- Home

- »

- Medical Devices

- »

-

Vascular Grafts Market Size, Share & Growth Report, 2030GVR Report cover

![Vascular Grafts Market Size, Share & Trends Report]()

Vascular Grafts Market Size, Share & Trends Analysis Report By Product (Hemodialysis Access Grafts, Endovascular Stent Grafts), By Application (Cardiac Aneurysm, Kidney Failure), By Raw Material, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-628-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Vascular Grafts Market Size & Trends

The global vascular grafts market size was estimated at USD 1.7 billion in 2023 and it is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. The increasing incidence of vascular diseases worldwide, including peripheral artery disease (PAD), coronary artery disease (CAD), chronic kidney disease (CKD), and aneurysms, serves as a significant catalyst for the market growth. For instance, according to Center for Disease Control and Prevention (CDC), in North America, approximately 6.5 million people aged 40 years and over live with the peripheral arterial disease (PAD).

Furthermore, the increasing healthcare expenditure, availability of reimbursement policies, and growing demand for technologically advanced products are poised to create numerous opportunities for market expansion during the forecast period. Technological advancements are driving the development of next-generation tissue-engineered vascular grafts for treating various vasculopathies. This approach effectively tackles significant challenges such as intimal hyperplasia, thrombosis, and constructive graft remodelling.

Moreover, the increasing demand for minimally invasive procedures has led to a surge in the adoption of the MIDCAB procedure, renowned for its safety and low mortality rate. In addition, its compatibility with aortic cross-clamp and cardiopulmonary bypass further enhances its appeal. Furthermore, advancements in surgical techniques involving coronary artery stent-grafts are expected to drive the demand for vascular grafts in the coming years. The widespread use of prosthetic grafts like electrospun polyurethane vascular grafts for complex vascular trauma, due to their ability to reduce the risk of neointimal formation, is anticipated to fuel market growth throughout the forecast period.

Market Concentration & Characteristics

The market is currently experiencing a phase of rapid growth, with the pace of expansion accelerating. This market is marked by a high level of innovation, driven by advancements in technology. Notably, the introduction of advanced devices has significantly contributed to meeting the critical needs of patients. These innovations have revolutionized treatment options for vascular conditions, enhancing patient outcomes and driving market growth to new heights.

The landscape of regional expansion within the vascular grafts sector is undergoing rapid transformation, as companies endeavor to penetrate new markets and capitalize on emerging opportunities. This dynamic environment highlights the market's robust growth potential across various geographic regions, accentuating the imperative for companies to adapt and innovate to meet the diverse healthcare needs of patients worldwide. As organizations expand their footprint into new territories, they are driven by a commitment to excellence and a strategic vision to enhance access to advanced healthcare solutions on a global scale.

Researchers and key market players are actively engaged in research and development aimed at exploring innovative vascular grafts. A notable example is a study published by MDPI in November 2023, which highlighted Electrospun Polyurethane (ePU) grafts as promising synthetic alternatives for autologous vascular grafts. The study provided evidence of the effectiveness of ePU vascular grafts, particularly in small-caliber vascular surgery applications. The encouraging findings from these industry-backed studies have the potential to significantly stimulate demand for grafts made from polyurethane materials.

As per a February 2023 publication from the Swanson School of Engineering, University of Pittsburgh, a group of researchers is in the process of developing self-cleaning vascular grafts intended to assist patients in need of bypass surgery for coronary artery disorder. These self-cleaning grafts are designed to repel microscopic blood cells, thereby mitigating the risk of blood clot formation. Consequently, such advancements are anticipated to drive significant growth during the forecast period.

Key market players and research institutions are dedicated to the creation of cutting-edge grafts tailored to meet essential requirements. They are actively seeking funds and investments to advance the development of vascular access grafts. For instance, in May 2022, the California Institute for Regenerative Medicine (CIRM) awarded UC Davis a USD 3 million grant to facilitate the development of an intelligent and long-lasting vascular graft specifically designed for hemodialysis patients. These industry advancements are anticipated to drive significant growth within the segment in the coming years.

