- Home

- »

- IT Services & Applications

- »

-

Vendor Risk Management Market Size, Industry Report, 2030GVR Report cover

![Vendor Risk Management Market Size, Share, & Trends Report]()

Vendor Risk Management Market (2025 - 2030) Size, Share, & Trends Analysis Report By Solution (Financial Control, Compliance Management), By Deployment (Cloud, On-premise), By Enterprise Size (SMEs, Large Enterprises), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-934-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vendor Risk Management Market Summary

The global vendor risk management market size was estimated at USD 10,671.1 million in 2024 and is projected to reach USD 24,953.3 million by 2030, growing at a CAGR of 15.2% from 2025 to 2030. The growth of the vendor risk management (VRM) industry can be attributed to the increasing reliance on third-party vendors across industries.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, financial control accounted for a revenue of USD 4,018.9 million in 2024.

- Compliance Management is the most lucrative solution segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 10,671.1 Million

- 2030 Projected Market Size: USD 24,953.3 Million

- CAGR (2025-2030): 15.2%

- North America: Largest market in 2024

Organizations are outsourcing critical functions to third-party suppliers, exposing them to potential risks such as data breaches, regulatory non-compliance, and reputational damage. As a result, the need for robust VRM solutions to assess, monitor, and mitigate these risks has become essential.

The rise in cyber threats and data breaches has heightened the focus on vendor cybersecurity. Companies are investing in VRM tools to evaluate the security postures of their vendors, ensuring sensitive data is protected throughout the supply chain. Cloud-based VRM platforms, in particular, are gaining traction due to their scalability, cost-efficiency, and real-time monitoring capabilities. According to a U.S.-based telecommunication company, Verizon's "2024 Data Breach Investigations Report," there was a significant 180% increase in the use of vulnerabilities to trigger data breaches in 2023 compared to 2022. Among these breaches, 15% were linked to third parties or suppliers, which include software supply chains, hosting partners, or data custodians.

The growing complexity of global supply chains also fuels vendor risk management industry expansion. Organizations with geographically dispersed vendors face increased risks related to geopolitical issues, economic instability, and supply chain disruptions. Advanced VRM solutions enable businesses to gain deeper insights into their vendors’ performance, compliance levels, and risk profiles, allowing proactive management of potential disruptions.

Regulatory compliance is another significant driver in the vendor risk management industry. Governments and regulatory bodies worldwide are enforcing stricter compliance requirements, such as the General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and other industry-specific standards. These regulations mandate organizations to maintain accountability for their vendors’ practices, further emphasizing the importance of implementing effective VRM systems.

Solution Insights

The financial control segment dominated the market and accounted for the revenue share of over 32.0% in 2024. When selecting vendors, organizations need to perform due diligence to ensure that the chosen third-party partners are financially sound and capable of meeting contractual obligations. The due diligence process includes assessing the financial health, creditworthiness, and operational stability of potential vendors. Financial risks associated with vendors can lead to significant losses, both in terms of the business’s bottom line and reputation.

The compliance management segment is expected to grow to a significant CAGR of 16.7% over the forecast period. VRM compliance management solutions are increasingly being integrated into broader Enterprise Risk Management (ERM) frameworks. This integration ensures that compliance is managed in tandem with other risk factors and provides a more comprehensive view of the risks posed by vendors. By integrating these systems, businesses can identify compliance risks earlier, reduce the likelihood of costly compliance violations, and improve overall risk mitigation efforts.

Deployment Insights

The on-premises segment accounted for a largest revenue share of over 66.0% in 2024. Despite the rise of cloud computing, many businesses still maintain on-premises environments due to specific regulatory, security, or operational requirements. As a result, managing vendor risks related to on-premises solutions remains crucial, especially in highly regulated industries and in organizations with legacy systems.

The cloud segment is expected to grow at a significant CAGR over the forecast period. The global shift towards digital transformation is a primary driver of the growing need for VRM solutions in the cloud segment. As organizations across industries such as finance, healthcare, retail, and manufacturing adopt cloud-based platforms and Software-as-a-Service (SaaS) solutions, they become increasingly dependent on third-party cloud service providers.

Enterprise Size Insights

The small & medium enterprises segment accounted for a largest revenue share of over 68.0% in 2024. With the advent of more affordable VRM tools and solutions tailored for SMEs, organizations are increasingly able to manage their vendor-related risks without straining their budgets. Many VRM vendors now offer cloud-based and SaaS solutions that are scalable and cost-effective for smaller organizations.

