- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Wastewater Secondary Treatment Equipment Market Report, 2020-2027GVR Report cover

![U.S. Wastewater Secondary Treatment Equipment Market Size, Share & Trends Report]()

U.S. Wastewater Secondary Treatment Equipment Market Size, Share & Trends Analysis Report By Equipment (PF, MBR, MBBR, SBR, IFAS), By Application, And Segment Forecast, 2020 - 2027

- Report ID: GVR-4-68038-572-4

- Number of Report Pages: 88

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Bulk Chemicals

Report Overview

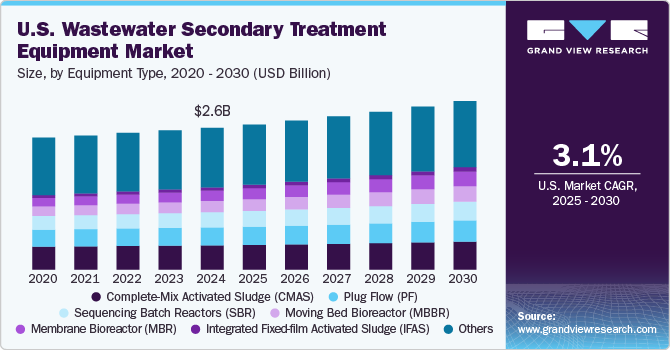

The U.S. wastewater secondary treatment equipment market size was valued at USD 1.68 billion in 2019 and is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 2.8% from 2020 to 2027. Growing demand for wastewater treatment plants coupled with positive government outlook with respect to funding is anticipated to have a positive impact on the demand. Secondary wastewater treatment refers to biologically removing contaminants from wastewater. The biological processes used for secondary wastewater treatment can be aerobic or anaerobic. Aerobic biological processes are commonly used for municipal wastewater treatment. In these processes, contaminants are converted into water, carbon dioxide, and other end products.

The Complete-mix Activated Sludge (CMAS) equipment segment dominated the market for wastewater secondary treatment equipment in U.S. and is anticipated to continue its dominance over the forecast period. The Membrane Bioreactor (MBR) equipment segment is anticipated to witness the highest growth rate over the forecast period. The growth of this segment can be primarily attributed to the stringent effluent regulations coupled with improved efficiency of the equipment.

The U.S. government has introduced stringent regulations and standards for wastewater treatment for both municipal and industrial sectors, which is expected to drive the demand for wastewater secondary treatment equipment. In addition, ongoing investments in various industries such as oil and gas, petrochemical, and chemical are anticipated to drive the demand.

Stringent federal regulations such as the Clean Water Act which establish a regulatory structure for pollutant discharges into the water bodies and regulates the quality standards for surface waters is anticipated to have a positive impact on the market growth. In addition, the National Pollutant Discharge Elimination System (NPDES) permit program has established the discharge conditions, and limits for discharges from municipal as well as commercial and industrial sources.

Equipment Insights

The Complete-mix Activated Sludge (CMAS) equipment segment accounted for the highest market share of 17.5% in terms of revenue in 2019. CMAS is one of the simplest forms of secondary wastewater treatment equipment. One of the primary advantages of this system is that the shock loads are rapidly diluted and dispersed. This equipment is employed across numerous wastewater treatment plants.

The Membrane Bioreactor (MBR) equipment segment is estimated to expand at a CAGR of 6.3% from 2020 to 2027. Membrane bioreactors is an advanced treatment system that integrates the conventional biological treatment process such as the activated sludge process with membrane filtration in order to provide more effective removal of suspended and organic solids.

Membrane bioreactors eliminate the sedimentation process owing to which the biological process can be operated at a higher mixed liquor concentration. Membrane bioreactors, therefore, allow advanced level filtration and deliver high-quality effluent. Increasing demand for high capacity and efficient wastewater treatment systems is anticipated to drive the growth of this segment.

Moving Bed Biofilm Reactor (MBBR) equipment segment is anticipated to expand at a CAGR of 5.5% from 2020 to 2027. MBBR is typically used for treating wastewater that is contaminated with high to medium levels of organic contaminants. MBBR employs plastic media within the aeration tank, which increases the surface area for the microorganisms to grow thereby reducing the overall footprint of the system.

