- Home

- »

- Next Generation Technologies

- »

-

Virtual Data Room Market Size, Share, Industry Report, 2030GVR Report cover

![Virtual Data Room Market Size, Share & Trends Report]()

Virtual Data Room Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Enterprise Size, By Vertical, By Business Function, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-136-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Data Room Market Summary

The global virtual data room market size was estimated at USD 2.42 billion in 2024 and is projected to reach USD 7.73 billion by 2030, growing at a CAGR of 22.2% from 2025 to 2030. The growth of this market is primarily driven by the growing applications in activities such as mergers and acquisitions, fundraising, real estate transactions, compliance and audit, collaborations, project management, and others.

Key Market Trends & Insights

- North America dominated the global virtual data room market with a revenue share of 40.7% in 2024.

- The U.S. virtual data room market held the largest revenue share of the regional industry in 2024.

- By component, the solutions segment dominated the global industry with a revenue share of 74.1% in 2024.

- By deployment, the cloud-based segment dominated the global industry with a revenue share of 74.1% in 2024.

- By enterprise size, the large enterprises segment accounted for the largest revenue share of the global industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.42 Billion

- 2030 Projected Market Size: USD 7.73 Billion

- CAGR (2025-2030): 22.2%

- North America: Largest market in 2024

The emergence of modern technologies such as Artificial Intelligence (AI), machine learning, the Internet of Things (IoT), and the increasing adoption of digital technologies in a variety of business functions is adding to the growth of this market. Multiple teams working on business areas, such as marketing, financial management, legal and compliance, workforce management, etc., from different locations with numerous approaches have developed requirements such as granular access control, remote monitoring, document tracking, and more. The global nature of multiple industries and operations has generated unique needs such as e-signatures, audit trails, watermarking, etc. These requirements of changed business environments are addressed efficiently by virtual data rooms.Increasing dependability on data, availability of large data sets, and presence of extensive data catalogs have developed needs such as digital solutions for faster data evaluation during routine operations. This has contributed to increasing innovation in the domain and adoption of technology. For instance, in September 2024, Bloomberg Finance L.P., one of the global industry participants operating in multiple business segments such as finance, media, data, software, etc., launched a virtual data room to reduce the time taken to discover and acquire the company’s data license content, especially for enterprise use. This is expected to assist its customers in examining the coverage, usability, relevance, and quality of the datasets in less time.

Secure online space, a virtual data room, is mainly used for storage, sharing, and reviewing large amounts of confidential data associated with businesses or governments. This includes financial transactions, strategy-related documents, company information, legal and compliance documents, and more. The primary functions of virtual data rooms are to protect the confidentiality of the files and documents and provide secure private space for multiple entities and individuals involved in numerous processes.

A growing number of mergers and acquisitions by large enterprises, a significant increase in collaborative projects initiated by two or more organizations, and rising compliance requirements and exchange of documents related to regulatory scenarios are adding growth opportunities to this market. Virtual data rooms are extensively utilized during mergers and acquisitions to share files and documents related to the company, which entail confidential information.

Component Insights

The solutions segment dominated the global virtual data room industry with a revenue share of 74.1% in 2024. The emergence of AI and its growing utilization by the technology innovation industry is significantly influencing this segment. Numerous industries have embraced digital technologies and modern strategy approaches in recent years. This has resulted in a changed work structure, the presence of cross-functional teams, the requirement of remote monitoring, and the development of unique requirements such as secure online space for storing and sharing information. Increasing global engagements and significant changes in the work environment are expected to generate growth for this market during the forecast period. Growing demand for enhanced security during cross-border transactions, as well as collaboration-based project management, is also contributing to the growth of this market.

The services segment is projected to experience significant growth during the forecast period. Some of the key services include consulting, implementation & integration, training, support, and maintenance. Various industries have been adopting VDR services for enhanced support, smooth flow of work, and training in-house employees for improved implementation of solutions provided by expert organizations. Lack of skilled personnel in multiple industries, the rapid pace of advancements in technology, and maintenance requirements are expected to generate greater demand for this segment in the next few years.

Deployment Insights

The cloud-based segment dominated the global virtual data room industry with a revenue share of 74.1% in 2024. This market is primarily influenced by the increasing number of organizations shifting to cloud computing-based solutions and infrastructures for improved control, hassle-free operations, and growing accessibility. The ease of use, availability of expert support, and enhanced convenience offered by cloud-based deployments add to the growing utilization. Dynamic changes in the business environment and greater dependence on technology have increased demand and a growing need for secure and efficient data management. This aspect is expected to add growth opportunities for this segment.