The large enterprise segment is expected to grow at a significant CAGR over the forecast period. Large enterprises often rely on multiple vendors for critical services, making business continuity and disaster recovery plans an essential part of risk management. A disruption in a key vendor’s operations can have a ripple effect on the enterprise’s ability to deliver products and services to customers. This risk is particularly significant for large enterprises with global operations or those who rely on just-in-time inventory or logistics.

End-use Insights

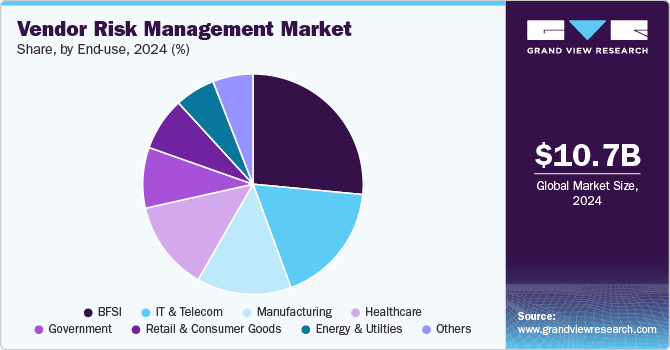

The BFSI segment accounted for a largest revenue share of over 26.0% in 2024. Digital transformation initiatives are driving growth in the VRM market for the BFSI segment. The adoption of technologies like AI, blockchain, and IoT increases the complexity of vendor ecosystems, necessitating sophisticated VRM systems. These tools leverage analytics and machine learning to assess risks proactively and streamline vendor lifecycle management.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. The adoption of advanced technologies, including telemedicine, electronic health records (EHRs), and cloud-based healthcare platforms, has significantly expanded the reliance on third-party vendors. These technologies, while enhancing operational efficiency, have also increased the complexity of vendor ecosystems and exposed healthcare organizations to potential risks such as data breaches and operational disruptions. VRM tools play a pivotal role in mitigating these risks by providing real-time visibility into vendor operations and ensuring alignment with security and performance standards.

Regional Insights

The vendor risk management market in North America held a largest share of nearly 59.0% in 2024. The digital transformation and adoption of cloud technologies are also fueling VRM market growth in North America. As businesses migrate to cloud-based environments, they are more reliant on third-party service providers, raising concerns about data privacy, uptime, and service reliability. Cloud-based VRM platforms offer organizations scalability, cost-efficiency, and real-time monitoring capabilities, which are essential for managing and mitigating risks associated with cloud vendors.

U.S. Vendor Risk Management Industry Trends

The vendor risk management market in the U.S. is expected to grow significantly at a CAGR of 14.5% from 2025 to 2030. Federal and state-level regulations, such as the Gramm-Leach-Bliley Act (GLBA), Sarbanes-Oxley Act (SOX), and California Consumer Privacy Act (CCPA), are pushing U.S. companies to ensure that their vendors comply with strict data protection, privacy, and financial regulations. The Federal Financial Institutions Examination Council (FFIEC) also mandates financial institutions to assess and manage third-party risks to protect consumers' financial data. The ever-expanding regulatory frameworks necessitate continuous monitoring and assessment of vendor performance, which VRM platforms are well-equipped to address.

Europe Vendor Risk Management Industry Trends

The vendor risk management market in Europe is anticipated to register considerable growth from 2025 to 2030. The increasing awareness among European businesses about the financial and reputational risks associated with vendor failures is driving VRM adoption. Companies understand that poor vendor performance, non-compliance, or cyber-breach originating from a third-party vendor can lead to significant financial losses, legal issues, and damage to their reputation. As a result, businesses across Europe are investing in VRM solutions that allow them to proactively identify and mitigate risks, improve vendor relationships, and ensure continuity in their supply chains.

UK Vendor Risk Management Industry Trends

The UK vendor risk management market is expected to grow rapidly in the coming years. The growth of the gig economy in the UK has introduced new types of vendors and third-party providers, such as freelancers, contractors, and digital platforms. These vendors often operate with different risk profiles compared to traditional suppliers, and their relationships with organizations can be harder to manage. As businesses increasingly rely on gig workers and freelancers, the need for specialized VRM solutions to assess the risks associated with these types of vendors particularly for compliance, data security, and quality assurance has risen.

Germany Vendor Risk Management Industry Trends

The Germany vendor risk management market held a substantial market share in 2024, owing to growth in the automotive and industrial sectors. Germany is highly dependent on complex, multinational supply chains. The reliance on suppliers and subcontractors across various geographies introduces risks related to political instability, economic changes, and natural disasters.

