- Home

- »

- Next Generation Technologies

- »

-

Virtual Networking Market Size, Share, Industry Report, 2030GVR Report cover

![Virtual Networking Market Size, Share & Trends Report]()

Virtual Networking Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Deployment (On Premise, Cloud), By Enterprise Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-053-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Networking Market Size & Trends

The global virtual networking market size was estimated at USD 48.57 billion in 2024 and is projected to grow at a CAGR of 26.5% from 2025 to 2030. The market growth can be attributed to several factors, including an increase in focus on virtual technologies that manage virtual machines, rising cloud computing adoption, high levels of advanced communication methods adopted by people, rising software-defined networking adoption in enterprises, and the need for network and physical hardware virtualization to lower network downtime. At the same time, the growing adoption of industrial automation and the shifting preferences of businesses toward cloud services are also significant factors contributing to the growth of the market.

Numerous virtual networking solution providers across the globe are focusing on developing virtual router appliances that offer better IP routing with better connectivity. For instance, in November 2022, BBIX, Inc., a company that operates Internet Exchange (IX) business, and BBSakura Networks, Inc., a network solution provider, launched a new feature OCX-Router(v1) in the Open Connectivity eXchange(OCX), a cloud-based network service. "OCX-Router(v1)" is a virtual router appliance that offers IP routing on the OCX network. Customers can use "OCX-Router(v1)" to exchange the traffic between regions or cloud services inside the tenant network without going via their on-premise facilities.

Ease in network management is also a major benefit offered by virtual networking solutions. Traditional network management involves manual configuration of network devices, which can be time-consuming and prone to errors. With virtual networking, network administrators can manage and configure the entire network infrastructure from a centralized location, simplifying network management and reducing the risk of errors. Virtual networking solutions come equipped with automation capabilities that allow network administrators to automate network configuration tasks. This helps reduce the time and effort required for manual configuration and ensures consistency across the network.

Virtual networking solutions are highly beneficial in cloud computing because they provide organizations with a flexible, scalable, and efficient way to manage their network infrastructure. Virtual networking solutions allow organizations to optimize their use of cloud resources by creating virtual networks tailored to their specific needs. This means that organizations can create separate networks for different workloads or applications, ensuring each workload or application receives the resources it needs to perform optimally. Moreover, virtual networking solutions are highly scalable, allowing organizations to quickly and easily add or remove resources from their virtual networks as needed.

With the proliferation of Internet-of-Things (IoT) devices, the demand for virtual networking solutions that can support a large number of connected devices has increased. As the number of IoT devices continues to grow, organizations are increasingly looking for scalable virtual networking solutions that can accommodate large numbers of devices and data. Virtual networking solutions need to be able to handle the vast amounts of data generated by IoT devices and provide efficient ways to process, store, and analyze it. However, the security concerns associated with virtual networking solutions are a significant factor that is expected to impact the market growth.

Component Insights

The software segment accounted for the largest revenue share of 42.67% in 2024. The growth can be attributed to the increasing adoption of Software-defined Networking (SDN) technologies. SDN enables organizations to abstract the network from the underlying hardware, creating a virtualized network infrastructure that is flexible, scalable, and efficient. This has led to a greater demand for software solutions that can provide advanced networking functionality, such as routing, switching, and security, without relying on proprietary hardware. Additionally, the availability of hypervisor software solutions allowing multiple virtual machines to run on a single physical server has further accelerated the adoption of software solutions in the virtual networking market, providing organizations with cost-effective and customizable solutions.

The services segment is expected to grow at a significant CAGR from 2025 to 2030, owing to the growing demand for professional and managed services that can help organizations plan, design, deploy, and manage virtual networking solutions. As virtual networking becomes more complex and critical to business operations, organizations are looking for specialized services that can provide them with the expertise, resources, and support they need to ensure the successful implementation and operation of their virtual networking solutions. Additionally, the emergence of cloud-based virtual networking solutions has created a greater need for cloud services and support, such as cloud migration, cloud management, and cloud optimization services.

Deployment Insights

The cloud segment held the largest revenue share in 2024. As organizations are increasingly adopting cloud computing, they are also looking to leverage the benefits of virtual networking in the cloud, such as flexibility, scalability, and cost-effectiveness. One emerging trend is the use of cloud-based virtual private networks (VPNs), which enable organizations to securely connect their cloud resources to their on-premises network and other cloud-based resources. Additionally, the use of cloud-based load balancers, can distribute traffic across multiple servers and optimize application performance. As organizations continue to adopt cloud computing, these trends are expected to continue to drive the growth of the cloud segment over the coming years.

