- Home

- »

- Animal Health

- »

-

Veterinary Video Endoscopy Market Size & Share Report 2030GVR Report cover

![Veterinary Video Endoscopy Market Size, Share & Trends Report]()

Veterinary Video Endoscopy Market (2023 - 2030) Size, Share & Trends Analysis Report By Solutions (Equipment, Accessories/Consumables, PACS), By Animal Type, By Application, By Procedure, By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-572-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global veterinary video endoscopy market size was valued at USD 188.95 million in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.77% from 2023 to 2030. The growing pet population, demand for less invasive procedures in veterinary medicine, adoption by veterinary healthcare centers to increase profits, technological developments, and awareness about zoonotic diseases and possible treatments are the key drivers driving growth. In 2022, SonoScape entered the market with the launch of its veterinary endoscopy portfolio comprising a compact video system center, rigid and flexible endoscopes, and camera heads.

The COVID-19 pandemic had a negative impact on the Veterinary Video Endoscopy Market, resulting in low demand and sales. This was due to supply chain challenges, veterinary procedures that were postponed or canceled, fewer veterinary visits, and movement restrictions. According to an AVMA 2020 survey, 18% of respondent veterinary practice owners were seeing only emergency-related cases as a result of the disease outbreak and the quarantine measures that followed. While 60% of practices reported appointment cancellations due to the pandemic. During the first half of 2020, only emergency veterinary care was permitted in several key European countries, including Spain, Italy, France, and the UK. According to the Federation of Veterinarians of Europe, this resulted in a loss of clients and revenue for practice owners (FVE). However, as lockdown measures were relaxed and veterinarians were recognized as essential in most European countries, the situation improved.

Video endoscopes offer the best in technology and are anticipated to be in high demand over the coming years. This is because video endoscopy systems display images in real-time on a digital screen so that the veterinarian and owner can directly observe the findings. Commonly performed procedures with video endoscopy include evaluation of the upper respiratory tract in cases of suspected abnormal breathing or nasal discharge. The longer gastroscopes are passed into the stomach through the nasal passages to assess gastric ulcers. Video endoscopes are also used to evaluate the urethra and bladder and to gain direct visualization of the sinuses in the head. Tele-View USB Video Endoscopes/Gastroscopes offered by Advanced Monitors Corporation, are endoscopes that can be used as plug-and-play devices. These work with Windows computers, laptops, tablets, and Android devices. The endoscopes are intended for use in small animals and horses for gastroscopy, bronchoscopy, and duodenoscopy.

The rising pet ownership is another key driver expected to fuel market growth. For example, in the Europe region, Germany has one of the largest pet populations according to the European Pet Food Industry report of 2020. Dogs are the predominant pets in the U.S. as per the 2021 National Pet Owners Survey by American Pet Products Association. As per the American Veterinary Medical Association, 2.8% of households in the country had pet birds from 2017 to 2018. The population of ferrets and rabbits was 0.5 million and 2.2 million respectively. In addition, Americans spent an average of USD 40 per household per year on pet birds, as per the same source. This is expected to contribute to the demand for small animal endoscopes in the coming years. Karl Storz, for instance, offers a wide portfolio of multi-purpose rigid endoscopes and telescopes for use in cats, dogs, birds, reptiles, amphibians, small mammals, and fishes for a variety of procedures.

Solution Insights

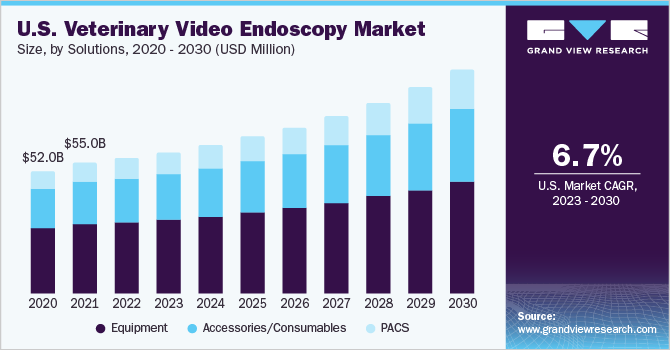

Equipment dominated the market with a share of over 50% in 2022. The growing adoption of veterinary video endoscopy procedures as a less invasive alternative to surgical procedures is expected to drive segment growth. For example, Point Grey Veterinary Hospital in Vancouver, Canada, utilizes a flexible fiberoptic endoscope to perform endoscopy on areas such as the stomach, trachea, and colon without the need for surgery. Video endoscopy is commonly used for stomach and gastrointestinal exams and biopsy, retrieval of objects from the stomach, placing of feeding tubes, and examination of the upper airways.

