- Home

- »

- Healthcare IT

- »

-

Virtual Fitness Market Size & Share Analysis Report, 2030GVR Report cover

![Virtual Fitness Market Size, Share & Trends Report]()

Virtual Fitness Market (2023 - 2030) Size, Share & Trends Analysis Report By Streaming Type (Live, On-demand), By Session Type (Group, Solo), By Device Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-032-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Fitness Market Summary

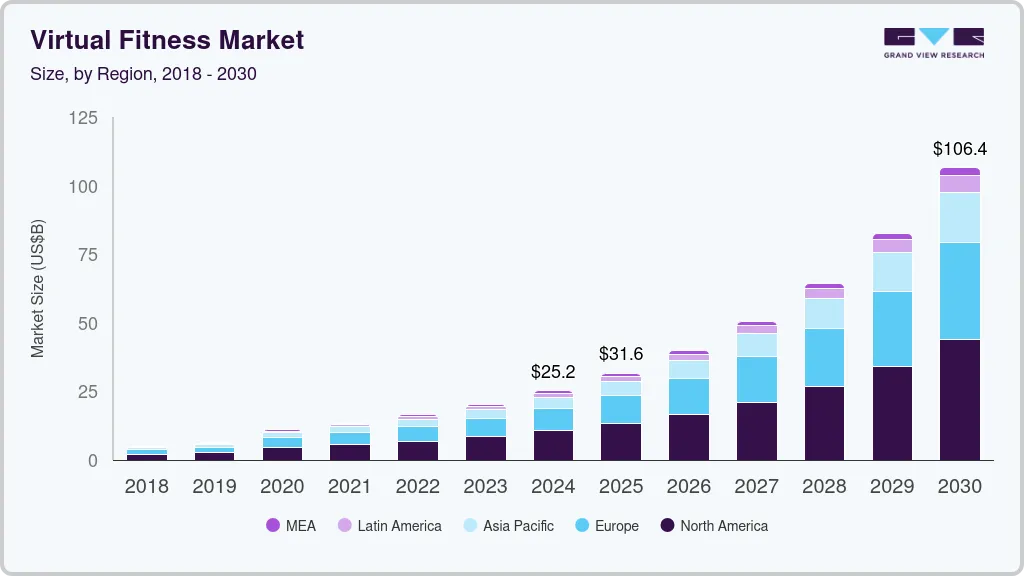

The global virtual fitness market size was estimated at USD 16.4 billion in 2022 and is projected to reach USD 106.4 billion by 2030, growing at a CAGR of 26.72% from 2023 to 2030. The growth is driven by factors such as the rapid shift of consumers to online fitness solutions from in-person workouts in gyms.

Key Market Trends & Insights

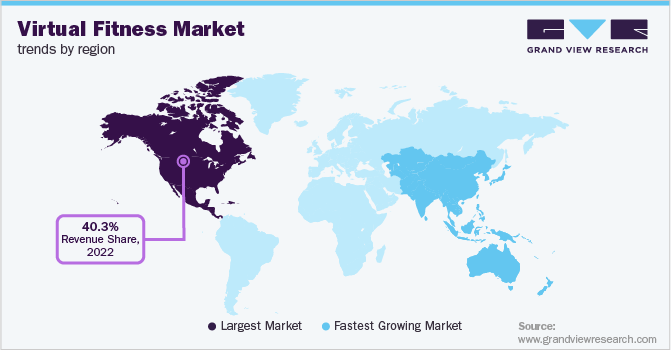

- North America led the overall market with a revenue share of 40.3% in 2022.

- The market in Asia Pacific is also expected to witness significant growth.

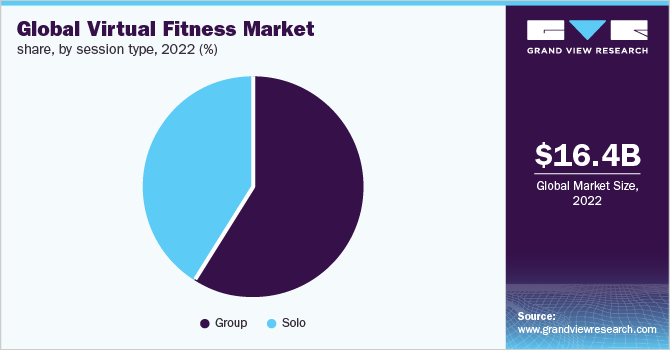

- By session type, the market is segmented into group and solo. The group segment dominated the market with a share of 59.1% in 2022.

- By streaming type, The on-demand segment accounted for the largest market share in 2022.

- By device type, the smartphone devices segment accounted for a major portion of the market share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 16.4 Billion

- 2030 Projected Market Size: USD 106.4 Billion

- CAGR (2023-2030): 26.72%

- North America: Largest market in 2022

Online solutions continue to rise in popularity among key demographic groups such as millennials. In addition, increased stress levels, increased health consciousness, and higher flexibility and accessibility offered by remote workouts are likely to boost the market growth.

