- Home

- »

- Medical Devices

- »

-

Uterine Fibroid Treatment Device Market Report, 2020-2027GVR Report cover

![Uterine Fibroid Treatment Device Market Size, Share & Trends Report]()

Uterine Fibroid Treatment Device Market Size, Share & Trends Analysis Report By Technology (Surgical, Ablation), By Mode Of Treatment (Invasive, Non-invasive), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-820-6

- Number of Report Pages: 124

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

Report Overview

The global uterine fibroid treatment device market size was valued at USD 4.6 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 9.5% from 2020 to 2027. High prevalence of uterine fibroids among women across the world, rising patients’ preference for minimally invasive procedures, and adoption of technologically advanced products are the major factors expected to drive the market. Uterine fibroid (UF) is the benign tumor of the smooth muscle cells formed in the woman’s uterus and these can lead to excessive menstrual bleeding, pelvic pain, infertility, and frequent urination. Despite being the fact that their cause is still unknown, its risk factors include race, age, familial predisposition, premenopausal state, hypertension, overweight, and diet. About 50 to 75% of UF cases remain asymptomatic, consequently, get less clinical attention, and often remain undiagnosed.

According to the Centers for Disease Control and Prevention (CDC), 11.7% of women aged between 40-44 years had a hysterectomy from 2006-2010. Every year in the U.S., more than 600,000 hysterectomies (surgical removal of their uterus) and around 20 million women have had a hysterectomy. However, it has been observed that at least 80,000 of those hysterectomies may be unnecessary and could be avoided as per the article issued in the American Journal of Obstetrics and Gynecology. This is anticipated to boost the market growth.

Moreover, a rise in patients’ preference for minimally and non-invasive fibroids surgeries are expected to boost the market growth. Smaller incisions decrease post-operative pain and facilitate speedy recovery, thus leading to high adoption of these procedures. Several key players are investing in R&D for the launch of innovative minimally and non-invasive surgical instruments. For instance, the MR-guided Focused Ultrasound (MRgFUS) used for the treatment of uterine fibroids is one of the incisionless procedures that is widely recommended by physicians. In this procedure, the device produces ultrasound beams, thus heating and removing targeted tissue from the uterine cavity. This is a non-invasive treatment and therefore has slight to no side effects and patients may return to normal activity within a few days. Thus, growing demand for such procedures due to minimal pain, efficacy, less chance of infection, and speedy recovery as compared to open surgeries is anticipated to boost the demand for uterine fibroids treatment devices.

Several initiatives are being undertaken by various governments and private organizations to increase awareness related to early fibroids diagnosis and treatment. For instance, in the U.S., July is being recognized as “Fibroids Awareness Month”. In recent years, there have been increased awareness efforts made related to uterine fibroids. Some of the notable programs are the White Dress Project, HealthyWomen.org, Fibroids Project, and Center for Innovative GYN Care. The White Dress Project organization aims for fibroids awareness, which includes raising funds for research as well as educating women on the basics. This project encourages and supports women to become members and share their experiences. In addition, the Fibroids Project is an online website and community, which is devoted to helping women become fibroids-free. Their mission is to provide both women and medical professionals with all the information on current research, programs, and procedures. This growing awareness among women regarding the treatment of uterine fibroids and initiatives is likely to boost the market growth.

Countries such as the U.S. and Canada have witnessed increasing cases of uterine fibroids and a growing number of surgeries in recent years. In the U.S., uterine fibroids are the foremost indication for hysterectomy, which accounts for 39% of all hysterectomies performed annually. In addition, as per the American Journal of Obstetrics & Gynecology, in the U.S., over one-third of hysterectomies are performed for uterine fibroids. Furthermore, as per the Journal of Obstetrics & Gynecology Canada (JOGC), over 41, 000 hysterectomies are performed every year in Canada. Uterine fibroids treatment devices are required to perform such procedures, and thus it is anticipated to boost the market growth over the forecast period.

