- Home

- »

- Medical Devices

- »

-

U.S. Wound Care Centers Market Size & Share Report, 2030GVR Report cover

![U.S. Wound Care Centers Market Size, Share & Trends Report]()

U.S. Wound Care Centers Market Size, Share & Trends Analysis Report By Procedure (Debridement, HBOT, Compression Therapy, Specialized Dressing, Infection Control), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-125-9

- Number of Report Pages: 65

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

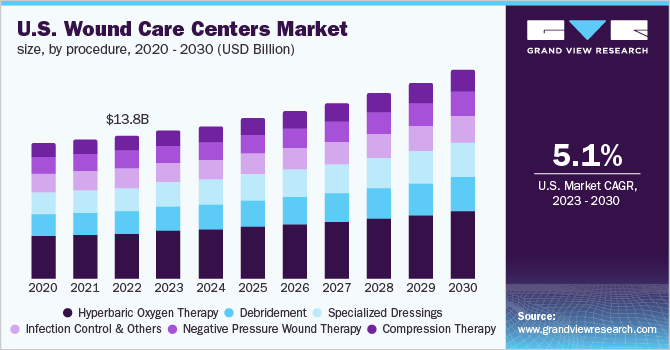

The U.S. wound care centers market size was valued at USD 13.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.10% from 2023 to 2030. The rising prevalence of chronic non-healing wounds in the elderly population and increasing demand for wound care services are expected to propel the industry growth over the forecast period. As per an article published by UpToDate, Inc., around 1 to 2 in 100,000 individuals in the U.S. are suffering from chronic non-healing wounds. Moreover, the rising adoption of advanced technologies in procedures and dressings is expected to drive the industry. According to an article published in Advances in Wound Care, chronic wounds are the most common in the geriatric population.

Open wounds are present in 3% of Americans over 65 years of age. The U.S. government projects that there will be over 77 million geriatric people in the country by 2060, which indicates that chronic wounds will continue to be a constant problem affecting this population group. According to estimates, chronic wounds affect 2% of the population in the U.S. The growing cases of diabetes and diabetic foot ulcers are anticipated to lead to an increased demand for efficient wound care, thereby supporting industry growth. According to the University of California, the leading cause of nontraumatic amputation of the lower extremity in the U.S. is diabetes, and around 14-24% of diabetic patients who develop foot ulcers undergo an amputation.

Furthermore, according to the International Diabetes Federation Diabetes Atlas 2022 statistics, in the 10th edition of 2021, there were 32,215 thousand cases of diabetes in the U.S., and this number is projected to reach 36,289 thousand by 2045. To cater to the rising demand for wound care, wound care centers are conducting awareness programs and adopting new technologies. For instance, in November 2019, Mariners Hospital, a part of Baptist Health South Florida, included hyperbaric oxygen therapy in its services portfolio. Such measures are expected to increase the demand for wound care due to an increase in awareness and accurate & quick treatment owing to the growing adoption of new technologies.

The market in the U.S. was adversely impacted during the first half of the COVID-19 pandemic. During the pandemic, healthcare providers were focusing on developing resources to support shared care and self-care, minimizing the risk of infection among health professionals & patients. However, many centers reported a reduced volume of patients when compared to a similar period of pre-pandemic. According to the data published by Tissue Analytics, collected from the U.S. wound clinics, a year-on-year weekly reduction of 5% was observed in early March 2020, which reached 25% as of April 17, 2020. Some centers were working at full capacity and, in many cases, were overbooked to compensate for the high appointment cancellation rate.

