- Home

- »

- Animal Health

- »

-

Veterinary CT Imaging Market Size, Industry Report, 2033GVR Report cover

![Veterinary CT Imaging Market Size, Share & Trends Report]()

Veterinary CT Imaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Solutions (Equipment, Consumables, CT Imaging Software & Services), By Animal, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-022-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary CT Imaging Market Summary

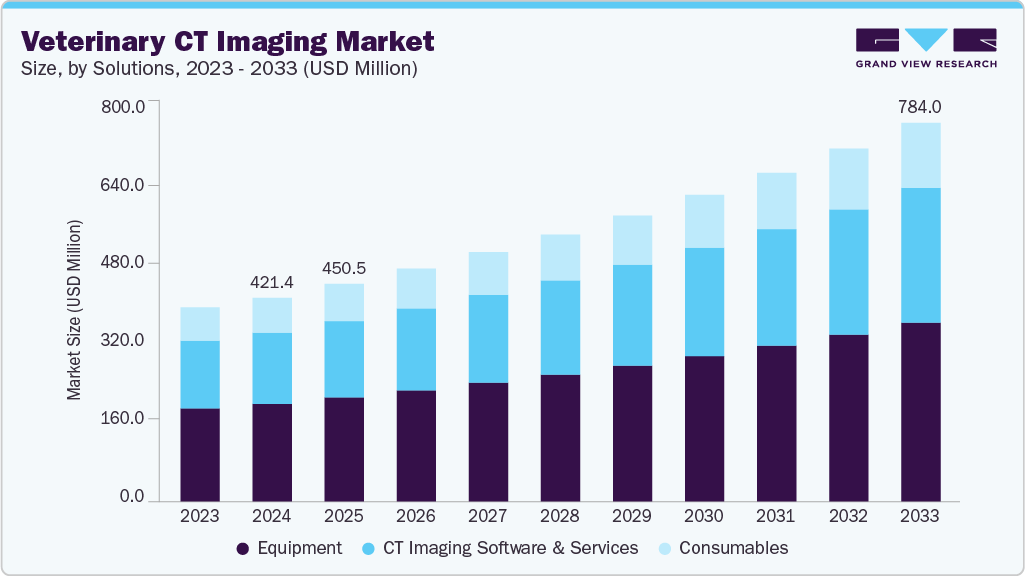

The global veterinary CT imaging market size was estimated at USD 421.4 million in 2024 and is projected to reach USD 784.0 million by 2033, growing at a CAGR of 7.17% from 2025 to 2033. Some of the key factors driving market growth are rising demand for advanced diagnostic accuracy, technological advancements in veterinary CT systems, and expansion of veterinary specialty clinics and hospitals.

