- Home

- »

- Digital Media

- »

-

U.S. Video Streaming Market Size And Share Report, 2030GVR Report cover

![U.S. Video Streaming Market Size, Share & Trends Report]()

U.S. Video Streaming Market (2024 - 2030) Size, Share & Trends Analysis Report By Streaming Type, By Solution, By Platform, By Service, By Revenue Model, By Deployment Type, By User, And Segment Forecasts

- Report ID: GVR-4-68040-203-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Video Streaming Market Size & Trends

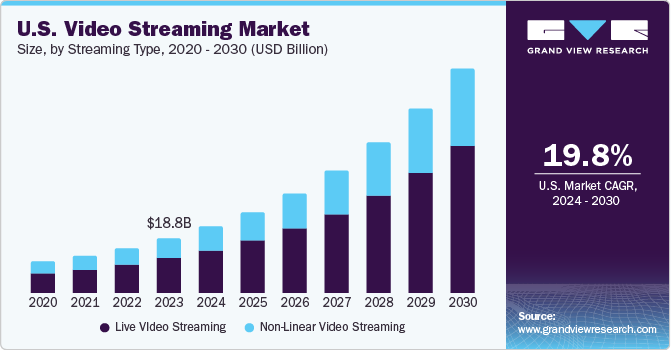

The U.S. video streaming market size was estimated at USD 18.79 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.8% between 2024 and 2030. Prevailing trends, such as rising internet penetration, evolving consumer preferences and increasing footfall of 5G services, have brought a paradigm shift in the regional landscape. Low latency and tremendous speed have made 5G a valuable proposition for faster downloads, enhanced performance, and smoother playback. Homes using online video services, including Netflix, Hulu, Disney+, and Amazon Prime, could overtake traditional multichannel in the ensuing period. Better streaming and high-profile theatrical content and digital sports make video streaming services a happy hunting ground.

Shifting user behavior towards 4K, 8K, full HD, and HD has engineered robust market growth in the U.S. The global average data consumption per smartphone from video streaming is likely to be pegged at 16.3 GB (by the end of 2024). The ubiquitous presence of streaming services in American homes has encouraged leading players to inject funds into the landscape. For instance, Netflix reported (as of December 31, 2023) around 260.28 million global paid memberships, with the U.S. and Canada accounting for 80.13 million subscribers.

While the COVID-19 pandemic wracked havoc globally, video streaming giants cashed in on the unprecedented demand for home entertainment. With theaters being shut down and consumers spending more leisure time at home, at-home video consumption grew by leaps and bounds. The outbreak also led to the launch of new content and services, as staying put in homes led to soaring demand for OTT services. For instance, New York, Washington, Orlando, Norfolk, Milwaukee, Denver, Chicago, Illinois and California witnessed a phenomenal rise in streaming consumption.

Market Concentration and Characteristics

As U.S. consumers are expected to inject funds into video entertainment in 2024 and beyond, innovations are likely to hold precedents in the landscape. For instance, Prime Video uses computer vision to automatically detect recaps, credits and introductions in content at scale. In April 2023, the American video streaming behemoth joined forces with the University of Texas at Austin to introduce the UT Austin-Amazon Science Hub. Prime Video is working on research areas, including video picture quality, compression and delivery; video understanding and augmentation; forecasting, automation and metrics; and search and recommendation.

Technology advancements in machine learning and AI have brought a tectonic shift in content creation, distribution and consumption. In essence, hybrid video on demand is opening new avenues of growth in the North American region. Trends, such as improved streaming quality, automated video editing and production (through AI), content personalization, and combatting against online piracy (through forensic watermarking and enhanced monitoring & detection), redefine the regional outlook.

Industry dynamics, such as mergers & acquisitions, regulations, availability of substitutes and end-user concentration, have reshaped the U.S. video streaming market revenue. To illustrate, in August 2023, sports leagues, including the NBA, NFL, and UFC, pushed for updates in the Digital Millennium Copyright Act (DMCA) for fast takedowns on pirate systems.

Streaming companies could witness tax streaming services (akin to local networks) as some states and cities have implemented taxes, most of which are passed on to the end-use customer. Prominently, video streaming has challenged the traditional relationship among service providers, users, copyright owners, and intermediaries.

Streaming Type Insights

The live video streaming segment spearheaded the market, accounting for 64.2% of the U.S. video streaming market revenue share in 2023. An unprecedented surge in internet penetration and heightened demand for ad-free content, analytics tracking, and mobile viewing have boded well for the market forecast. Live streaming in 4K, 3D, and mono formats modes will continue to receive an impetus. Stakeholders are expected to bank on live streaming for increased engagement and real-time feedback.

