- Home

- »

- Automotive & Transportation

- »

-

Used Semi Truck Market Size, Share & Trends Report, 2030GVR Report cover

![Used Semi Truck Market Size, Share & Trends Report]()

Used Semi Truck Market Size, Share & Trends Analysis Report, By Sales Channel (Franchised Dealer, Independent Dealer, Peer-to-Peer), By Propulsion Type (ICE, Electric), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-170-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Used Semi Truck Market Size & Trends

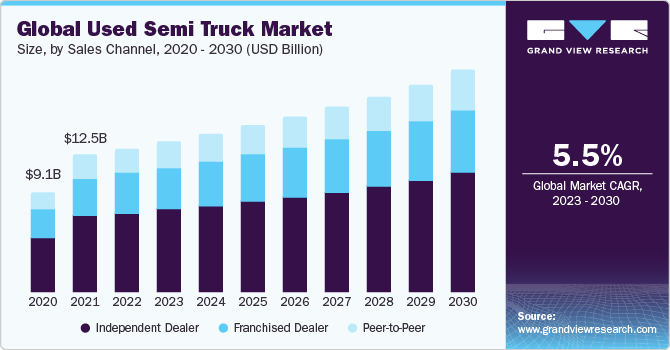

The global used semi truck market size was valued at USD 13.10 billion in 2022 and is anticipated to grow at a CAGR of 5.5% over the forecast period. The market growth is mainly attributed to the escalating demand for cost-effective transportation solutions in various industries, including logistics, construction, and agriculture. As businesses seek to optimize their operations and minimize expenses, the affordability and reliability of used semi-truck vehicles become increasingly demanding across the globe.

The expansion of international trade and the growing need for cross-border transportation have propelled the demand for sturdy and dependable semi-trucks, further bolstering the growth of the global used semi-truck market. According to the World Trade Organization, the global merchandise trade witnessed a significant surge of 12%, reaching a remarkable USD 25.3 trillion in 2022. This growth can be attributed, in part, to the soaring global commodity prices. The trend is expected to continue as businesses seek to optimize their supply chain and transportation networks to meet the evolving demands of the modern consumer-driven economy.

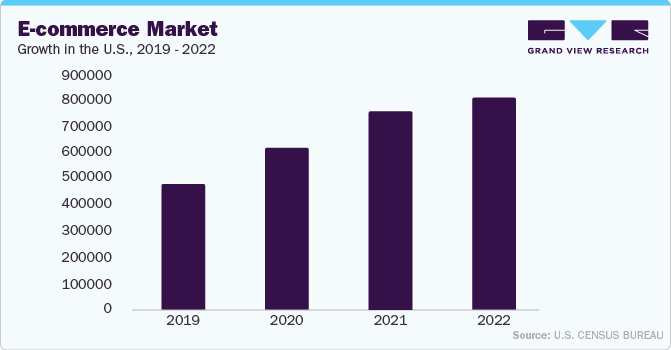

Another factor that drives the used semi truck market is the rise of e-commerce and the consequent surge in the demand for efficient logistics solutions. With the exponential growth of online retail and the increasing need for seamless and timely delivery of goods, there has been a heightened requirement for a robust and cost-effective transportation network. Used semi-trucks have filled this gap by offering a practical solution that balances both affordability and reliability.

The technological advancements in the refurbishment and maintenance of used semi-trucks have significantly enhanced their performance and extended their operational lifespan, making them a viable alternative to expensive brand-new models. Additionally, the global focus on sustainable practices and the need to reduce the environmental impact of the transportation industry has prompted many businesses to opt for second-hand semi-trucks, thereby contributing to the overall growth of the used semi-truck market.

Sales Channel Insights

Based on the sales channel, the used semi-truck market is segmented into franchised dealers, independent dealers, and peer-to-peer. The independent dealer segment dominated the market in 2022. The growing adoption of independent dealers can be attributed to factors such as they often offer competitive prices for these trucks, allowing businesses to acquire reliable vehicles at lower costs compared to buying brand-new ones.

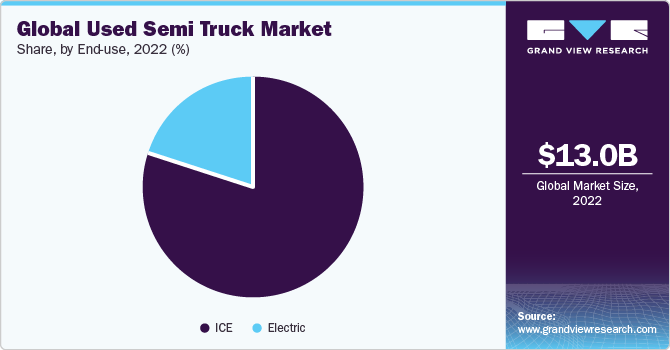

Propulsion Type Insights

On the basis of propulsion, the market is segmented into ICE and electric. The OEM segment held the largest market share in 2022. The ICE segment growth can be attributed to its durability and proven performance over the years. Many businesses prefer the reliability and familiarity of ICE trucks, especially in industries where long-haul, heavy-duty transportation is critical.

Regional Insights

North America dominated the market in 2022. Technological advancements and changes in industry regulations also significantly influence the used semi-truck market in the region. Newer technologies, such as more fuel-efficient engines or advanced safety features, can make older models less desirable, leading to a decline in their demand. Similarly, changes in emission standards and regulations may prompt businesses to update their fleets, resulting in an increased supply of used semi-trucks.

Competitive Insights

Key players operating in the market include AB Volvo; Arrow Truck Sales, Inc.; INTERNATIONAL USED TRUCK CENTERS; IronPlanet, Inc.; IVECO S.p.A; MAN; PACCAR Financial Used Truck Center; Ryder System, Inc.; Sandhills Global (Truckpaper); Scania; and Tata Motors Limited.; among others. The market players are adopting strategic initiatives such as mergers & acquisitions, collaborations, and new product developments to gain a competitive edge.

-

In June 2023, Ryder System, Inc. opened a used vehicle sales location in Boston South for used trucks. The new facility offers a wide selection of used trucks, including semi trucks, vans, and trailers. All of Ryder's used vehicles are inspected and reconditioned before being offered for sale, and customers can choose from a variety of financing options and maintenance services to meet their needs.

-

In May 2021, AB Volvo launched a new platform in Europe for buying used trucks online. The platform, called Volvo Selected, is a one-stop shop for customers to find and purchase used Volvo trucks. It offers a wide range of trucks, from regional and long-haul tractors to construction and distribution trucks. The platform allows customers to search for trucks by vehicle type, axle configuration, price range, and other criteria.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."