Asia Pacific Vendor Risk Management Industry Trends

Asia Pacific is growing significantly at a CAGR of 17.2% from 2025 to 2030. The region is undergoing significant digital transformation, with a large number of businesses shifting to cloud-based platforms and services. Countries such as Australia, and Japan are at the forefront of this digital shift, with organizations increasingly relying on cloud service providers, SaaS platforms, and IT outsourcing for operational efficiency and cost savings. While cloud adoption offers many benefits, it also introduces new risks associated with data security, vendor lock-in, and compliance.

Japan Vendor Risk Management Industry Trends

The Japan vendor risk management market is expected to grow rapidly in the coming years. As Environmental, Social, and Governance (ESG) factors gain importance globally, Japanese companies are under increasing pressure from investors, consumers, and regulators to adopt more responsible and sustainable practices. Japan has also committed to achieving net-zero emissions by 2050 and is implementing ESG frameworks in corporate governance, which extends to third-party vendors. Organizations in Japan are adopting VRM tools to assess the ESG performance of their vendors, ensuring that suppliers align with environmental sustainability, social responsibility, and good governance practices

China Vendor Risk Management Industry Trends

The China vendor risk management market held a substantial market share in 2024. China’s rapid technological innovation is impacting the VRM market, with new solutions emerging to meet the growing need for managing vendor risks. Companies are increasingly turning to advanced blockchain technology, big data analytics, and IoT-based solutions to track vendor performance and ensure supply chain transparency. These technologies help businesses gather real-time data on vendor activities, assess risk factors, and make informed decisions regarding their supplier relationships.

Key Vendor Risk Management Company Insights

Key players operating in the vendor risk management industry areBitSight Technologies, Genpact, NAVEX Global, Inc.,and Prevalent, Inc. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2024, NAVEX Global, Inc. announced a major update to NAVEX One Compliance Assistant, which includes microlearning suggestions tailored to the specific needs of individual employees. This enhancement provides employees with real-time relevant information about company policies and procedures. The update streamlines the compliance process by allowing employees to access information more personalized and intuitively and encourages more accessible and self-driven compliance in organizations.

-

In August 2024, Genpact announced plans to strengthen its strategic partnership with Advantage Solutions, a U.S.-based provider of business solutions for consumer goods companies and retailers. This expanded collaboration aims to address challenges in finance and supply chain management within the consumer-packaged goods (CPG) and retail industries. The partnership aims to focus on improving order-to-cash processes and supply chain management by tackling issues such as deductions leakage, ineffective claim recovery, manual customer service, and inefficient planning, logistics, and fulfillment.

Key Vendor Risk Management Companies:

The following are the leading companies in the vendor risk management market. These companies collectively hold the largest market share and dictate industry trends.

- BitSight Technologies

- Genpact

- LogicGate

- MetricStream, Inc.

- NAVEX Global, Inc.

- Prevalent, Inc.

- ProcessUnity

- Quantivate, LLC

- SAI Global

- ServiceNow

Vendor Risk Management Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.29 billion

Revenue forecast in 2030

USD 24.95 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

BitSight Technologies; Genpact; LogicGate; MetricStream, Inc.; NAVEX Global, Inc.; Prevalent, Inc.; ProcessUnity; Quantivate, LLC; SAI Global; ServiceNow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vendor Risk Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the vendor risk management market report based on solution, deployment, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vendor Information Management

-

Contract Management

-

Financial Control

-

Compliance Management

-

Audit Management

-

Quality Assurance Management

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vendor risk management market size was estimated at USD USD 10.67 billion in 2024 and is expected to reach USD 12.29 billion in 2025.

b. The global vendor risk management market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 24.95 billion by 2030.

b. North America dominated the global market with a share of nearly 59.0% in 2024. The digital transformation and adoption of cloud technologies are fueling VRM market growth in North America. As businesses migrate to cloud-based environments, they are more reliant on third-party service providers, raising concerns about data privacy, uptime, and service reliability. Cloud-based VRM platforms offer organizations scalability, cost-efficiency, and real-time monitoring capabilities, which are essential for managing and mitigating risks associated with cloud vendors.

b. Some key players operating in the vendor landscape market include BitSight Technologies, Genpact, LogicGate, MetricStream, Inc., NAVEX Global, Inc., Prevalent, Inc., ProcessUnity, Quantivate, LLC, SAI Global, ServiceNow.

b. The growth of the vendor risk management (VRM) market can be attributed to the increasing reliance on third-party vendors across industries. Organizations are outsourcing critical functions to third-party suppliers, exposing them to potential risks such as data breaches, regulatory non-compliance, and reputational damage. As a result, the need for robust VRM solutions to assess, monitor, and mitigate these risks has become essential.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.