- Home

- »

- Petrochemicals

- »

-

Vacuum Grease Market Size & Share, Industry Report, 2030GVR Report cover

![Vacuum Grease Market Size, Share & Trends Report]()

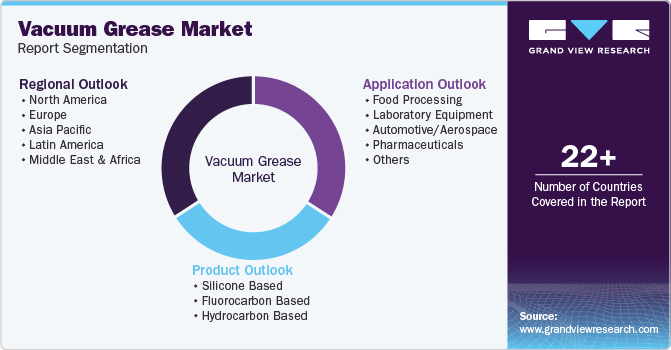

Vacuum Grease Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Silicone Based, Fluorocarbon Based, Hydrocarbon Based), By Application (Food Processing), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-200-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacuum Grease Market Summary

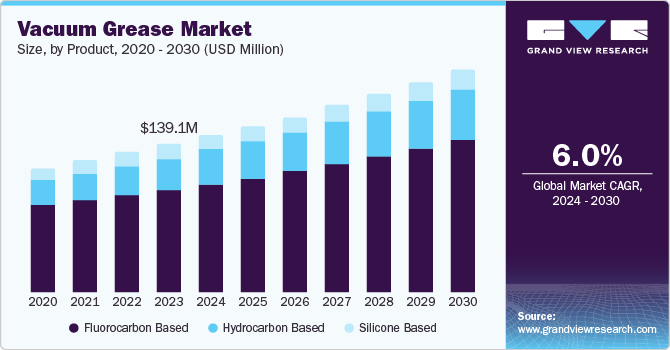

The global vacuum grease market size was valued at USD 139.1 million in 2023 and is projected to reach USD 209.2 million by 2030, growing at a CAGR of 6.0% over the forecast period from 2024 to 2030. The increasing demand for sealing lubricants in the food processing sector and the adoption of heavy precision machinery increase the demand for vacuum grease.

Key Market Trends & Insights

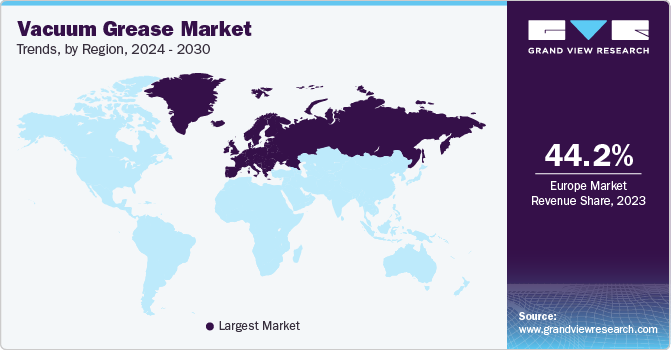

- Europe vacuum grease market dominated the vacuum grease market with a revenue share of 44.2% in 2023.

- Germany dominated the Europe vacuum grease market in 2023.

- By product, the fluorocarbon-based segment dominated the market and accounted for a market share of 69.9% in 2023.

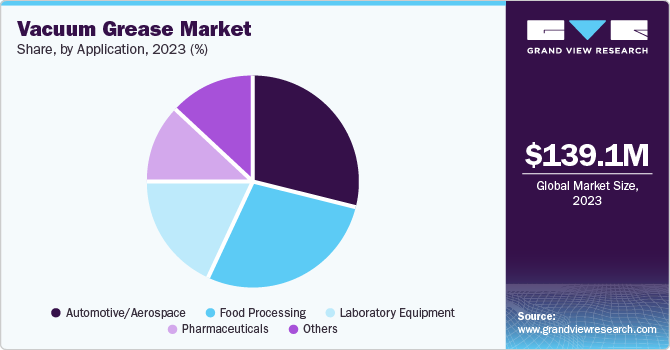

- By application, the automotive/aerospace segment dominated the market and accounted for a market share of 29.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 139.1 Million

- 2030 Projected Market Size: USD 209.2 Million

- CAGR (2024-2030): 6.0%

- Europe: Largest market in 2023

In addition, the majority of experiments conducted recently take place in vacuum conditions to minimize exposure to contaminants. Therefore, such settings are widespread in most manufacturing industries and research sectors, positively driving the market growth over the forecast period.

In addition, vacuum grease can withstand extreme conditions, making it more appealing to the automotive sector. Key players have adopted strategies for higher production and portfolio expansion globally. For instance, Shell announced that it would triple the size of its Marunda lubricant facility in Indonesia, increasing its yearly output from 136,000 to 300,000 kiloliters by 2022. This growth indicates the increasing need for lubricants and sealing solutions in the automotive industry, leading to a higher usage of vacuum grease.

