- Home

- »

- Animal Health

- »

-

Veterinary Eye Care Market Size, Share, Industry Report 2033GVR Report cover

![Veterinary Eye Care Market Size, Share & Trends Report]()

Veterinary Eye Care Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Canine, Feline, Bovine), By Indication (Cataract, Glaucoma, Uveitis, Conjunctivitis), By Product, By Distribution Channel (Specialty Stores, E-Commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-194-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Eye Care Market Summary

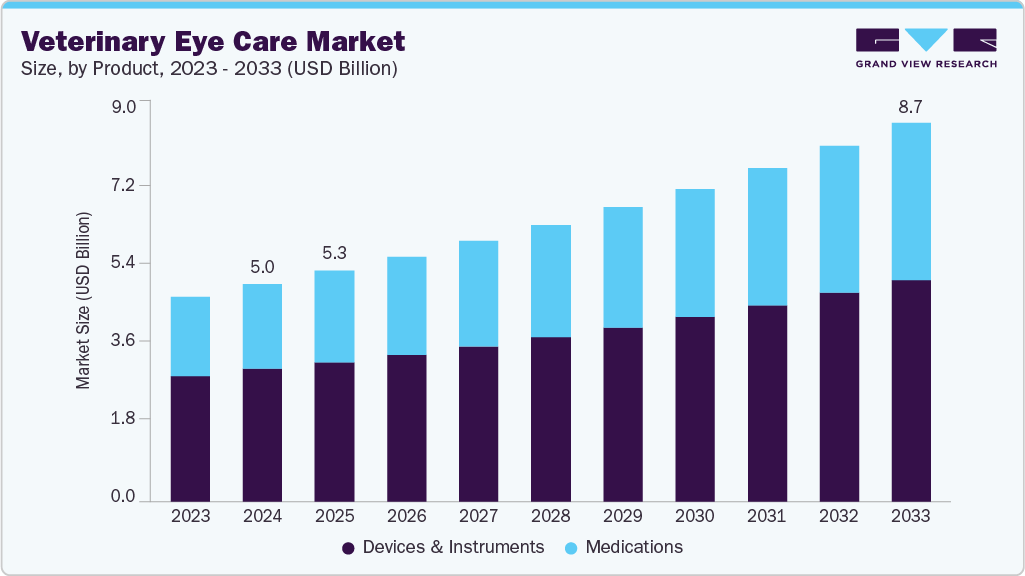

The global veterinary eye care market size was estimated at USD 5.00 billion in 2024 and is projected to reach USD 8.69 billion by 2033, growing at a CAGR of 6.37% from 2025 to 2033. The market is advancing, driven by growing pet humanization and expenditure, advancements in veterinary ophthalmic technologies, awareness campaigns, and preventive eye care.