Procedure Insights

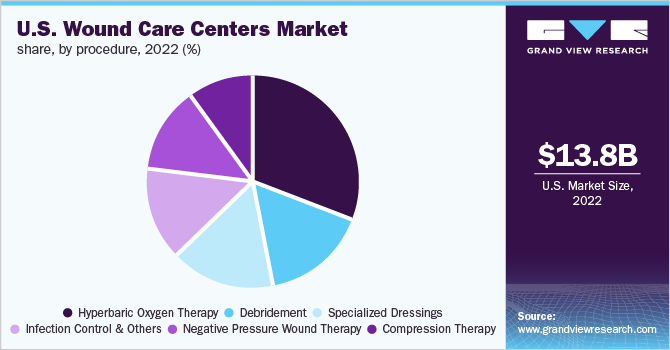

The Hyperbaric Oxygen Therapy (HBOT) segment held the largest share of 31.15% of the overall revenue in 2022 and is expected to witness the fastest growth rate during the forecast period. Increasing awareness about the use of HBOT for chronic wounds, including diabetic foot ulcers, is expected to drive segment growth. Effective results with the use of HBOT for the treatment of chronic wounds, such as arterial ulcers & diabetic foot ulcers, are expected to boost the demand for HBOT from physicians. The number of HBOT treatments requires changes depending on the extent of a patient’s wound and how well the wound responds to the therapy. Wound care centers are proving reliable and improved HBOT services to promote effective & faster healing.

For instance, in May 2021, Mayo Clinic reported using HBOT to heal complications occurring after cleft palate surgery in an infant. In addition, medical facilities are introducing HBOT services due to the increasing awareness about its benefits in wound healing. Moreover, the debridement segment is expected to witness significant growth during the forecast period, owing to its rising adoption for the treatment of diabetic foot ulcers. According to the National Library of Medicine, the lifetime prevalence of Diabetic Foot Ulcerations (DFU) is around 15-34% in the U.S., and debridement as a treatment can enhance ulcer healing and prevent complications, such as infections & amputations, which can otherwise cause major clinical & public health implications.

Key Companies & Market Share Insights

The industry is highly competitive. There are around 47 centers of EmergeOrtho in the U.S., three of Baptist Health South Florida, and six of Tower Wound Care Center. Industry players adopt this strategy to expand the outreach of their service in the market and increase the availability of their service in diverse geographical areas. For instance, in February 2020, Healogics, Inc., in partnership with the University of Southern California (USC), produced a model that identifies wounds most likely to heal within 12 weeks. Some of the prominent players in the U.S. wound care centers market include:

-

Healogics, Inc.

-

TOWER WOUND CARE CENTER

-

Wound Care Center NYC

-

SNF Wound Care

-

WOUND INSTITUTE OF AMERICA

-

Schoolcraft Memorial Hospital

-

EmergeOrtho

-

Clarion Hospital

-

North Shore Health and Hyperbarics

-

Baptist Health South Florida

-

Natchitoches Regional Medical Center

U.S. Wound Care Centers Market Report Scope

Report Attribute

Details

The revenue forecast in 2030

USD 20.2 billion

Growth rate

CAGR of 5.10% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure

Country scope

U.S.

Key companies profiled

Baptist Health South Florida; TOWER Wound Care Center; SNF Wound Care; Wound Care Center NYC; Wound Institute of America; EmergeOrtho; North Shore Health and Hyperbarics; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; Healogics, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Care Centers Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. wound care centers market report based on procedure:

-

Procedure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Debridement

-

Negative Pressure Wound Therapy

-

Compression Therapy

-

Hyperbaric Oxygen Therapy

-

Specialized Dressings

-

Infection Control & Others

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. wound care centers market include Healogics, Inc.; Tower Wound Care Center; SNF Wound Care; Wound Care Center NYC; Wound Institute of America; EmergeOrtho; North Shore Health and Hyperbarics; Baptist Health South Florida; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital.

b. Key factors that are driving the U.S. wound care centers market growth include the increasing prevalence of chronic wounds in the geriatric population and the growing demand for outpatient wound care services.

b. The U.S. wound care centers market size was estimated at USD 13.8 billion in 2022 and is expected to reach USD 14.3 billion in 2023.

b. The U.S. wound care centers market is expected to grow at a compound annual growth rate of 5.10% from 2023 to 2030 to reach USD 20.2 billion by 2030.

b. Hyperbaric oxygen therapy dominated the U.S. wound care centers market with a share of 30.8% in 2022. This is attributable to increasing awareness regarding the use of hyperbaric oxygen therapy for chronic wounds such as diabetic foot ulcers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."