- Home

- »

- Clinical Diagnostics

- »

-

Global Vitamin D Testing Market Size & Share Report, 2030GVR Report cover

![Vitamin D Testing Market Size, Share & Trends Report]()

Vitamin D Testing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (25-Hydroxy Vitamin D Test, 1,25-Dihydroxy Vitamin D Test), By Indication, By Technology, By Patient, By Test Location, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-934-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

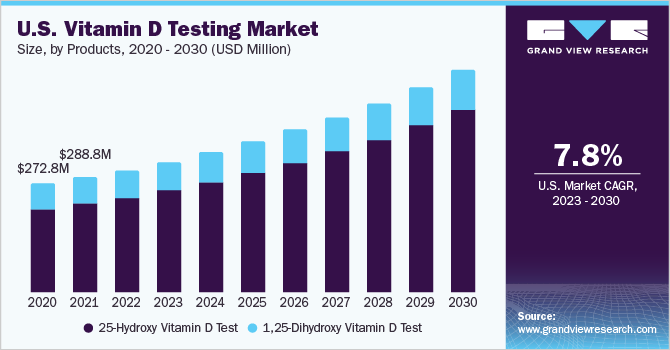

The global vitamin D testing market size was estimated at USD 848.80 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.53% from 2023 to 2030. The market is witnessing growth due to the factors such as the increasing prevalence of osteoporosis, rickets, thyroid disorders, and vitamin D deficiency. Moreover, the rising awareness related to these disorders and the need to incorporate testing to overcome disorders is further propelling growth. The market is expected to be driven by the increasing geriatric population. According to The American Geriatrics Society and the National Osteoporosis Foundation, in 2021, it is recommended that a slightly higher dose of Vitamin D supplementation, as well as calcium supplements, to older adults (≥65 years), should be given to reduce the risk of fractures and falls. The COVID-19 pandemic has led to an increase in the population with Vitamin D deficiency owing to long indoor stays as a precautionary measure of the pandemic. This has led to an increasing prevalence of deficiency among the population during the pandemic leading to the growth of the market with increasing testing after the lockdowns and restrictions were lowered.

Deficiency of vitamin D is highly common, which is leading to repetitive testing and monitoring to ensure optimum levels in the patient. This increased level of testing is burdening the health systems globally. For instance, the testing rate for vitamin D increased from 119 tests per 1000 population in 2015 to 159 per 1000 in 2019, which is a 34% increase. This rise has led to an increase in Medicare costs in Australia by 42%.

Moreover, market players are focusing on developing novel drugs for the treatment of related disease conditions. For instance, Quest diagnostics offers two methods of testing that can help in regularly analyzing at-risk patients, identifying deficiencies and disorders, and managing the condition after being diagnosed. Moreover, increasing demand and the launch of home-based test kits are further propelling the growth of the market.

Vitamin D testing needs to be supplemented with unnecessary supplements, which increase medical costs and retesting. On average, a test can cost around USD 50, when covered by health insurance. Without health insurance the same test for 25-hydroxyvitamin D test costs around USD 15 to USD 263, and 1,25-dihydroxyvitamin D test costs around USD 75 to USD 499. The cost associated with the test is one of the major factors restraining the growth of the market.

The increasing number of studies relating to the role of vitamin D in diverse clinical settings and the rise of testing. Moreover, the increasing adoption of at-home tests is further fueling the segment's growth. For instance, in April 2021, Hologram Sciences launched its first product, a direct-to-consumer brand based on vitamin D that includes a testing component as a home test product for testing.

Product Insights

25-hydroxy vitamin D test segment held the largest market share in 2022 and is expected to witness the fastest growth during the forecast period. The ideal test to check vitamin D levels is the 25-hydroxy vitamin D test. The blood's concentration of 25-hydroxyvitamin D is a reliable indicator of how much vitamin D is in body. Vitamin D levels can be checked to identify if the levels are normal or abnormally high or low. The test is also known as the calcitriol 25-hydroxycholecalciferol test and the 25-OH vitamin D test and is also a key sign of rickets and osteoporosis. Moreover, tests are developed that can easily determine nutrient deficiency by monitoring level of 25-hydroxy in blood. For instance[, Cerascreen GmbH, has a cerascreen test, a diagnostic test that can be used at home to determine blood concentration of vitamin D.

1, 25-dihydroxy vitamin D test segment is expected to show lucrative growth during the forecast period. The use of this test is limited to patients diagnosed with hypercalcemia, vitamin D dependent rickets, or hereditary deficiency of 1-alpha-hydroxylase. Moreover, the high price associated with the test is further restraining the growth. For instance, the average cost of test is around USD 300-500.