Key Market Trends & Insights

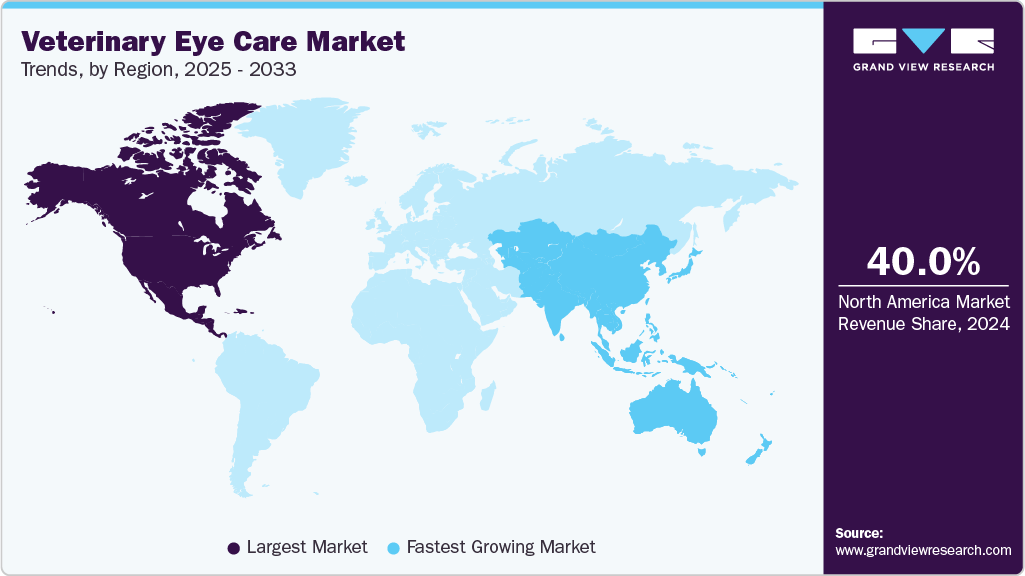

- North America veterinary eye care market held the largest share of about 40% of the global market in 2024.

- The veterinary eye care market in the U.S. is evolving with growing demand for advanced diagnostics, tele-ophthalmology, and tailored therapeutics.

- By product, devices & instruments segment held the largest share of over 61% of the market in 2024.

- By animal, canine segment dominated the global market with a share of 33.83% in 2024.

- Based on indication, uveitis segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.00 Billion

- 2033 Projected Market Size: USD 8.69 Billion

- CAGR (2025-2033): 6.37%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The trend of pet humanization has significantly influenced spending behavior among pet owners, who prioritize advanced healthcare, including ophthalmology services. Rising disposable incomes, particularly in North America and Europe, have supported demand for premium veterinary eye treatments such as laser therapies, microsurgeries, and intraocular lens implants. According to the American Pet Products Association (APPA), spending in the U.S. pet industry reflects strong growth across multiple categories. In 2024, Supplies, Live Animals & OTC Medicine accounted for USD 33.3 billion, while Veterinary Care & Product Sales reached USD 39.8 billion.In addition, insurance coverage for pets is expanding, lowering the financial burden of costly ophthalmic procedures. This willingness to invest in preventive care and surgical interventions reflects a shift in pet ownership attitudes, treating animals as family members. Consequently, increased spending strengthens the market across developed and emerging economies.

Technological innovation is a key driver of market growth. Modern diagnostic imaging tools, including optical coherence tomography (OCT) and advanced fundus cameras, enable early and precise detection of complex eye disorders. Surgical breakthroughs, such as phacoemulsification for cataract removal and minimally invasive glaucoma surgeries, improve treatment outcomes. In addition, veterinary-specific pharmaceuticals like anti-inflammatories, lubricating eye drops, and antibiotics have expanded therapeutic options. The integration of digital telemedicine platforms further supports remote consultations and follow-ups. These technological advancements enhance clinical efficiency, reduce recovery times, and broaden accessibility, making veterinary eye care more sophisticated and in-demand.

Innovations Transforming Veterinary Ophthalmology

Technology

Description

Handheld Fundus Cameras

Portable, user-friendly devices that capture high-resolution retinal images for in-clinic use and tele-ophthalmology, improving accessibility.

Optical Coherence Tomography (OCT)

Provides detailed cross-sectional imaging of the retina and cornea, enabling early diagnosis of glaucoma, retinal degeneration, and tumors.

Phacoemulsification Systems

Advanced cataract surgery tools adapted for veterinary use, allowing smaller incisions, faster healing, and improved surgical outcomes.

Minimally Invasive Glaucoma Implants

Innovative drainage shunts and implants to control intraocular pressure in pets, offering better long-term management of glaucoma.

AI-Based Image Analysis

Artificial intelligence algorithms that detect subtle ocular changes, assisting veterinarians in faster, more accurate diagnoses.

Tele-ophthalmology Platforms

Secure digital systems that enable remote consultations, case-sharing, and specialist collaboration, enhancing access to care.

Veterinary-Specific Eye Drops & Implants

Novel pharmaceuticals and sustained-release drug delivery implants designed specifically for ocular conditions like uveitis.

Awareness initiatives by veterinary associations, NGOs, and pet healthcare brands encourage preventive eye care, further driving demand. Educational campaigns highlighting early symptoms of ocular disorders have improved pet owner responsiveness, leading to quicker diagnosis and treatment. The adoption of routine eye exams, especially for breeds prone to hereditary eye diseases, is increasing. Preventive use of eye drops, supplements, and protective eyewear for working or sporting dogs is also gaining traction. These proactive measures extend the quality of pets’ lives and increase long-term demand for specialized veterinary eye care products, services, and preventive solutions.