Key Market Trends & Insights

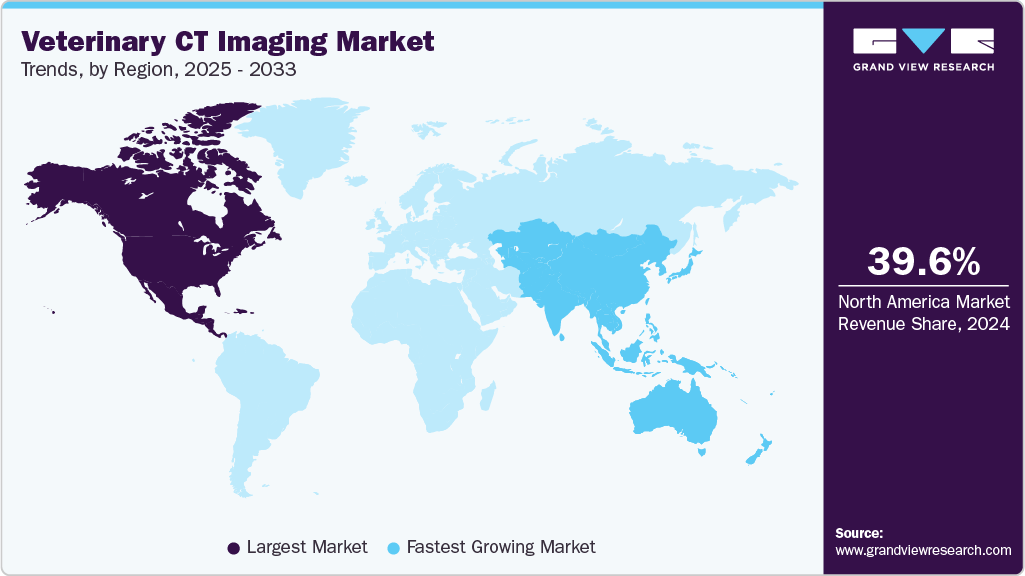

- North America dominated the global veterinary CT imaging market with the largest revenue share of 39.65% in 2024.

- The veterinary CT imaging market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By solution, the equipment segment led the market with the largest revenue share of 47.83% in 2024.

- By animal, the small animals segment accounted for the largest market revenue share in 2024.

- Based on application, the orthopedic & traumatology segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 421.4 Million

- 2033 Projected Market Size: USD 784.0 Million

- CAGR (2025-2033): 7.17%

- North America region: Largest market in 2024

- Asia Pacific region: Fastest growing market

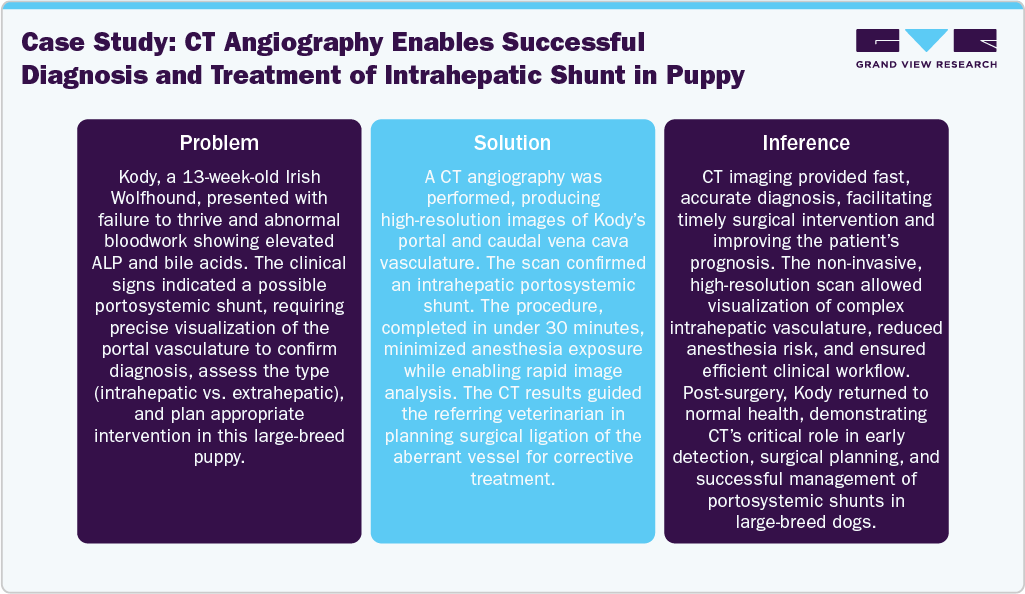

As veterinary cases become more complex and pet owners increasingly expect human-grade care, the demand for precise diagnostic imaging has risen distinctly, leading to greater adoption of CT technology across clinics and hospitals. This increased expectation for accuracy leads veterinarians to rely on CT imaging to detect subtle fractures, soft-tissue lesions, neurological disorders, and internal abnormalities that conventional X-ray cannot capture. As a result, clinics invest in modern CT scanners to improve case outcomes, reduce diagnostic uncertainty, and enhance surgical planning.For instance, in September 2025, Modern Animal’s rapid growth and new funding strengthened its tech-enabled care model, enhancing imaging workflows, improved diagnostic precision, and supported veterinarians with AI-driven tools that accelerated accurate clinical decision-making.

