- Home

- »

- Animal Health

- »

-

Veterinary Antibiotics Market Size And Share Report, 2030GVR Report cover

![Veterinary Antibiotics Market Size, Share & Trends Report]()

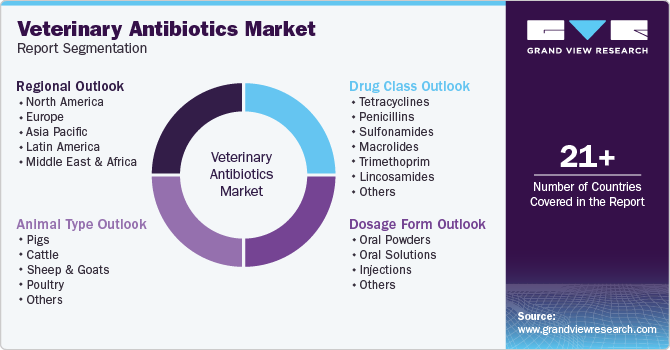

Veterinary Antibiotics Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Pigs, Cattle, Sheep & Goats, Poultry), By Drug Class (Tetracyclines, Penicillins), By Dosage Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-298-9

- Number of Report Pages: 258

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Antibiotics Market Size & Trends

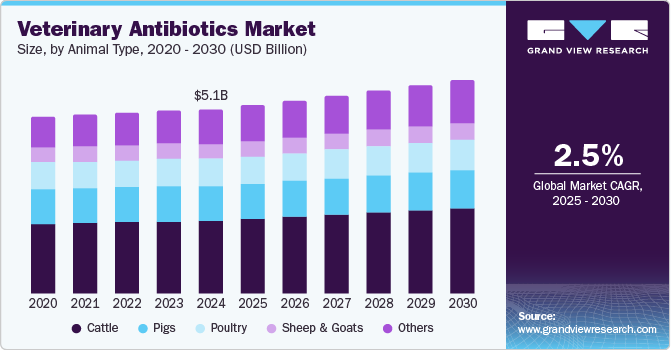

The global veterinary antibiotics market size was estimated at USD 5.10 billion in 2024 and is anticipated to grow at a CAGR of 2.54% from 2025 to 2030. Key factors expected to drive the market growth include the increasing prevalence of livestock diseases, focus on animal-only antibiotics & ionophores, and product launches or initiatives key companies undertake. Additionally, increasing FDA drug approvals drives the market growth by expanding treatment options for animal diseases and ensuring compliance with antimicrobial stewardship. For instance, in April 2024, the FDA approved Pradalex, a pradofloxacin injection, for treating respiratory diseases in cattle and swine. This critically important fluoroquinolone antimicrobial, prescribed only by veterinarians, targets specific respiratory pathogens in young cattle and weaned swine intended for slaughter, supporting antimicrobial stewardship.

Furthermore, major players in the market have shifted their focus to animal-only antibiotics to address antibiotic resistance while protecting animal health. For instance, Elanco Animal Health Incorporated offers a global antibiotic stewardship plan, which focuses on reducing shared-class antibiotics and increasing the production of animal-only antibiotics. Similarly, the 2024 Veterinary Antibiotic Amnesty, sponsored in part by Zoetis, encourages the return of unused antibiotics to veterinary practices to combat antimicrobial resistance (AMR) and prevent environmental pollution. Led by RUMA CA&E, the campaign educates the public on the safe disposal of antibiotics and promotes responsible antibiotic use in animals.

The veterinary antibiotics market is witnessing a shift toward animal-only antibiotics and ionophores. This trend is primarily driven by antibiotic resistance and health & welfare concerns. The awareness about the relationship between the use of antibiotics in livestock and the development of antibiotic-resistant bacteria is growing, which may threaten both animal and human health. As a result, there is a need to develop antibiotics that are exclusively used in animals to minimize the risk of cross-resistance. Moreover, animal welfare considerations are driving the shift toward traditional antibiotic alternatives. Healthier animals can often be raised without routine antibiotics, promoting sustainable and ethical farming practices.