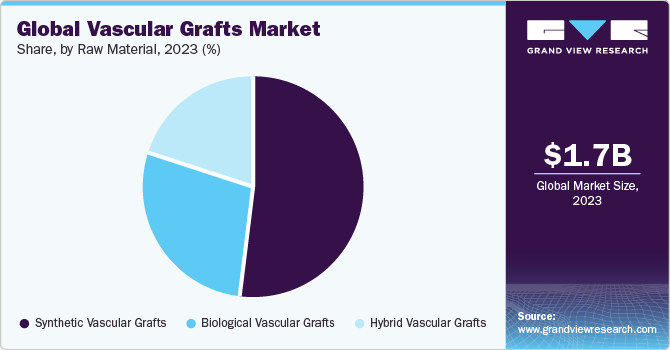

Raw Material Insights

Based on raw material, the synthetic vascular grafts segment led the market with the largest revenue share of 51.64% in 2023. Polyester vascular grafts represent a significant component within this segment. Polyester fabric, a synthetic material renowned for its robust mechanical properties, serves as the substrate for these grafts, making them a popular choice for vascular surgeries. Major industry players such as Getinge AB are actively involved in the production of high-quality polyester grafts designed for the treatment of aortic and peripheral vascular diseases. In addition, companies like LeMaitre Vascular, Inc. and B. Braun SE are notable contributors to the market, offering vascular grafts crafted from polyester materials. The availability of polyester vascular grafts from these key players is poised to drive growth within this segment during the forecast period.

The hybrid vascular grafts are projected to witness the fastest CAGR over forecast period. The segment growth is driven by the demand for innovative solutions that combine the advantages of synthetic materials with the biocompatibility of biological components. Hybrid vascular grafts typically integrate synthetic materials like polyethylene terephthalate (PET) or polytetrafluoroethylene (PTFE) with biological components such as tissue-engineered scaffolds or extracellular matrices. This combination offers enhanced mechanical properties, durability, and biocompatibility, making them suitable for various vascular applications.

Product Insights

Based on product, the endovascular stent grafts segment led the market with the largest revenue share of 63.78% in 2023. An endovascular stent graft is a tube comprised of fabric supported by a stent, which is a metal mesh. These grafts are widely used in various conditions involving the blood vessels, including thoracic and abdominal aortic aneurysms. Their ability to provide effective treatment while reducing patient trauma and recovery time contributes to their widespread adoption and dominance in the market.

The peripheral vascular grafts segment is expected to witness a considerable CAGR over the forecast period. The increasing prevalence of peripheral vascular diseases (PVD) is expected to propel the segment. For instance, according to a study published by Elsevier, Inc. in November 2023, around 145,870 cases of peripheral arterial diseases (PAD) were diagnosed among the Danish population. The study further concluded that the prevalence has increased and is projected to increase during the forecast period. This rising prevalence of PVD is expected to act as a significant driver for the market growth.

Application Insights

Based on application, the cardiac aneurysm segment led the market with the largest revenue share of 50.93% in 2023. Aneurysms, characterized by bulges in the wall of blood vessels, typically arteries, primarily affect the aorta, responsible for transporting oxygenated blood from the heart to the body. This segment encompasses coronary artery aneurysms and abdominal aortic aneurysms (AAA), conditions that afflict numerous individuals. As reported in a July 2021 article by John Wiley & Sons, Inc., approximately 80,000 individuals aged 65 to 74 years in England have AAA, contributing to an estimated 6,000 deaths annually in England and Wales. Thus, the prevalence of AAA among individuals is driving the demand for various vascular grafts utilized in the treatment of cardiac aneurysms.

The vascular occlusion segment is expected to register the fastest CAGR during the forecast period. The increasing incidence of vascular occlusive diseases such as peripheral arterial occlusive disease is expected to drive demand for grafts utilized in their treatment. Peripheral arterial disease (PAD) represents a chronic occlusive ailment. As highlighted in a study published by Frontiers in April 2022, approximately 113,443,017 individuals globally were affected by peripheral artery disease (PAD) in 2019, with approximately 10,504,092 new cases reported. Consequently, the growing prevalence of these occlusive diseases is anticipated to fuel demand for grafts aimed at addressing such vascular occlusive conditions.

Regional Insights

North America dominated with the revenue share of 40.90% in 2023. The market growth drivers in region stem from the increasing prevalence of cardiovascular diseases and the rising demand for vascular surgeries. As conditions such as atherosclerosis and aneurysms continue to escalate, there is an expanding requirement for vascular grafts to facilitate blood flow and address vascular issues. According to CDC data, the prevalence of heart disease as the primary cause of mortality among various demographic segments in the U.S. underscores a pressing necessity for medical interventions, including vascular grafts. With cardiovascular disease claiming a life every 33 seconds and accounting for approximately 699,659 deaths in 2022, there exists a significant demand for efficacious treatment modalities.