In addition, rapid innovation such as reduced scan times, enhanced image resolution, and lower radiation exposure has transformed veterinary CT systems, causing broader acceptance across diverse practice settings. Newer scanners accommodate animals of varying sizes, minimize anesthesia requirements, and deliver faster results, making CT imaging more efficient and pet-friendly. These improvements encourage veterinarians to replace older systems with modern models to improve patient throughput and clinical confidence. As equipment becomes more compact, affordable, and digitally integrated, even mid-size clinics adopt CT technology, increasing overall market penetration.

Moreover, increasing cases of trauma, orthopedic injuries, cancer, respiratory diseases, and age-related chronic conditions in pets. According to a report, as of March 2024, 407 dogs in the study had been diagnosed with hemangiosarcoma, and despite treatment, approximately 90% succumb within a year of diagnosis. Such rising number of disease overload creates a strong clinical need for advanced imaging, causing veterinarians to rely more heavily on CT diagnostics. Besides this, as companion animals live longer and lifestyle-related disorders become more common, CT imaging becomes essential for timely detection and treatment planning. This clinical complexity pushes veterinarians to adopt systems capable of detailed 3D visualization and rapid assessment. The rising caseload also drives clinics to improve diagnostic efficiency, prompting investment in in-house CT capabilities to reduce external referrals.

Furthermore, rapid growth of veterinary specialty centers, emergency hospitals, and referral practices has increased the demand for sophisticated diagnostic tools, causing expanded adoption of CT imaging systems. For instance, in October 2025, government approved a project to rebuild a modern multi-specialty veterinary hospital in Mumbai, India, offering advanced care for pets and stray animals. Besides this, as more clinics offer advanced services in neurology, oncology, orthopedics, and internal medicine, they require high-resolution imaging to support accurate case evaluations and specialized treatments. This expansion leads hospitals to integrate CT scanners to enhance diagnostic capabilities, reduce referral delays, and remain competitive within regional networks. In addition, professionalization of veterinary care encourages continuous infrastructure upgrades, resulting in greater market penetration of advanced CT systems. Thus, this institutional growth drives consistent demand for high-performance imaging technologies.

Market Concentration & Characteristics

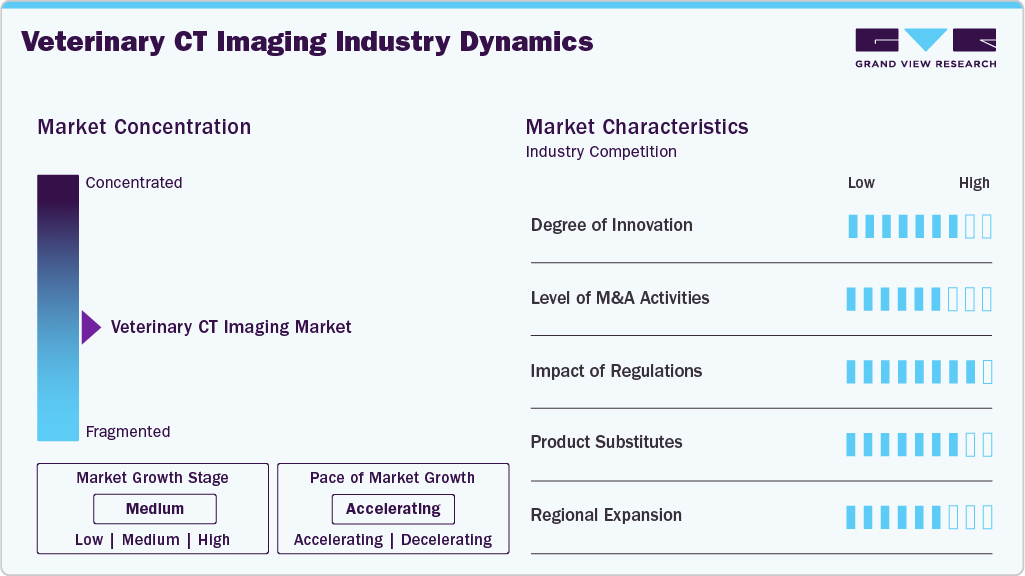

The veterinary CT imaging industry is at a moderate growth stage, and the pace is accelerating. The market is dominated by a few global leaders such as Siemens Healthineers, Canon Medical, GE HealthCare, and Fujifilm. These companies maintain strong technological capabilities, extensive service networks, and established distributor partnerships, whereas smaller specialized manufacturers compete through niche innovations and species-specific CT solutions.