Additionally, an increasing number of cases of uterine fibroids related disorders in the developed and developing countries has driven the launch of technologically advanced products in the market. For instance, Channel Medsystem’s Cerene Cryotherapy device is used in the treatment of heavy menstrual bleeding. This device uses extreme cold to destroy the lining of the uterus tissues to reduce heavy menstrual bleeding without giving general anesthesia. In addition, Insightec’s MR-guided Focused Ultrasound (MRgFUS) used for the treatment of uterine fibroids. This procedure is incisionless and produces ultrasound beams, thus heating and removing targeted tissue from the uterine cavity. Thus, market players are making constant efforts for introducing technologically advanced products in the market.

Technology Insights

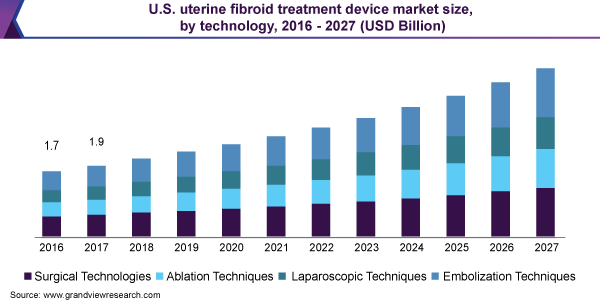

On the basis of technology, the market is segmented into surgical techniques, laparoscopic techniques, ablation techniques, and embolization techniques. The surgical techniques segment dominated the overall market with a share of 33.9% in 2019. This is due to an increasing number of hysterectomy and myomectomy surgical procedures as these are the most performed procedures for fibroids treatment in women. In addition, this technique is the most preferred and proven permanent solution for uterine fibroids treatment. Thus, an increasing number of related surgeries are expected to fuel segment growth.

The ablation techniques segment is expected to expand at the highest CAGR of 10.2% from 2020 to 2027. This is a minimally invasive technique that surgically ablates the endometrium lining of the uterus. This is a common surgical treatment for heavy menstrual bleeding. No incisions are needed for endometrial ablation and can be done in the doctor's office without giving general anesthesia. Moreover, pregnancy is possible after the endometrial ablation procedure. Thus, benefits offered by ablation techniques are expected to fuel the segment growth.

Mode Of Treatment Insights

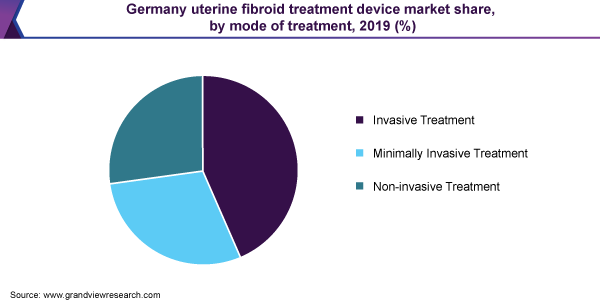

On the basis of mode of treatment, the market is segmented into invasive, minimally invasive, and non-invasive treatment. The invasive treatment segment dominated the overall market with a share of 44.0% in 2019. This is attributed to increasing cases of uterine fibroids and associated symptoms in women around the world. As abdominal myomectomy and hysterectomy are gold-standard procedures for the uterine fibroids treatment and have achieved widespread acceptance due to their cost-effectiveness. Thus, these factors are anticipated to increase the demand for uterine fibroids treatment devices during the forecast period.

The non-invasive treatment segment is expected to expand at the highest CAGR of 9.9% from 2020 to 2027. This is attributed to the increasing demand for incisionless procedures for associated disorders. The major benefit of such procedures is the small size incision, unlike conventional surgeries that make use of large openings, minimally invasive procedures rely on small openings. Thus, these factors are expected to increase the demand for uterine fibroids treatment devices during the forecast period.

Regional Insights

North America dominated the market with a share of 58.2% in 2019. This is attributed to the presence of well-established healthcare facilities in the region, rising government initiatives, and increasing hysterectomy related surgical procedures/hospital visits. Furthermore, the availability of technologically advanced products and the presence of major key players, such as Medtronic, Stryker, and CooperSurgical, Inc., are contributing towards the market growth in the region. In addition, the ease of access to healthcare technologies and the presence of strong distribution channels are driving the adoption of uterine fibroids treatment devices in the region.