Increasing focus on healthy lifestyle coupled with the continuously rising popularity of balanced diets, flexible workouts, and mental health are favoring the market. Due to the increasing demand for online instructors and sessions, service providers are implementing various business models to meet client needs. For instance, in April 2020, My Virtual Mission launched the ‘Race Host’ platform. With the help of this platform, entrepreneurs, companies, and nonprofit organizations can host virtual fitness competitions for engaging the potential audience, increase revenue and expand their geographical footprints.

There is a growing consensus among fitness executives that virtual training is emerging as a permanent feature rather than a passing trend. Furthermore, new techniques of fitness training, such as home workouts and live video classes, are becoming more popular. According to a survey published in ACSMs Health & Fitness Journal, online training was ranked as the #1 fitness trend in 2021, up from #26 in 2020, mainly due to the COVID-19 pandemic. According to Health Club Industry Data & Consumer Trends report 2021, nearly 38% of the consumers in the U.S. started using online workout services during COVID and plan to continue using them in the future.

During the pandemic, many gyms were closed and social distancing guidelines were imposed. This drove consumers to adopt virtual fitness solutions from gyms and yoga centers. As per a survey conducted by ClubIntel in 2020, around 54% of 2,000 surveyed individuals either stopped their gym memberships or canceled them entirely. Furthermore, 72% of the health club owners started offering livestream group and on-demand workouts, higher than 25% in 2019 to cope with the declining gym memberships.

Key players also employed certain successful techniques, such as introducing informative workout sessions, strategic collaborations, and free subscriptions during the pandemic. For instance, in March 2020, Peloton, an American manufacturer of physical exercise equipment, and media platform extended its subscription-free trial duration from 30 to 90 days. This was to aid and support consumers in maintaining physical and mental well-being during the COVID-19 pandemic.

Session Type Insights

Based on session type, the market is segmented into group and solo. The group segment dominated the market with a share of 59.1% in 2022. This can be attributed to the increasing use of group sessions that place a greater prominence on enhancing functional fitness and improving postural alignment. According to a survey conducted by OnePoll for Zhou Nutrition, 56% of respondents prefer group workouts, with 27% preferring to exercise with others.

Group sessions come in a variety of forms, from yoga to Zumba. Many people undergo group workout courses as they enjoy the exburance of a training environment.As a result, organizations such as NOUFLEX LLC, a Boston-based company, are introducing an enhanced portfolio to broaden their consumer base. For instance, in December 2020, the NouFlex Training System products, online personal training sessions, and online group exercise classes were all introduced by NOUFLEX LLC. The fitness products and personal & virtual group training offered by NouFlex enable each individual to choose programs and trainers best suited to their aesthetic and health objectives.

On the other hand, the solo segment is projected to register the highest CAGR from 2023 to 2030. One-on-one sessions enable the trainer to concentrate on a specific user and provide guidance based on their needs. Solo training can be customized for each user, which can aid in achieving their unique goals more quickly.Furthermore, the segment growth is anticipated to be driven by the launch of new software, mergers, and collaboration among major firms to offer innovative solo programs to their customers.

Streaming Type Insights

In terms of streaming type, the market is segmented into live and on-demand. The on-demand segment accounted for the largest market share in 2022. On-demand or pre-recorded videos are witnessing a significant increase in market share. With the help of on-demand services, customers may access workout videos at any time, with a trainer of their choice and a training program of their choosing.

On-demand service providers are improving their offerings to appeal to a wide range of customers of all fitness levels and to provide a variety of coaching styles, music genres, and difficulty levels. For instance, in May 2022, Matrix Connected solutions were introduced by Johnson Health Technology Company, to enable gyms and health club operators to offer their patrons digital experiences and on-demand access to special training programs.

The live segment is projected to expand at the fastest CAGR during the forecast period owing to the high demand for studios in health clubs that connect to trainers from remote locations in real-time. Several renowned gym chains and fitness equipment industry players are entering the live online fitness market landscape to offer sophisticated training routines. For example, 24 Hour Fitness USA, Inc. launched a free 24/7 Live At-Home Streaming Channel in March 2020. The channel offers cutting-edge training materials and opportunities for community interaction to keep viewers engaged and relieve stress.

Device Type Insights

Based on device type, the global virtual fitness market has been further segmented into smartphones, smart TVs, laptops & desktops, and tablets. The smartphone devices segment accounted for a major portion of the market share in 2022. Due to its increasing penetration among consumers of all ages, this segment will continue to dominate during the projection period. The introduction of fitness apps such as Google Fit, Strava, MyFitnessPal, and others, and their integration with fitness trackers such as Fitbit, Garmin Forerunner, and Amazfit, are favoring the acceptance of virtual fitness on smartphones.

Additionally, the growing use of smartphones in emerging nations such as India may present a favorable chance for the expansion of the segment. For instance, According to the GSMA Mobile Economy 2019 study, India's penetration rate in 2018 was 55% and is anticipated to reach 63% by 2025. According to a 2018 Pew Research Center report on smartphone penetration, India has a 40% mobile phone ownership rate and a 24% smartphone ownership rate. While estimates may differ significantly, they all indicate a substantial upward trend. As smartphone adoption increases, mobile app usage will increase, which may provide appealing market potential in the coming years.