The veterinary CT imaging industry features a high degree of innovation driven by faster acquisition times, enhanced 3D reconstruction, lower radiation doses, and AI-enabled image interpretation. Manufacturers are developing compact, species-adaptable systems and weight-bearing CT for equine use. For instance, in October 2025, WOORIEN’s MyVet CT Plus launched offering faster scans, sharper spiral imaging, and adaptable FOVs for animals of all sizes, reducing anesthesia needs.

M&A activity in the veterinary CT imaging industry is steadily rising as large medical imaging companies acquire specialized veterinary manufacturers to expand portfolios and strengthen global presence. The deals focus on integrating advanced software, AI analytics, and complementary imaging modalities. For instance, in September 2025, IMV Imaging and Asto CT partnered to integrate advanced equine and multi-species imaging, enhancing diagnostic accuracy, workflow efficiency, and patient safety.

Regulations play a significant role in transforming the veterinary CT imaging industry, as countries enforce strict guidelines on radiation safety, equipment quality, import approvals, and facility licensing. Compliance requirements drive manufacturers to improve device performance, user safety, and documentation standards.

Substitutes such as ultrasound, digital radiography, and MRI cannot totally replace CT imaging due to limitations in detecting subtle fractures, assessing complex soft-tissue structures, or providing rapid 3D visualization. These modalities serve complementary roles rather than alternatives. As clinical cases grow more complex, CT becomes the preferred modality for orthopedic, neurological, thoracic, and trauma diagnostics, reducing reliance on potential substitutes.

Regional expansion is accelerating as imaging companies target high-growth markets in Asia-Pacific, Latin America, and the Middle East, where veterinary infrastructure is rapidly modernizing. Manufacturers are establishing local partnerships, distributor networks, and training programs to increase accessibility.

Animal Insights

The small animals segment accounted for the largest market revenue share in 2024, comprising of dogs, cats and other small animals. Growing pet adoption and ownership rates in developed countries have simultaneously increased the willingness of people to spend more on their pet’s healthcare. For instance, according to the American Pet Products Association's 2024-2025 National Pet Owners Survey, 66% of American homes, or about 94 million families, own a pet. Besides this, small animal clinics and specialty hospitals frequently adopt CT imaging for diagnostics of orthopedic, neurological, oncological, and internal conditions, benefiting from rapid, high-resolution, and 3D imaging capabilities. In addition, equipment designed for small animals, including adjustable fields of view and lower anesthesia requirements, enhances workflow efficiency and diagnostic accuracy.

The large animals segment is expected to grow at the fastest CAGR during the forecast period, driven by rising demand for advanced diagnostics in equine and livestock care. Increasing awareness of early disease detection, preventive healthcare, and precise surgical planning in horses and farm animals is prompting adoption of specialized CT systems, including weight-bearing and large-bore scanners. For instance, in October 2024, Colorado State University’s Qalibra CT scanner enables high-resolution, standing 3D imaging of equine heads and limbs without general anesthesia, enhancing detection of bone and select soft tissue injuries, expanding diagnostic capabilities. These systems enable high-resolution imaging of complex structures such as the equine spine, joints, and thoracic regions while minimizing anesthesia risks.