The on premise deployment segment is expected to experience noteworthy growth over the forecast period. This segment's development is mainly influenced by government agencies, semi-government organizations, and private contractors working on government-funded projects using virtual data rooms. On-premise deployment is preferred for complete control over operations, data sharing, storage, and security measures.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of the global virtual data room industry in 2024. This is attributed to factors such as large-scale operations, multiple teams operating from numerous locations, and increasing outside interactions driven by processes such as mergers, financial transactions, compliances, collaborative projects, and more. Significant changes in work culture, increasing requirements for remote monitoring, and growing demand for numerous sectors are expected to drive the growth of this segment during the forecast period.

The SME segment is anticipated to experience the highest CAGR during the forecast period. The growth of this segment is mainly driven by the lack of in-house experts, changing business requirements, rapid adoption of digital technologies by multiple industries, and availability of affordable virtual data room solutions and services provided by various market participants. SMEs lack the technology experts and resources to develop technology-driven environments with advanced features and robust security. This stimulates demand for tailored solutions and consulting services in the virtual data room market.

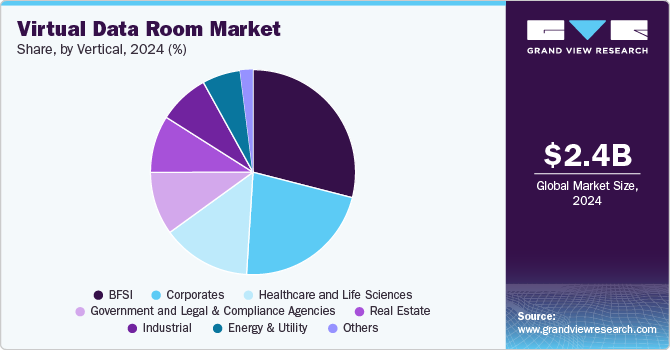

Vertical Insights

The Banking, Financial Services, and Insurance (BFSI) segment dominated the global virtual data room industry in 2024. BFSI organizations are largely involved in activities exchanging vital and confidential business information, such as mergers, audits, fundraising, investments, acquisitions, and more. This develops the requirement of secured digital space for storing and sharing data that holds higher significance in business operations. Increasing adoption of digital technologies by BFSI organizations, the rise in availability of BFSI-specific virtual data room services, and growing data security concerns are adding to the growth opportunities for this market.

The corporate segment is projected to experience substantial growth from 2025 to 2030. This is attributed to increasing requirements of secured space dedicated to exchanging corporate information, the company’s financial data, and significant information associated with processes such as audits, compliances, mergers, acquisitions, collaborative project management, and more. The global scale of operations, complex work structures, increasing remote work culture, and data security and protection requirements are likely to generate greater demand for this segment in the forecast period.

Business Function Insights

The finance segment held the largest revenue share of the global virtual data room industry in 2024. The involvement of financial organizations in processes such as audits, mergers, collaborative projects, acquisitions, fundraising, and foreign investments is primarily driving this segment’s growth. In recent years, data security concerns and the increasing need for data protection have also contributed to the growing demand for virtual data rooms during an exchange of information associated with a company’s finances.

The legal and compliance segment is anticipated to experience noteworthy growth during the forecast period. Legal and compliance-related processes involve extensive data exchange and hand-over of information to other organizations and government agencies. Robust security measures, protected digital space, and confidentiality play vital roles in such processes. This is expected to fuel the growth of this segment in the next few years. Increasing adoption of digital technologies, growing embracement of technologies such as process automation, and rising dependency on customer-generated data add to estimated growth for this segment.

Regional Insights

North America dominated the global virtual data room market with a revenue share of 40.7% in 2024. This is attributed to an increase in the focus of multiple organizations on adopting advanced digital technologies, leading to growing dependability on data, involvement of large-scale data exchanges during numerous processes, and changing work environments. Various companies operating in the region are linked with teams operating outside the area, primarily in Europe, Asia Pacific, and Latin American countries. This has developed the requirement for secured digital space for storing and sharing information and data during day-to-day operations. The presence of cross-border collaborations and global-scale operations of numerous businesses adds to the growth.

U.S. Virtual Data Room Market Trends

The U.S. virtual data room market held the largest revenue share of the regional industry in 2024. This market is primarily driven by the presence of multiple IT and telecom industry participants in the country, the growing domestic demand for technology and innovation, and the early adoption of technology trends in the U.S. The availability of various platforms and solutions provided by domestic market participants in the virtual data room market increases utilization.