Asia Pacific is expected to expand at the highest CAGR of 10.6% from 2020 to 2027. Factors such as the presence of a large patient base and unmet needs regarding the fibroids diagnosis and treatment are contributing towards the market growth in this region. Moreover, advances in clinical development framework of developing economies, such as India, China, and Japan, are likely to contribute to market growth. In addition, an increase in the number of hospitalization and rising healthcare expenditure by the government are a few other factors aiding growth in this region.

Key Companies & Market Share Insights

Companies are focusing on research and development to develop technologically advanced products to gain a competitive edge. For instance, in April 2019, Channel Medsystems has received the U.S. FDA approval for the Cerene Cryotherapy device used in the treatment of heavy menstrual bleeding. This device uses extreme cold to destroy the lining of the uterus tissues so as to reduce heavy menstrual bleeding without giving general anesthesia. Similarly, in March 2020, Karl Storz has launched a compact endoscopy system called Tele Pack+. It is a transportable video system that merges all of the key components, such as camera control unit, light source, and display together required for diagnosis and treatment, as well as data management.

Companies are involved in mergers, partnerships, and acquisitions, aiming to strengthen their product portfolio, manufacturing capacities, and provide competitive diversity. For instance, in May 2020, Minerva Surgical Inc. acquired the Intrauterine Health products segment from Boston Scientific Corporation. The products including Resectr Tissue Resection Device, Symphion Tissue Removal System, and the Genesys HTA System are used for the treatment of abnormal uterine bleeding. Some of the prominent players in the uterine fibroid treatment device market are:

-

Medtronic

-

Stryker Corporation

-

Boston Scientific Corporation

-

INSIGHTEC

-

CooperSurgical Inc.

-

Hologic, Inc.

-

Lumenis

Uterine Fibroid Treatment Device Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 4.96 billion

Revenue forecast in 2027

USD 9.3 billion

Growth Rate

CAGR of 9.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, mode of treatment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Medtronic; Stryker Corporation; CooperSurgical Inc.; Ethicon, Inc.; Hologic, Inc.; Minerva Surgical, Inc.; Lumenis; Boston scientific; INSIGHTEC; Karl Storz GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global uterine fibroid treatment device market report on the basis of technology, mode of treatment, and region:

-

Technology Outlook (Revenue, 2016 - 2027 (USD Million))

-

Surgical Techniques

-

Hysterectomy

-

Myomectomy

-

-

Laparoscopic Techniques

-

Laparoscopic Myomectomy

-

Myolysis

-

-

Ablation Techniques

-

Microwave Ablation

-

Hydrothermal Ablation

-

Cryoablation

-

Ultrasound Ablation

-

High Intensity Focused Ultrasound (HIFU)

-

MRI-guided Focused Ultrasound (MRgFUS)

-

-

Other Ablation Techniques

-

-

Embolization Techniques

-

-

Mode of Treatment Outlook (Revenue, 2016 - 2027 (USD Million))

-

Invasive Treatment

-

Minimally Invasive Treatment

-

Non-invasive Treatment

-

-

Regional Outlook (Revenue, 2016 - 2027 (USD Million))

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

The Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global uterine fibroid treatment device market size was estimated at USD 4.6 billion in 2019 and is expected to reach USD 5.0 billion in 2020

b. The global uterine fibroid treatment device market is expected to grow at a compound annual growth rate of 9.5% from 2020 to 2027 to reach USD 9.3 billion by 2027.

b. North America dominated the uterine fibroid treatment device market with a share of 58.2% in 2019. This is attributable to the increasing prevalence of uterine fibroids and related surgeries, the presence of favorable reimbursement policies, and sophisticated healthcare infrastructure.

b. Some of the key players operating in the uterine fibroid treatment device market include Medtronic, Stryker Corporation, CooperSurgical Inc., Ethicon, Inc., Hologic, Inc., Minerva Surgical, Inc., Lumenis, Boston scientific, INSIGHTEC, and Karl Storz GmbH.

b. Key factors that are driving the market growth include increasing population base of uterine fibroids patients, increasing adoption of minimally invasive and non-invasive treatment procedures, and rapid technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."