Vietnam Animal Feed Market Size & Trends

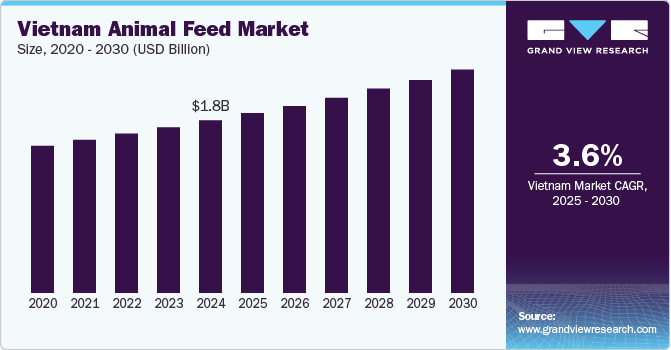

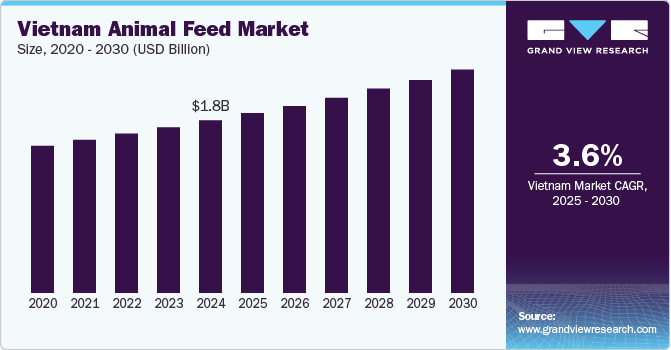

The Vietnam Animal Feed Marketsize was valued at 1.76 billion in 2024 and is expected to grow at a CAGR of 3.6% from 2025 to 2030. This growth can be attributed to the increasing meat and dairy consumption due to rising incomes, particularly in emerging economies. In addition, the shift towards protein-rich diets among health-conscious consumers further fuels demand for livestock and poultry production. Furthermore, the expansion of the livestock and aquaculture industries, alongside technological advancements in feed production, enhances efficiency and nutritional quality.

Animal feed refers to food given to domesticated animals, primarily livestock and poultry, to support their growth, health, and productivity. The Vietnam animal feed industry is experiencing robust demand driven by changing dietary habits and population growth. As the global population expands, food needs, especially protein sources, increase significantly. Emerging markets are witnessing a shift towards diets rich in animal proteins, resulting in heightened demand for meat, dairy, and fish products. This transformation is largely fueled by rising incomes and urbanization, necessitating innovative and sustainable animal feed solutions to optimize nutrition and growth.

In addition, the adoption of advanced technologies is reshaping feed production and animal nutrition. Techniques such as precision feeding and data analytics ensure that animals receive the right nutrients, enhancing their health while minimizing waste. Automation in production processes reduces labor costs and improves consistency in feed formulation. Quality assurance solutions have become essential with growing concerns regarding food safety and transparency. Furthermore, consumers and regulatory bodies are increasingly demanding stringent quality controls throughout the animal feed supply chain. This has led to the development of sophisticated testing methods that ensure animal feed's safety and nutritional value.

Moreover, businesses that prioritize these quality assurance measures meet regulatory expectations and gain a competitive advantage by boosting consumer confidence in their products. Moreover, ensuring high-quality feed contributes to disease prevention among livestock, further driving demand in the market. These dynamics highlight a significant evolution within the animal feed industry as it adapts to meet the increasing global demand for protein-rich diets while maintaining sustainability and quality standards.

Product Insights

Fodder dominated the market and accounted for the largest revenue share in 2024. This growth can be attributed to the increasing demand for high-quality forage to support livestock production. In addition, as populations rise and dietary preferences shift towards protein-rich foods, the need for efficient and nutritious fodder becomes essential. Furthermore, agricultural practices and technological advancements enhance the quality and yield of forage crops, making them more appealing to livestock producers. This trend is further supported by the growing emphasis on sustainable farming practices that prioritize animal health and productivity.

The forage segment is expected to grow at the fastest CAGR over the forecast period, owing to rising meat consumption and a shift towards intensive livestock farming are propelling growth. In addition, the demand for forage is closely linked to the expanding livestock industry, particularly in developing regions where urbanization and income growth are driving increased meat and dairy consumption. Furthermore, the integration of innovative farming techniques and improved forage management practices enhances the nutritional value of forage crops.

