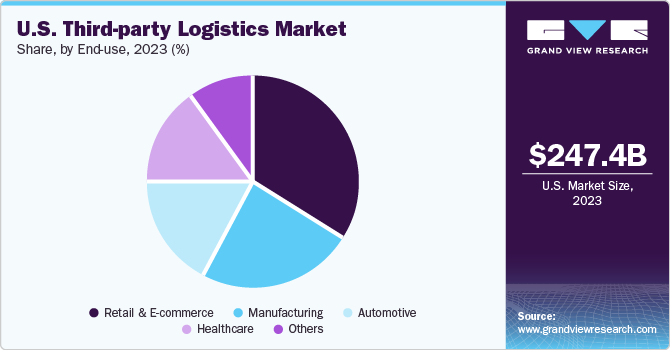

The U.S. third-party logistics market size was estimated at USD 247.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. Third party logistics (3PL) is a system in which a company offers logistics services to other businesses in need of distribution and inventory management services. Growth of the 3PL market in the U.S. is driven by factors such as the e-commerce boom, supply chain complexity, and cost optimization. Modern supply chains have become increasingly complex, with global sourcing, just-in-time inventory management, and dynamic customer demands.

3PL providers offer end-to-end solutions to streamline supply chain processes, reduce costs, and improve operational efficiency. Their expertise in logistics management, transportation, and inventory optimization enable businesses to navigate through intricacies of supply chain operations with lesser vulnerability. Additionally, the integration of advanced technologies such as artificial intelligence, machine learning, and IoT devices is enhancing the efficiency and visibility of supply chain operations. Companies like XPO Logistics, DSV, and FedEx leverage predictive analytics for demand forecasting and route optimization, contributing to overall supply chain resilience.

In the U.S., delivery costs are significantly influenced by shipping zones and the weight of the shipment, which are determined by zip codes. These zones are differentiated based on the distance between the point of origin and the destination of a shipment. Notably, higher zones correlate with increased shipping costs. In a time marked by narrow margins and intense competition, businesses are constantly seeking ways to reduce costs. Outsourcing logistics operations to 3PL providers allows companies to eliminate the need for large investments in infrastructure, technology, and human resources.

By leveraging the economies of scale and operational expertise of 3PL providers, businesses can achieve significant cost savings. Moreover, with the rise in same-day and next-day delivery trends, last-mile logistics has emerged as a critical aspect of the supply chain. 3PL providers that can offer innovative last-mile delivery solutions, such as crowd shipping, drone delivery, and locker systems, have the potential to capture a significant market share. Collaborations with local delivery partners and investments in smart logistics infrastructure are key to unlocking this opportunity.

The 3PL providers specialize in offering various transportation services, such as freight brokerage, freight forwarding, and carrier management. They specialize in warehousing & distribution services as well, including inventory, storage, order fulfillment, and distribution operations. These service providers are experts in forwarded-based services; and financial-based services, including auditing & payment services, insurance, & trade finance solutions, etc. These services enable businesses to focus on their core competencies and streamline their supply chain processes to reduce costs, and improve overall operational efficiency.

In addition, the trade & finance-based and other value-added services help businesses while navigating through customs regulations. Also, it assists businesses in cross-border transportation, and ensures compliance with trade requirements. These services eventually help the 3PL providers leverage the opportunities of globalization and trade liberalization by providing end-to-end logistics solutions. The rise of e-commerce and digital phenomenon, also called The Amazon Effect, has drastically changed consumer expectations and patterns of buying behavior.

End-users now seem to have distinctive expectations in terms of cost, control, convenience, and choice. Moreover, omnichannel operation demands fast, reliable, and free shipping services, which has prompted companies to adopt a new business model in order to provide low-cost and on-demand delivery services. 3PL companies proactively implement various changes in supply chain management to address the notable challenges and transformations of e-commerce.

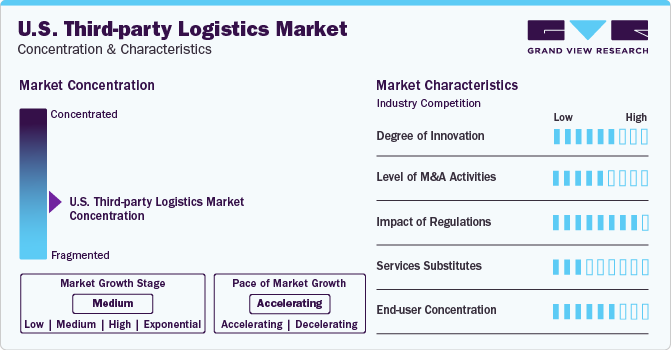

Market Concentration & Characteristics

The market growth stage is moderate and the pace is accelerating. The target market is characterized by a moderate degree of innovation owing to technological advancements and the evolving needs of supply chain management. Companies in the U.S. 3PL market are increasingly adopting digital technologies and automation to enhance efficiency. Automated warehouses with robotics and AI-driven order fulfillment systems, such as those deployed by companies like XPO Logistics and DHL Supply Chain, showcase the industry's commitment to streamlining operations and reducing manual errors. For instance, in 2023, Amazon, Inc. unveiled Sequoia, a comprehensive system that includes mobile robots and robotic arms deployed in its Houston warehouses. The introduction of Sequoia marked a significant stride in warehouse efficiency, with the company reporting a 75% acceleration in the identification and storage of inventory.

