- Home

- »

- Healthcare IT

- »

-

U.S. Urgent Care Centers Market Size, Industry Report, 2030GVR Report cover

![U.S. Urgent Care Centers Market Size, Share & Trends Report]()

U.S. Urgent Care Centers Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Acute Respiratory Infection, Injuries, Joint/Soft Tissue Issues), By Ownership (Hospital, Corporation, Physicians), And Segment Forecasts

- Report ID: GVR-2-68038-655-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Urgent Care Centers Market Trends

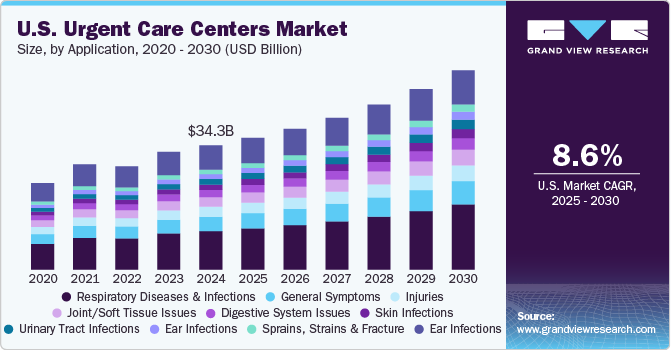

The U.S. urgent care centers market size was estimated at USD 34.34 billion in 2024 and is expected to grow at a CAGR of 8.6% from 2025 to 2030. This growth is attributed to the delivery of rapid services and short wait times compared to primary care physicians (PCPs). In addition, the growing burden of chronic diseases and the geriatric population, coupled with the rising number of urgent care centers, are propelling market growth. According to a Trilliant Health study published in May 2024, the number of urgent care centers in the U.S. experienced a nearly two‐fold increase between 2014 and 2023. Specifically, the count grew from 7,220 in 2014 to 14,382 in 2023, which represents a 99.2% increase.

The COVID-19 pandemic has significantly transformed the healthcare landscape, particularly emphasizing the role of urgent care centers. These facilities have become crucial access points for patients seeking immediate medical attention, especially when traditional healthcare systems are overwhelmed. In January 2020, the first confirmed case of COVID-19 in the U.S. was reported at an urgent care center in Snohomish County, Washington. This event marked a pivotal moment, showcasing the ability of urgent care centers to respond swiftly to emerging health crises.

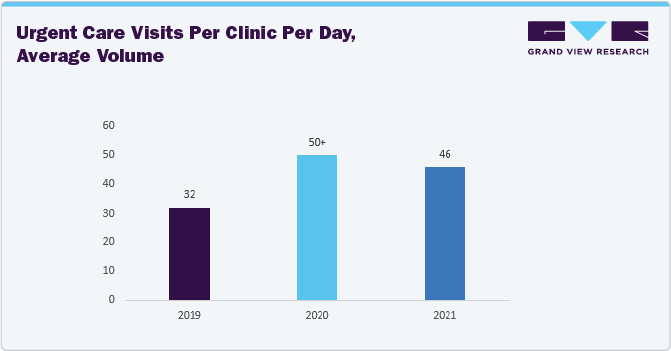

In addition, as the pandemic progressed, many patients turned to urgent care centers due to limited access to primary care providers and hospitals inundated with COVID-19 cases. Before the pandemic, an average urgent care center saw approximately 32 daily patient visits. However, between 2019 and 2020, there was a remarkable 60% increase in patient visits per center across the U.S.

Patient Volume Increased Over COVID

Moreover, a major shift from conventional hospitals or clinics to UCCs has been observed in the country in recent years. Various factors such as affordability, transparency, and efficiency in health delivery are significantly fueling market growth. Patients receive immediate care and treatment at these centers, as they are easy to access, which is expected to drive the demand for UCCs across the country.

The average cost of treatment at UCCs is much lower compared to the PCPs, which is majorly contributing to the increase in the patient influx at these facilities. It treats similar conditions for which patients tend to visit PCPs. The average cost of treatment at these facilities without insurance ranges from USD 80 to USD 280 for acute treatment and around USD 140 to USD 440 for more advanced treatment. The average cost of PCPs without insurance ranges from USD 300 to USD 600, which is considerably higher compared to UCCs.

Telehealth adoption has developed a huge demand for these facilities in the U.S. As per the Harvard Business News published in January 2023, telehealth has emerged as a critical component of the U.S. healthcare system. Its integration into mainstream healthcare practices offers numerous benefits, including increased access to care, convenience for patients, and potential cost savings for both providers and patients. For instance, as per the American Medical Association, around 70% of PCP visits and around 40% of ED visits are unnecessary. UCCs could effectively handle these visits through telemedicine consultations.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including a degree of innovation, industry competition, and impact of regulations, level of mergers & acquisitions activities, and service expansion. For instance, the market is fragmented, with many small players entering the market and launching new innovative facilities & services. The degree of innovation is high, the level of mergers & acquisitions activities is medium, the impact of regulations on the market is high, and the service expansion of the market is high.

