- Home

- »

- Advanced Interior Materials

- »

-

U.S. Toilet Partition Market Size & Share Report, 2022-2030GVR Report cover

![U.S. Toilet Partition Market Size, Share & Trends Report]()

U.S. Toilet Partition Market Size, Share & Trends Analysis Report By (Powder-coated Metal, Stainless Steel, Plastic Sheets, Solid Plastic), By Region, And Segment Forecast, 2022 - 2030

- Report ID: GVR-3-68038-844-2

- Number of Report Pages: 74

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

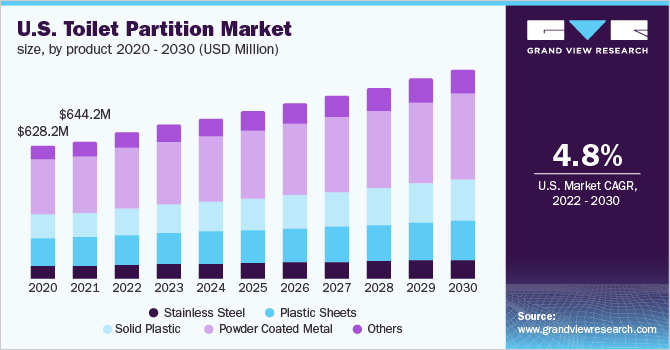

The U.S. toilet partition market size was estimated at USD 644.2 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030. The Texas toilet partition market size was valued at USD 82.07 million in 2021 and is projected to grow at a CAGR of 5.0% from 2022 to 2030. The growth is driven by the increasing development of commercial buildings and renovations in the existing construction. Significant and continual growth in urbanization and the building & construction industry in the country has substantially driven the market for partitioning products for interior applications including rooms, dividers, and toilets. The product growth is expected to accelerate, as it is economical and offers considerable longevity in comparison to conventional solutions.

The coated metal segment accounted for 41.2% market share in 2021 owing to their extensive use in various commercial spaces including public toilets, commercial restrooms, schools, offices, and airports. This segment is followed by plastic sheet partitions that gained popularity on account of their strength and durability.

Technological advancements in the industry have resulted in the production of toilet partitions with scratch & scuff resistance and easy-to-clean & maintain properties. In addition, major market players are focused on the development of new products having high aesthetic values and additional properties such as waterproof, and mildew resistance, among other performance characteristics.

The construction of new retail facilities faced a decline in the recent past owing to switching consumer preference toward online purchasing. The slow growth in the construction of shopping malls and retail centers in the U.S. has slowed down the growth of toilet and restroom constructions in the aforementioned structures. This has resulted in declining demand for toilet partitioning products in the retail industry.

Product Insights

Powder coating metal led the product market and is estimated at over USD 260 million in 2021. Powder-coated metallic panels are the common choice for the construction of toilet partitions on account of their wide availability, lightweight, and durability. These are powder-coated sheets that are made with honeycomb cardboard and covered with thick metal sheets on both sides which enhances durability.

Stainless steel partitions are widely used and account for 9.5% of the market share in 2021. The rising demand for stainless steel partitions in commercial toilet spaces is owing to the luxury and modern appearances offered by these products. These stainless-steel partitions or screens are largely used in commercial restrooms, public toilets, and urinals.

Solid plastic used for toilet partition is growing at a CAGR of 5.8% over the forecast period owing to its durability and resistance to dust, moisture, mold, rust, and common cleaners is generally made from polymer plastics and has a thickness of at least an inch. These solid plastic sheets are used owing to their enhanced strength as compared to that provided by plastic sheets.

Plastic sheet partitions account for a significant market share and are used in light as well as heavy traffic commercial toilets and urinals, hotels, restaurants, bus stations, airports, and educational institutes. These toilet partitions possess lightweight properties and thus are preferred for the overall toilet cabin construction in washrooms. The availability of these materials in a wide variety of colors and textures supports their demand in the country.

Other materials used for the construction of toilet partitions include black core solid phenolic, color-thru phenolic sheets, and solid color reinforced composite materials estimated to expand at a CAGR of 6.1% in terms of revenue over the forecast period. Resistance from rust, corrosion, dust, graffiti, and paints offered by these materials is anticipated to increase their demand over the forecast period.