Moreover, a few countries and key players operating in the market for veterinary antibiotics have already taken measures to reduce the use of antibiotics in animals. However, antibiotics are still widely used in animals due to rising disease outbreaks among food-producing animals and growing demand for treating or curbing the spread of disease. For instance, according to The Alliance to Save Our Antibiotics, farm animals consume an estimated 66% of all antibiotics used globally. Most of the usage is routine, allowing farm animals, primarily pigs & poultry, but occasionally cattle, to be kept in poor conditions where disease spreads rapidly. In addition, the chicken industry frequently uses antibiotics to treat and prevent bacterial infections & other respiratory illnesses.

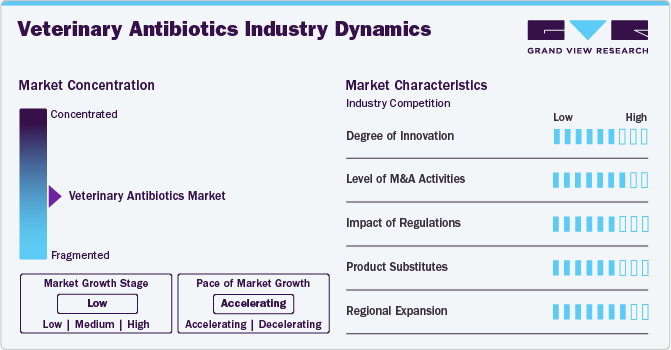

Market Concentration & Characteristics

The veterinary antibiotics market exhibits a moderate market concentration. The market growth stage is high, and the market growth is accelerating. One major factor propelling the market growth is the increasing incidence of livestock diseases. The rise in the incidence of livestock diseases plays a significant role in driving the market growth. Livestock diseases pose severe threats to animal health, welfare, and productivity, which can have cascading effects on food security & public health. Antibiotics are crucial tools in the veterinary sector for preventing and treating animal bacterial infections. As livestock production intensifies to meet the growing demand for animal products, animals are often raised in crowded conditions, making them more susceptible to diseases. The World Organization for Animal Health (WOAH) has identified the most severe diseases as pullorum disease and chicken typhoid, which are caused by Salmonella enterica subspecies enterica serovar Gallinarum biovars Pullorum (bvSP) and Gallinarum (bvSG), respectively.

The market is witnessing significant innovation by developing novel antimicrobials, such as third-generation fluoroquinolones, and targeted therapies that combat antimicrobial resistance. Advances in drug formulations, increased R&D investments by companies like Zoetis, the exploration of alternatives to traditional antibiotics, such as bacteriophages, and development of combination formulations contribute to the market's innovative landscape. For instance, in January 2024, Dechra launched Cyclofin, a fast-acting, single-dose injectable solution for bovine respiratory disease (BRD) caused by oxytetracycline-sensitive bacteria. Combining the anti-inflammatory flunixin-meglumine and the antibiotic oxytetracycline, Cyclofin provides sustained antibacterial activity for up to six days with a single intramuscular injection.

Within the market, a moderate to high level of merger and acquisitions activity exists, indicative of ongoing consolidation and strategic acquisition and partnerships among industry players. For instance, in April 2024, Virbac acquired Sasaeah to strengthen its position in the veterinary antibiotics market, especially in the cattle segment. Through this acquisition, the company plans to offer manufacturing and R&D facilities in Japan and Vietnam.

The market experiences a moderate to high impact of regulations. Governments and regulatory agencies across the globe are enforcing strict measures to track and limit consumption in response to the growing concerns surrounding antibiotic resistance caused by the improper & excessive use of antimicrobials in livestock production. Regulations may include approval processes for antibiotic products, labeling requirements, Maximum Residue Limits (MRLs), and guidelines for responsible antibiotic use. Regulatory agencies such as the U.S. FDA in the U.S. and the European Medicines Agency (EMA) in the European Union monitor antibiotic resistance patterns in bacteria isolated from animals, food products, and the environment to assess the impact of antibiotic use on public health.