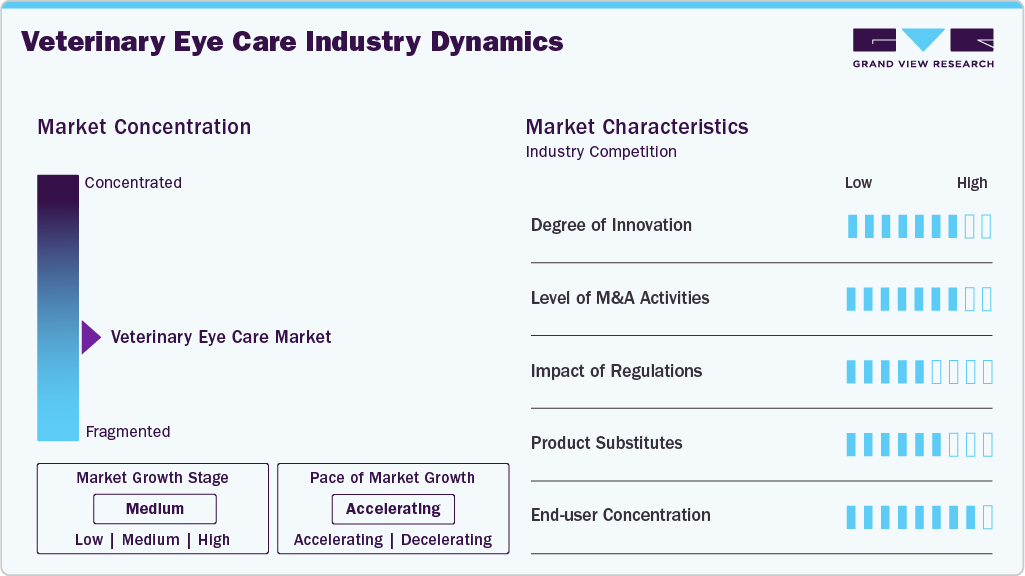

Market Concentration & Characteristics

The veterinary eye care industry is moderately concentrated, with a mix of global pharmaceutical companies, specialized ophthalmic device manufacturers, and niche veterinary clinics driving innovation. Key players such as Merck & Co., Inc., Bausch & Lomb Incorporated, and Dechra dominate through advanced technologies, proprietary drugs, and specialist services, while regional practices and tele-ophthalmology platforms broaden accessibility, creating a balanced competitive landscape.

The veterinary eye care industry shows a high degree of innovation, with advances in diagnostic imaging, tele-ophthalmology, AI-based analysis, and sustained-release ocular drug delivery. In August 2023, Dômes Pharma leveraged SentrX’s BioHAnce technology and successful product portfolio, strengthening its presence in North America and expanding its therapeutic franchises. These breakthroughs improve early detection, precision treatments, and patient outcomes.

Mergers and acquisitions are increasingly shaping the market as large animal health companies acquire niche ophthalmic players and technology developers. For instance, in August 2023, Dômes Pharma acquired U.S.-based SentrX Animal Care, expanding its global ophthalmology portfolio with BioHAnce technology. The move strengthens its international presence, supported by subsidiaries and the leadership’s commitment to North American growth. Strategic partnerships with diagnostic imaging and pharmaceutical companies also support innovation and enhance competitiveness in this evolving segment.

Regulations significantly influence the veterinary eye care industry by ensuring product safety, efficacy, and compliance with animal welfare standards. Approval processes for ophthalmic drugs, surgical devices, and diagnostic tools can affect timelines and market entry. Regulatory alignment with human ophthalmology frameworks often accelerates innovation adoption, while regional differences in veterinary drug approvals create market access challenges.

Product substitution is moderate in veterinary eye care, as general ophthalmic medications and human eye care tools are sometimes adapted for animal use. However, increasing demand for veterinary-specific formulations, devices, and minimally invasive treatments reduces reliance on substitutes. The trend toward tailored, species-specific solutions drives growth and differentiation in the eye care segment.