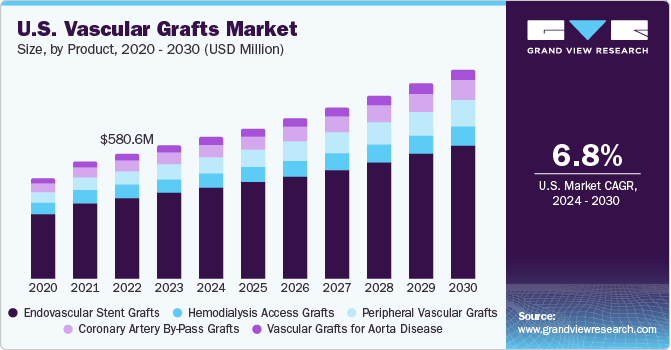

U.S. Vascular Grafts Market Trends

The vascular graft market in the U.S. held the largest share in 2023. The increasing incidence of kidney disease is a key factor influencing market expansion. As per a May 2023 article from the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), Chronic Kidney Disease (CKD) affects more than one-seventh of adults in the U.S., representing approximately 37 million individuals. This high prevalence of CKD underscores the critical need for vascular graft procedures, as they are often utilized in treatments related to kidney disease complications, thus contributing significantly to market growth in the U.S.

Europe Vascular Grafts Market Trends

The vascular graft market in Europe is growing at a considerable rate due to the increasing prevalence of cardiac disorders and rising healthcare expenditure. The major causes of death in European countries are stroke and ischemic heart disease (IHD). The Central and Eastern European countries recorded a higher prevalence of CVDs than the Northern, Western, and Southern. Moreover, according to the European Commission, SCA accounts for approximately 20% of the deaths in the region. Thus contributing significantly to market growth.

The Germany vascular graft market held the largest share of the Europe market. The coronary heart disease (CHD) mortality rates is driving demand for vascular grafts in Germany. According to a Medscape article published in October 2023, CHD is the leading cause of death in Germany. In 2021, 121,172 individuals died due to CHD, and among them, 45,181 experienced acute heart attack. The CHD death rate stood at 129.7 deaths per 100,000 citizens. This high mortality highlights the urgent need for advanced medical solutions, driving the demand for vascular grafts in Germany.

Vascular graft market in UK is estimated to grow at a significant CAGR over the forecast period. The growing prevalence of cardiovascular diseases in the UK is boosting the market growth. According to the British Heart Foundation, the latest figures revealed that over 39,000 individuals in England died due to cardiovascular conditions in 2022, interpreting to an average of 750 lives lost weekly, highlighting the urgent need for advanced interventions. As cardiovascular diseases, including heart attack, coronary heart disease (CHD), and stroke, continue to pose a significant health threat, the demand for innovative solutions, such as vascular grafts, increases.

Asia Pacific Vascular Grafts Market Trends

The vascular grafts market in Asia Pacific is the fastest growing market in 2023. The increasing incidence of kidney disorders in the Asia Pacific region is fueling demand for vascular grafts. With an estimated 434.3 million cases in the region, of which 65.6 million individuals are experiencing advanced disease, the prevalence varies significantly, ranging from 4.7% to 17.4%. China and India carry the highest burdens in this regard. The rise in risk factors like diabetes, hypertension, obesity, and cardiovascular disease has contributed to a prevalence rate of 34% in Asia. This substantial prevalence acts as a primary driver propelling the market growth.

The Japan vascular grafts market is expected to grow at the fastest CAGR over the forecast period. The increasing prevalence of chronic kidney disease (CKD) is propelling the market in Japan. As per the World Kidney Program, Japan is experiencing a worrying trend due to the rising number of CKD patients, with 13.3 million individuals affected, representing one out of every eight adults in the country.

The vascular graft market in China is expected to grow at a significant CAGR over the forecast period. The expanding elderly demographic presents a burgeoning market opportunity for vascular grafts, given the rising prevalence of age-related ailments, notably vascular diseases. As a significant proportion of the elderly population struggles with cardiovascular health issues, there is an increasing demand for sophisticated medical interventions, including vascular grafts, to address their critical healthcare needs. According to insights from The Global Times, the geriatric population, constituting 14.9% of the total population, emerges as a pivotal driver fueling the market growth.

Latin America Vascular Grafts Market Trends

The vascular grafts market in Latin America is estimated to grow at the fastest CAGR over the forecast period, owing to increasing government spending, the presence of skilled healthcare professionals, growing focus by multinational medical companies on untapped markets, and rising patient awareness.