The on-premise segment is expected to grow at a significant CAGR from 2025 to 2030. Increasing demand for hybrid cloud and multi-cloud environments, which require on-premise virtual networking solutions to securely connect the cloud-based resources with the on-premise resources, is a significant factor driving the segment growth. As organizations adopt more cloud-based services and applications, the need for secure and reliable on-premise virtual networking solutions will continue to grow. Moreover, the use of NFV and SDN solutions to optimize on-premise virtual networking infrastructure is also a significant factor contributing to the growth of the segment.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024. Large enterprises across the globe are increasingly adopting cloud-based solutions and infrastructures to increase their scalability. As a result, there is a growing need for virtual networking solutions that can provide secure and reliable connectivity between different cloud environments, as well as between on-premises infrastructure and cloud environments. Moreover, with the rise of remote and hybrid work models, organizations need virtual firewall solutions as employees are accessing corporate resources from various locations and devices. Such factors mentioned above bode well for the growth of the segment over the forecast period.

The small & medium enterprise is projected to grow at a significant CAGR from 2025 to 2030. Small and medium enterprises are increasingly adopting cloud-based solutions for their IT infrastructure, including cloud storage, SaaS applications, and cloud-hosted servers. Virtual networking solutions can help small & medium enterprises segment to connect their on-premises infrastructure to the cloud, as well as provide secure and reliable connectivity between different cloud environments. Moreover, SDNs can help small & medium enterprises to centralize and automate network management while reducing costs and increasing agility. Such factors are expected to create growth opportunities for the segment over the coming year.

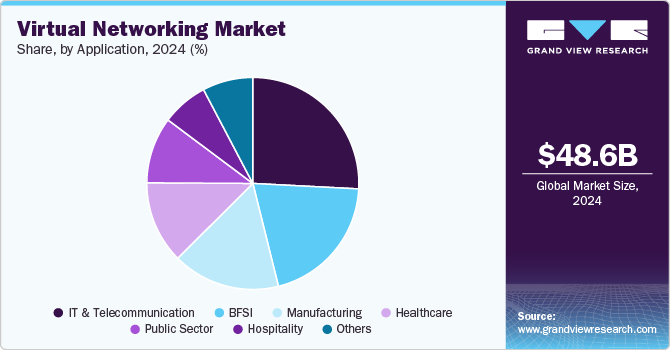

Application Insights

The IT & telecommunication segment dominated the market in 2024. The ability of virtual networking solutions to offer better flexibility, cost savings, and scalability is a major factor driving segment growth. Virtual networking solutions allow IT & telecommunication companies to create, modify, or remove virtual networks as needed to support changing business requirements without the need to deploy and manage physical network infrastructure. This increases agility and reduces costs associated with physical network infrastructure, such as hardware, cabling, and maintenance. Additionally, virtual networking solutions enable companies to scale their networks easily and efficiently without investing in additional hardware or software.

The BFSI is projected to grow at a significant CAGR from 2025 to 2030. BFSI firms are increasingly implementing virtual networking technologies to improve network performance, boost agility, and minimize expenses, thereby contributing to segment growth. BFSI firms may use virtual networking solutions to construct customized and secure virtual networks that are independent of their physical network infrastructure, allowing them to manage better and safeguard critical data. Moreover, virtual networking solutions can offer higher flexibility and scalability than traditional networking solutions, allowing BFSI firms to easily adapt their networks to changing business needs. Additionally, virtual networking solutions may assist BFSI businesses in lowering the cost of hardware and maintenance associated with traditional network infrastructure while boosting network performance and dependability.

Regional Insights

The North America virtual networking market held a significant revenue share in 2024. North America is experiencing significant growth due to the increasing demand for cloud computing, software-defined networking (SDN), and Network Function Virtualization (NFV) solutions. Cloud computing adoption is boosting demand for virtual networking solutions in North America as businesses migrate their IT infrastructure to the cloud to improve agility, save costs, and increase scalability. Because of its capacity to consolidate and automate network administration while lowering costs and enhancing agility, SDN is gaining popularity in North America. Those elements mentioned above point to a positive outlook for the region's economy throughout the anticipated period.

U.S. Virtual Networking Market Trends

The virtual networking market in the U.S. held a dominant position in 2024. The widespread adoption of cloud-based services in the U.S. drives the growth of the market. Organizations are increasingly shifting their operations to public, private, and hybrid clouds to achieve cost efficiency, scalability, and business continuity. Virtual networking enables seamless connectivity between on-premises systems and cloud environments, supporting the rapid deployment of applications and services. As cloud adoption accelerates among enterprises and small to medium-sized businesses (SMBs), the demand for virtualized network infrastructure continues to grow.

Europe Virtual Networking Market Trends

The Europe virtual networking market was identified as a lucrative region in 2024. The widespread adoption of remote and hybrid work across Europe has significantly boosted demand for virtual networking solutions. Organizations need a reliable and secure network infrastructure to support distributed workforces and maintain business continuity. Virtual private networks (VPNs), virtual desktops, and cloud-based collaboration tools are increasingly being deployed to ensure seamless connectivity and data protection for remote workers.

The virtual networking industry in the UK is expected to grow rapidly in the coming years due to heightened focus on cybersecurity and regulatory compliance. Cybersecurity and data protection are top priorities in the UK, particularly with the enforcement of stringent regulations such as the General Data Protection Regulation (GDPR). Virtual networking enhances security by enabling features like micro-segmentation, encrypted communications, and virtual firewalls.

