- Home

- »

- Biotechnology

- »

-

Viral Inactivation Market Size & Share, Industry Report, 2030GVR Report cover

![Viral Inactivation Market Size, Share & Trends Report]()

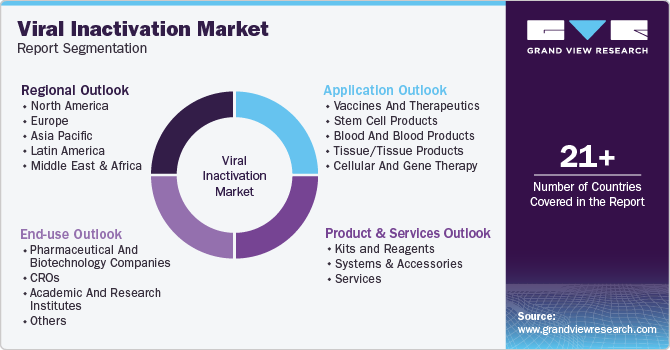

Viral Inactivation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Kits & Reagents), By Application (Vaccines & Therapeutics), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-998-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Viral Inactivation Market Size & Trends

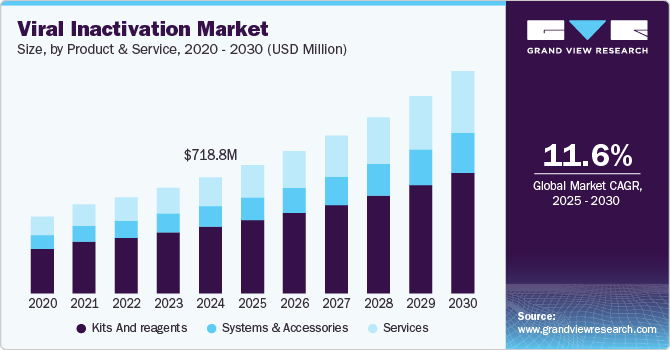

The global viral inactivation market size was estimated at USD 718.8 million in 2024 and is projected to grow at a CAGR of 11.58% from 2025 to 2030. The rise in the number of pharmaceutical and biotechnological companies, rise in drug launches and approvals, increasing funding and investments for R&D, and the increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders leading to the increase in healthcare expenditure are the driving factors propelling the market growth.

The development of novel therapeutics against SARS-CoV2 during the outbreak of the COVID-19 pandemic has led many biopharmaceutical companies to study viral inactivation procedures and their market. Recent developments have helped this market grow positively to quite an extent, such as viral inactivation procedures, which irradiation rays can also perform. For instance, according to a research report published in 2023 by Springer Nature Limited, irradiation rays help in inactivating virions through ionizing and non-ionizing effects. These rays destroy the genome by the action of radicals on viral nucleic acids, causing less damage to the protein membrane.

In addition, according to a report published by the PDA Journal of Pharmaceutical Science and Technology, in 2024, the use of detergents or low pH was employed in downstream biologics processing to inactivate enveloped viruses. In addition, other procedures such as media supplement treatments, virus filtration, and high-temperature, short-time processing have been widely used for viral inactivation procedures. For instance, according to a study by the Institute of Virology, Slovakia, in 2023, an approach to combat infectious diseases was performed by using heat inactivation (high temperature). It was found that 99.8% of SARS-CoV2 were killed by a single Ni foam-based filter pass-through, which was heated up to 200 degrees Celsius.

Market Concentration & Characteristics

The viral inactivation industry demonstrates a moderate to high degree of innovation, driven by advancements in biopharmaceutical manufacturing and safety protocols. Emerging technologies, such as advanced filtration methods and UV-C irradiation, enhance process efficiency and scalability. Innovations focus on ensuring compliance with stringent regulatory standards, improving product quality, and reducing operational costs.

The viral inactivation industry exhibits a high level of collaboration and partnership, with biopharmaceutical companies, research institutions, and technology providers working together to develop advanced solutions. Strategic alliances, co-development agreements, and shared expertise drive innovation, regulatory compliance, and market expansion, fostering growth and ensuring the safe production of biologics.