The target market is also characterized by a high level of expansions as well as mergers & acquisitions. Players adopt this strategy to increase the reach of their services and the availability of their multi-client distribution centers in diverse geographical areas. The increasing demand for efficient logistics services to cater to the growing customer base and tap into new business opportunities has created a need for expanded service centers, bigger and more advanced warehouses. These strategies also allow 3PL providers to increase their efficiency and scalability by reducing transportation costs and optimizing their operations by handling larger volumes of goods simultaneously.

The target market is also subject to increasing regulatory scrutiny. The regulatory landscape in the U.S. third party logistics (3PL) market is complex and subject to various rules and guidelines, both at the national and international levels. The regulations influence the operations of 3PL providers, aiming to ensure integrity, security, and fair practices within the logistics industry. For instance, The Federal Motor Carrier Safety Administration (FMCSA) regulates interstate trucking and transportation. 3PL providers involved in motor carrier operations must comply with safety regulations, including driver qualifications and hours of service.

The Customs and Border Protection (CBP) regulations are crucial for 3PL providers engaging in international trade. Compliance with customs regulations, including proper documentation and adherence to import/export laws, is essential. For 3PL providers handling pharmaceuticals and food products, adherence to Food and Drug Administration (FDA) regulations is vital. Labor laws can impact the employment of workers in the logistics industry and affect the cost of logistics operations. Changes in labor laws related to wages, benefits, and working conditions might create positive as well as negative impacts on the operations of 3PL service providers.

While there is a restricted availability of direct services substitutes for 3PL, few alternative methods and technologies, such as in-house logistics management; technology-driven platforms & software solutions such as TMS, WMS also seem to have a share. Also, route optimization software, crowd sourced logistics, on-demand logistics can partially cater to specific needs or preferences of businesses. However, it's important to note that these alternatives may not match the expertise or flexibility provided by 3PL providers.

The end-user concentration in the 3PL market is quite competitive as the 3PL providers serve a diverse range of end-users across various sectors, including retail, manufacturing, automotive, pharmaceuticals, and technology, among others. Geographical factors can also influence the end-user concentration. Some 3PL providers may have a strong presence in specific regions, serving clients with localized logistics needs. Others may operate on a global scale, distributing their client base across various countries and regions.

Furthermore, 3PL providers offering specialized services for niche industries may have a more concentrated end-user base within that specific sector. Conversely, providers offering generalized logistics services may have a more diverse clientele. Thus, a balance of diversified clients across industries and regions is often sought by 3PL providers to minimize risks associated with concentration and ensure a resilient business model.

Service Insights

In terms of services, the market is classified into domestic transportation management (DTM), dedicated contract carriage (DCC)/freight forwarding, warehousing & distribution (W&D), international transportation management (ITM), and value-added logistics services (VALs). The DTM segment dominated the market with a share of 37.6% in 2023. The continuous increase in carrier rates drives the growth of the DTM segment. In response to rising costs, businesses are increasingly relying on third party logistics providers to reduce their transportation expenses and enhance operational efficiency. Outsourcing DTM to a 3PL provider also helps reduce transportation costs. 3PL providers can leverage their buying power and extensive transportation network to negotiate better rates with carriers, thereby reducing transportation costs for their customers. By optimizing the transportation process, 3PL providers can also help reduce transportation time and improve delivery reliability.

The VALs segment is expected to attain the highest CAGR over the forecast period. VALs refer to the services offered in addition to the conventional logistics and transportation services provided by 3PL providers. VALS provides additional value to customers by enhancing the functionality and efficiency of the supply chain. Businesses are increasingly seeking specialized logistics services to meet their unique requirements. Value-added logistics services, such as inventory management, packaging, labeling, kitting, customization, and reverse logistics, provide added value and differentiation to businesses. As companies focus on enhancing customer satisfaction and optimizing supply chain operations, the demand for value-added logistics services is expected to grow.

Transport Insights

The roadways segment held the largest market share of 81.0% in 2023. A major advantage of road transport is that it can be customized according to the changing demands and requirements. For instance, 3PL providers can utilize vehicles of different types and sizes depending upon the specific needs of every individual customer. Using the most appropriate vehicle for each delivery can help 3PL providers improve efficiency while cutting costs. Road transport also guarantees a high level of visibility and control throughout the supply chain.