Indication Insights

Osteoporosis indication segment dominated the market with the largest segment share in 2022. This can be attributed to the increasing prevalence of vitamin D related osteoporosis. Vitamin D deficiency is also linked to weakened muscles, poorer balance and athletic performance, and a higher risk of fractures and falls. Osteoporosis affects more than 10 million people in the United States and is expected to affect approximately 14 million adults over the age of 50 by 2020. Worldwide, about 200 million women suffer from osteoporosis. The increasing prevalence is in turn fueling the growth of testing.

Rickets indication segment is expected to witness lucrative growth over the forecast period. The growth of the segment is attributed to increasing rickets among the population due to extreme vitamin D deficiency for prolonged periods. The recommended dose of Vitamin D in the diet for all infants should be 400 IU a day. Human milk contains only a small amount of vitamin D which makes it necessary for supplementary nutrients in the diet. The rising concerns related to the deficiency of vitamin D enables necessary testing.

Technology Insights

LC-MS technology segment dominated the overall market with a market share of 2022. The dominance of the segment is attributed to the accuracy offered by LC-MS/MS assays for vitamin-D metabolite analysis. Although other technologically advanced forms of diagnostic alternatives are available the accuracy in measuring Vitamin-D metabolite levels serves as an important way to classify patients as deficient and a proper supplement medication can be given. For instance, Immundiagnostik, Inc. develops and manufactures Vitamin D Combi ImmuTube LC-MS/MS Kit, intended for the quantitative determination of 25 (OH) in plasma and serum.

Radioimmunoassay technology segment is expected to show lucrative growth in the forecast period owing to the high variability produced by these tests that create limitations for determining the normal status of vitamin D. Immunoassays include radioimmunoassay and ELISA, however, they serve as gold standard for 25(OH) D, they are not acceptable due to the variability is results caused by them. Moreover, a quick screening 25-hydroxyvitamin D (25OH-D) assessment without chromatographic separation that provides superior precision and accuracy than immunoassays is also in high demand clinically which further enables the growth of segment.

Patient Insights

Adult patients segment dominated the market share in 2022. Adult population are more prone to osteoporosis. In general, adult population is advised to take a supplement containing 800 international units (20 micrograms) of vitamin D per day to maintain a normal vitamin D level. The incidence of lower vitamin D levels in older people is due to their time spent indoors and they may have a deficiency even at this intake level.

Pediatric patient segment is expected to grow at the fastest growth in the forecast period. The growth of the segment is attributed to malnutrition among infant and children population living in countries with limited resources. The deficiency of vitamin D in extreme cases causes rickets in children and osteomalacia in all age groups. QuestAssureD by Quest Diagnostics is developed for Infants, based on 25-Hydroxyvitamin D and LC/MS/MS technology. Moreover, a high risk of hypocalcemia which may result in seizures and tetany is also associated with low vitamin D levels. This deficiency among the pediatric population to reduce the risk of related disorders is propelling the growth of the market.

Test Location

Point-of-Care test location is expected to grow at the fastest rate in the forecast period. The dominance of the market is attributed to the accuracy and reliability of results obtained from point-of-care. Increasing awareness among the population for testing and the availability of point-of-care products is further propelling the growth of the segment. For instance, DiaSys, a point-of-care kit, QDx Vitamin D test gives results within 10 minutes and costs 90% less than other standard products available.

Others segment dominated with a high market share in 2022. Laboratory-based tests are high in accuracy and preferred over PoC tests attributable of their low costs. However, the higher turnaround time of laboratory-based tests acts as a restraint to the overall growth of the market. The easier availability and preference to other conventional tests are gives the other segment a competitive edge.

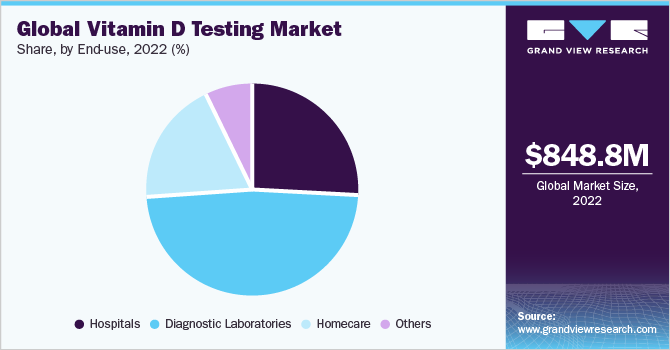

End-use Insights

Diagnostic laboratories dominated the market in 2022. Diagnostic laboratories have diagnostics equipment that makes it easier for testing on a larger scale. Moreover, many hospitals and healthcare service providers rely on testing from diagnostic laboratories for precise and accurate results. Diagnostic laboratories have gained popularity due to the ease of testing and availability of laboratory-based tests for diagnosis and detection. There is a large number of diagnostic laboratories operating in the market to provide proper test kits and enhance the accuracy of the result.