While live streaming will continue to amass traction, non-linear (video-on-demand) streaming will be highly sought-after across the region. American consumers have depicted a strong demand for VOD due to convenience and ease as it is pre-recorded and can be made available for streaming anytime. In essence, video-on-demand has added a fillip to the U.S. market with surging footfall of summits, town halls, exhibitions, and conferences. U.S. consumers have also depicted demand for news and sports (apart from series and movies), prompting industry leaders to infuse funds into the non-linear portfolio.

Solution Insights

The over-the-top (OTT) segment contributed the largest revenue share in 2023. Video streaming behemoths, such as Netflix, Disney+ and Amazon Prime Video, have observed notable growth since the lockdown. OTT giants have even joined forces with film studios and producers to gain a competitive edge in the market. Predominantly, advanced IT infrastructure and expanding footfall of 5G have fared well for the market growth.

Pay TV has continued to gain an impetus as a home entertainment device in the North American country. While the challenges posed by OTT have been evident, sports enthusiasts have often banked on cable TV to watch live games. Moreover, U.S. consumers seek pay TV networks for live broadcasts of events, news updates, live broadcasts and breaking stories. Besides, areas with unreliable internet connections are expected to observe robust demand for pay TV.

Platform Insights

The smartphones and tablets segment accounted for the largest market revenue share in 2023. The growth is partly due to the soaring adoption of advanced devices across the region. In April 2023, the U.S. Census Bureau noted that four out of five households with children owned tablets. To put this in perspective, 64% of U.S. households owned a tablet computer in 2021. Furthermore, 5G penetration and soaring demand for iPhone and Android devices reinforce the growth outlook of smartphones.

Gaming consoles have emerged as one of the most common home entertainment devices. Flagship products of Xbox and Microsoft have redefined the gaming industry. With internet connection becoming more robust and 5G becoming palpable, gaming traffic has witnessed an unprecedented spike. The emergence of 4K TVs has furthered the penetration of home consoles. Prevailing trends suggest AR/VR-based consoles could hold traction in the ensuing period.

Service Insights

The training and support service contributed significant U.S. video streaming market revenue share in 2023 and will continue to gain an uptick on the back of soaring demand for employee training and development. Video streaming (both live and pre-recorded) has bridged the gap between learners and educators, emerging as a game-changer in the training and support landscape. To illustrate, live video streaming can bolster real-time collaboration and eradicate the need for travel and accommodation expenses.

Managed services have received an impetus to take away the burden of maintaining the infrastructure, underpin the personalization experience, and prevent downtime. Besides, video conferencing solutions have gained an uptake as corporates continue to bank on innovative technologies. Furthermore, managed OTT platforms have gained ground in the wake of surging demand for subscription management, content management and content analytics.

Revenue Model Insights

The subscription-based model depicted the largest revenue share in 2023 and is expected to gain considerable traction during the forecast period. Subscription-based revenue (with recurring annual or monthly fees) has amassed huge popularity across the U.S. The trend has prompted industry leaders to inject funds into high-quality and original content. Lately, video streaming service providers have focused on OTT content covering meditations, training, workouts and recipes.

The advertising segment is poised to exhibit notable growth against the backdrop of the expectation of increased revenue by selling advertising space to other businesses. For instance, YouTube offers pre-roll, mid-roll and in-video ads for advertising companies. Predominantly, Pay TV is one of the largest markets for advertisers. In addition, advertising is also seen as a considerable revenue source during live streaming of sports events and tournaments.

Deployment Type Insights

The cloud deployment segment exhibited the largest revenue share in 2023 and will observe an uptick on the back of increased scalability. Robust projection is partly attributed to the demand for personalized content and the adoption of a pay-as-you-go business model. Predominantly, cloud-based solutions offer agility, capacity, and flexibility to handle fluctuations in traffic. The advanced solution has also helped video service providers to monetize offerings through targeted advertising.

The on-premise deployment has gained prominence to avoid bandwidth constraints and foster smooth network accessibility for seamless video streaming. Besides, sensitive content is profoundly retained on-premise for security and control. The growth is also attributed to the innate ability of the model to ensure virtually 100% uptime by negating service outages and interruptions. In essence, on-premise for OTT platforms could be resource-intensive with high upfront costs.

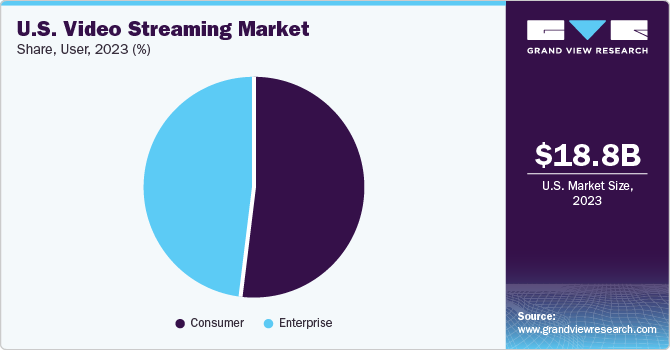

User Insights

The consumer segment accounted for the largest revenue share in 2023 and is poised to observe an uptick on the back of trends for gaming, e-learning, real-time entertainment, and social networking. In essence, live video and non-linear streaming providing e-learning and gaming have witnessed a massive uptick among consumers. Consumers will continue to bank on video streaming of theater performances, live concerts, vising museums and sporting events.

