- Home

- »

- Pharmaceuticals

- »

-

Uterine Fibroid Treatment Drugs Market Size Report, 2030GVR Report cover

![Uterine Fibroid Treatment Drugs Market Size, Share & Trends Report]()

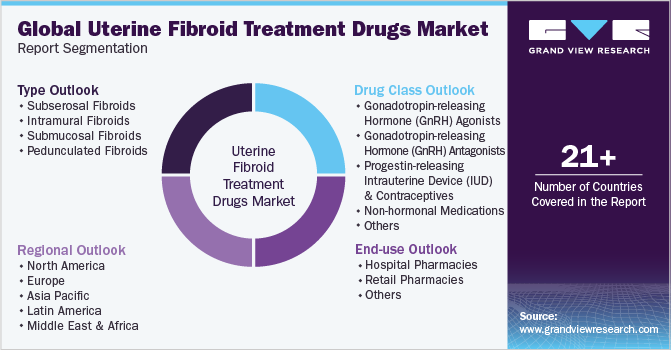

Uterine Fibroid Treatment Drugs Market Size, Share & Trends Analysis Report By Drug Class (GnRH Agonists, GnRH Antagonists), By Type (Submucosal Fibroids, Intramural Fibroids), By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-065-3

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

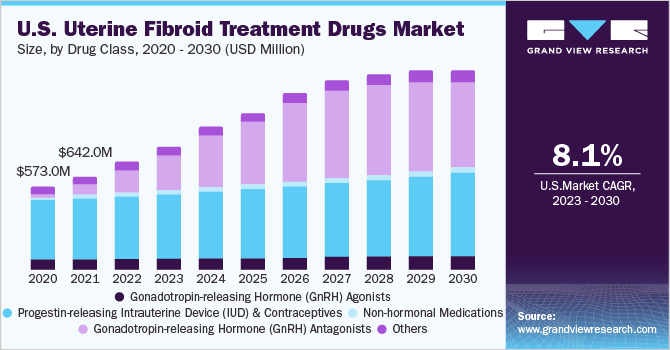

The global uterine fibroid treatment drugs market size was estimated at USD 1.80 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030. The major factors driving the market growth are the increasing number of new product launches and the rising prevalence of uterine fibroids. Some risk factors causing the development of fibroids are reduced fertility, frequent alcohol, early age at menarche, caffeine consumption, hypertension, obesity, diabetes mellitus, and previous pelvic inflammatory disease. These factors have led to an increase in the prevalence of uterine fibroids, which, in turn, will drive the market growth. The effectiveness of newly launched novel drugs in reducing heavy menstrual bleeding in women with Uterine Fibroid (UF) is also expected to drive market growth.

For instance, Yselty, an oral GnRH antagonist was approved by the EMA in June 2022 for the treatment of moderate to severe symptoms of uterine leiomyomas. Another GnRH antagonist, Myfembree, was approved by the U.S. FDA for the treatment of heavy bleeding associated with uterine fibroids. These drugs coupled with add-back therapy are very effective in reducing heavy menstrual bleeding. Rising awareness regarding leiomyomas, emphasis on early diagnosis and treatment, and educating people about the condition are also expected to drive growth. For instance, in November 2021, Minerva Surgical, Inc. launched the uterine health education website.

Thus, government and private organizations are actively taking initiatives to raise awareness in society and boost space growth. Uterine fibroids are the most common benign tumors in women of childbearing age and the world is witnessing a rise in the disease prevalence, which is the key factor driving the market. In February 2022, Contemporary OB/GYN published an article, ‘A Look At The Current State of Uterine Fibroid Care’, which estimates around 70% of women develop the disease by the age of 50 years. Black and Hispanic women are more likely to have uterine fibroids. Black women are more susceptible to UF due to various factors, such as genetic susceptibility, age, hypertension, premenopausal status, and an imbalanced diet, leading to an increased risk of leiomyoma.

Drug Class Insights

The progestin-releasing Intrauterine Device (IUD) & contraceptives segment accounted for a share of 67.8% in 2022. The high share can be attributed to several potential benefits for women with uterine leiomyomas, such as fibroid shrinkage, reduction in menstrual bleeding, prevention of surgery, and improvement in quality of life. In addition, the Gonadotropin-releasing Hormone (GnRH) agonist drugs are also an effective treatment option as these drugs suppress ovulation by reducing the production of estrogen and progesterone, thereby relieving the symptoms. Examples of GnRH agonists include nafarelin (Synarel), goserelin (Zoladex), leuprorelin (Prostap), and Buserelin.

Leuprolide is an FDA-approved drug used as a GnRH agonist for the management of uterine leiomyomata. Similarly, goserelin is used for reducing fibroid growth & endometrial thickness. The GnRH antagonists segment is anticipated to witness the fastest growth rate over the forecast period. The approval of multiple products in the past couple of years along with their efficacy & safety for fibroid treatment will be major factors contributing to segment growth. For instance, in May 2021, Myovant Sciences and Pfizer received approval from the U.S. FDA for Myfembree (relugolix) for the treatment of heavy bleeding associated with UF. The oral administration of GnRH anatagonists is also a factor that will enable the rapid uptake of these drugs among the target population.

Type Insights

The submucosal fibroids segment held the largest share of 35.48% of the overall revenue in 2022. Submucosal fibroids are non-cancerous growth in the uterus that generally appears during reproductive years. These type of fibroids develop in the muscle layer of the uterus, underneath the inner lining, & grows into the uterine cavity. These fibroids can range from the size of a seedling to a more bulky mass that may enlarge the uterus. The submucosal fibroids are usually embedded into the uterine wall; however, can be hanging and pedunculated into the cavity with a stalk.

