- Home

- »

- Homecare & Decor

- »

-

U.S. Vacation Rental Market Size, Industry Report, 2030GVR Report cover

![U.S. Vacation Rental Market Size, Share & Trends Report]()

U.S. Vacation Rental Market (2024 - 2030) Size, Share & Trends Analysis Report By Booking Mode (Online, Offline), By Accommodation Type (Home, Resort/Condominium), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-212-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vacation Rental Market Size & Trends

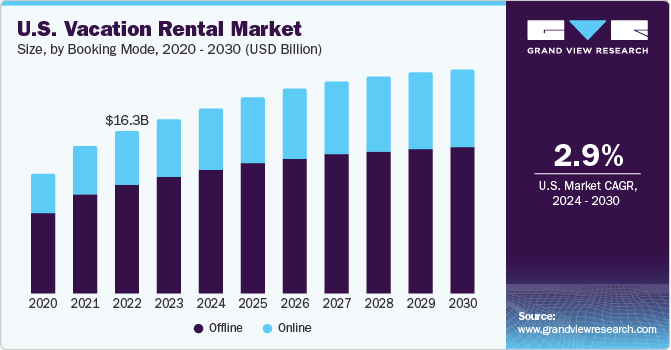

The U.S. vacation rental market size was estimated at USD 17.47 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 2.9% from 2024 to 2030. The growing participation of travelers in the tourism sector from across the globe is growing immensely and is primarily contributing to the growth of the U.S. vacation rental market. With increasing trends of type of tourism in market, the participation of demand for vacation rentals accommodation is spreading in the U.S.

The U.S. vacation rental market accounted for 19.6% share of the global vacation rental market revenue in 2023. Since vacation rental homes are more economical, provide more comfort and privacy than hotels, and are suitable for families with children and pets, they are preferred by travelers over hotels. Customers are drawn to these properties because of their low cost when compared to hotels with comparable features. For example, 64% of travelers favor vacation rentals over hotels, per the TurnKey Vacation Rentals 2019 poll. Moreover, customers take a number of variables into account when selecting a vacation rental for comfort and facilities when traveling with family.

The expansion of government initiatives to stimulate the economy by funneling money into the system is assisting a number of industries in launching their own businesses, which will benefit the expansion of the travel and tourist industry in the U.S. For example, on March 25, 2020, the U.S. Senate approved a USD 2.2 trillion emergency aid package with the goal of reducing the financial hardship brought on by the coronavirus pandemic. In addition, beginning of May 13, 2020, the U.S. Federal Reserve is creating money at a never-before-seen pace to boost the economy amid the coronavirus outbreak.

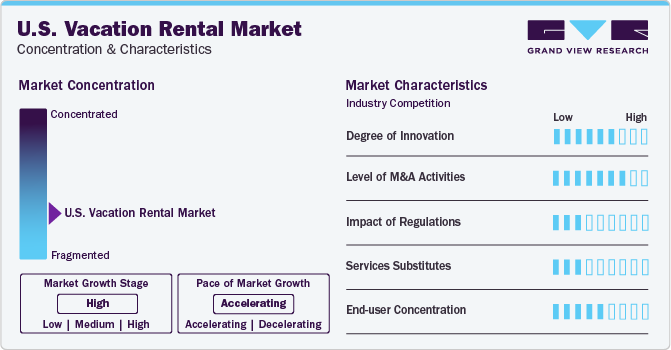

Market Concentration & Characteristics

As there are several foreign participants, with few locals as well, the vacation rental industry is highly fragmented. Moreover, the majority of industry participants have acquired recognition and assisted in drawing in customers from around the globe by introducing features and technologies that make traveling simple and convenient. Both organized and unorganized businesses participate in the vacation rental sector; organized players are reported to control a sizable portion of the market.

With their massive client bases, well-known brands, and extensive distribution networks, the leading competitors in the vacation rental sector present fierce competition for participants. To keep ahead of the competition, businesses have been using a variety of expansion methods, including mergers and acquisitions, the introduction of new campaigns, technological developments, and geographic expansion.

These advancements, when combined with the application of creative tactics, have improved the U.S. vacation rental market by increasing industry rivalry and diversifying the players' clientele. To obtain a competitive advantage over rivals, a rising number of businesses have also started investing in product development.

