- Home

- »

- Next Generation Technologies

- »

-

U.S. Vertical Farming Market Size, Industry Report, 2030GVR Report cover

![U.S. Vertical Farming Market Size, Share & Trends Report]()

U.S. Vertical Farming Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Growing Mechanism (Aeroponics, Hydroponics), By Structure, By Crop Category, And Segment Forecasts

- Report ID: GVR-4-68040-208-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vertical Farming Market Size & Trends

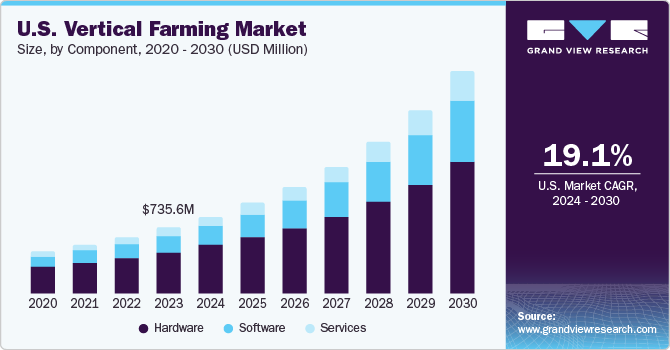

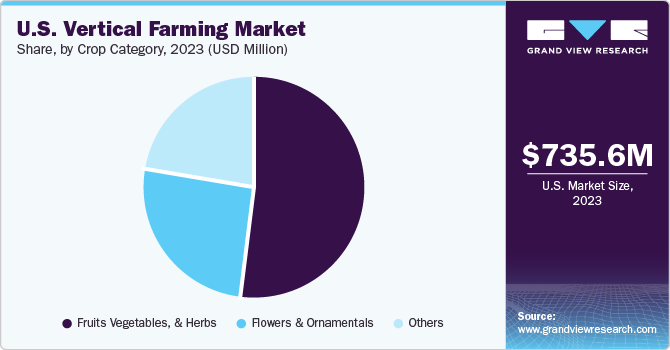

The U.S. vertical farming market size was estimated at USD 735.6 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 19.1% from 2024 to 2030. The growth in vertical farming is attributed to the reduced amount of arable land due to growing urbanization and soil degradation. The increasing adoption of vertical farming also aids in environment-friendly production of fruits and vegetables year-round, independent of the external climate, which is also fueling its market growth.

The growing demand for organic foods because of their nutritious and healthy qualities has also propelled the market growth. The US market accounted for approximately 10.6% of the global vertical farming market.

Traditional farming methods require vast land, which is becoming increasingly scarce due to urbanization and soil degradation. Vertical farming tackles this challenge by utilizing vertical space and stacking multiple layers of crops. One of the primary advantages of vertical farming lies in maximizing land use efficiency. Vertical farming produces significantly higher yields in a smaller footprint. This makes it particularly suitable for urban areas with limited and expensive land.

The increasing adoption of controlled growing environments, including vertical farming, is driven by factors such as urbanization, resource efficiency, consumer demand for sustainable food, technological advancements, and supportive government policies. These growing environments offer the potential to produce food in urban areas, optimize resource usage, provide local and sustainable food options, leverage technology for efficiency, and contribute to food security. In vertical farming, corps are grown under selected and well-monitored conditions that ensure optimal growth throughout the year. Compared to open-field agriculture, other farming practices such as vertical farm systems provide more crop rotation. This year-round crop yield also propels the market growth for vertical farming.

The high initial investment is the key factor restraining the growth of the market. Vertical farming requires warehouses for cultivation, and the high price of warehouses in an urban area compared to farmland further limits the adoption of vertical farming. In addition, the high cost of active heat systems, installing LEDs, creating a controlled environment, and high maintenance costs further restrain the market growth.

Market Concentration & Characteristics

The market growth stage is high and the rate of growth is accelerating. As vertical farming practices are in an evolving and emerging stage, technologies related to vertical farming are still novel and gaining traction. Various innovative techniques for vertical farming are being adopted by early-stage companies and startups for different crops, growing methods, and technologies. Therefore, the degree of innovation is moderate to high as the R&D investment is high for developing new techniques as well as refining them for crop yield optimization.

As the market for vertical farming in the U.S. is still yet emerging, there are various companies in the market, big and small, vying for an increased market share. The market is moving towards consolidation, which is also resulting in high activities of mergers of acquisitions by companies to consolidate market share or gain access to the latest innovations in vertical farming techniques and technologies related to it.

Vertical farming techniques have the advantage of growing year-round crops and reducing water wastage. However, substitutes such as outdoor farming remain the most preferred method for large-scale production of commodity crops like grains and oilseeds. Outdoor farming relies on natural sunlight, soil, and traditional irrigation methods.