The intramural fibroids segment is anticipated to register the fastest growth rate over the forecast period. Intramural fibroids significantly reduce fertility outcomes, hence making treatment necessary. Intramural fibroids can distort the uterine cavity or cervical canal and thus, can affect fertility or lead to pregnancy complications. In addition, the International Journal of Reproduction, Contraception, Obstetrics & Gynecology mentioned that the prevalence of intramural fibroids was 19.3%, submucosal fibroids were 38.6%, and subserosal fibroids 10.2%.

End-User Insights

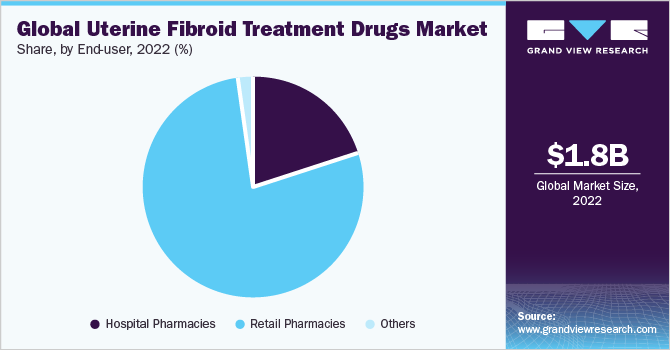

The retail pharmacies segment dominated the market with a revenue share of 78.4% in 2022. The dominance of the segment can be attributed to the ease of availability of drugs, such as NSAIDs, hormonal contraceptives, and non-hormonal medications, in retail pharmacies. Most of the fibroid patients, except those requiring surgeries, are treated in outpatient settings and hence would mostly buy drugs from retail pharmacies. The aforementioned factors are contributing to the dominance of this segment In addition, rising demand for effective and safe treatment options, such as over-the-counter (OTC) pain medications, oral therapies, and GnRH antagonists, in retail pharmacies will drive the segment at a high CAGR during the forecast period.

Hospital pharmacies are expected to be the second-largest revenue-generating end-user segment. Hospital pharmacy services would only be availed by hospitalized patients, and as the hospitalization rate in uterine fibroid patients is low, the segment accounted for the second-largest share. The hospitalization rate is around 0.42%, with most of the patients being admitted for surgeries. Hence, these patients may not require the routinely prescribed drugs for the treatment of uterine fibroids.

Regional Insights

North America emerged as the prominent regional market with a revenue share of 44.8% in 2022. The growth in the region can be attributed to the rising prevalence of uterine fibroids, increasing cases of pregnancy complications due to fibroids, and the approval of novel treatment options. According to the U.S. National Institutes of Health, 20-25% of females have fibroids. And by the age of 50 years, up to 80% of Black women and up to 70% of white women have fibroids. Furthermore, according to the Society for Maternal-Fetal Medicine, approximately 36% of UF cases are diagnosed in early pregnancy and 76% of fibroids shrink by the postpartum period. Thus, the increasing prevalence of fibroids is expected to drive market growth.

Asia Pacific is expected to grow at the fastest CAGR of 12.3% during the forecast period. With the presence of China and India in the region and a massive population with a high number of uterine fibroid patients, the market is expected to witness growing demand. Global companies are entering into agreements with local players for the development and commercialization of therapies in the APAC region. For instance, in September 2021, Kissei Pharmaceutical Co., Ltd. formed an agreement with Bio Genuine for the development and commercialization of linzagolix in China.

Key Companies & Market Share Insights

The key players are undertaking strategic initiatives, such as expansion, mergers & acquisitions, new launches, and licensing partnerships, to increase their industry share. For instance, in June 2022, Pfizer, Inc. collaborated with Myovant Sciences GmbH to bring the drug Myfembree to the market. Key players in the global uterine fibroid treatment drugs market include:

-

Myovant Sciences GmbH

-

Pfizer Inc.

-

Abbvie, Inc.

-

Ferring B.V.

-

AstraZeneca

-

Bayer AG

-

Amring Pharmaceuticals Inc.

-

Watson Pharma, Inc.

Uterine Fibroid Treatment Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.0 billion

Revenue forecast in 2030

USD 3.91 billion

Growth rate

CAGR of 10.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; China; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Myovant Sciences GmbH; Pfizer Inc.; Abbvie, Inc; Ferring B.V.; AstraZeneca; Bayer AG; Amring Pharmaceuticals Inc.; Watson Pharma, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Uterine Fibroid Treatment Drugs Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the uterine fibroid treatment drugs market based on drug class, type, end-user, and region:

-

Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gonadotropin-releasing Hormone (GnRH) Agonists

-

Gonadotropin-releasing Hormone (GnRH) Antagonists

-

Progestin-releasing Intrauterine Device (IUD) & Contraceptives

-

Non-hormonal Medications

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Subserosal Fibroids

-

Intramural Fibroids

-

Submucosal Fibroids

-

Pedunculated Fibroids

-

-

End-User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global uterine fibroids treatment drugs market size was estimated at USD 1.80 billion in 2022 and is expected to reach USD 2.0 billion in 2023.

b. The global uterine fibroids treatment drugs market is expected to grow at a compound annual growth rate of 10.2% from 2023 to 2030 to reach USD 3.91 billion by 2030.

b. Based on region, North America held the largest share of the uterine fibroid treatment drugs market in 2022 owing to the presence of key players, and awareness amongst patients regarding the availability of medications.

b. Some key players in space include Myovant Sciences GmbH; Pfizer Inc.; Abbvie, Inc.; Ferring B.V.; AstraZeneca; Bayer AG; Amring Pharmaceuticals Inc.; and Watson Pharma, Inc. amongst others.

b. Key factors that are driving the uterine fibroids treatment drugs market growth include rising target disease prevalence and the recent approval of multiple GnRH antagonists.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."