Innovations include integrating urgent care features into various platforms, reflecting a broader shift in healthcare consumer behavior towards seeking immediate and convenient care options. For instance, in February 2025, Zocdoc announced the launch of an urgent care feature within its healthcare marketplace. The launch of an urgent care feature by Zocdoc is a strategic move aimed at improving patient access to immediate medical care for acute health issues. By integrating urgent care services into its existing platform, Zocdoc enables patients to easily find and book appointments with urgent care centers. This convenience is crucial, as many individuals face barriers when seeking timely medical attention, such as long waiting times or difficulty in locating nearby facilities.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. For instance, Ardent Health made significant strides in expanding its urgent care services through strategic acquisitions. In January 2025, the company announced the acquisition of 18 urgent care clinics from NextCare Urgent Care, located across New Mexico and Oklahoma. This move is part of Ardent Health’s broader strategy to enhance access to healthcare services in mid-sized urban communities.

The impact of regulations on the market is high, with strict guidelines influencing device development and deployment. Federal programs such as Medicare and Medicaid and private insurers influence the reimbursement landscape for urgent care services. Regulatory changes affecting reimbursement rates can directly impact the financial viability of urgent care centres. For instance, if reimbursement rates decrease or certain services are excluded from coverage, UCCs may struggle to maintain profitability.

Service expansion efforts are evident as urgent care centres aim to penetrate underserved markets across the U.S. In December 2023, Northwest Urgent Care acquired certain urgent care centers owned and operated by Carbon Health in Arizona. Northwest Healthcare now has over 80 care sites within its network. This expansion is significant as it enhances resource allocation, improves patient access to urgent care services, and ensures better continuity of care across various healthcare settings.

Application Insights

The respiratory diseases & infections segment held the largest revenue share of 31.00% in 2024. Its dominance is attributed to the rising demand for these categories owing to the growing prevalence of respiratory conditions. In April 2023, the National Center for Biotechnology Information highlighted the U.S. National Health and Nutrition Examination Survey III (NHANES III), in which approximately 19.2% of COPD cases are expected to be attributed to workplace exposures across the general population. This statistic highlights the significant impact that occupational environments can have on respiratory health. Among never-smokers, the fraction of COPD attributable to workplace exposures is even higher at 31.1%. This finding underscores the importance of considering occupational hazards as a critical factor in the development of COPD, particularly for individuals who do not smoke and thus may be more susceptible to other environmental risk factors.

The urinary tract infections segment is expected to grow at the fastest CAGR of 9.7% over the forecast period. Its growth is attributed to the growing prevalence of antimicrobial resistance, which complicates outpatient treatment options and leads to more patients seeking care in urgent care facilities. As traditional first-line oral antimicrobials become less effective, patients who might have previously managed their UTIs at home are now presenting with more severe symptoms that necessitate urgent medical attention. The demographic shift also plays a role; women, particularly those aged 18-24 and older adults, are among the most affected groups, leading to higher visit rates to urgent care centers for UTI management.

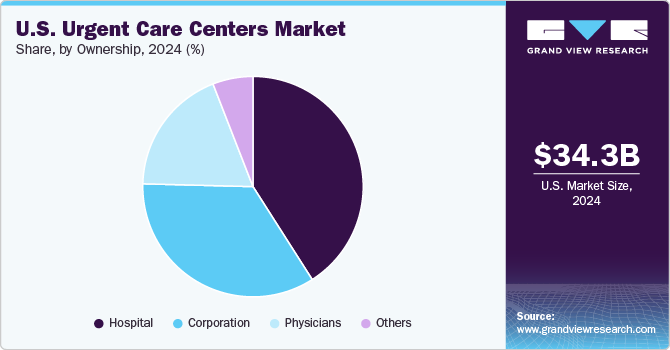

Ownership Insights

The hospitals segment held the largest revenue share of 40.97% in 2024. Its dominance is attributed to the growing interest of healthcare systems such as HCA, Aurora Health, Community Health Systems (CHS), Carolinas Healthcare, Dignity Health, and others to provide accessible care at an affordable price. For instance, in December 2024, Northwest Urgent Care, a subsidiary of CHS, successfully acquired urgent care centers previously owned and operated by Carbon Health in Arizona. This acquisition is part of Northwest Healthcare’s strategy to expand its integrated healthcare network that serves Tucson and the surrounding communities. Following this acquisition, Northwest Healthcare now boasts more than 80 sites of care within its network.