While the market is characterized by a diverse array of companies, market concentration exists among a select group of established companies that lead the industry in innovation, market share, and influence. However, the market remains dynamic, with opportunities for new entrants and disruptive technologies to challenge the dominance of incumbent companies.

Component Insights

In terms of component, the market is segmented into hardware, software, and services. The hardware segment held the largest market share of 63.22% in 2023. Hardware is vital to maintaining the environment in vertical farming. The segment is further categorized into lighting, hydroponic components, climate control, and sensors. The lighting sub-segment led the market with 38.84% of the revenue share in 2023. This large share can be attributed to the dependence of vertical farms on artificial lighting. Artificial lights provide sufficient light intensities required for crop growth. The climate control segment is anticipated to register the fastest CAGR from 20243 to 2030 among the sub-segments. The main aim of climate control farming is to facilitate the protection and maintain optimum growth conditions throughout the development period of a crop.

The software segment is anticipated to witness the fastest CAGR of 21.0% from 2024 to 2030, owing to the upcoming trends in technologies and farming practices. The software helps in tracing the fruit and vegetables back to their crop batch/patch, grower, area of land/field, and supplier details. Since cloud-based software gathers millions of data points in real-time that can be examined with machine learning techniques to determine the changes in particular environmental parameters affecting the yield and taste of the final product, it is expected that the segment will grow significantly in the forthcoming years.

Growing Mechanism Insights

The hydroponics segment registered the largest market share in 2023 of 55.56% and is expected to remain dominant from 2024 to 2030. Hydroponics is a popular growth mechanism due to low installation costs and ease of operations. In addition, the hydroponics method removes the risk of soil organisms causing diseases. Consumers are becoming increasingly aware of the pesticide effects, which in turn, is projected to fuel the growth of the hydroponics segment. Hydroponically grown plants produce a greater yield than similar plants grown in soil because of proper control over the nutrients.

The aquaponics segment is anticipated to gain a significant growth rate over the forecast period. Compared to traditional farming, aquaponic farming wastes minimal water, which is among the major advantages of aquaponic agriculture. Aquaponics utilizes approximately 90% less water than conventional farming, Aquaponics is the integration of hydroponics and aquaculture, which eliminates the need for harmful chemicals for cultivation. The water used in the aquaponics systems contains fish waste that becomes nutrient-rich and increases the crop production time. This creates a sustainable natural system, which eliminates the need for chemicals to produce food.

Structure Insights

The shipping container segment dominated the market in 2023 with a revenue share of 51.09%. Structures help in growing crops irrespective of the geographic location. One of the primary benefits of container-based farming is that container farms are easy to transport, and do not require a large piece of land or a dedicated building to start cultivating. Moreover, the price of shipping containers decreases with increased competition because the cost of acquiring used containers is relatively less, which allows other companies to enter the market space.

The building-based vertical farming segment is anticipated to witness the fastest growth over the forecast period. Factors such as growing technological advancements and increasing penetration of precision farming are anticipated to drive the building-based segment over the forecast period. Building based farming helps minimize the cultivation cost associated with farming by producing food on buildings, ensuring that larger space is utilized compared to single farming practices and ensuring food security.

Crop Category Insights

The fruits, vegetables, & herbs segment registered the largest market share in 2023 and is expected to remain dominant from 2024 and 2030. The increasing cultivation of commonly grown fruits and vegetables in vertical farming is driving the segment growth. These crops are grown on a large scale and deliver maximum profit from their cultivation to the companies involved in the production of the crops. Concurrently, vertical farming improves biodiversity as it does not cause land disturbances. As such, vertical farming is in high demand for growing different types of crops.

The fruits, vegetables, & herbs segment is further sub-segmented into tomato, lettuce, leafy greens (excluding lettuce), herbs, bell & chili peppers, strawberry, cucumber, and others. Among these, the tomatoes segment led the market with a revenue share of 24.98% in 2023. This large share is attributed to the high average demand for tomatoes in all regions compared to other crops. One of the important factors behind growing any crop in vertical farming is to validate the economic viability of that crop, which ensures that the company is making a large amount of money from its cultivation. The crop types also play an important role in the feasibility study of vertical farming.

The flowers and ornamentals segment is projected to register a significant CAGR over the forecast period. The growing use of flowers and ornamentals for aesthetic and decorative purposes is expected to fuel market growth. In addition, vertical farming has gained popularity in growing edible flowers which include marigolds, matthiol, cloves, and snapdragons. The segment is further subcategorized into perennials, annuals, and ornamentals. The ornamentals flowers held the largest market share in 2023, owing to its increasing sales.