Regulations significantly shape the viral inactivation industry, driving innovation and ensuring product safety. Strict guidelines from agencies like the FDA and EMA mandate rigorous testing, validation, and compliance in biopharmaceutical manufacturing.

Product and service expansion in the viral inactivation industry is accelerating, driven by rising demand for biologics, vaccines, and gene therapies. Companies are diversifying their offerings with advanced inactivation technologies, enhanced filtration systems, and integrated validation services. These expansions address evolving industry needs, enabling scalability, efficiency, and improved biopharmaceutical manufacturing processes.

Regional expansion in the viral inactivation industry is fueled by growing biopharmaceutical industries in emerging markets like Asia-Pacific and Latin America. Established players are entering these regions through partnerships, new facilities, and distribution networks. This expansion supports local biologics production, meeting rising demand while diversifying the global market presence.

Product & Services Insights

The kits & reagents segment led the market with the largest revenue share of 57.37% in 2024. This is attributed to the rise in biopharmaceutical and biotechnological companies worldwide. The increasing development activities of companies and product launches have positively impacted the market. For instance, in 2023, Croda Pharma launched Virodex TXR-1 and TXR-2 for effective viral inactivation. The increase in R&D investments has led to drug development, which is driving growth in the market.

The services segment is expected to register at the fastest CAGR of 13.71% over the forecast period. This growth can be attributed to the ease of management and services offered by various service-providing companies, thereby helping the segment growth of this market. Contract Research Organizations offer quality standards and safety guidelines by providing virus inactivation procedures and planning further steps in the drug development process.

Application Insights

Based on application, the vaccines and therapeutics segment led the market with the largest revenue share of 34.41% in 2024. It can be attributed to the rising investments in R&D applications such as gene therapy and stem cell research, contributing significantly to market growth. The increasing incidences of cancer and other chronic diseases have increased demand for inactivated vaccines, which is further expected to help market growth. Researchers and scientists have developed various procedures for viral activation. For instance, according to a research report published in Frontiers in 2023, chemical reagents such as TNA-Cifer Reagent E help in the effective inactivation of the virus while preserving RNA for sensitive PCR testing. This also helps in the safe handling of samples and transport without the need for biosafety facilities.

The stem cell products segment is expected to register at a significant CAGR over the forecast period. Stem cell products are at high risk of contamination, so intense requirement for viral inactivation is required. Stem cell research has also been increasing in developed and developing countries with the help of government support. Stem cell research has progressed a lot within a shorter time period and has contributed to treating various diseases, thereby driving market growth. For instance, according to the information published by the Ministry of Health and Family Welfare in February 2022, the Department of Biotechnology (DBT), India, invested USD 8.79 million in stem cell research and other potential therapeutic applications in the past three years.

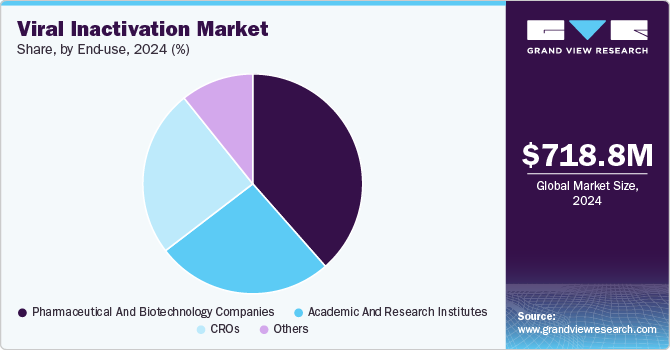

End-use Insights

Based on end use, the pharmaceutical and biotechnology companies segment led the market with the largest revenue share of 38.51% in 2024. It can be attributed to the growth of pharmaceutical and biopharmaceutical companies, which has helped in the investment to find alternative therapies, thereby increasing the number of new drugs. These companies use bioreactors and various techniques such as solvent detergent, low pH, and other methods to ensure the safety of the product. For instance, in March 2022, Thermo Fisher Scientific Inc., a global company operating in life science research, developed and introduced a viral inactivation Medium formula, InhibiSURE. The new formula is expected to help in the collection and inactivation of the SARS-CoV-2 virus and RNA stabilizing at ambient temperature for use in in-vitro diagnostic testing procedures.