Hospitals segment is expected to grow at a lucrative rate over the forecast period. Hospitals are equipped with specialized testing space, well-trained technicians, and hospital staff which makes them one of the major locations for testing and prescribing proper medication to patients. All these factors together propel the growth of the market. Moreover, hospitals serve to provide proper diagnosis and detection tools aided with providing medication for the treatment of the condition.

Regional Insights

North America dominated the global market in 2022. This can be attributed to the high awareness of regular screening, and a favorable regulatory & reimbursement landscape that enhances access to tests. The high prevalence of deficiency in this region is one of the most prominent factors driving the market growth. For instance, in 2021, a survey conducted by The University of Texas stated that Vitamin D deficiency affects nearly 42% of the population. The COVID-19 pandemic has led to an increase in the population with vitamin D deficiency owing to the safety precautions and long indoor stays during the pandemic.

Europe is expected to grow at a lucrative growth rate over the forecast period. In Germany, public awareness associated with the potential health issues attributable to the deficiency been intensified over the past years. Furthermore, the rise of a sedentary lifestyle leading to diminished exposure to the sun is driving the high prevalence of deficiency in the country. For instance, according to The European Society of Endocrinology, deficiency occurs in <20% of the population in Northern Europe, in 30–60% in Western, Southern, and Eastern Europe, and up to 80% heightened prescription rates of tests by physicians are driving the sales in the nation.

Key Companies & Market Share Insights

Key players operating in the market are focusing on geographical expansion, partnerships, strategic collaborations, and, emerging and economically favorable regions with product launches. For Instance, in 2020 to speed up growth OmegaQuant, launched a vitamin D test with a sample collection kit that allows testing for the deficiency from home. Some of the key players in the global vitamin D testing market include:

-

Abbott

-

Danaher

-

F. Hoffmann-La Roche Ltd

-

Siemens Healthineers AG

-

Quest Diagnostics Incorporated.

-

BIOMÉRIEUX

-

DiaSorin S.p.A.

-

Thermo Fisher Scientific Inc.

-

Beckman Coulter, Inc. (BD)

-

Tosoh Bioscience, Inc.

Vitamin D Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 914.16 million

Revenue forecast in 2030

USD 1.63 billion

Growth rate

CAGR of 8.53% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, patient, technology, test location, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Thailand; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott, Danaher; F. Hoffmann-La Roche Ltd; Siemens; Quest Diagnostics Incorporated.; bioMérieux SA; DiaSorin S.p.A.; Thermo Fisher Scientific Inc.; Beckman Coulter, Inc.(BD); Tosoh Bioscience, Inc.;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vitamin D Testing Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global vitamin D testing market report based on product, indication, technology, patient, test location, end-use, and region

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

25-Hydroxy Vitamin D Test

-

1,25-Dihydroxy Vitamin D Test

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Osteoporosis

-

Rickets

-

Thyroid Disorders

-

Vitamin D Deficiency

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Radioimmunoassay

-

ELISA

-

HPLC

-

LC-MS

-

Others

-

-

Patient Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Test Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Point-of-Care

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Laboratories

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vitamin D testing market size was estimated at USD 848.80 million in 2022 and is expected to reach USD 914.16 million in 2023.

b. The global vitamin D testing market is expected to grow at a compound annual growth rate of 8.53% from 2023 to 2030 to reach USD 1,633.25 million by 2030.

b. North America dominated the vitamin D testing market with a share of 40.78% in 2019. This is attributable to local presence of major market players, easy availability of various assays, higher adoption of tests by people, entry of newer tests, and increasing incidence of vitamin D deficiency due to limited exposure to sunlight and unhealthy diet in the U.S.

b. Some key players operating in the vitamin D testing market include Abbott, Danaher, F. Hoffmann-La Roche Ltd, Siemens, Quest Diagnostics Incorporated., bioMérieux SA, DiaSorin S.p.A., Thermo Fisher Scientific Inc., Beckman Coulter, Inc., Tosoh Bioscience, Inc.

b. Key factors that are driving the market growth include the increasing prevalence of osteoporosis, rickets, thyroid disorders, and vitamin D deficiency. Moreover, the rising awareness related to these disorders and the need to incorporate testing to overcome disorders is further propelling the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.