End user concentration in veterinary eye care is fragmented, encompassing general veterinary practitioners, specialty ophthalmologists, academic institutes, and referral hospitals. While specialist clinics represent a growing share due to complex procedures, general practices are expanding the adoption of tele-ophthalmology and imaging tools. This diversity creates broad demand and fosters continuous innovation across multiple end-user segments.

Animal Insights

In 2024, the canine segment accounted for the largest share of 33.83%, driven by the high prevalence of ocular disorders such as cataracts, glaucoma, corneal ulcers, and retinal diseases in dogs. Breeds like Pugs, Bulldogs, and Cocker Spaniels, which are genetically predisposed to eye conditions, further contribute to the strong demand for specialized ophthalmic care. Rising pet ownership, the increasing humanization of dogs, and wider access to advanced diagnostics and surgical solutions fuel this growth. Strengthening this trend, in July 2025, Dômes Pharma partnered with Fear Free under its Preferred Product Program to promote stress-free veterinary eye care, with flagship products Oculenis, Ocunovis Procare, and Fluodrop recognized for enhancing comfort, healing, and compassionate treatment. Veterinarians and specialists continue to prioritize canine eye health, solidifying this segment as the most dominant and profitable.

Feline is emerging as the fastest-growing category in the market, fueled by rising awareness of cat ocular diseases, such as conjunctivitis, corneal ulcers, uveitis, and glaucoma. Advances in diagnostics, tele-ophthalmology, and feline-specific ophthalmic treatments are improving access to specialized care. Increasing pet cat ownership globally, coupled with the trend of pet humanization, is driving owners to invest more in preventive and advanced eye care solutions. As a result, the feline segment is experiencing rapid growth and expanding its share within the veterinary ophthalmology market.

Product Insights

Devices and instruments represented the largest share of about 61% in 2024, driven by the rising adoption of advanced diagnostic and surgical tools. Technologies such as fundus cameras, slit lamps, tonometers, and optical coherence tomography (OCT) are becoming essential for early detection and precise management of ocular disorders. Increased availability of minimally invasive surgical instruments, including phacoemulsification systems and glaucoma implants, further strengthens this segment. Growing awareness among veterinarians, coupled with technological advancements and rising demand for accurate, efficient eye care solutions, positions devices and instruments as the most dominant category in the market.

The medications segment is the fastest-growing over the forecast period, fuelled by rising demand for advanced ophthalmic drugs addressing conditions like dry eye, conjunctivitis, glaucoma, and corneal ulcers. Growth is further supported by strategic collaborations, such as the amended licensing agreement of June 2023, between Kiora Pharmaceuticals and Sentrx Animal Care, which strengthens innovation pipelines using patented hyaluronic acid-based technologies. These developments enable the creation of next-generation therapies that combine enhanced healing, hydration, and antibiotic integration, offering more effective treatments. Increasing pet humanization and owner willingness to invest in advanced therapeutics further accelerate this segment’s rapid expansion.

Indication Insights

Uveitis represented the largest segment in 2024, driven by its high prevalence among companion animals, particularly dogs and horses. This inflammatory condition of the uveal tract can result from infections, autoimmune disorders, or trauma, often leading to vision loss if untreated. Rising awareness among pet owners and veterinarians about early diagnosis and treatment has increased demand for advanced therapies, including corticosteroids, immunosuppressants, and anti-inflammatory eye drops. The growing availability of specialized diagnostics and improved treatment protocols positions uveitis management as the dominant focus within veterinary ophthalmology.

Conjunctivitis is emerging as the fastest-growing segment in the market, fueled by its widespread occurrence in dogs and cats. Often caused by infections, allergies, or environmental irritants, conjunctivitis is one of the most common ocular conditions presented in clinics. Increasing awareness of preventive eye health, along with the availability of effective medications such as lubricating drops, antibiotics, and anti-inflammatory formulations, is driving rapid adoption. Pet humanization and rising veterinary visits for routine care further support growth, making conjunctivitis management a key expanding area within veterinary ophthalmology.