Regional Insights

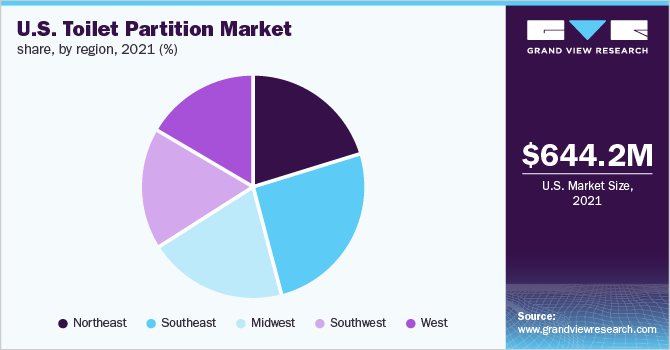

The Southeast U.S. region is expected to emerge as the market leader growing at a CAGR of 6.3% in terms of revenue over the forecast period. The construction industry in the Southeast U.S. is anticipated to grow on account of major upcoming construction projects that include the development of new cities with residential spaces, healthcare facilities, educational buildings, and other commercial buildings.

The Northeast U.S. accounted for 20.0% market in 2021 and is anticipated to register significant growth over the forecast period on account of numerous pipelined construction projects. The state witnessed an investment of more than USD 180 billion as of 2021 in overall construction projects which will drive the demand for toilet partitions in this region.

The Southwest U.S. includes states such as Arizona, Oklahoma, New Mexico, and Texas. Texas is growing at a CAGR of 5.0% in terms of revenue over the forecast period. The market comprises products including stainless steel, plastic sheets, solid plastic, and powder-coated metal. According to the Construction Industry Training Board in the region, the construction of two new reactor projects at Hinkley Point C power station is projected to boost the growth of the construction industry in the region.

Midwest U.S. accounted for 19.8% of the market share in 2021. The region expects over a 20% increase in hospital construction, a 15% increase in manufacturing facility construction, and a 14% increase in office space construction, thereby augmenting the demand for partitioning products for public toilets, restrooms, and other commercial spaces. North Dakota contributes significantly to the construction industry in the region owing to the ongoing investments in the construction sector.

Key Companies & Market Share Insights

The industry has a number of players providing a range of product varieties and price differentiation leading to highly competitive rivalry in the industry. The key players operating in the U.S. toilet partition market include Bobrick Washroom Equipment Inc.; Scranton Products; Inpro Corporation, and Hadrian Inc. with their strong distribution networks.

High capital investment is required for setting up a new manufacturing facility and developing a strong distribution network is likely to create an entry barrier to new entrants. Moreover, competing on the basis of price with existing players will be a challenging task for the entrants. Some prominent players in the U.S. toilet partition market include:

-

Inpro Corporation

-

Bradley Corporation

-

Bobrick Washroom Equipment Inc.

-

Scranton Products

-

Hadrian Inc.

-

General Partitions Mfg. Corp.

-

Knickerbocker Partition Corp.

-

AJW

-

ASI Global Partitions

-

Metpar Corporation

U.S. Toilet Partition Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 689.1 million

Revenue forecast in 2030

USD 985.6 million

Growth rate

CAGR of 4.8% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

Northeast U.S.; Southeast U.S.; Midwest U.S.; West U.S.; Southwest U.S.

Key companies profiled

Inpro Corporation; Bradley Corporation; Bobrick Washroom Equipment Inc.; Scranton Products; Hadrian Inc.; General Partitions Mfg. Corp.; Knickerbocker Partition Corp.; AJW; Metpar Corporation; ASI Global Partitions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Toilet Partition Market Report Segmentation

This report forecasts revenue growth at the country and state levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the U.S. toilet partition market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2022 - 2030)

-

Stainless Steel

-

Plastic Sheets

-

Solid Plastic

-

Powder Coated Metal

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2022 - 2030)

-

Northeast U.S.

-

Southeast U.S.

-

Midwest U.S.

-

West U.S.

-

Southwest U.S.

-

Frequently Asked Questions About This Report

b. U.S. toilet partitions market size was estimated at USD 644.2 million in 2021 and is expected to reach USD 985.6 million in 2030.

b. The U.S. toilet partition market is expected to grow at a CAGR of 4.8% from 2022 to 2030 to reach USD 985.6 million by 2030.

b. The powder-coated metal segment dominated the U.S. toilet partition market with a share of 41% in 2021. This is due to the wide availability, lightweight, and durability of the products.

b. Some key players operating in the U.S. toilet partition market include Bobrick Washroom Equipment, Inc.; Scranton Products; Inpro Corporation; Bradley Corporation; Hadrian, Inc.; General Partitions Mfg. Corp.; Knickerbocker Partition Corp.; AJW; Metpar Corporation; ASI Global Partitions.

b. Key factors driving the U.S. toilet partition market growth include growing demand for single-occupancy gender-neutral bathrooms, in turn, benefitting the demand for toilet partitions across the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."