Solutions Insights

The equipment segment led the market with the largest revenue share of 47.83% in 2024, due to its central role in enabling advanced diagnostics across species. Slice CT and cone beam solutions are included in this segment. The market is advancing due to high demand for CT scanners stems from their ability to provide rapid, high-resolution, and three-dimensional imaging for complex orthopedic, neurological, and soft-tissue conditions in companion animals, equines, and livestock. Besides this, clinics and specialty hospitals invest in state-of-the-art equipment featuring spiral CT, weight-bearing designs, and adjustable fields of view to improve diagnostic accuracy and workflow efficiency. The growing number of technically trained radiologists and veterinary students is unveiling opportunities in the market of developing countries. Moreover, rising awareness of imaging software solutions among veterinary professionals has increased their demand in the vet CT industry. Therefore, these factors are expected to be some of the major drivers of market expansion.

The CT imaging software & services segment is projected to grow at the fastest CAGR from 2025 to 2033. The market’s growth is boosted due to increasing demand for enhanced image analysis, workflow optimization, and remote diagnostic capabilities. Some of the advanced software solutions, including 3D reconstruction, AI-assisted interpretation, and cloud-based PACS integration, enable veterinarians to improve diagnostic accuracy, reduce analysis time, and streamline patient management. In addition, services such as installation, maintenance, training, and technical support further enhance clinical efficiency and ensure optimal utilization of CT systems. Furthermore, as veterinary practices adopt multimodal imaging and telemedicine solutions, the reliance on sophisticated software and associated services grows rapidly, positioning this segment as the primary driver of future market expansion.

Application Insights

The orthopedic and traumatology segment accounted for the largest market revenue share in 2024, driven by high prevalence of bone fractures, joint disorders, and trauma-related injuries in companion animals, equines, and livestock. CT imaging provides rapid, high-resolution, and three-dimensional visualization of complex skeletal structures, allowing veterinarians to accurately diagnose fractures, luxations, and other musculoskeletal abnormalities. The ability to plan surgical interventions, monitor post-operative recovery, and assess subtle lesions not visible on conventional radiographs increases reliance on CT technology. Besides this, hyperactive companion animals such as dogs suffer from bone injuries and fractures very frequently, for which CT scanning is widely performed. This factor is widely supporting the estimated market share.

The dental segment is projected to grow at the fastest CAGR during the forecast period. The veterinary CT imaging industry is driven by increasing awareness of oral health’s impact on overall animal wellbeing. Advanced CT scanners allow veterinarians to capture high-resolution, three-dimensional images of teeth, jaws, and surrounding structures in small and large animals, facilitating accurate diagnosis of fractures, malocclusions, periodontal disease, and oral tumors. The technology supports precise surgical planning, minimally invasive procedures, and early intervention, reducing treatment complications. In addition, rising demand for preventive dental care in pets, growing veterinary dental specialty services, and the introduction of species-specific dental imaging solutions are accelerating adoption.

End Use Insights

The veterinary clinics & hospitals segment accounted for the largest market revenue share in 2024, as these facilities are primary adopters of advanced diagnostic technologies. Veterinary hospitals offer a wide range of diagnostic CT imaging options, which is a high-impact rendering driver of this market. Over the past few years, the opportunity for segment growth has increased because of the rising number of veterinary practices and trained veterinarians. In addition, high-resolution, rapid, and three-dimensional imaging enhances diagnostic accuracy, surgical planning, and treatment outcomes, making CT systems essential in clinical settings.

The other end-use segment, which includes academic & research institutes, is expected to expand at the fastest CAGR over the forecast period. CT scanning has proven to be a great tool in the academic research of veterinary medicine. Since its clinical introduction, this sophisticated imaging technology has become more common in veterinary research and development programs. This enables researchers to understand the depth of anatomic structure to unveil novel treatment options for several chronic diseases in animals. Although the penetration of CT in general veterinary medicine is rising, the need for further advancements, such as using CT with less or no anesthesia, is expected to be studied in the near future.