On the other hand, the laptops & desktops, and tablets segment is anticipated to grow at a significant growth rate during the forecast period. This expansion is brought on by an increase in the popularity of indoor exercise. Furthermore, the laptops & desktops segment offers fitness enthusiasts other essential features including longer battery life, better display, high-performance speed, and usability.

Regional Insights

North America led the overall market with a revenue share of 40.3% in 2022. In North America, the adoption of virtual fitness is being driven by several factors, including the rapid growth of smartphone usage, the increase in the aging population, the rise in the prevalence of chronic conditions, and the ongoing COVID-19 pandemic. The widespread adoption of mhealth in North America is one of the primary factors driving the market's expansion. According to a survey conducted by Freeletics, 74.0% of Americans were using at least one fitness app during the COVID-19 pandemic. In addition, 60% of these consumers intended to discontinue their gym subscriptions.

In addition, the region's growth is largely attributable to the rising prevalence of chronic illnesses such as diabetes, obesity, CVDs, and others. For instance, According to the Centers for Disease Control and Prevention (CDC), the prevalence of obesity in the United States increased from 30.5% to 41.9% between 1999-2000 and 2017-March 2020. In addition, extreme obesity prevalence increased from 4.7% to 9.2% throughout the same period.

The market in Asia Pacific is also expected to witness significant growth. Increasing fitness and health consciousness in various nations, including Japan, South Korea, Indonesia, Malaysia, and China, will increase the demand for exercise videos. According to the Asia Development Bank Institute (ADB), the region has had the highest obesity rate in recent years. In addition, the ADB reports that as of July 2018, around 100 million Chinese had been diagnosed with diabetes. A growing awareness of the repercussions of obesity, such as heart disease and diabetes, has prompted many to sign up for daily online workout sessions.

Key Companies & Market Share Insights

The virtual fitness industry is highly competitive and is dominated by a few large competitors. Acquisitions, collaborations, partnerships, and the launch of new products are key strategies adopted by market players. For instance, in September 2020, Apple launched Fitness+ its online fitness subscription-based services platform. This platform offers video workouts such as core, HIIT, dance, yoga, meditation, and stretching. Some prominent players in the global virtual fitness market include:

-

MINDBODY, Inc.

-

ClassPass

-

Fitness On Demand

-

Unscreen

-

Navigate Wellbeing Solutions

-

Sworkit (Nexercise, Inc)

-

Les Mills International Ltd.

-

VIXY BV

-

Wellbeats.

-

Move Technologies Group Ltd

-

Wexer

Virtual Fitness Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 20.3 billion

The revenue forecast in 2030

USD 106.4 billion

Growth Rate

CAGR of 26.72 % from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Session type, streaming type, device type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MINDBODY, Inc.; ClassPass Inc.; Fitness On Demand; Les Mills International Ltd.; Unscreen, Navigate Wellbeing Solutions; Sworkit (Nexercise, Inc); VIXY BV; Move Technologies Group Ltd; Wellbeats, INC.; Wexer

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

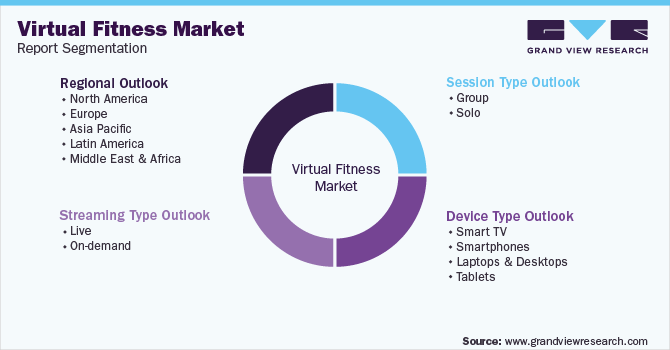

Global Virtual Fitness Market Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual fitness market report based on session type, streaming type, device type, and region:

-

Session Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Group

-

Solo

-

-

Streaming Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Live

-

On-demand

-

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart TV

-

Smartphones

-

Laptops & Desktops

-

Tablets

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

Australia

-

China

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global virtual fitness market size was estimated at USD 16.4 billion in 2022 and is expected to reach USD 20.3 billion in 2023.

b. The global virtual fitness market is expected to grow at a compound annual growth rate of 26.7% from 2023 to 2030 to reach USD 106.4 billion by 2030.

b. North America dominated the virtual fitness market with a share of 40.3% in 2022. This is attributable to the rapid growth of smartphone usage, the increase in the ageing population, the rise in the prevalence of chronic conditions, and the ongoing COVID-19 pandemic.

b. Some key players operating in the virtual fitness market include MINDBODY Inc.; ClassPass Inc.; Fitness On Demand; Les Mills International Ltd.; Navigate Wellbeing Solutions; Sworkit (Nexercise, Inc); Wellbeats, INC.; Move Technologies Group Ltd; Unscreen; and Wexer

b. Key factors driving the market growth include the rapid shift of people to online fitness solutions from in-person workouts in gyms and rising popularity among millennials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.