The market experiences a moderate level of product substitutes. The increasing penetration of substitutes is also a consequence of the high-profit margins of manufacturers. In addition, the veterinary antibiotics market faces the threat of substitutes from alternative therapies, including probiotics, vaccines, phage therapy, and immunomodulators. These alternatives may offer advantages such as reduced antimicrobial resistance, targeted therapy, or enhanced animal health outcomes.

High levels of regional growth operations in the market are caused by initiatives by significant competitors in the market. For example, in December 2023, Norbrook opened three state-of-the-art cleanrooms at its Nairobi manufacturing facility, following a GBP 2.3 million (USD 3.2 million) investment to enhance quality, regulatory compliance, and support local agriculture. The launch emphasized Norbrook's role in improving animal health & food security and creating job opportunities in East Africa.

Animal Type Insights

The cattle segment held the dominant market share of 39.69% in 2024. The increased consumption of beef and dairy products is a significant factor driving segment growth. As global demand for animal-based products rises, livestock production increases, leading to a greater need for antibiotics to prevent and treat animal diseases. According to market data, EU milk production is forecast to decrease slightly to 148.9 million metric tons (MMT) in 2024, down from 149.3 MMT in 2023, due to lower cow numbers and reduced profitability. Despite this, cheese production in the EU27 is expected to rise by 0.6 percent to 10.62 MMT, driven by strong domestic and export demand. In parallel, the growth of the beef industry contributes to increased use of veterinary antibiotics, especially in regions with high production intensity.

The other segment is anticipated to grow at the fastest CAGR over the forecast period. The segment comprises dogs, cats, horses, and small mammals. The increasing number of pet owners globally, especially in developed countries, will likely boost the demand for veterinary antibiotics. With more households welcoming furry companions into their homes, the need for healthcare, including antibiotic treatments, rises accordingly. For instance, 91% of the pet owners in the U.S. consider pets as their family members. Furthermore, pet owners are becoming more proactive about the health and well-being of their animals, leading to an uptick in preventive veterinary care.

Drug Class Insights

The tetracyclines segment dominated the veterinary antibiotics market in 2024 with a share of 29.04%. Tetracyclines are a class of commonly used veterinary antibiotics. They are the first-line antibiotic drugs given to food-producing animals and are less used among companion animals such as dogs, cats, & horses. Tetracycline veterinary antibiotic drugs with brand names such as Achromycin, Sumycin, Medicycline, and Tetracyn are used to treat inflammatory skin diseases & bacterial infections in dogs. Most of these tetracycline drugs are prescribed for off-label or extra-label use in veterinary medicine. According to the Republic of Estonia Agency of Medicines, the tetracycline sales percentage in 2023 was 23.3%. According to VCA Animal Hospitals, tetracycline is an antibiotic used to treat inflammatory skin diseases in dogs and some bacterial infections (such as lupus). Although many bacteria are resistant to it, they are less frequently used to treat bacterial illnesses.

The others segment includes antibiotic drug classes such as amphenicols, cephalosporins, other quinolones, imidazole derivatives (metronidazole), nitrofuran derivatives (furazolidone), and other veterinary antimicrobials. Amphenicols are a group of compounds that are authorized for veterinary usage, including thiamphenicol, florfenicol, and chloramphenicol. Chloramphenicol is highly effective with broad-spectrum activity; however, thiamphenicol is less effective than chloramphenicol but much safer than the latter. Cephalosporins are of four types-1st, 2nd, 3rd, and 4th generation antibiotics-and are widely used in veterinary medicine.