Asia Pacific Virtual Networking Market Trends

The Asia Pacific virtual networking market is expected to grow at the fastest CAGR of 27.5% over the forecast period. Increasing adoption of hybrid cloud models, where organizations use a combination of public and private clouds to achieve greater flexibility, scalability, and cost-effectiveness, is a significant factor contributing to regional growth. Cloud computing also includes the use of virtual routers and virtual firewalls, as well as more sophisticated technologies such as Zero Trust Network Access (ZTNA) and Secure Service Edge (SSE), to safeguard workloads as they migrate to the public cloud.

The virtual networking market in Japan is expected to grow rapidly in the coming years owing to rising interest in energy efficiency. Japan's focus on sustainability and energy efficiency is driving the adoption of virtual networking, which enables more efficient use of IT resources. Virtualized networks reduce the need for physical hardware, lowering power consumption and cooling requirements in data centers. This aligns with Japan's broader efforts to reduce its carbon footprint and transition to greener technologies. As organizations increasingly prioritize sustainability, virtual networking solutions that support energy-efficient operations are gaining traction.

India virtual networking market held a substantial revenue share in 2024 owing to growing investment in data center infrastructure. India is witnessing substantial investment in data center development, driven by the growth of digital services and the region's position as a hub for global IT infrastructure. Virtual networking plays a crucial role in data center operations by enabling efficient resource utilization, network segmentation, and rapid deployment of services.

Key Virtual Networking Company Insights

Some key companies in the virtual networking industry include Huawei Technologies Co., VMware, Inc., IBM Corporation, Citrix Systems, Inc., Verizon Communications Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Verizon Communications Inc. is a telecommunication company headquartered in New York, U.S. Its offering in the market includes software-defined networking (SDN) and network functions virtualization (NFV). These technologies enable more efficient and flexible network management, catering to the growing demand for cloud-based services and digital transformation among enterprises.

-

VMware, Inc. is a virtualization and cloud computing company. The company specializes in software-defined networking (SDN) and network functions virtualization (NFV), which are critical for modern data center operations and cloud environments. VMware's flagship product, VMware Cloud Foundation, integrates various services, including vSAN for storage and NSX for networking, providing a comprehensive platform for private cloud deployments.

Key Virtual Networking Companies:

The following are the leading companies in the virtual networking market. These companies collectively hold the largest market share and dictate industry trends.

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- VMware, Inc.

- Cisco Systems, Inc.

- Microsoft Corporation

- IBM Corporation

- Citrix Systems, Inc.

- Juniper Networks, Inc.

- Oracle

- Verizon Communications Inc.

Recent Developments

-

In January 2024, Veracity Industrial Networks launched the Veracity OT Network Security Appliance. This device uniquely integrates a virtual switch with an operational technology (OT) software-defined networking (SDN) controller on a single platform. This innovative solution aims to streamline industrial network management by enabling centralized control over connected devices enhancing cybersecurity measures such as micro-segmentation and network resiliency.

-

In March 2023, Edgecore Networks introduced the Virtual Wireless LAN Controller Series (VEWS), designed to enhance resource utilization significantly, return on investment (ROI), and network security for enterprises, telecommunications companies, internet service providers (ISPs), and managed service providers (MSPs). This innovative solution provides centralized management capabilities from a single interface, enabling organizations to efficiently manage their wireless networks while reducing capital and operational expenditures.

Virtual Networking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 60.00 billion

Revenue forecast in 2030

USD 194.63 billion

Growth rate

CAGR of 26.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Huawei Technologies Co., Ltd.; Hewlett Packard Enterprise Development LP; VMware, Inc.; Cisco Systems, Inc.; Microsoft Corporation; IBM Corporation; Citrix Systems, Inc.; Juniper Networks, Inc.; Oracle; Verizon Communications Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Networking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virtual networking market report based on component, deployment, enterprise size, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Public sector

-

Manufacturing

-

Hospitality

-

IT and Telecommunication

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual networking market size was estimated at USD 48.57 billion in 2024 and is expected to reach USD 60.00 billion in 2025.

b. The global virtual networking market is expected to grow at a compound annual growth rate of 26.5% from 2025 to 2030 to reach USD 194.63 billion by 2030.

b. North America dominated the virtual networking market with a share of 33.52% in 2024. Rising investments in cloud services is a major factor driving the regional growth.

b. Some key players operating in the virtual networking market include Huawei Technologies Co., Ltd.; Hewlett Packard Enterprise Development LP; VMware, Inc.; Cisco Systems, Inc; Microsoft Corporation; IBM Corporation; Citrix Systems, Inc.; Juniper Networks, Inc.; Oracle; Verizon Communications Inc.

b. Key factors driving the virtual networking market growth include an increase in focus on virtual technologies that manage virtual machines, rising cloud computing adoption, and high levels of advanced communication methods adopted by people.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.