Enterprises have emerged as significant recipients of video streaming services as the demand for training, knowledge sharing & collaborations, and marketing & client engagement have soared recently. In essence, video streaming services have been sought for corporate communication to help leaders convey important information effectively. Corporations are banking on video platforms to bolster their internal and external communication strategies.

Key U.S. Video Streaming Company Insights

Some of the key players operating in the market include Apple Inc., Google LLC, IBM and Netflix, Inc. Some dynamics reshaping the U.S. market are delineated below:

-

In January 2023, IBM announced the rollout of a live mobile video streaming app to foster workplace communication globally. It is reported that the features added to the app are in line with businesses, such as closed captioning (AI-powered).

-

In March 2023, Apple reportedly acquired WaveOne, a startup that uses AI to compress videos. The AI-powered scene and object detection is expected to help understand a video frame and save bandwidth.

-

In February 2024, Netflix was reported to be contemplating a foray into video games with the launch of the streaming service. The twin innovations of subscription and streaming can redefine the gaming landscape.

Some emerging companies, such as Hulu and Stacked, have augmented their strategies to gain a competitive edge in the industry.

-

In November 2023, The Walt Disney Company announced it would acquire Hulu in a USD 8.6 billion deal. It is likely to help the former underpin its streaming business.

-

In August 2022, Stacked was reported to be making a video streaming platform for gaming content—Twitch for web3 users. The startup is reconfiguring its video streaming service with NFT and crypto features.

Key U.S. Video Streaming Companies:

- Amazon Web Services, Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Google LLC

- Kaltura, Inc.

- Netflix, Inc.

- International Business Machine Corporation (IBM Cloud Video)

- Wowza Media Systems, LLC

- Hulu, LLC (Walt Disney)

Recent Developments

-

In February 2023, Amazon asserted that it augmented content spending to USD 16.6 billion in 2022. Approximately USD 7 billion of that figure was earmarked for Amazon Originals, licensed third-party video content included with Prime and live sports programming.

-

In October 2023, Apple is gearing up to inject funds into Formula 1 as it contemplates gaining exclusive streaming rights for Formula 1 racing. The American giant is apparently seeking a 7-year deal, while global rights are expected to become accessible five years into the deal.

U.S. Video Streaming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.42 billion

Revenue Forecast in 2030

USD 66.41 billion

Growth Rate

CAGR of 19.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Streaming type; Solution; Platform; Service; Revenue Model; Deployment Type; User

Key Companies Profiled

Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC (Walt Disney)

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Video Streaming Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. video streaming market report based on streaming type, solution, platform, service, revenue model, deployment type, and user.

-

Streaming Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Live Video Streaming

-

Non-Linear Video Streaming (Video on Demand)

-

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Internet Protocol TV

-

Over-the-Top (OTT)

-

Pay TV

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gaming Consoles

-

Laptops & Desktops

-

Smartphones & Tablets

-

Smart TV

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consulting

-

Managed Services

-

Training & Support

-

-

Revenue Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Advertising

-

Rental

-

Subscription

-

-

Deployment Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Enterprise

-

Corporate Communications

-

Knowledge Sharing & Collaborations

-

Marketing & Client Engagement

-

Training & Development

-

-

Consumer

-

Real-Time Entertainment

-

Web Browsing & Advertising

-

Gaming

-

Social Networking

-

E-Learning

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. video streaming market include Amazon Web Services, Inc.; Apple Inc.; Cisco Systems, Inc.; Google LLC; Kaltura, Inc.; Netflix, Inc.; International Business Machine Corporation (IBM Cloud Video); Wowza Media Systems, LLC; Hulu, LLC (Walt Disney)

b. Key factors that are driving the market growth include Technology advancements in machine learning and AI, and soaring Internet Penetration

b. The global U.S. video streaming market size was estimated at USD 18.79 billion in 2023 and is expected to reach USD 22.42 billion in 2024.

b. The global U.S. video streaming market is expected to grow at a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 66.41 billion by 2030.

b. Over-the-top (OTT) segment dominated the U.S. video streaming market with a share of 28.9% in 2019. This is attributable to the predominant advancement in IT infrastructure and expanding footfall of 5G have fared well for the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.