Regional Insights

North America dominated the global veterinary CT imaging market with the largest revenue share of 39.65% in 2024. The market is driven by rising pet population & humanization, growing demand for advanced diagnostic imaging, and increased cross-sector collaborations. For instance, in September 2025, Esaote North America and Epica International formed a strategic partnership to integrate MRI and advanced CT solutions, expanding reach across human and veterinary markets. The veterinary CT imaging industry is witnessing growth due to increased availability of compact and mobile CT units, increasing AI and workflow automation and rising trial and promotion of next-generation spectral and photon-counting CT (PCCT). In addition, well-established veterinary hospitals & clinics, and imaging centers with varieties of equipment are registering a significant number of CT imaging appointments each year.

U.S. Veterinary CT Imaging Market Trends

The veterinary CT imaging market in the U.S. accounted for the largest market revenue share in North America in 2024, owing to increasing prevalence of chronic conditions, increasing peer-reviewed veterinary research and expansion of corporate veterinary chains and multi-clinic hospitals. In addition, U.S. Food and Drug Administration (FDA) has regulatory authority over devices intended for animal use. CT scanners are qualified as medical devices under the FDA act, if they diagnose or monitor disease in animals. However, FDA does not always mandate a 510(k) or PMA submission when a device is exclusively marketed for veterinary use.

Furthermore, emerging innovations are transforming veterinary CT imaging. For instance, in May 2025, VET-DINO was introduced, leveraging self-supervised learning on multi-view veterinary radiographs to develop detailed anatomical understanding, enhancing 3D reconstruction and AI-powered diagnostics, and ultimately accelerating adoption and innovation in veterinary CT applications.

The Canada veterinary CT imaging market is expected to grow at a significant CAGR during the forecast period. The region is transforming due to investments in advanced diagnostic technologies and increasing awareness of preventive and diagnostic care. The University of Saskatchewan’s Western College of Veterinary Medicine in October 2025, upgraded its imaging capabilities with a new 3 Tesla MRI and linear accelerator, enhancing oncology and medical imaging services. These upgrades, supported by more than USD 5 million in donor contributions, complement existing PET-CT and CT units, improving diagnostic accuracy, treatment planning, and hands-on training for veterinary students. Such initiatives highlight growing adoption of high-end imaging in Canadian veterinary care.

Europe Veterinary CT Imaging Market Trends

The veterinary CT imaging market in Europe is expanding rapidly, supported by growing expertise in diagnostic imaging, expansion of veterinary referral and specialty centers and increasing awareness of early disease detection. Many veterinary medical devices in the EU (including imaging equipment) are not subject to the same strict regulatory regime to that of human medical devices. In several EU countries, veterinary devices are not required to carry CE marking under EU medical device legislation. In addition, key players such as Esaote, Siemens Healthineers, Canon Medical Systems, and Xoran are expanding portfolios with high-performance, low-dose, and AI-enabled CT systems.

The UK veterinary CT imaging market is expected to grow at a significant CAGR over the forecast period. The market is expanding rapidly, driven by rising demand for advanced diagnostics in equine and companion animals, the need for early detection of complex conditions, and the growing adoption of large-bore CT scanners, which enable comprehensive imaging under sedation or anesthesia. For instance, in December 2024, the Royal Veterinary College installed a large-bore CT scanner, enabling comprehensive imaging of horses’ heads, necks, limbs, and cervicothoracic junction, improving diagnosis, early treatment, and outcomes for complex equine conditions. The competitive landscape is transforming by strategic collaborations, for instance, in July 2025, Canon Medical Systems’ partnered with Quality Medical Services, to advance ultrasound, CT and MRI technologies with veterinary-specific expertise. These alliances enhance market reach, improve service support, and accelerate the adoption of high-performance CT, MRI, and ultrasound solutions across veterinary practices in the UK.

The veterinary CT imaging market in Germany held a significant share in 2024. The veterinary CT imaging industry is expanding rapidly, supported by regulatory support & quality standards, well-established veterinary infrastructure, and growing awareness of pet health. Some of the technological advancements include high-resolution and faster CT scanners. In addition, the competitive landscape is dominated by global and regional players such as Siemens Healthineers, IDEXX, and FUJIFILM, who compete through product innovation, strategic partnerships, and service support, aiming to capture Germany’s expanding veterinary imaging segment.