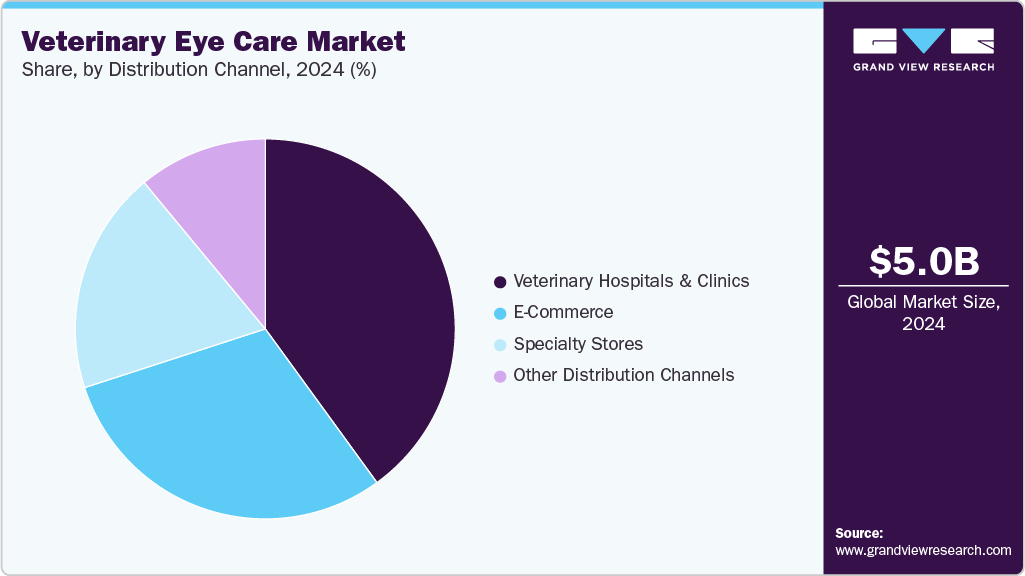

Distribution Channel Insights

Veterinary hospitals and clinics account for the largest market share, as they serve as primary centers for diagnosis, treatment, and management of ocular disorders in animals. Equipped with advanced diagnostic tools such as slit lamps, fundus cameras, and tonometers, these facilities enable timely and accurate interventions. Specialized ophthalmology departments and referral clinics further strengthen their role in delivering surgical and medical eye care. Rising pet ownership, increased awareness of animal eye health, and accessibility to trained specialists solidify hospitals and clinics as the dominant segment in this market.

E-commerce is the fastest-growing segment in the market, driven by the rising demand for convenient access to medications, supplements, and eye care products. Online platforms provide pet owners with a wide range of ophthalmic solutions, including lubricating drops, diagnostic kits, and prescription refills, delivered directly to their homes. The growth of tele-ophthalmology further complements online sales, enabling remote consultations and product recommendations. Increasing digital adoption, competitive pricing, and subscription-based models accelerate market expansion, positioning e-commerce as a worldwide critical distribution channel for veterinary eye care products.

Regional Insights

The North American veterinary eye care market had a share of about 40% in 2024, driven by rising pet ownership, advanced diagnostics, and demand for specialized ophthalmology services. Some players, such as Dômes Pharma, Sentrx Animal Care, and Kiora Pharmaceuticals, lead innovation with technologies such as BioHAnce and OCT imaging. Expanding tele-ophthalmology and tailored therapeutics further strengthen market growth and competitiveness.

U.S. Veterinary Eye Care Market Trends

The veterinary eye care market in the U.S. is evolving with growing demand for advanced diagnostics, tele-ophthalmology, and tailored therapeutics. Key players such as Dômes Pharma, Sentrx, Kiora Pharmaceuticals, and Mars Inc., which is emphasizing reduced antibiotic use across its 2,500 practices. Innovations in imaging, minimally invasive surgeries, and sustainable treatment approaches drive growth while aligning with FDA-backed antimicrobial stewardship efforts.