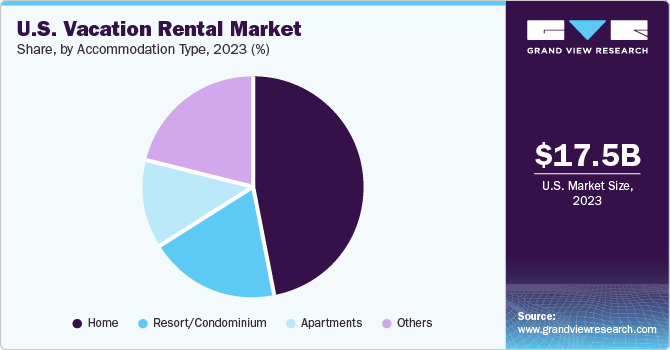

Accommodation Type Insights

Based on accommodation type, the industry has been further categorized into home, apartments, resort/condominium, and others. Home accommodation accounted for a market share of 47.1% in 2023. This is attributed to the great popularity of homes among travelers owing to space accessibility, safety, and admission to amenities. In addition, the low cost of accommodation in rural and travel places is acting as a prime driver for the segment growth.

The demand for resort/condominium is projected to grow at a CAGR of 3.9% from 2024 to 2030. The segment growth is majorly driven by millennials as they are more inclined toward spending on experiencing numerous facilities including barbeque pits, games, swimming pools, clubhouses, and tennis.

Booking Mode Insights

In terms of revenue, the offline booking mode accounted for a market share of 66.9% in 2023. This is attributed to the Baby Boomers and Gen X being the prime consumer base favoring offline mode of booking. Growing penetration of the internet and smartphone among consumers is projected to shift consumers’ predisposition toward online booking mode.

The online booking mode is estimated to expand at a CAGR of 3.7% over the forecast period. The expansion is attributed to customers' desire for comprehensive access to lodging, facilities, and surplus benefits. The pursuit for genuine travel experiences, convenience, and value for money are three key aspects boosting the growth of internet booking. An upsurging number of new businesses and third-party travel agencies are only offering services through applications and websites.

Key U.S. Vacation Rental Market Company Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of vacation rentals. Players in the market are diversifying the service offering to maintain market share.

Some key players functioning in the U.S. vacation rental market include, Airbnb Inc., Booking Holdings Inc., and Expedia Group Inc.

In December 2020, Airbnb and Nasdaq announced a new joint campaign to host a stay on New Year’s Eve in New York, to close 2020. The one-night stay will be arranged in a private dome with a view of the Times Square ball drop. Mariah Carey, an American singer and songwriter, will be hosting the event for Airbnb and Nasdaq

Key U.S. Vacation Rental Companies:

- Airbnb Inc.

- Booking Holdings Inc.

- Expedia Group Inc.

- Hotelplan Holding AG

- Vrbo

- FlipKey Inc.

- Wimdu

- TripAdvisor Inc.

- Wyndham Destinations Inc.

- 9flats.com Pte Ltd.

Recent Development

-

In December 2020, Airbnb announced the launch of Airbnb.org, a nonprofit, which will allow hosts who rent out their properties through the platform to provide discounted and free stays to refugees and essential workers affected by the coronavirus pandemic and natural disasters. The hosts who offer free stays or make continuous donations to Airbnb.org will get a special badge on their profiles, to award the generosity and commitment to people in need. The company has promised 400,000 shares of its stock to support the nonprofit.

-

In October 2020, Vrbo, an Expedia Group, Inc. company, announced that the Utah vacation home with a private ski mountain will be available for booking from 30th October. The property is a one-time only vacation rental listing for one family at USD 100 per night, a fraction of its usual cost. This initiative is expected to inspire families to plan ski-vacations.

U.S. Vacation Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.58 billion

Revenue forecast in 2030

USD 21.11 billion

Growth rate

CAGR of 2.9% from 2023 to 2030

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation type, booking mode

Country scope

U.S.

Key companies profiled

9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; Vrbo; FlipKey Inc.; Wimdu; TripAdvisor Inc.; Wyndham Destinations Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vacation Rental Market Report SegmentationThis report forecasts revenue growth at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the vacation rental market report on the basis of accommodation type and booking mode:

-

Accommodation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home

-

Apartments

-

Resort/Condominium

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. vacation rental market was estimated at USD 17.47 billion in 2023 and is expected to reach USD 18.58 billion in 2024.

b. The U.S. vacation rental market is expected to grow at a compound annual growth rate of 2.9% from 2024 to 2030 to reach USD 22.11 billion by 2030.

b. Home accommodation accounted for a market share of 47.1% in 2023. This is attributed to the great popularity of homes among travelers owing to space accessibility, safety, and admission to amenities. In addition, the low cost of accommodation in rural and travel places is acting as a prime driver for the segment growth.

b. Some of the key players operating in the U.S. vacation rental market include 9flats.com Pte Ltd.; Airbnb Inc.; Booking Holdings Inc.; Expedia Group Inc.; Hotelplan Holding AG; Vrbo; FlipKey Inc.; Wimdu; TripAdvisor Inc.; Wyndham Destinations Inc.

b. The growing participation of travelers in the tourism sector from across the globe is growing immensely and is primarily contributing to the growth of the U.S. vacation rental market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.