While the PACS segment is the fastest-growing segment with a CAGR of about 9% in coming years. Veterinary picture archiving and communication systems (PACS) are expected to grow at a rapid pace due to their widespread use in clinical settings. The increasing adoption of devices with image sharing and data storage capabilities contributes to the segment share. Companies are concentrating on the creation of advanced enterprise image-displaying solutions to meet the image-processing needs of veterinarians.

Animal Type Insights

The small animal segment dominated the market and accounted for a market share of in 2022. Growing pet population and expenditure, advances in veterinary science and diagnosis, and the availability of advanced veterinary video endoscopes for a variety of applications are expected to drive market growth during the forecast period. Moreover, growing awareness among pet owners about diseases, diagnosis, and treatments and the availability of innovative solutions specifically designed for small animals are anticipated to contribute to market growth. For example, the DE551 Veterinary Video Otoscope was designed by Firefly Global for inner ear examination in dogs, cats, small animals, and exotics.

The large animal segment is anticipated to grow at a rate of about 6% during the forecast period. According to a key market player Karl Storz, flexible endoscopes are a standard component of diagnostic equipment used in large animal medicine. They are primarily used to distinguish between pathological conditions in the gastrointestinal tract and upper respiratory tract. For example, the company's video endoscope line supports these applications while providing improved image quality.

Application Insights

In terms of application, the diagnostic segment held the dominant share of the market in 2022. Veterinary video endoscopes are used in a variety of procedures, including liver and kidney biopsy samples during laparoscopy and clinical sampling during otoscopy. Various diagnostic procedures are used to analyze incidences of weight loss, chronic vomiting, and digestive problems. This is expected to fuel segment growth during the forecast period.

The surgical/ interventional segment is anticipated to grow at a notable rate owing to the increasing number of minimally invasive procedures performed in animals. Another important factor is the expansion of the applications of veterinary video endoscopes for interventional procedures such as the removal of gastric and esophageal foreign bodies, bladder polyp removal or stone retrieval, feeding tube placement, foreign body retrieval, and balloon dilation of strictures.

Procedure Insights

The Abdominal/ GI tract segment held the largest share of about 50% of the market in 2022. This is due to the increasing number of interventional and diagnostic procedures performed to ensure the health of small and large animals. For instance, According to Healthy Paws pet insurance provider, digestive problems accounted for 26% and 31.8% of the 10 leading complaints among dog and cat owners in 2019. The company's plans cover a variety of digestive problems, including diagnoses endoscopy in dogs and cats.

ENT endoscopy is the fastest-growing segment estimated to grow at a CAGR of about 9% in the near future. Otoscopy and rhinoscopy are two ENT endoscopy procedures. In veterinary medicine, diagnostic otoscopy is used to examine an animal's external and middle ear. Due to the increasing prevalence of external ear disorders in dogs, it is among the most significant applications of veterinary endoscopes. Otoendoscopy allows for easy access and superior imaging, resulting in more precise diagnosis and treatment. Rhinoscopy, in contrast, is most commonly used to treat nasal obstruction, severe sneezing, severe acute sneezing, nasal pain, nasal discharge, facial distortion, epistaxis, reverse sneezing, and abnormal radiographs in dogs and cats.

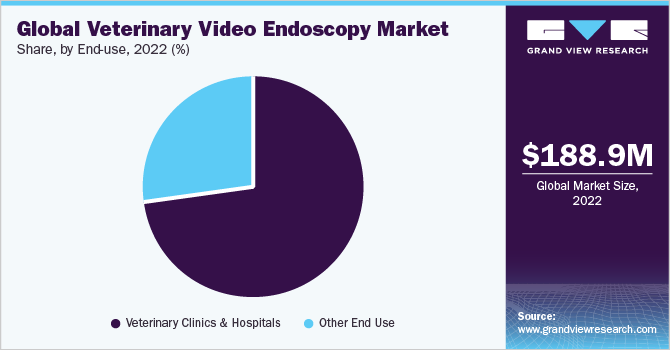

End-use Insights

By end use, the veterinary clinics and hospitals segment dominated the market in 2022 and is also projected to grow the fastest at a rate of over 8%. This is due to a larger volume of patients treated at hospitals and clinics as well as improving veterinary healthcare infrastructure in developing markets. Kulshan Veterinary Hospital in the U.S., for instance, uses 1.5 and 3 meter video endoscopes for a range of diagnostic and surgical procedures in horses including respiratory, gastric, and uterine endoscopy.

Benalla veterinary clinic in Australia is another end user that offers small animal rigid and video endoscopy services using video and fiberoptic flexible endoscopes. The clinic also uses these to perform minimally invasive ‘keyhole surgery’ in the chest cavity (thoracoscopy), abdomen (laparoscopy), and joints (arthroscopy). Other endoscopy procedures performed by the clinic include gastroscopy, bronchoscopy, colonoscopy, rhinoscopy, etc.

