- Home

- »

- Next Generation Technologies

- »

-

Voice Picking Solution Market Size, Industry Report, 2030GVR Report cover

![Voice Picking Solution Market Size, Share & Trends Report]()

Voice Picking Solution Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-premises), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-761-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Voice Picking Solution Market Size & Trends

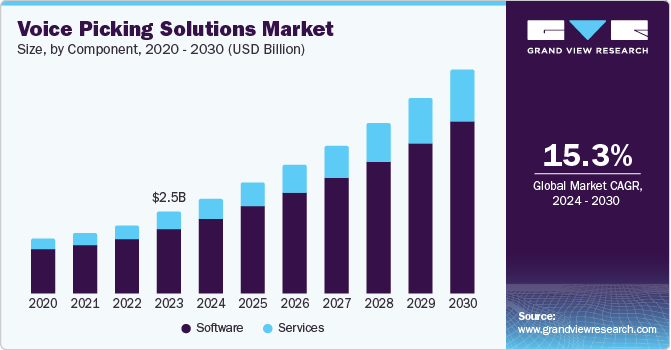

The global voice picking solutions market size was valued at USD 2.47 billion in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. Some of the key growth driving factors for this market include increasing demand experienced by the retail industry, especially e-commerce and online retail businesses, rising adoption of advanced technologies by companies to reduce costs and enhance productivity, and investment by technology industry in innovation based new product developments.

Emergence of voice recognition technology and its growing adoption has changed operational processes in multiple industries, especially retail. The customer experience, warehousing and inventory management are some of the key areas, which have gone under major shifts. Voice picking solutions offered by the key market players have enabled multiple industries in picking, picking & passing, count, move, receive, load, put away items. This has also ensured accuracy and eliminated large amount of errors that have been affecting productivity and results. Highly advanced solutions adopted by key retail industry participants have enabled workers with faster order picking through voice directives.

As businesses enhanced the online presence and global footprint, shipping, warehousing and logistics industry have experienced enormous growth in recent years. This has encouraged multiple businesses to adopt technology solutions that improve worker’s productivity and reduce the errors through innovation-based technologies such as voice picking. Emergence of artificial intelligence, machine learning, and Internet of Things have aided this digital transformation in the warehousing and retail sector.

Component Insights

Based on components, the software segment dominated the global industry and accounted for a revenue share of 79.3% in 2023. Software is the core component of a voice-picking system. It provides the core functionality for voice picking. The software allows warehouse operators real-time supply chain visibility, which is crucial for efficient inventory management. It enables operators to monitor stock levels, track shipments, and manage orders more effectively. Complete control over operations, performance improvement, and the growing availability of dedicated software products for voice picking are expected to generate growth for this segment in the approaching years.

The services segment is expected to experience the fastest CAGR from 2024 to 2030. Services have enabled companies to reap the full benefits of voice-picking capacities by offering expertise in implementation, customization, and ongoing support. Service providers ensure a smooth adoption process and maximize the return on investment for voice-picking technology. Companies lacking in-house IT expertise choose outsourced services for implementation and ongoing maintenance. In addition, warehouse complexity requires more customization and ongoing support, which drives the service demand.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share 2023. Lower upfront costs, scalability and flexibility, improved accessibility, and remote management are driving the growth of the cloud segment. Cloud solutions eliminate the need for companies to purchase expensive hardware and software licenses. Companies purchase services by paying subscription fees based on usage, making it a more accessible option for businesses of all sizes. Cloud-based systems offer extra scalability and flexibility coupled with remote monitoring which has attracted multiple businesses.

The on premise deployment segment is expected to experience a significant CAGR during the forecast period. On-premise deployments have allowed greater customization scope for users and developer to meet specific business requirements. This has ensured seamless adoption of newly launched systems into existing workflows, integration even with legacy systems, and adapt to specific industry practices. Such customization can include the development of bespoke features, adjustments to user interfaces, and incorporating specialized functionalities that cloud-based solutions might not offer. On-premises deployments can significantly enhance overall operational efficiency by enabling deeper integration with other on-site systems, such as warehouse management, enterprise resource planning (ERP), and inventory control.

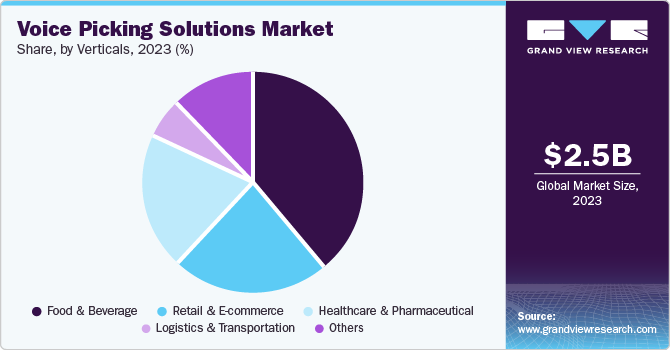

Vertical Insights

The retail & e-commerce segment dominated the global industry in 2023. This is attributed to the high order and fast fulfillment requirements in the retail, and efficiency and cost reduction attained through innovation-based process implementations. Retail and e-commerce businesses handled a high volume of orders, the increasing e-commerce demand, and faster delivery with the help of voice-picking technology. Voice-picking solutions have significantly reduced time and errors in delivery. Ease of use, increased availability and accessibility, and enhanced productivity experienced by the industry participants is expected to drive further growth for this market in approaching years.

The healthcare & pharmaceutical segment is expected to grow at the fastest CAGR of 16.2% from 2024 to 2030. Voice-guided systems minimize the risk of picking incorrect medications and ensure patient safety. Real-time tracking is an increasing need in every sector; it provides accurate and up-to-date inventory information, preventing stockouts and overstocking. Voice-picking solutions can be integrated into the Enterprise Resource Planning (ERP) system; this integration creates a seamless flow of information between the warehouse floor and the broader business operations.