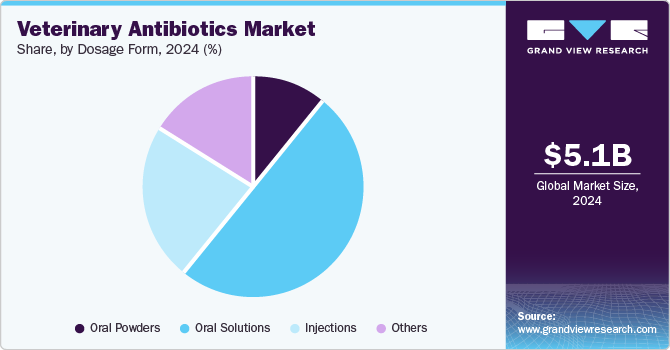

Dosage Form Insights

The oral solutions segment dominated the market in 2024. Oral liquids or solutions are among the most accessible dosage forms of veterinary antibiotics to develop and use. Most veterinary antibiotics used in food-producing animals are oral concentrated solutions dispensed directly in drinking water & later proportionated into farms' water lines. Oral solutions offer a convenient method of administering antibiotics to animals, especially for those difficult to inject or handle. Moreover, owners may find administering oral solutions to their pets easier than injections, leading to better adherence to treatment regimens. Some large animal farms use automatic metering devices or medication proportions to treat a large number of animals at the same time. According to EMA, oral antimicrobial solutions sales in over 31 EU countries were estimated to be 63.4% in 2022, which exhibits their wide suitability for veterinary treatments in European animal farms.

The other segment is anticipated to grow at the fastest CAGR over the forecast period. Other antibiotic dosage forms used in veterinary applications include oral pastes, tablets or capsules, and sprays. Antibiotic tablets are generally solid and are solely provided for companion animal usage. According to EMA, the overall sales of antibiotic tablets used for companion animals were estimated at 70.8 tons in 2022. France topped the list with 17.3 tons of antibiotic tablet sales. Premix products are solid dosages in which the active substance is formulated with other excipients and mixed in animal feed. Other dosage forms, such as intravaginal and intramammary infusions, are administered in food-producing animals. Intramammary infusion products are widely used to treat mastitis in cattle and are available for nonlactating & lactating cows.

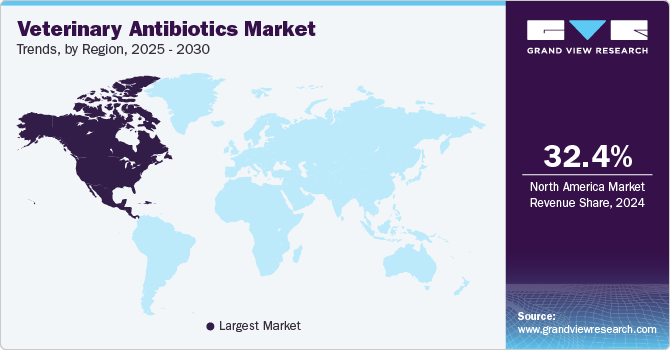

Regional Insights

The veterinary antibiotics market in North America accounted for the largest revenue share of 32.37% in 2024 of the global market and is expected to grow at a significant CAGR over the forecast period. The market growth is driven by the presence of established players and increasing demand for treatment among veterinary practices. According to the Centers for Disease Control and Prevention, Zoonotic diseases are prevalent globally, including in the United States. Scientists estimate that over 60% of known infectious diseases in humans can be transmitted from animals, and 75% of new or emerging infectious diseases in humans originate from animal sources. They are an additional threat to public health as animals are often the source of zoonotic diseases. The high prevalence of zoonotic diseases is contributing to market growth.