Asia Pacific Veterinary CT Imaging Market Trends

The veterinary CT imaging market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The region's market is expanding due to increasing adoption of service delivery models, rising use in research & academics, and increasing veterinary infrastructure & economic development. in addition, veterinary CT scanners fall under the broader medical-device regulatory frameworks, as few countries have regulations specifically for veterinary devices. Furthermore, to overcome the shortage of trained veterinary radiologists and support wider adoption, service models such as teleradiology and reporting-as-a-service are being employed in the APAC region to scale CT usage across clinics and hospitals.

The China veterinary CT imaging market held significant revenue share in 2024 andis witnessing new growth opportunities due to rising regulatory support for high-end imaging and innovation incentives. Veterinary AI adoption is growing rapidly in China. According to a survey of October 2025, it was found that 71% of Chinese vets are already using AI for tasks such as disease diagnosis and imaging analysis. The regulatory framework is also transforming in China. For instance, in July 2025, China’s NMPA announced measures to optimize lifecycle regulation and accelerate innovation in advanced imaging and AI-driven technologies. Streamlined approvals, standardization of classification, and proactive post-market monitoring are expected to ease market entry for international high-end imaging manufacturers, including those specializing in veterinary CT systems, thereby boosting adoption by clinics and referral hospitals across China.

The veterinary CT imaging market in India is emerging, driven by rising pet ownership and increased pet humanization, which in turn is fueling demand for advanced diagnostics, including veterinary CT imaging. In addition, due to accessibility to state-of-the-art imaging centers and specialized surgical services, timely and accurate interventions were ensured, thereby improving outcomes. The competitive landscape includes a mix of international OEMs, domestic diagnostic chains, and multi-specialty veterinary hospitals, many leveraging human healthcare expertise.

Latin America Veterinary CT Imaging Market Trends

The veterinary CT imaging market in Latin America is poised by increasing awareness of advanced diagnostics and expanding veterinary infrastructure in urban centers. In addition, growing investment in pet healthcare and government initiatives to improve animal health further boost demand. The competitive scenario comprises of players such as Siemens Healthineers, IDEXX, and FUJIFILM, competing through technological innovation, localized service networks, and strategic partnerships to address the region’s emerging veterinary imaging needs and improve diagnostic efficiency.

The Brazil veterinary CT imaging marketis gaining momentum, due to rising disposable income and the expansion of private veterinary clinics. In addition, growing awareness of early disease detection and preventive care, coupled with government initiatives on animal health, further drives the adoption of advanced CT imaging technologies.

Middle East & Africa Veterinary CT Imaging Market Trends

The veterinary CT imaging market in Middle East & Africa is driven by rising awareness of advanced animal healthcare, increasing companion animal adoption, and growing livestock health initiatives. Additionally, the expansion of veterinary infrastructure, government-backed programs to control zoonotic diseases, and increasing investments in modern diagnostic technologies further support market growth. Furthermore, the region’s focus on preventive care, coupled with demand for high-precision imaging in specialty clinics, is encouraging the adoption of CT systems, while international players are entering to meet the evolving veterinary diagnostic needs.

The South Africa veterinary CT imaging market is expanding, fueled by increasing investment in advanced diagnostic infrastructure, rising demand for specialized imaging in both companion and large animals, growth in veterinary education and research, and the need for precise diagnostics in livestock and wildlife, further boost adoption. For instance, in February 2024, the University of Pretoria’s Onderstepoort Veterinary Academic Hospital launched South Africa’s largest veterinary CT scanner, a Siemens Somatom 64 Slice with sliding gantry, enhancing specialist training, research, and large-animal diagnostics. In addition, support from charitable foundations, government initiatives, and expanding veterinary specialty services enhances access to advanced CT technology across the country.

The veterinary CT imaging market in Oman is growing due to increasing demand for advanced diagnostic services and growing awareness of animal health and preventive care. The expansion of veterinary hospitals and specialty clinics further supports the adoption of CT technology. The regulatory landscape is transforming due to the Ministry of Agriculture, Fisheries, and Water Resources, which enforces strict import, quality, and safety standards for veterinary medical devices, ensuring compliance and promoting modern diagnostic practices across the country.