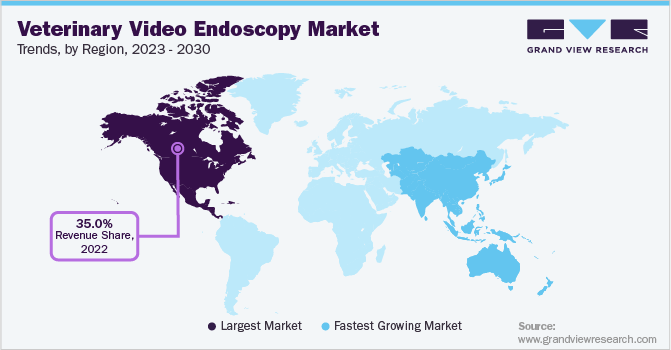

Regional Insights

North America held the largest market share of over 35% in 2022. The region's large share is due to the rising prevalence of zoonotic diseases, the humanization of pets, and widespread pet insurance coverage. In addition, the Veterinary Endoscopy Society (VES) was established in the U.S. in 2003 to advance the field of veterinary endoscopy and encourage diagnosis, research, management, and developments in veterinary endoscopy. The VES also funds research projects that have a direct impact on the development of veterinary endoscopy, thereby having contributed to market growth.

Asia Pacific is estimated to grow the fastest at a CAGR of over 9% in the next few years. This is due to the growing pet population, increased awareness of animal diseases, and the existence of key market players. For example, Zhuhai Seesheen Medical Technology Co., Ltd. is a Chinese company that develops, manufactures, and markets medical endoscopes throughout the globe. Endoscopes for veterinary bronchoscopy, rhino laryngoscopy, and ureteroscopy are among the products available from the company.

Key Companies & Market Share Insights

The market is competitive owing to the presence of several large and small companies. Market players focus on the implementation of strategic initiatives that include product development, portfolio expansion, geographical expansion, partnerships and collaborations, and mergers and acquisitions to increase their market share. For instance, in July 2020, eKuore launched a new APP- eKuore Vet to integrate its lineup of veterinary devices including stethoscopes, cardiac monitors, and digital otoscopes, thus enhancing its offerings. The Endo-i system by Steris, on the other hand, is the company’s flagship offering of a wireless veterinary endoscope system. It comprises endoscopes in multiple working lengths and diameters from 1 to 3.3m and 8 to 13mm respectively and includes biopsy channels ranging from 2 to 3.7 mm. It also connects to the Endo-i App which acts as a hub for all flexible endoscopy procedures allowing users to automatically export and share images and photos from procedures. Some of the key players in the veterinary video endoscopy market include:

-

Steris

-

MDS Incorporated

-

Firefly Global

-

KARL STORZ SE & Co. KG

-

Advanced Monitors Corporation

-

Dr. Fritz Endoscopes GmbH

-

Biovision Veterinary Endoscopy, LLC

-

Eickemeyer

-

Ambu

-

Olympus Corporation

Veterinary Video Endoscopy Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 199.40 million

The revenue forecast in 2030

USD 336.76 million

Growth Rate

CAGR of 7.77% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solutions, animal type, application, procedure, end-use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; U.K.; Germany; Italy; France; Spain; Netherlands; Poland; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Steris; MDS Incorporated; Firefly Global; KARL STORZ SE & Co. KG; Advanced Monitors Corporation; Dr. Fritz Endoscopes GmbH; Biovision Veterinary Endoscopy; LLC; Eickemeyer; Ambu; Olympus Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Video Endoscopy Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global veterinary video endoscopy market based on solutions, animal type, application, procedure, end-use, and region:

-

Solutions Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Accessories/Consumables

-

PACS

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Surgical/ Interventional

-

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Abdominal/ GI tract

-

Urogenital

-

ENT

-

Other Procedures

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Clinics & Hospitals

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Poland

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

MEA

-

South Africa

-

Saudi Arabia

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary video endoscopy market size was estimated at USD 188.95 million in 2022 and is expected to reach USD 199.40 million in 2023.

b. The global veterinary video endoscopy market is expected to grow at a compound annual growth rate of 7.77% from 2023 to 2030, reaching USD 336.76 million by 2030.

b. North America held the largest share of over 35% of the Veterinary Video Endoscopy Market in 2022. The region's large share is due to the rising prevalence of zoonotic diseases, the humanization of pets, and widespread pet insurance coverage.

b. Some key players operating in the veterinary video endoscopy market include Steris, MDS Incorporated, Firefly Global, KARL STORZ SE & Co. KG, Advanced Monitors Corporation, Dr. Fritz Endoscopes GmbH, Biovision Veterinary Endoscopy, LLC, Eickemeyer, Ambu, Olympus Corporation.

b. Key factors that are driving the veterinary video endoscopy market growth include rising pet population, demand for minimally invasive procedures in animals, adoption by clinics to increase revenue, technological advancements, and awareness about animal diseases & treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.