Livestock Insights

The poultry segment led the market and accounted for the largest revenue share in 2024, primarily driven by the rising demand for poultry meat products. As populations increase and incomes rise, consumers are shifting towards more affordable protein sources, particularly chicken. In addition, the expansion of industrial livestock production and a growing preference for organic feed options further supports this trend. Furthermore, advancements in feed formulations that enhance nutritional content are crucial for meeting the dietary needs of poultry, thereby boosting market growth.

The aquaculture segment is expected to grow at the fastest CAGR over the forecast period, owing to the increasing global demand for seafood and fish products. As health awareness rises, consumers are gravitating towards fish as a healthy protein alternative, leading to greater aquaculture production. In addition, innovations in feed technology that improve feed efficiency and sustainability also play a significant role in enhancing aquaculture practices. Furthermore, government initiatives promoting sustainable fishing practices and investments in aquaculture infrastructure contribute to the expanding market for animal feed tailored to aquatic species.

Key Vietnam Animal Feed Company Insights

Key companies in the global animal feed industry include Vinamilk, Cargill Vietnam, New Hope Group, and others. These companies are adopting various strategies to enhance their competitive edge. These strategies include investing in research and development to create innovative and sustainable feed formulations that meet evolving consumer demands. In addition, companies are focusing on strategic partnerships and collaborations to expand their market reach and improve supply chain efficiencies. Furthermore, emphasizing quality assurance and compliance with regulatory standards is also crucial for maintaining consumer trust and ensuring product safety in the animal feed industry.

-

Vinamilk operates in the dairy segment, specializing in producing and distributing a wide range of dairy products, including liquid and powdered milk, yogurt, ice cream, and cheese. Vinamilk is involved in manufacturing compound feed for cattle, poultry, and fishery, catering to domestic and international markets. With a robust portfolio of over 250 products, it plays a significant role in the animal feed sector by ensuring quality nutrition for livestock through its subsidiary, Vietnam Dairy Cow One-Member Company Limited (VINACOW).

-

GreenFeed Vietnam Corporation provides comprehensive solutions across the food chain, from feed production to farming and food processing. The company manufactures high-quality animal feed tailored for various livestock species while also engaging in breeding and effective farming solutions. The company emphasizes sustainability and health in its operations, contributing to the development of a clean food supply chain that benefits both consumers and producers.

Key Vietnam Animal Feed Companies:

- C.P. Group

- Vinamilk

- Cargill Vietnam

- New Hope Group

- GreenFeed Vietnam Corporation

- De Heus Vietnam

- Emivest Feedmill Vietnam Co. Ltd.

- Proconco

- Uni-President Vietnam Co. Ltd.

- Dabaco Group

Recent Developments

-

In January 2024, Cargill inaugurated a new state-of-the-art premix plant in Vietnam, enhancing its capabilities in the animal feed sector. This facility, located in Binh Duong province, aims to produce high-quality premix products tailored to the region's growing Vietnam Animal Feed Market. The investment underscores Cargill's commitment to supporting local farmers and the livestock industry.

-

In August 2024, Charoen Pokphand Foods Public Company Limited (CP Foods) announced a strategic partnership with VEGA Instruments Co., Ltd. to enhance efficiency in animal feed production. The agreement, signed by key executives at CP Tower in Silom, aims to integrate advanced radar sensor technology for real-time monitoring of raw materials. This innovation is part of CP Foods’ Smart Feed initiative, which is essential for optimizing production and ensuring food security across its operations in Thailand and beyond.

Vietnam Animal Feed Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.83 billion

|

|

Revenue forecast in 2030

|

USD 2.27 billion

|

|

Growth rate

|

CAGR of 3.6% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, livestock, country

|

|

Country scope

|

Vietnam

|

|

Key companies profiled

|

C.P. Group; Vinamilk; Cargill Vietnam; New Hope Group; GreenFeed Vietnam Corporation; De Heus Vietnam; Emivest Feedmill Vietnam Co. Ltd.; Proconco; Uni-President Vietnam Co. Ltd.; Dabaco Group.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country and segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Vietnam Animal Feed Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Vietnam animal feed market report based on product and livestock.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Livestock Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Poultry

-

Cattle

-

Pork

-

Aquaculture

-

Others