Continuous innovations and developments enhance the performance characteristics of vacuum grease. Key players are thereby increasing their focus on R&D and investments to drive market growth. For instance, in May 2024, Klüber Lubrication, an expert in manufacturing specialty lubricants, announced an investment of USD 17.4 million to open its operations facility in Mysore, India.

Vacuum grease plays an important role in maintaining a cleanroom environment, especially in sectors such as pharmaceuticals, where the vacuum grease helps seal and lubricate equipment to prevent particulate contamination. For instance, Krytox low vapor pressure (LVP) high-vacuum grease functions safely and effectively, outperforming silicone, hydrocarbon, and chlorofluorocarbon greases in extreme temperature and pressure conditions. It performs reliably in vapor pressures as low as 10-13 mmHg, with extreme temperatures ranging from 15 to 300°C, and in harsh chemical environments, demonstrating consistent and proven effectiveness.

The gradual increase in the usage of vacuum grease in chemical processing industries and the manufacturing sector is due to its ability to assure equipment efficiency and longevity and its excellent lubrication, which enables the management of wear and tear and plays a significant role in driving the market growth.

Product Insights

The fluorocarbon-based segment dominated the market and accounted for a market share of 69.9% in 2023, attributed to the increasing demand across various industries such as automotive, aerospace, food processing, and others. For instance, NYE Lubricants, a U.S.-based fluorocarbon manufacturer, caters to the automotive and aerospace sectors. Products such as fluorocarbon gel 800, a specialty lubricant, are used in automotive components to withstand harsh environmental conditions.

Increasing awareness about the environmental sustainability and ability of fluorocarbon-based grease to minimize environmental impact and the increasing trends towards lubricants that can withstand extreme conditions have driven market growth. Due to their corrosion-resistant, nonflammable, and nontoxic properties, the market is expected to grow over the forecast period. In addition, continuous innovations and development in materials and manufacturing processes enhance effectiveness and efficiency, further driving market growth.

The hydrocarbon-based segment is expected to grow at a significant CAGR of 7.8% over the forecast period owing to the rapid global industrialization, which is increasing demand. This increase in demand from the automotive industry, changing preference towards sustainable and efficient lubricants, and its usage in industrial and scientific applications have boosted the market growth. For instance, Apiezon AP101 is a specialized hydrocarbon anti-seize grease that provides metal and glass surfaces with long-lasting lubrication and protection from fusing and corrosion.

Application Insights

The automotive/aerospace segment dominated the market and accounted for a market share of 29.4% in 2023, contributing to the ability of vacuum grease to withstand extreme conditions and provide excellent sealing properties in high vacuum environments, making them more appealing in the industry. In automotive applications, hydrocarbon-based grease is applied to lubricate bearings, valves, O-rings, suction cups, lifting systems, conveyors, and gripping systems. Many players producing vacuum solutions for the automotive industry are emerging, particularly in Asia Pacific, such as India and China, which is anticipated to boost the market growth.

The increasing adoption of electric vehicles demands specialized types of lubrication solutions, which help the development of the vacuum grease market. Furthermore, vacuum grease can be used in aerospace applications because it can resist vapor loss in a vacuum, such as during deep space flight or high-altitude orbit. All these factors have played a significant role in the growth of this segment. For instance, Krytox perfluoropolyether-based oils and greases provide significant properties for aviation and aerospace applications, such as stable physical properties that reduce radiation resistance and friction-reducing characteristics for low-energy and long-term consumption in spacecraft.

The food processing segment is expected to grow at a significant CAGR of 6.2% over the forecast period attributed to the ability of vacuum grease to ensure airtight seals in packaging, which helps preserve the freshness and quality of food products and makes them more appealing to the industry, thereby boosting market growth. For instance, Super lube silicone dielectric and vacuum grease is registered by NSF as a food-grade grease, with an H1 rating for accidental food contact, making it appropriate for food processing settings. It helps to decrease leak rates in vacuum applications and works with different rubber and plastic materials utilized in food machinery. In addition, the expansion of food industries, especially in emerging countries, has driven market growth.

Regional Insights

North America vacuum grease market is expected to grow at a significant rate in the coming years attributed to the increasing utilization of heavy machines in various industries and the rapid expansion of various industrial usage. The continuous innovations resulting in effective and efficient lubricating solutions and the growing emphasis on eco-friendly and sustainable solutions have driven market growth. In addition, the rising research activities across various sectors have further led to improvement and understanding of the requirements of industries, which further drives the market growth.