Europe Veterinary Eye Care Market Trends

The veterinary eye care market in Europe is expanding, fueled by increasing cases of glaucoma, cataracts, and other ocular disorders in companion animals. Leading innovators such as Sentrx and Kiora Pharmaceuticals drive advancements, while collaborations between veterinary and human ophthalmologists accelerate glaucoma research. Growth in diagnostic imaging, tele-ophthalmology, and minimally invasive therapies further positions Europe as a hub for veterinary ophthalmic innovation, underscoring the value of One Health collaboration in research and clinical progress.

The UK veterinary eye care market is gaining momentum, driven by rising awareness of pet ocular diseases and increasing demand for early diagnosis. TVM UK plays a crucial role by launching Pet Eye Health Awareness Week to educate owners on symptoms and preventive care. Advancements in diagnostic tools, minimally invasive treatments, and awareness initiatives strengthen competitive positioning and market growth.

Asia Pacific Veterinary Eye Care Market Trends

The veterinary eye care market in the Asia Pacific is the fastest-growing region over the forecast period, driven by rising pet ownership, increased ocular disease awareness, and improving treatment access. Key players like Zoetis, Boehringer Ingelheim, Merck, Elanco, and Ceva dominate, while emerging regional innovators shape local growth. Enhanced diagnostic and therapeutic investments support the region’s rapid advancement.

India veterinary eye care market is expanding, driven by rising pet ownership, awareness of ocular diseases, and access to advanced treatments. The February 2025 launch of an advanced eye care centre in Vadodara, Gujarat, highlights progress in cataract, glaucoma, and corneal therapies. Key players like Zoetis, Intas, and TVM India foster innovation, while tele-ophthalmology and surgical advancements strengthen care standards.

Latin America Veterinary Eye Care Market Trends

The veterinary eye care market in Latin America is growing, driven by rising companion animal adoption, the increasing prevalence of ocular disorders, and improved access to specialized veterinary services. Some companies, such as Ourofino, Zoetis, and Elanco, strengthen their presence through ophthalmic drugs and devices. Advancements in diagnostic imaging, minimally invasive surgeries, and tele-ophthalmology enhance treatment accessibility across emerging markets.

Brazil veterinary eye care market is expanding, driven by growing companion animal ownership, high incidence of ocular diseases, and innovative local research. Key players like Ourofino, Zoetis, and Ceva are active, while in September 2023, advancements such as tilapia-skin biotissue grafts for corneal injuries highlight Brazil’s innovation. Expanding specialty clinics and tele-ophthalmology services further boost accessibility and treatment outcomes.

Middle East & Africa Veterinary Eye Care Market Trends

The veterinary eye care market in MEA is gaining traction, fueled by rising pet ownership, growing awareness of animal wellness, and demand for advanced ophthalmic treatments. Key players like Elanco, Boehringer Ingelheim, and regional distributors dominate. Advancements include the adoption of diagnostic imaging, cataract surgery, and tele-ophthalmology services, with the UAE and Saudi Arabia emerging as hubs for specialized veterinary eye care.

South Africa veterinary eye care market is expanding, driven by increasing companion animal ownership, rising cases of glaucoma, cataracts, and corneal injuries, and greater awareness of specialized treatments. Key players include Zoetis, Boehringer Ingelheim, and local veterinary clinics. Advancements in diagnostic imaging, laser therapies, and minimally invasive ophthalmic surgeries enhance accessibility, positioning South Africa as a growing hub for advanced veterinary ophthalmology.

The veterinary eye care market in Saudi Arabia is expanding, driven by growing pet ownership, rising awareness of ocular diseases, and increasing demand for specialized veterinary services. Global players like Zoetis, MSD, Elanco, and Boehringer Ingelheim compete alongside regional clinics. Advancements in diagnostic imaging, tele-ophthalmology, and specialized treatment centers strengthen veterinary eye health and support modern care delivery.

Key Veterinary Eye Care Company Insights

Veterinary eye care is led by major players such as Bausch & Lomb, Zoetis, Merck Animal Health, Dechra, Boehringer Ingelheim, and I-MED Animal Health, which dominate through ophthalmic devices and therapeutics. Innovation continues with technologies like OCT imaging, laser therapies, and patented lubricants. Strategic alliances and product launches are reshaping competitive dynamics.

Key Veterinary Eye Care Companies:

The following are the leading companies in the veterinary eye care market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- An-Vision GmbH

- Jorgensen Laboratories

- LKC Technologies Inc.