The Brazil vascular grafts market is expected to grow at a significant CAGR over the forecast period, due to positive economic growth following financial and political stability in the country. In addition, demographic trends, such as an aging population and rising prevalence of cardiovascular diseases, contribute to the rising demand for vascular grafts in Brazil. With a growing patient population requiring vascular interventions, there is a heightened need for innovative and effective graft solutions, driving market growth.

MEA Vascular Grafts Market Trends

The vascular grafts market in MEA is growing due to the high economic development and improved healthcare facilities. This expansion is especially prominent in emerging markets such as South Africa, Saudi Arabia, and UAE where substantial gaps in medical provision highlight the pressing need for enhanced healthcare solutions.

The Saudi Arabia vascular grafts market is expected to grow at a lucrative CAGR over the forecast period. High unmet clinical needs, rising disposable income, and increasing prevalence of vascular diseases are expected to create opportunities for market growth in Saudi Arabia.

Key Vascular Grafts Company Insights

Some of the key established players operating in global market include Medtronic, Terumo Corporation, LeMaitre Vascular, Inc., Getinge AB, BD (Becton Dickinson), and Abbott. These companies are collaborating with regional players to expand their services geographically. B. Braun Melsungen AG., W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, and Endologix are some of the emerging market. Emerging players focus more on collaborating with various distribution channels, and availability of devices.

Key Vascular Grafts Companies:

The following are the leading companies in the vascular grafts market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Terumo Corporation

- LeMaitre Vascular, Inc.

- Getinge AB

- BD (Becton Dickinson)

- Abbott

- B. Braun Melsungen AG.

- Abbott

- W. L. Gore and Associates, Inc.

- MicroPort Scientific Corporation

- Endologix

Recent Developments

-

In September 2023, MicroPort Scientific Corporation received registration approval from the Thailand Food and Drug Administration (TFDA) for three products, namely, the Castor Branched Aortic Stent-Graft, the Hercules Thoracic Stent Graft System, and the Minos Abdominal Aortic Stent-Graft

-

In August 2022, W. L. Gore & Associates, Inc. acquired InnAVasc Medical, Inc., a company specializing in grafts designed to mitigate issues such as excessive bleeding and injuries to the back and side walls during dialysis

-

In May 2021, Endologix introduced the Alto abdominal stent graft system in the Argentina and Canada markets after acquiring approval from the regulatory body of Argentina and Health Canada. This device was among the latest innovations in polymer-based therapies for patients suffering from abdominal aortic aneurysms

Vascular Grafts Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.8 billion

Revenue forecast in 2030

USD 2.8 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

March 2024

Quantitative units

Revenue in USD billion/million, number of patients treated in thousands, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, raw material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Terumo Corporation; LeMaitre Vascular, Inc.; Getinge AB; BD (Becton Dickinson); Abbott; B. Braun Melsungen AG.; W. L. Gore and Associates, Inc.; MicroPort Scientific Corporation; Endologix

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vascular Grafts Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the vascular grafts market report based on product, application, raw material, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemodialysis Access Grafts

-

Endovascular Stent Grafts

-

Coronary Artery By-Pass Grafts

-

Vascular Grafts for Aorta Disease

-

Peripheral Vascular Grafts

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Aneurysm

-

Endovascular Stent Graft

-

Vascular Graft

-

-

Kidney Failure

-

Vascular Occlusion

-

Coronary Artery Disease

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic Vascular Grafts

-

Polytetrafluoroethylene (PTFE) Grafts

-

Polyester Grafts

-

Polyurethane Grafts

-

-

Biological Vascular Grafts

-

Autografts

-

Allografts

-

Xenografts

-

-

Hybrid Vascular Grafts

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vascular grafts market size was estimated at USD 1.7 billion in 2023 and is expected to reach USD 1.8 billion in 2024.

b. The global vascular grafts market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 2.8 billion by 2030.

b. Endovascular stent graft dominated the vascular grafts market with a share of 89.9% in 2023. This is attributable to the increasing number of abdominal aortic aneurysm procedures with less potential for access site complications.

b. Some key players operating in the vascular grafts market include Medtronic, plc; LeMaitre Vascular Inc.; Terumo Corp.; Getinge AB; W.L. Gore and Associates, Inc.; and Cook Medical, Inc.

b. Key factors that are driving the vascular grafts market growth include increasing incidence of cardiac diseases, diabetes, End-Stage Renal Disease (ESRD), and vascular occlusions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."