The academic and research institutes segment is expected to register at a significant CAGR during the forecast period. These institutes help in conducting fundamental research by studying the mechanisms, developing various viral inactivation techniques and collaborating with biopharmaceutical and biotechnological companies to translate research findings into practical applications for enhancing the safety of biological products. This is expected to help this segment grow positively in this market.

Regional Insights

North America viral inactivation market dominated the industry with the largest revenue share of 41.37% in 2024. This growth can be attributed to the advanced infrastructure, presence of major pharmaceutical and biotechnological companies, significant R&D investments, and healthcare expenditure by the government and companies. For instance, in May 2024, the University of Alberta researchers received federal research grants of nearly USD 100 million to find and develop diagnostic tests, vaccines, and treatments against a wide range of threats.

U.S. Viral Inactivation Market Trends

The viral inactivation market in U.S. accounted for the largest revenue share in North America in 2024. The growth can be attributed to the increasing R&D facilities and government initiatives. The high prevalence of various diseases and their requirement for treatment facilities has also surged market growth in the country. The U.S. viral clearance testing service providers have helped in upgrading capabilities and infrastructure. The increase in funding has also driven the market growth.

Europe Viral Inactivation Market Trends

The viral inactivation market in Europe registered significant growth in 2024. Europe’s well-developed infrastructure, healthcare facilities, and scope of R&D have driven the market to grow. The German Center for Infection Research (DZIF) studies eco-immunological factors associated with viral infections, which can inform the development of better viral inactivation methods. Various partnerships have proved to be a major source of market growth in Germany. The University of Technology Sydney has collaborated with German partners on using irradiation to inactivate viruses by damaging their genome and disrupting viral proteins.

The UK viral inactivation market theld a significant share in 2024, due to a strong biopharmaceutical sector and advanced research infrastructure. Demand is fueled by vaccine production, biologics development, and stringent regulatory standards. Companies focus on innovative solutions and partnerships to enhance manufacturing efficiency, ensuring compliance and competitiveness in the global market.

The viral inactivation market in France is experiencing significant growth. The market is growing steadily, supported by a well-established pharmaceutical industry and strong government investment in biotechnology. The country's focus on biologics, vaccines, and gene therapies drives demand for innovative inactivation technologies. Regulatory compliance and collaborations with research institutions further enhance market growth and global competitiveness.

The Germany viral inactivation market is growing due to a combination of factors. The market is bolstered by its leadership in biotechnology and pharmaceutical manufacturing. The country's emphasis on precision engineering and innovation supports the development of advanced inactivation technologies. Strong regulatory frameworks, extensive R&D investments, and collaborations with global players position Germany as a key hub in the viral inactivation sector.

Asia Pacific Viral Inactivation Market Trends

The viral inactivation market in the Asia Pacific is anticipated to witness at a significant CAGR during the forecast period, owing to the significant increase in investments, technological advancements, and research across the region. The Department of Biotechnology (DBT) and the Ministry of Science and Technology of India are supporting various R&D projects. Researchers at the Indian Institute of Technology (IIT) Guwahati are conducting fundamental research to understand the mechanisms of viral inactivation. Their labs focus on studying immune responses to viral infections that can inform the development of better inactivation methods. The continuous efforts made by the government and various initiatives have also helped in driving the market growth.

The China viral inactivation market is rapidly expanding, driven by the growing biopharmaceutical industry and increasing demand for biologics and vaccines. Government initiatives, substantial R&D investments, and local manufacturing capabilities fuel innovation. Partnerships with global firms and adherence to evolving regulatory standards position China as a rising player in the global market.

The viral inactivation market in Japan is steadily advancing, supported by a strong biopharmaceutical sector and cutting-edge research in biotechnology. The country’s focus on high-quality biologics and vaccines drives demand for innovative inactivation technologies. Regulatory rigor, government support, and collaborations with global and domestic players enhance Japan’s competitiveness in the global market.