The waterways segment is projected to register the fastest CAGR from 2024 to 2030. Waterways provide an efficient and cost-effective means of moving goods in large volumes over longer distances. Waterways are particularly preferred for the transportation of bulky and heavy items. 3PL companies play an important role in optimizing supply chain operations and reducing transportation costs by facilitating the movement of goods via waterways. One of the key benefits of waterway transportation is that it is highly energy-efficient, as it involves significantly lower fuel consumption per ton-mile compared to other modes of transportation.

End-use Insights

The retail & e-commerce segment held the largest market share of 33.7% in 2023. E-commerce businesses experience rapid growth, typically during peak shopping periods, such as Black Friday and Cyber Monday. 3PL providers offer the flexibility to scale up or scale down as needed, thereby annulling the need for e-commerce businesses to invest in any dedicated infrastructure or personnel. As a result, the need for efficient and cost-effective order fulfillment, international shipping expertise, while considering flexibility as well as scalability is driven by the adoption of 3PL services. Additionally, 3PL companies help retailers toward this end by providing transportation management, inventory management, warehousing and distribution, and e-commerce fulfillment, among other services. By outsourcing these functions to 3PL providers, retailers can focus on their core competencies, such as merchandising and marketing.

The manufacturing segment is expected to register the fastest CAGR from 2024 to 2030. The manufacturing segment's growth is driven by the industry's intricate supply chains, global operations, emphasis on efficiency and cost optimization, a strategic focus on core competencies, demand for customized solutions, scalability requirements, technology integration, regulatory compliance needs, and adherence to Just-in-Time inventory practices. Many manufacturing companies operate on a global scale, sourcing materials from diverse locations and distributing finished goods internationally. 3PL providers facilitate seamless global trade by optimizing transportation, adhering to customs regulations, and ensuring the efficient flow of goods across borders.

Region Insights

East Coast held a significant market share of 26.67% in 2023. The East Coast states of the U.S. are integral to the thriving third party logistics (3PL) market owing to their strategic location and robust infrastructure. Featuring major ports such as the Port of New York and New Jersey and advanced transportation networks, these states are pivotal in facilitating seamless international trade. The geographic advantage of being closer to international trade hubs and some of the largest cities in terms of population enhances the efficiency of supply chain operations. For instance, businesses operating via the Port of Miami benefit from streamlined access to global trade routes, which leads to lower transit times and costs.

West Coast is anticipated to witness the fastest CAGR from 2024 to 2030. The West Coast's economic diversity, spanning technology, and presence of entertainment, aerospace, as well as agriculture sectors contributes to the increasing demand for 3PL services. Logistics providers cater to the unique needs of these sectors by offering tailored solutions. The region's major ports, particularly the Ports of Los Angeles and Long Beach, form the largest port complex in the U.S. and account for a substantial share of the nation's imports and exports.

Key U.S. Third-party Logistics Company Insights

Some of the key players operating in the market include FedEx, CEVA Logistics, DSV, Nippon Express, and United Parcel Service of America, Inc.

-

CEVA Logistics, a leading global supply chain management company and a part of the CMA CGM Group (a prominent shipping & logistics company), has established itself as a key player in the logistics industry, delivering integrated solutions to industries such as automotive, healthcare, consumer & retail, aerospace, e-commerce, and energy across the world. The company’s 3PL solutions encompass freight management, contract logistics, and supply chain optimization, including the complete supply chain lifecycle, starting from sourcing & procurement to transportation, warehousing, and distribution for a diverse range of industries. The company offers its solutions & services through various modes of transport, including air, ocean, ground, and finished vehicle. It has more than 1,300 facilities in over 170 countries.

-

FedEx is one of the global leaders in transportation, warehousing & order fulfillment, logistics, and courier delivery services. The company’s operations and activities are categorized under four reportable business segments, namely FedEx Freight, FedEx Express, FedEx Services, and FedEx Ground. FedEx Express utilizes a vast air cargo network to ensure fast and timely deliveries across the globe to more than 220 countries. FedEx Ground is a leading North American provider of small package ground delivery services catering to both residential and commercial customers, providing cost-effective and reliable options. FedEx Ground Economy focuses on consolidating and delivering large quantities of lightweight, less time-critical business-to-consumer shipments. FedEx Freight specializes in less-than-truckload (LTL) freight services, offering efficient transportation solutions for larger and heavier shipment packages. The FedEx Services segment encompasses various support services, including technology, sales, marketing, and customer service, enhancing the overall efficiency and customer experience. The company’s global network provides air-ground express, time-sensitive, service through more than 650 airports worldwide, transporting an average volume of 5.3 million packages on a daily basis.

Flexport, Inc. and Burris Logistics are some of the emerging market participants in the market.