Europe Virtual Data Room Market Trends

Europe was identified as one of the key global virtual data room market regions in 2024. This is attributed to multiple regional financial services companies and growing involvement in international trade and cross-border business engagements. Increasing security and data protection threats experienced by European organizations have stimulated multiple businesses to embrace virtual data room technology in recent years.

The UK virtual data room market held the largest revenue share of the industry in 2024. This market is mainly influenced by the rising need for a controlled and secure environment for data sharing and storage and the increasing number of complex business activities such as mergers, fundraising, and others. Changes in work culture and the growing adoption of remote work profiles by individuals and teams are also contributing to the growth experienced by this market.

Asia Pacific Virtual Data Room Market Trends

Asia Pacific virtual data room market is projected to experience the highest CAGR during the forecast period. This market is mainly influenced by factors such as the increasing involvement of service providers in the region with global industry participants, growing data security threats, and a rising number of activities such as audits, fundraisers, investments, and more. Multiple industries have been focusing more on improving business functions and presence in the Asia Pacific market owing to the presence of growing economies such as India and key global trade participant China.

China dominated the regional industry for virtual data rooms in 2024. This is attributed to the presence of multiple technology-driven industries in the country, increasing cyber security threats, and the growing requirement for secured and protected digital space to exchange data and information. The increasing engagement of domestic industry participants with companies that operate globally has developed cross-border teams and increased interactions among businesses. This is expected to add significant growth opportunities for this market during the forecast period.

Key Virtual Data Room Company Insights

Some of the key companies in the global virtual data room market are DealRoom Inc., Datasite, Intralinks, SS&C Inc., and others. Multiple manufacturers have adopted strategies such as mergers & acquisition, product portfolio diversification, new launches, collaborations, and others to address growing competition.

-

DealRoom Inc. primarily provides M&A software for transactions associated with both buyers and sellers. The DealRoom M&A platform features DealRoom Pipeline, DealRoom Dilligence, DealRoom Integration, DealRoom AI, and more. Its solutions are designed for corporate developments, roll-ups, legal functions, private equity, investment banking, and others.

-

Datasite provides a comprehensive business platform featuring Datasite Dilligence, Datasite Acquire, Datasite Prepare, Datasite Outreach, Datasite Pipeline, Datasite Archive, Datasite Intelligence, Datasite Outreach, and more. The company provides solutions for various purposes, including restructuring, Initial Public Offering (IPO), financing, fundraising, licensing, M&A search, and others.

Key Virtual Data Room Companies:

The following are the leading companies in the virtual data room market. These companies collectively hold the largest market share and dictate industry trends.

- Ideals

- Intralinks, SS&C Inc.

- Datasite

- BlackBerry Limited

- Brainloop AG

- OneHub

- CapLinked

- FORDATA SP. Z O.O.

- ShareVault

- DealRoom Inc.

- FirmRoom

- Intralinks, SS&C Inc.

- securedocs

- ShareFile (Progress Software Corporation)

- Caplinked

Recent Developments

-

In October 2024, EthosData was acquired by Ideals, one of the key market participants in the virtual data room market, especially for finance-related business activities such as M&A. The acquisition is expected to strengthen Ideals’ position in the growing Indian market, showing strong potential for M&A deals during the next few years.

-

In November 2024, Bite Alternative Investments, a global financial technology industry participant, introduced Virtual Data Room 2.0 (VDR). The newly delivered offering was launched as part of Bite Stream, a fundraising and investment relations platform. The improved offerings are characterized by enhanced security, increased integrated collaboration tools, and greater workflow efficiency.

Virtual Data Room Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.83 billion

Revenue forecast in 2030

USD 7.73 billion

Growth rate

CAGR of 22.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, vertical, business function, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, China, India, Japan, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Ideals; Intralinks, SS&C Inc.; Datasite; BlackBerry Limited; Brainloop AG; OneHub; CapLinked; FORDATA SP. Z O.O.; ShareVault; DealRoom Inc.; FirmRoom; Intralinks, SS&C Inc.; securedocs; ShareFile (Progress Software Corporation); Caplinked

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Data Room Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual data room market report based on component, deployment, enterprise size, vertical, business function, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

AI-Powered

-

Non AI-Powered

-

-

Services

-

Consulting

-

Implementation & Integration

-

Training and Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-Based

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Banking, financial services, and insurance (BFSI)

-

Corporates

-

Healthcare and Life Sciences

-

Government and Legal & Compliance Agencies

-

Real Estate

-

Industrial

-

Energy & Utility

-

Others

-

-

Business Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Marketing and Sales

-

Legal and Compliance

-

Finance

-

Workforce Management

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.