MEA Viral Inactivation Market Trends

The viral inactivation market in MEA has experienced considerable growth in recent years, driven by several factors. The region is driven by increasing investments in healthcare infrastructure and the rising demand for vaccines and biologics. The region benefits from growing pharmaceutical industries, collaborations with global companies, and improving regulatory standards, positioning MEA as a promising market for viral inactivation technologies.

The Saudi Arabia viral inactivation market is growing, fueled by significant investments in healthcare and biotechnology as part of the Vision 2030 initiative. The country's expanding pharmaceutical sector, focus on vaccine production, and regulatory reforms drive demand for advanced inactivation technologies. Strategic partnerships and local manufacturing boost Saudi Arabia's position in the regional market.

The viral inactivation market in Kuwait is emerging, supported by the country's investments in healthcare and biotechnology. While the market is still developing, the demand for viral inactivation technologies is growing due to the increasing focus on biologics, vaccines, and regulatory advancements. Collaborations with global pharmaceutical companies are expected to drive future growth.

Key Viral Inactivation Company Insights

Key companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

Key Viral Inactivation Companies:

The following are the leading companies in the viral inactivation market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories, Inc.

- Clean Cells

- Cytiva (Danaher Corporation)

- Merck KGaA

- Mettler Toledo

- Parker Hannifin Corp

- Rad Source Technologies Inc

- Sartorius AG

- Texcell SA

- Vironova AB

Recent Developments

-

In June 2023, Texcell SA announced the launch of a testing facility in North America. This step is expected to help the company in enhancing the viral safety and clearance procedures of medical devices and biotherapeutics.

-

In May 2021, Charles River Laboratories announced its plans to acquire Rockville’s Vigene Biosciences, which is engaged in providing viral vector-based gene delivery solutions. The acquisition is expected to help the company in enhancing its gene therapy capabilities.

-

In September 2020, Merck KGaA announced the expansion of its biosafety testing laboratory services in Singapore. It is expected to enable customers to conduct viral clearance studies and ensure the safety & quality of various biological drugs during clinical development.

Viral Inactivation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 793.0 million

Revenue forecast in 2030

USD 1,371.6 million

Growth rate

CAGR of 11.58% from 2025 to 2030

Base year for estimation

2023

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & Services, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; KSA; UAE; South Africa, Kuwait.

Key companies profiled

Charles River Laboratories, Inc.; Clean Cells; Cytiva (Danaher Corporation); Merck KGaA; Mettler Toledo; Parker Hannifin Corp; Rad Source Technologies Inc; Sartorius AG; Texcell SA; Vironova AB

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Viral Inactivation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global viral inactivation market report based on product & services, application, end-use, and region:

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits and Reagents

-

Systems & Accessories

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vaccines and Therapeutics

-

Stem Cell Products

-

Blood and Blood Products

-

Tissue/ Tissue Products

-

Cellular and Gene Therapy

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

CROs

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global viral inactivation market size was estimated at USD 718.8 million in 2024 and is expected to reach USD 793.0 million in 2025.

b. The global viral inactivation market is expected to grow at a compound annual growth rate of 11.58% from 2025 to 2030 to reach USD 1,371.6 million by 2030.

b. Kits and reagents dominated the viral inactivation market with a share of 57.37% in 2024. This is attributable to their continuous usage by pharmaceutical and biopharmaceutical companies and rises in R&D spending for the purpose of new drug development.

b. Some key players operating in the viral inactivation market include Sartorius AG, Merck KGaA, Parker Hannifin, Rad Source Technologies, Clean Cells, WuXi PharmaTech (Cayman) Inc., and Danaher.

b. Key factors that are driving the market growth include the global rise in the number of pharmaceutical and biopharmaceutical companies, increasing investment in the life sciences sector, rise in the number of drug launches & approvals, increase in funding by government for the development of pharmaceutical and biopharmaceutical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.