Key U.S. Vertical Farming Company Insights

Some of the major companies in U.S. vertical farming market include AeroFarms, Freight Farms, Inc., and American Hydroponics (U.S.).

-

Freight Farms, Inc. provides digital and physical solutions to create a local produce ecosystem. The company manufactures a flagship product called The Leafy Green Machine, a total hydroponic growing system that produces various herbs and vegetables. It also offers solutions to customers across North America and serves small businesses & entrepreneurs, hotels & restaurants, corporations, and educational institutions.

-

BrightFarms finances, designs, and builds indoor greenhouse farms at or near supermarkets to improve the supply chain by reducing time, cost, and distance. Moreover, the company focuses on improving the environmental effect of the food supply chain and increasing the relative consumption of fresh foods. The major aim of building greenhouses at or near supermarkets is to prioritize farmers, food quality, health, and the environment.

Bowery Farming and AeroFarms are some of the emerging companies in the U.S. market for vertical farming:

-

Bowery Farming is engaged in providing solutions related to vertical farming and digital agriculture. Bowery Farming is a New York-based company that has farms in New Jersey, Maryland, and Pennsylvania.

-

Aerofarm, is a U.S.- based indoor vertical farming solution provider. The company uses artificial intelligence and plant biology to fix broken food system and improve fresh produce growth.

Key U.S. Vertical Farming Companies:

- AmHydro

- AeroFarms

- BrightFarms

- Freight Farms

- Green Sense Farms Holdings, Inc.

- Bowery Farming Inc.

- Gotham Greens

- Plenty Unlimited Inc.

- General Hydroponics

- Hydrodynamics International

Recent Developments

-

On February 13, 2024, Local Bounti Corporation announced that it received a patent from the United States Patent and Trademark Office for its proprietary Stack & Flow Technology. The Stack & Flow Technology, which combines the best of vertical and greenhouse growing technologies, enables superior unit economics and efficiencies across the production cycle.

-

On November 3, 2023, JR Automation (JRA) and Forever Feed Technologies (FFT) announced a definitive agreement to design and build on-farm controlled environment feed mills for large-scale dairy and beef cattle producers. With this partnership, FFT and JRA will design and deliver custom automated systems that maximize the productivity and effectiveness of Forever Feed's water and carbon emission reduction technology, improving both farm operations and meeting a growing demand for sustainably produced high-quality animal feed.

U.S. Vertical Farming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 857.8 million

Revenue forecast in 2030

USD 2453.2 million

Growth rate

CAGR of 19.1 % from 2024 to 2030

Actual estimates/Historic data

2017 - 2022

Forecast period

2024 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Structure, component, growing mechanism, crop category

Country scope

U.S.

Key companies profiled

AmHydro; AeroFarms; BrightFarms; Freight Farms; Green Sense Farms Holdings, Inc.; Bowery Farming Inc.; Gotham Greens; Plenty Unlimited Inc.; General Hydroponics; Hydrodynamics International

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Customization scope

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vertical Farming Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. vertical farming market report based on structure, component, growing mechanism, and crop category:

-

Structure Outlook (Revenue, USD Million, 2017 - 2030)

-

Shipping Container

-

Building-based

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Lighting

-

Hydroponic Components

-

Climate Control

-

Sensors

-

-

Software

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

Services

-

-

Growing Mechanism Outlook (Revenue, USD Million, 2017 - 2030)

-

Hydroponics

-

Aeroponics

-

Aquaponics

-

-

Crop Category Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits Vegetables, & Herbs

-

Tomato

-

Lettuce

-

Bell & Chili Peppers

-

Strawberry

-

Cucumber

-

Leafy Greens (excluding lettuce)

-

Herbs

-

Others

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others (Cannabis, Microgreens)

-

Frequently Asked Questions About This Report

b. The U.S. vertical farming market size was estimated at USD 735.6 million in 2023 and is expected to reach USD 857.8 million in 2024.

b. The U.S. vertical farming market is expected to grow at a compound annual growth rate of 19.1% from 2024 to 2030 to reach USD 2,453.2 million by 2030.

b. The fruits, vegetables, and herbs segment dominated the U.S. vertical farming market and accounted for the largest market share of over 52% in 2023.

b. Some key players operating in the U.S. vertical farming market include AmHydro, AeroFarms, BrightFarms, Freight Farms, Green Sense Farms Holdings, Inc., Bowery Farming Inc., Gotham Greens, Plenty Unlimited Inc., General Hydroponics, and Hydrodynamics International, among others.

b. Key factors driving the growth of the U.S. vertical farming market include the decreasing amount of available farmland due to urbanization and soil damage and the increasing use of vertical farming for producing fruits and vegetables all year round in an eco-friendly manner.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.