Application Insights

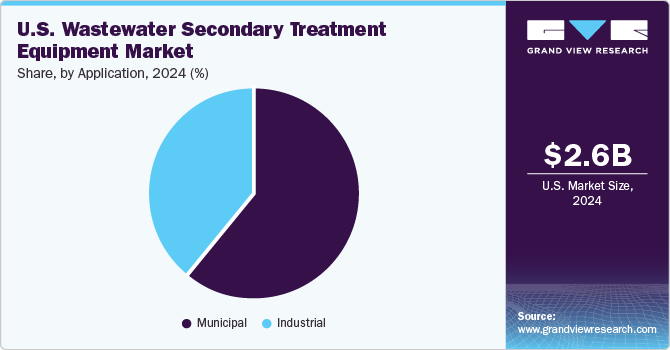

The municipal application segment was valued at USD 1,035.5 million in 2019 with a revenue share of more than 60%. Factors such as ongoing new housing developments; population growth, most notably in the western and southern parts of the country; and increasing number of rural households switching to public sewers are expected to exert pressure on existing centralized wastewater treatment systems.

In addition, favorable government policies and programs are also expected to boost investments in municipal wastewater treatment facilities over the forecast period. The aforementioned factors are anticipated to drive the need for either new capacity construction or existing capacity expansion, which, in turn, is expected to drive the demand for wastewater secondary treatment equipment over the forecast period.

The industrial application segment is estimated to witness the highest CAGR from 2020 to 2027 and is anticipated to reach USD 829.9 million in 2027. Rising investments in various industries and stringent regulations pertaining to discharges from these industries are some of the key factors driving the demand for wastewater secondary treatment equipment in industrial application in the country.

In addition, upcoming projects within the petrochemical industry coupled with the availability of affordable natural gas and natural gas liquids from shale gas is compelling chemical companies around the world to invest in projects to expand their respective capacities or build new facilities in the country. This, in turn, is expected to drive the demand.

Key Companies & Market Share Insights

The market is highly competitive and dependent on technological advancements and product developments. The equipment manufacturers are adopting various strategies such as mergers and acquisitions and new product developments in order to cater to the changing technological requirements from various end-use applications as well as increase the market penetration in the region.

Manufacturers are adopting various strategies such as mergers and acquisitions and new product developments to cater to the changing technological requirements from various end-use applications and increased market penetration. Some of the prominent players in the U.S. wastewater secondary treatment equipment market include:

-

Xylem, Inc.

-

Pentair plc

-

Evoqua Water Technologies LLC

-

Aquatech International LLC

-

SUEZ

-

Ecolab Inc.

-

Calgon Carbon Corporation

-

Toshiba Water Solutions Private Limited

-

Veolia

-

Ecologix Entertainment Systems, LLC

-

Parkson Corporation

-

Lenntech B.V.

-

H2O Innovation

-

Smith & Loveless

-

Samco Technologies, Inc.

U.S. Wastewater Secondary Treatment Equipment Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 1.7 billion

Revenue forecast in 2027

USD 2.1 billion

Growth Rate

CAGR of 2.8% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application

Country scope

U.S.

Key companies profiled

Xylem, Inc.; Pentair plc; Evoqua Water Technologies LLC; Aquatech International LLC; SUEZ; Ecolab Inc.; Calgon Carbon Corporation; Toshiba Water Solutions Private Limited; Veolia; Ecologix Entertainment Systems, LLC; Parkson Corporation; Lenntech B.V.; H2O Innovation; Smith & Loveless; Samco Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the U.S. wastewater secondary treatment equipment market report on the basis of equipment and application:

-

Equipment Outlook (Revenue, USD Million, 2016 - 2027)

-

Plug Flow (PF)

-

Complete-Mix Activated Sludge (CMAS)

-

Membrane Bioreactor (MBR)

-

Moving Bed Biofilm Reactor (MBBR)

-

Sequencing Batch Reactor (SBR)

-

Integrated Fixed-film Activated Sludge (IFAS)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Municipal

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. wastewater secondary treatment equipment market size was estimated at USD 1.69 billion in 2019 and is expected to reach USD 1.72 billion in 2020.

b. The U.S. wastewater secondary treatment equipment market is expected to grow at a compound annual growth rate of 2.8% from 2020 to 2027 to reach USD 2.10 billion by 2027.

b. Complete-Mix Activated Sludge (CMAS) dominated the U.S. wastewater secondary treatment equipment market with a share of 17.5% in 2019. This is attributable to the ease of use and uniform distribution ensures that the outflow mixed liquor is similar to the mixed liquor in the aeration tank.

b. Some key players operating in the U.S. wastewater secondary treatment equipment market include Xylem, Inc., Pentair plc, Evoqua Water Technologies LLC, Suez, Veolia, Ecolab, Inc., H2O Innovation, and Aquatech International LLC

b. Key factors that are driving the market growth include the need for removing contaminants biologically and increasing need for improved water treatment services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."