Key Veterinary CT Imaging Company Insights

Key players in the global veterinary CT imaging industry include Siemens Healthineers, GE Healthcare, FUJIFILM, Canon Medical Systems Corporation, and Sound. These companies compete through advanced imaging solutions, technological innovations, and strong service networks, focusing on enhancing diagnostic accuracy, expanding regional presence, and capturing growing demand in veterinary clinics and hospitals. For instance, in October 2025, WOORIEN launched the MyVet CT Plus, an upgraded veterinary CT system offering faster acquisition, sharper spiral-based imaging, reduced anesthesia needs, and versatile FOV options to accommodate animals of various sizes.

Key Veterinary CT Imaging Companies:

The following are the leading companies in the veterinary CT imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Canon Medical Systems Corporation

- Epica International (Epica Animal Health)

- Neurologica Corporation

- Siemens Healthcare Limited

- Sound

- Hallmarq Veterinary Imaging

- Shenzhen Anke High-Tech Co. Ltd

- Xoran Technologies, LLC.

- PLANMED OY

Recent Developments

-

In November 2025, researchers at the Cancer Center at Illinois and Washington University are developing data-driven 4D radiotherapy to improve tumor targeting in veterinary oncology, aiming to reduce radiation exposure to healthy tissue during treatment.

-

In September 2025,UC Davis launched its donor-funded All Species Imaging Center featuring advanced CT, MRI, PET/CT, and equine CT suites, offering expanded diagnostic capabilities and becoming one of the most advanced veterinary imaging hubs

-

In September 2025, IMV Imaging and Asto CT formed a global partnership to expand advanced equine and mixed-practice imaging, integrating IMV’s multi-species imaging portfolio with Asto CT’s weight-bearing equine CT technology to enhance diagnostic precision.

Veterinary CT Imaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 450.5 million

Revenue forecast in 2033

USD 784.0 million

Growth rate

CAGR of 7.17% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, solutions, application, end use, regional

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

GE Healthcare; Canon Medical Systems Corporation; Epica International (Epica Animal Health); Neurologica Corporation; Siemens Healthcare Limited; Sound; Hallmarq Veterinary Imaging; Shenzhen Anke High-Tech Co., Ltd; Xoran Technologies, LLC.; PLANMED OY

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary CT Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary CT imaging market report based on animal, solutions, application, end use, and region.

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Animals

-

Dogs

-

Cats

-

Others

-

-

Large Animals

-

-

Solutions Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Slice CT

-

Cone Beam

-

-

Consumables

-

CT Imaging Software & Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Neurology

-

Orthopedic & Traumatology

-

Oncology

-

Dental

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

Diagnostic Laboratories

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary CT imaging market size was estimated at USD 421.4 million in 2024 and is expected to reach USD 450.5 million in 2025.

b. The global veterinary CT imaging market is expected to grow at a compound annual growth rate (CAGR) of 7.17% from 2025 to 2033 to reach USD 784.0 million by 2033.

b. North America dominated the global veterinary CT imaging market with a share of 39.65% in 2024. This is attributable to the rising pet population & humanization, growing demand for advanced diagnostic imaging, and increased cross-sector collaborations.

b. Some key players operating in the global veterinary CT imaging market include GE Healthcare; Canon Medical Systems Corporation; Epica International (Epica Animal Health); Neurologica corporation; Siemens Healthcare Limited; Sound; Hallmarq Veterinary Imaging; Shenzhen Anke High-Tech Co. Ltd; Xoran Technologies, LLC.; and PLANMED OY.

b. Key factors that are driving the market growth include advancing imaging modalities in veterinary medicine, growing access to CT in general veterinary practices, rising adoption of pets, and increasing veterinary expenditure. In addition, the increasing number of veterinary clinics with improved infrastructure is further propelling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.