Europe Vacuum Grease Market Trends

Europe vacuum grease market dominated the vacuum grease market with a revenue share of 44.2% in 2023 owing to advanced manufacturing capabilities, stringent regulations, key industries, and increasing demand for processed foods. Europe is known for its advanced technology and strong foothold in manufacturing, especially in fields like pharmaceuticals, semiconductors, and chemicals. These sectors depend greatly on vacuum systems for different procedures, leading to a consistent need for vacuum greases. It enforces stringent rules on safeguarding the environment and ensuring the safety of workers. These rules increase the need for top-notch lubricants, such as vacuum greases that adhere to strict purity and performance criteria.

In Europe, numerous sectors, including aerospace, automotive, and electronics, use vacuum systems. These sectors need high-quality lubricants such as vacuum greases for coating, sealing, and lubricating tasks. Europe's strong foothold in the vacuum grease market is attributed to the existence of these industries across the region. Europe's food processing industry is well-established, and the demand for processed foods continues to grow. This has increased the need for vacuum greases in food processing equipment to ensure proper lubrication and prevent contamination.

Germany dominated the Europe vacuum grease market in 2023 owing to the presence of a strong industrial base with pharmaceuticals, automotive, and electronics companies. These sectors need high-quality lubricants for various uses, such as sealing and lubricating vacuum systems, and having these industries around results in a steady need for vacuum grease products.

German companies invest in R&D to produce effective vacuum lubricants that fit the stringent standards for different uses, especially in cleanroom settings where managing contamination is crucial. For instance, IKO, a German-based vacuum grease manufacturing company, provides solutions for low dust generation grease in clean rooms, with products such as CG2 grease and CGL grease.

Asia Pacific Vacuum Grease Market Trends

Asia Pacific vacuum grease market was identified as a lucrative region in 2023 due to factors such as the rise in automotive industries and its increasing demand for vacuum grease. In addition, using vacuum grease in electric vehicles has aided the market expansion in emerging countries such as India and China, which have emphasized eco-friendly and sustainable lubricating solutions.

India vacuum grease market is expected to grow significantly during the forecast period. This can be attributed to the increase in the automotive industry and the demand for processed foods. In addition, the rising demand for a cleanroom environment, advancements in medical equipment, and its wide use in industrial applications have enabled this market to grow positively during the forecast period. For instance, Mosil Lubricants is an Indian company that produces vacuum grease products such as HVG 200. It is a non-melt silicone grease, is water repellent, and has high adhesivity, which makes it suitable as an excellent chemical-resistant stop-cock grease and has a wide range of industrial applications.

Key Vacuum Grease Company Insights

Some key companies in the fuel ethanol market include Dow, M&I Materials Ltd., CASTROL LIMITED, Maax Lubrication Pvt Ltd, and others. These companies are growing their market revenue by launching new products, collaborating, and adopting various other strategies.

-

Dow manufactures high vacuum grease designed for various industrial applications, including pharmaceuticals. Dow Corning High Vacuum Grease is characterized by its excellent sealing and lubricating properties, making it suitable for valves, gaskets, O-rings, bearings, and vacuum systems. The continued expansion is driven by technological advancements and rising needs across industries such as aerospace and electronics, alongside pharmaceuticals, which have driven the market growth.

-

CASTROL LIMITED is a UK-based company that produces high-quality lubricants with various applications in the automotive and industrial sector. They have the Braycote 803 Series of high-vacuum grease, which is used in areas where traditional grease would fail. The ability of these greases to maintain a vacuum environment and prevent contamination is crucial in applications involving sensitive equipment and processes, particularly in drug manufacturing and packaging.

Key Vacuum Grease Companies:

The following are the leading companies in the vacuum grease market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- M&I Materials Ltd.

- CASTROL LIMITED

- Maax Lubrication Pvt Ltd

- Shin-Etsu Chemical Co., Ltd.

- MPT Industries

- The Chemours Company

- Solvay

- Supervac Industries LLP

- Eastern Petroleum

- Kluber Lubrication

Recent Developments

-

In May 2024, Fuschs acquired a german company named LUBCON Group to drive the development of leading specialty lubricant products, and enhance the company’s global competitiveness and expand its portfolio of specialty lubricants.

Vacuum Grease Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 147.3 million

Revenue forecast in 2030

USD 209.2 million

Growth Rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico , Germany, UK, France, China, Japan, India, Brazil, Argentina, UAE, Saudi Arabia

Key companies profiled

Dow, M&I Materials Ltd., CASTROL LIMITED, Maax Lubrication Pvt Ltd, Shin-Etsu Chemical Co., Ltd., MPT Industries, The Chemours Company, Solvay, Supervac Industries LLP, Eastern Petroleum, Kluber Lubrication.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacuum Grease Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vacuum grease market report based on product, application and region.

-

Product Outlook (Revenue, USD Million, Kilotons, 2018 - 2030)

-

Silicone Based

-

Fluorocarbon Based

-

Hydrocarbon Based

-

-

Application Outlook (Revenue, USD Million, Kilotons, 2018 - 2030)

-

Food Processing

-

Laboratory Equipment

-

Automotive/Aerospace

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.