U.S. Veterinary Antibiotics Market Trends

The growth of the veterinary antibiotics market in the U.S. is driven by the rising requirement for antibiotics in veterinary treatments & surgeries, disease prevention, control of disease outbreaks to reduce the severity of disease in animals, and the increasing number of animal healthcare centers & practitioners. Furthermore, the U.S. market is also shaped by increasing regulatory measures to combat antimicrobial resistance (AMR). The FDA's initiatives, such as the Veterinary Feed Directive, limit medically necessary animal antibiotics, driving a shift toward more judicious use. Demand for antibiotics remains steady in treating livestock and companion animals, but there is growing emphasis on alternatives like vaccines and probiotics. Awareness campaigns and stricter policies are reshaping the market, prioritizing responsible antibiotic use while maintaining animal health and productivity.

Europe Veterinary Antibiotics Market Trends

The veterinary antibiotics market in Europe is expected to grow significantly due to favorable government regulations, such as the European Union (EU) Veterinary Medicines Regulation. According to an article published by the European Public Health Alliance, stringent regulations limiting the use of veterinary antibiotics came into effect across the EU in January 2022. Additionally, the rise in government initiatives to combat antibiotic resistance in Europe significantly drives the European veterinary antibiotic market. Policies such as stricter regulations on antibiotic use in animals, national action plans for antimicrobial resistance (AMR), and programs promoting responsible antibiotic stewardship encourage veterinary practices to adopt safer, regulated usage. These measures, alongside increased awareness and education campaigns, are raising demand for antibiotics that comply with new guidelines, boosting the market while prioritizing the reduction of AMR risks in animal and human health.

The veterinary antibiotics market in Germany is driven by the rising adoption of animals, such as pets and growing animal husbandry. According to the German livestock data, the country has the largest dairy cattle herd and the second-largest cattle population in the EU. In addition, according to the International Committee for Animal Recording (ICAR), around 50% of German farms specialize in livestock, which is anticipated to create a conducive environment for the market.

Asia Pacific Veterinary Antibiotics Market Trends

The veterinary antibiotics market in Asia Pacific is expected to exhibit lucrative growth over the forecast period. The growth of the market in the region can be attributed to the increasing adoption of pet animals, the growing health concerns in animals, the rising vigilance about animal health, the surging livestock population, and the prevalence of animal diseases.

The veterinary antibiotics market in India is expected to grow at a CAGR of 4.96% over the forecast period due to the rising livestock production, growing dairy industry, and increasing number of veterinary healthcare facilities. According to NCBI, livestock production, particularly the dairy industry, plays a significant role in communities' food and nutritional well-being in India. Moreover, it supports the number of farmers and contributes to the country's economy. Furthermore, India plays a vital role in the global dairy industry, contributing over 25% of the world's dairy output. In FY23, India's milk production reached about 231 million tonnes, growing at a 6% CAGR over the past decade. NITI Aayog projects that milk production could rise to 300 million tonnes by 2030, highlighting continued growth in the sector.

Latin America Veterinary Antibiotics Market Trends

The growth of the veterinary antibiotics market in Latin America is driven by the increasing prevalence of pet injuries and the rising sales of products. In addition, the growing livestock population and the presence of animal pharmaceutical companies are expected to drive the market growth over the forecast period.

The veterinary antibiotics market in Brazil is growing due to rising mandates for vaccination to curb livestock disease outbreaks and the increasing demand for livestock-related food. The market growth in Brazil can be attributed to a large cattle population. According to the American Feed Industry Association, Brazil's cattle production is projected to grow by 3% in 2022 and 1% in 2023, reaching 48.2 million head, driven by strong global demand and high beef prices. As the world's second-largest beef producer and top chicken meat exporter, Brazil's chicken meat exports are expected to rise by 6% to 5 million metric tons in 2023, with production reaching a record 14.85 million metric tons due to increased domestic and global demand. China remains the largest market, accounting for 34% of Brazil's exports. However, the swine sector is expected to reduce stocks in both 2022 and 2023.

Middle East & Africa Veterinary Antibiotics Market Trends

South Africa, Saudi Arabia, and the UAE constitute the Middle East & Africa (MEA) veterinary antibiotics market. In the MEA, the increasing requirement of veterinary medicine is expected to drive the market growth over the forecast period. The growing prevalence of infectious diseases in animals is predicted to improve the demand for veterinary treatments and medicines.