- Flexport, Inc. is a global freight forwarder and logistics company that streamlines international shipping processes for businesses. The company's emphasis on real-time data analytics platforms and automation has allowed businesses to optimize their supply chains, reducing costs and improving overall operational efficiency.

- Burris Logistics is a U.S.-based, family-owned, and privately-held logistics company with expertise in refrigerated warehousing, food-service redistribution, and retail specialty work. The company uses its in-house software for logistics operations, thereby reducing time and costs. The company has established itself as a leader in temperature-controlled logistics, catering to industries with stringent requirements, such as food and pharmaceuticals. As a 3PL provider, the company excels in managing and optimizing key aspects of the supply chain, including transportation, warehousing, distribution, and inventory management for numerous industries and sectors.

Key U.S. Third-party Logistics Companies:

The following are the leading companies in the U.S. third-party logistics market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. 3PL companies are analyzed to map the supply network.

- Ultra

- BDP INTERNATIONAL INC.

- Burris Logistics

- C.H. Robinson Worldwide, Inc

- CEVA Logistics

- DSV

- DB Schenker Logistics

- FedEx

- J.B. Hunt Transport, Inc.

- Kuehne + Nagel

- Nippon Express

- United Parcel Service of America, Inc

- XPO Inc.

- Yusen Logistics Co. Ltd.

- Ryder System, Inc.

- Flexport Inc.

Recent Developments

-

DSV, a Danish transport and logistics brand which offers global transport services, the opening of new offices in Raleigh-Durham, North Carolina, in January 2024. Here, they will be serving the healthcare & pharmaceutical industry by offering specialized logistics solutions.

-

In November 2023, Nippon Express Holdings progressed into a strategic alliance with Cryoport Systems, a subsidiary of U.S. based specialized pharmaceutical carrier Cryoport, Inc.; to offer cryogenic transport services, catering to the global pharmaceutical industry's needs for transporting regenerative medicine products and cellular raw materials at temperatures of -150°C or below.

-

In February 2023, Flexport Inc. launched an app on Shopify's marketplace specifically created to assist small-scale online retailers in gaining seamless access to instant quotes, booking services, shipment tracking, and customs clearance solutions. This initiative was part of Flexport's strategic goal to broaden its influence among a wider range of U.S. importers, particularly those operating within the long tail segment.

U.S. Third-party Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 265.8 billion

Revenue forecast in 2030

USD 451.3 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, transport, end-use, region

Regional scope

East Coast; West Coast; Rest of the U.S.

Key companies profiled

BDP INTERNATIONAL INC.; Burris Logistics; C.H. Robinson Worldwide, Inc.; CEVA Logistics; DSV; DB Schenker Logistics; FedEx; J.B. Hunt Transport, Inc.; Kuehne + Nagel; Nippon Express; United Parcel Service of America, Inc.; XPO Inc.; Yusen Logistics Co. Ltd.; Ryder System, Inc.; Flexport Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Third Party Logistics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. third-party logistics market report based on service, transport, end-use, and region:

-

Services Outlook (Revenue, USD Billion, 2017 - 2030)

-

Dedicated Contract Carriage (DCC)/Freight Forwarding

-

Domestic Transportation Management (DTM)

-

International Transportation Management (ITM)

-

Warehousing & Distribution (W&D)

-

Value Added Logistics services (VALs)

-

-

Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roadways

-

Railways

-

Waterways

-

Airways

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Retail & E-commerce

-

Healthcare

-

Automotive

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2017 - 2030)

-

East Coast

-

Florida

-

New York

-

New Jersey

-

Others

-

-

West Coast

-

California

-

Washington

-

Oregon

-

Others

-

-

Rest of the U.S.

-

Frequently Asked Questions About This Report

b. The U.S. third-party logistics market size was estimated at USD 247.4 billion in 2023 and is expected to reach USD 265.8 billion in 2024.

b. The U.S. third-party logistics market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 451.3 billion by 2030.

b. West Coast is forecasted to register the highest CAGR of 10.7% from 2024 to 2030. The West Coast's diverse economy, encompassing technology, entertainment, aerospace, and agriculture sectors, is driving the growing demand for third party logistics (3PL) services. Logistics providers are responding to the specific requirements of these industries by offering customized solutions that cater to their unique needs.

b. Some key players operating in the U.S. 3PL market include BDP INTERNATIONAL INC., Burris Logistics, C.H. Robinson Worldwide, Inc, CEVA Logistics, DSV, DB Schenker Logistics, FedEx, J.B. Hunt Transport, Inc., Kuehne + Nagel, Nippon Express, United Parcel Service of America, Inc, XPO Inc., Yusen Logistics Co. Ltd., Ryder System, Inc., Flexport Inc.

b. Key factors that are driving the market growth include rise of e-commerce, reducing shipping cost through 3PL, and the strategic impact of multimodal transport on the U.S. 3PL market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.