Regional Insights

North America voice picking solutions dominated the global market and accounted for revenue share of 41.9 % in 2023. The growth of e-commerce in regional and global market has led to a significant increase in the volume of orders and the need for efficient order fulfillment. Voice-picking solutions have helped e-commerce businesses in managing high order volumes with greater accuracy and speed. By using voice-directed instructions, these systems have assisted companies in streamlining the picking process, allowing workers to keep their hands and eyes free, which has significantly reduced the frequency of errors and increased overall efficiency.

U.S. Voice Picking Solutions Market Trends

The U.S. voice picking solutions market dominated the regional industry in 2023. The advanced technological infrastructure, a high adoption rate of automation in businesses, and large-scale operations of the e-commerce industry in the country primarily influence this market. The presence of multiple large enterprises operating in the retail sector, such as Amazon, Walmart, and others, growing dependency on technology-driven solutions in warehousing, and increasing need for reduced costs and performance enhancements in the retail sector have generated higher demand for this market in recent years. Early adoption trends in technology innovation, the availability of advanced voice-picking solutions tailored by domestic businesses, and the diverse warehousing processes have encouraged multiple companies to adopt advanced voice-picking solutions in this market.

Europe Voice Picking Solutions Market Trends

Europe is identified as lucrative region for global voice picking solutions industry in 2023. The increased demand for inventory management from various sectors such as healthcare, manufacturing, retail & e-commerce. In addition, the benefits of voice-picking solutions, such as minimizing errors and lowering labor costs due to increased productivity, are driving the market growth. Improvements in voice recognition technology, integration capabilities with existing warehouse management systems (WMS), and advancements in artificial intelligence have enhanced the functionality and reliability of voice-picking solutions, fostering wider adoption.

The UK voice-picking solutions market held a substantial revenue share of regional industry in 2023. Growth of this market is driven by the factor such as increasing demand for efficiency and productivity in warehousing systems and adoption across various industry verticals, availability of multiple innovation-based solutions, and growing burden of order volume on multiple industries owing to online presence including personal care, retail, and others. Presence of multiple large enterprises operating in retail and cosmetics industry in the country is expected to drive growth of this market in approaching years.

Asia Pacific Voice Picking Solutions Market Trends

Asia Pacific voice-picking solutions market is expected to grow at the fastest CAGR of 19.0% during the forecast period. The economic growth experienced by countries such as India, China, and others has generated unprecedented growth in the retail and logistics industries in the region. The growing demand for online shopping platforms has resulted in enhanced warehousing solutions driven by advanced technology tools. Entry of multiple e-commerce and retail businesses from North America and Europe, coupled with the presence of domestic retail industry and e-commerce businesses, have developed an extraordinary flow of operations and order volume in the region. This is expected to fuel the growth of this regional industry from 2024 to 2030.

The India voice-picking solutions market held a significant revenue share of the regional industry in 2023. This market is primarily driven by the higher demand and growing order volumes experienced by the retail industry in the country, increase in organized retail sector establishments, inclination towards online shopping experiences, and alarming need developed through these factors for effective warehousing process enhancement solutions.

Key Voice Picking Solutions Company Insights

Some of the key companies in the voice picking solutions market include Lucas Systems, Voxware, Honeywell International Inc., Ivanti, Bastian Solutions, LLC and others. To address growing competition, the companies have adopted strategies such as enhanced portfolios, innovation based new product developments, service improvements, ongoing support offerings, and collaborations with other industry participants.

-

Bastian Solutions, LLC offers voice-directed order picking systems designed for environments with a large number of product Stock-keeping units. Integration with its Exacta intralogistics software streamlines order processing and provides real-time updates.

-

Lucas Systems, prominent companies in technology driven solutions and services industry, offers multiple solutions such as voice directed warehousing, warehouse optimization suite, labor management solutions and more. The AI-driven product offering of the company, Jennifer, a software that helps businesses in performance enhancements and warehousing excellence have been part of retail industry management for several years.

Key Voice Picking Solutions Companies:

The following are the leading companies in the voice picking solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Bastian Solutions, LLC

- DEMATIC

- Ehrhardt + Partner Solutions Inc.

- Honeywell International Inc

- Ivanti

- Lucas Systems

- Voxware

- Zebra Technologies Corp.

- Körber AG

- ZETES Industries S.A.

Recent Developments

- In May 2024, Lucas Systems, one of the prominent companies in the voice-picking industry, announced that warehouse workers that operate Lucas Systems software have reached 100 billion warehouse picks. The company provides software solution to nearly 400 warehousing facilities across four different continents.

- In March 2024, ProGlove, a major market participant in warehousing solutions market, announced that it has joined forces with Ehrhardt Partner Group (EPG)’s topsystem to offer integrated solution for mobile logistics featuring LYDIA Voice Pick-by-Voice by EPG and wearable barcode scanners solutions by ProGlove.

Voice Picking Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.90 billion

Revenue forecast in 2030

USD 6.80 billion

Growth Rate

CAGR of 15.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, vertical, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan, China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, and UAE.

Key companies profiled

Bastian Solutions, LLC; DEMATIC; Ehrhardt + Partner Solutions Inc.; Honeywell International Inc; Ivanti; Lucas Systems; Voxware; Zebra Technologies Corp.; Körber AG; ZETES Industries S.A.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Voice Picking Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the voice picking solutions report based on component, deployment, vertical and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Retail & E-commerce

-

Healthcare & Pharmaceutical

-

Logistics & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.