- Accutome Inc.

- Dechra Pharmaceuticals

- Bausch & Lomb Incorporated

- Zoetis Services LLC.

- Ceva Sante Animale

- Sandoz

- Boehringer Ingelheim

- I-Med Animal Health

- Iridex Corporation

- Baxter (Welch Allyn)

- OptoMed

- Reichert, Inc.

- Occuity

Recent Developments

-

In July 2025, Dômes Pharma partnered with Fear Free to launch stress-free veterinary eye care, spotlighting Oculenis, Ocunovis Procare, and Fluodrop. This aligns innovation with compassionate treatment for pets and veterinarians.

-

In June 2025, Kiora Pharmaceuticals and Sentrx amended their licensing deal, strengthening innovation in veterinary ophthalmology with KIO-201 technology for corneal wound healing, combining hyaluronic acid with antibiotics for advanced companion animal eye care.

-

In February 2025, an advanced veterinary eye care centre was launched in Chapad, India. The centre offers cataract, glaucoma, corneal, eyelid, and emergency treatments, strengthening regional access to comprehensive surgical and therapeutic ophthalmic solutions for animals.

Veterinary Eye Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.30 billion

Revenue forecast in 2033

USD 8.69 billion

Growth rate

CAGR of 6.37% from 2025 to 2033

Historical data

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Merck & Co., Inc.; An-Vision GmbH; Jorgensen Laboratories; LKC Technologies Inc.; Accutome Inc.; Dechra Pharmaceuticals; Bausch & Lomb Incorporated; Zoetis Services LLC.; Ceva Sante Animale; Sandoz; Boehringer Ingelheim; I-Med Animal Health; Iridex Corporation; Baxter (Welch Allyn); OptoMed; Reichert, Inc.; Occuity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Eye Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global veterinary eye care market report based on animal, product, indication, distribution channel, and region:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Canine

-

Feline

-

Equine

-

Bovine

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Devices & Instruments

-

Diagnostic Devices

-

Tonometers

-

Ophthalmic Test Kits

-

Electroretinogram (ERG)

-

Fundus Camera

-

Ophthalmoscopes

-

Pachymeter

-

Other Diagnostic Devices

-

-

Treatment Devices

-

Lenses

-

Bandage Lenses

-

Intraocular Lenses

-

-

Laser Devices

-

Other Treatment Devices

-

-

-

Medications

-

Antibiotics

-

NSAIDs

-

Corticosteroids

-

Lubricants / Artificial Tears

-

Analgesics / Pain Relievers

-

Other Medications

-

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Eyelid Abnormalities

-

Cataract

-

Glaucoma

-

Retinal Complications

-

Uveitis

-

Conjunctivitis

-

Corneal Complications

-

Other Indications

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

Specialty Stores

-

E-Commerce

-

Other Distribution Channels

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global veterinary eye care market size was estimated at USD 5.00 billion in 2024 and is expected to reach USD 5.30 billion in 2025.

b. The global veterinary eye care market is expected to grow at a compound annual growth rate of 6.37% from 2025 to 2033 to reach USD 8.69 billion by 2033.

b. By product, devices and instruments segment represented the largest share of about 61% in 2024, driven by rising adoption of advanced diagnostic and surgical tools. Technologies such as fundus cameras, slit lamps, tonometers, and optical coherence tomography (OCT) are becoming essential for early detection and precise management of ocular disorders.

b. Key players in the veterinary eye care market are Merck & Co., Inc., An-Vision GmbH, Jorgensen Laboratories, LKC Technologies Inc., Accutome Inc., Dechra Pharmaceuticals, Bausch & Lomb Incorporated, Zoetis Services LLC., Ceva Sante Animale, Sandoz, Boehringer Ingelheim, I-Med Animal Health, Iridex Corporation, Baxter (Welch Allyn), OptoMed, Reichert, Inc., and Occuity

b. The veterinary eye care market is primarily driven by factors like growing pet humanization and expenditure, advancements in veterinary ophthalmic technologies, expanding pet insurance coverage and awareness campaigns and preventive eye care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.