The corporation segment is expected to grow at a lucrative CAGR of 8.42% over the forecast period. Its growth is attributed to the private equity firms that have become increasingly involved in the urgent care sector, acquiring smaller centers and forming partnerships with multi-site operators. Companies Such as FastMed and American Family Care exemplify this trend, actively pursuing acquisitions to expand their market presence. The financial backing from private equity provides growth resources and enhances operational efficiencies through shared best practices and technology integration. As a result, corporate ownership is reshaping the urgent care landscape, allowing for greater scalability and improved patient services while responding effectively to market demands.

Key U.S. Urgent Care Centers Company Insights

Some emerging companies in the market are NextCare (nextcare.com), Pediatric Urgent Care Piscataway, FastMed Urgent Care, Tiny Pediatrics, RCE Technologies, Inc., and others. The strategies of key players to strengthen their market presence include new product launches, partnerships & collaborations, mergers & acquisitions, and geographical expansion. For instance, in May 2023, HCA Healthcare signed an agreement to purchase 41 urgent care centers from FastMed to enhance its healthcare services in Texas. This acquisition includes 19 locations branded as FastMed and 22 under the MedPost branding. The urgent care centers are strategically located across major Texas cities, including Dallas, Austin, San Antonio, Houston, and El Paso.

Key U.S. Urgent Care Centers Companies:

- Concentra, Inc.,

- American Family Care

- CityMD Urgent Care

- MedExpress Urgent Care

- NextCare Urgent Care

- Tenet Health Urgent Care

- FastMed Urgent Care

- Ascension Health Urgent Care

- Aurora Urgent Care

- WellNow Urgent Care

- Sutter Health

- Intuitive Health

- HCA Healthcare

Recent Developments

-

In July 2025, the University of Maryland Urgent Care is expanding its services by opening two new locations in Anne Arundel County. This initiative aims to enhance access to urgent care services for residents in the area, providing timely medical attention for non-life-threatening conditions.

-

In September 2024, Yale New Haven Health (YNHH) officially rebranded its urgent care centers, marking a significant change in its healthcare service offerings. This rebranding was highlighted with the opening of a new facility at 340 Grasmere Ave. in Fairfield, Connecticut. This location is notable as it is the first to operate under the newly adopted name of Yale New Haven Health Urgent Care.

-

In July 2024, Virginia Mason Franciscan Health (VMFH) entered a partnership with Intuitive Health, a company known for its innovative approach to healthcare delivery. This collaboration aims to enhance residents' access to healthcare services in the Puget Sound region. The partnership is designed to address the growing demand for accessible and efficient healthcare solutions, particularly considering the challenges posed by the COVID-19 pandemic and ongoing public health needs.

-

In July 2024, CentraCare partnered with KeyCare to provide patients with virtual urgent care services that are available anytime and anywhere. This partnership leverages KeyCare’s Epic-based telehealth platform, designed to enhance healthcare service delivery through digital means.

U.S. Urgent Care Centers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.41 billion

Revenue forecast in 2030

USD 55.07 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, ownership

Country scope

U.S.

Key companies profiled

Concentra, Inc.; American Family Care; CityMD Urgent Care; MedExpress Urgent Care; NextCare Urgent Care; Tenet Health Urgent Care; FastMed Urgent Care; Ascension Health Urgent Care; WellNow Urgent Care; Sutter Health; Aurora Urgent Care; Intuitive Health; HCA Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Urgent Care Centers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. urgent care centers market report based on application, and ownership.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory Diseases & Infections

-

General Symptoms

-

Injuries

-

Joint/Soft Tissue Issues

-

Digestive System Issues

-

Skin Infections

-

Urinary Tract Infections

-

Ear Infections

-

Sprains, Strains and Fracture

-

Influenza & Pneumonia

-

Others

-

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Corporation

-

Physicians

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. urgent care centers market size was established at USD 34.34 billion in 2024 and is expected to reach USD 36.41 billion in 2025.

b. The U.S. urgent care centers market is expected to grow at a compound annual growth rate of 8.63% from 2025 to 2030 to reach USD 55.07 billion by 2030.

b. respiratory diseases & infections dominated the market in 2024, with a 31.00% share. This can be attributed to an increase in the prevalence of acute respiratory infections and the adoption of antibiotics for their treatment.

b. Some key players operating in the U.S. urgent care centers market include Concentra, Inc.; American Family Care; CityMD Urgent Care; MedExpress Urgent Care; NextCare Urgent Care; Tenet Health Urgent Care; FastMed Urgent Care; Ascension Health Urgent Care; WellNow Urgent Care; Sutter Health; Aurora Urgent Care; Intuitive Health

b. Key factors that are driving the market growth include shorter wait times, transparency, and the quality of healthcare provided by these centers. Technological advancements and adoption of management software in urgent care centers are anticipated to boost market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.