The South Africa veterinary antibiotics market is expected to witness growth during the forecast period. Livestock is the country’s economic backbone, as several farmers look after their animals for meat and milk to supply across the country and the globe. However, livestock are vulnerable to several infectious diseases, leading to a rise in demand for veterinary antibiotics to treat pets/livestock, preventing the disease from spreading within animals. In addition, these infectious diseases can be transmitted to humans.

Key Veterinary Antibiotics Company Insights

The market is fairly competitive due to numerous small to major market participants. Due to the existence of multiple small and large companies, the market is highly fragmented. Thus, small players face intense competition to maintain their market position. Moreover, companies are increasingly adopting various strategies, such as mergers & acquisitions, geographic expansion, and launch of products to grow in the market.

Key Veterinary Antibiotics Companies:

The following are the leading companies in the veterinary antibiotics market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Ceva Santé Animale.

- Vetoquinol

- Zoetis Services LLC

- Boehringer Ingelheim International GmbH

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Virbac S.A.

- Calier

- Bimeda, Inc

- Prodivet pharmaceuticals SA/NV

- Norbrook Laboratories

Recent Developments

-

In February 2024, Blacksmith Medicines and Zoetis announced a collaboration to develop novel antibiotics targeting metalloenzymes for animal health, addressing antibiotic resistance. Blacksmith's platform utilizes metal-binding pharmacophores and computational tools to drug metalloenzymes, while Zoetis contributes its veterinary expertise and pathogen library to reduce reliance on antibiotics critical for human health.

-

In May 2023, Virbac acquired GS Partners, its long-standing distributor in the Czech Republic & Slovakia, marking its 35th subsidiary and reinforcing its presence in Central Europe. With the acquisition, Virbac aimed to enhance its ability to meet the health needs of animals in the region, particularly in the pet & ruminant sectors.

Veterinary Antibiotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.21 billion

Revenue forecast in 2030

USD 5.91 billion

Growth rate

CAGR of 2.54% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, drug class, dosage form, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Belgium; Netherlands; Hungary; Poland; Portugal; Romania; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Merck & Co., Inc.; Ceva Santé Animale; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Elanco Animal Health Incorporated; Virbac S.A.; Calier; Bimeda, Inc.; Prodivet pharmaceuticals SA/NV; Norbrook Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Antibiotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the veterinary antibiotics market report based on animal type, drug class, dosage form, and region:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pigs

-

Cattle

-

Sheep & Goats

-

Poultry

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Tetracyclines

-

Penicillins

-

Sulfonamides

-

Macrolides

-

Trimethoprim

-

Lincosamides

-

Polymyxins

-

Aminoglycosides

-

Fluoroquinolones

-

Pleuromutilins

-

Other

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Powders

-

Oral Solutions

-

Injections

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherlands

-

Belgium

-

Hungary

-

Poland

-

Portugal

-

Romania

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global veterinary antibiotics market size was estimated at USD 5.10 billion in 2024 and is expected to reach USD 5.21 billion in 2025.

b. The global veterinary antibiotics market is expected to grow at a compound annual growth rate of 2.54% from 2025 to 2030 to reach USD 5.91 billion by 2030

b. North America dominated the global veterinary antibiotics market with a share of 32.37% in 2024. This regional market is likely to be driven by the presence of established players and increasing demand for treatment among veterinary practices.

b. Some key players operating in the veterinary antibiotics market include Merck & Co., Inc.; Ceva Santé Animale; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Elanco Animal Health Incorporated; Virbac S.A.; Calier; Bimeda, Inc.; Prodivet pharmaceuticals sa/nv, and Norbrook Laboratories

b. Key factors that are driving the market growth include the increasing prevalence of livestock diseases, rising focus on animal-only antibiotics & ionophores, and growing product launches or other initiatives undertaken by key companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.