- Home

- »

- Advanced Interior Materials

- »

-

Warm Air Furnace Market Size, Share & Growth Report 2030GVR Report cover

![Warm Air Furnace Market Size, Share & Trends Report]()

Warm Air Furnace Market Size, Share & Trends Analysis Report By Type (Gas Warm Air Furnaces, Oil Warm Air Furnaces), By Application (Residential, Industrial, Commercial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-104-7

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Warm Air Furnace Market Size & Trends

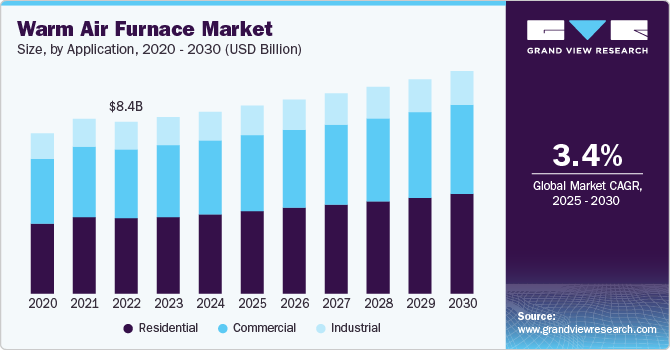

The global warm air furnace market size was estimated at USD 8,911.2 million in 2024 and is expected to grow at a CAGR of 3.4% from 2025 to 2030. The increasing demand for efficient heating solutions in residential, commercial, and industrial sectors is driving the adoption of warm air furnaces. As energy costs rise, consumers and businesses are seeking systems that provide optimal heating with lower energy consumption. Moreover, advancements in technology, such as smart thermostats and improved energy efficiency ratings, are making modern warm air furnaces more appealing.

Warm air furnaces are high-efficiency appliances with Annual Fuel Utilization Efficiency ratings as high as 99%. Further, hydronic and electric heating systems also take longer to heat up the area, but warm air furnaces offer shorter start times and bring comfort to the entire area in minutes. Furthermore, warm air furnaces are noted for their longevity and dependability, with an average life expectancy of 15-30 years, outliving heat pumps and boilers. These aforementioned factors are anticipated to propel the demand for warm air furnaces in the coming years.

Drivers, Opportunities & Restraints

The steady growth in home construction and renovation projects has increased the demand for warm air furnaces which is a popular choice for many of these projects. For instance, according to U.S. Census Bureau, commercial construction spending rose from USD 120.10 Million in September 2022 to USD 125.87 Million in October 2022, while lodging and hotel construction spending in the U.S. increased to USD 21.85 Million and USD 89.97 Million in September 2022 and October 2022, respectively. Thus, growing commercial construction is anticipated to drive the demand for warm air furnaces in the coming years.

The market is experiencing competition from alternative heating solutions, such as heat pumps and radiant heating systems, which may offer greater efficiency or lower operating costs. The availability of less expensive, less efficient heating options can also influence consumer choices and therefore restrain market growth. Furthermore, fluctuations in fuel prices, particularly for natural gas and electricity, can affect demand for warm air furnaces, as consumers may seek cheaper alternatives during periods of high energy costs.

The increasing emphasis on energy efficiency and sustainability offers manufacturers the chance to develop innovative, eco-friendly heating solutions that meet consumer demands for lower carbon footprints. Advances in smart technology also open new avenues, as integrating warm air furnaces with smart home systems can enhance user experience and operational efficiency.

Type Insights

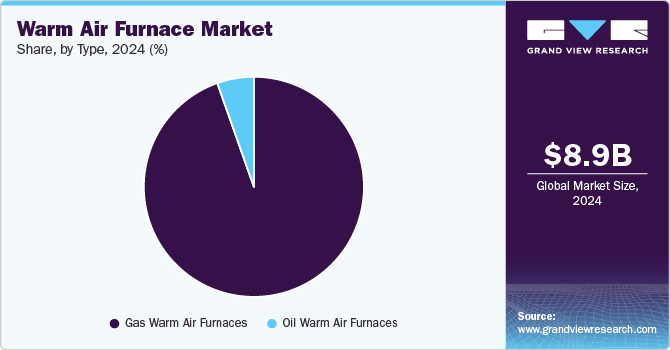

The gas warm air furnaces type segment dominated the market and held 94.6% of the global market share in 2024. Gas warm air furnaces are generally more efficient than electric furnaces. They can convert a higher percentage of the fuel they consume into usable heat, resulting in reduced environmental impact and lower energy costs. These can heat up spaces quickly, providing almost instant warmth. This is especially crucial in colder climates, where a rapid response is necessary to maintain comfort. Further, natural gas is often cheaper than electricity, making gas furnaces a cost-effective heating option, particularly in regions with abundant natural gas supplies. These aforementioned factors are expected to drive the demand for warm air furnaces in the coming years.

The oil warm air furnaces type segment accounted for 5.4% of the global revenue share in 2024. The rising demand for oil warm air furnaces is significantly driven by their ability to provide reliable heating in regions where natural gas infrastructure is limited or unavailable. Many rural and remote areas rely on oil as a primary heating source due to its accessibility and effectiveness in delivering consistent warmth during harsh winter months.

Application Insights

The residential application segment is anticipated to witness a CAGR of 3.9% over the forecast period. Warm air furnaces are a common heating option for residential applications. They are widely used in residential spaces to provide central heating. For instance, warm air furnaces are designed to provide heating to the entire house through a network of ducts and vents. They can efficiently distribute warm air to different rooms, ensuring consistent and comfortable temperatures throughout the home. These aforementioned factors are anticipated to propel the demand for warm air furnaces for residential applications in the coming years.

The commercial segment accounted for 40.7% of the market share in 2024. The increasing adoption of warm air furnaces in commercial applications is largely driven by the growing need for efficient and reliable heating systems in various business environments. As commercial spaces, such as warehouses, retail stores, and offices, prioritize operational efficiency, warm air furnaces offer the advantage of rapid heating and even temperature distribution, which is crucial for maintaining comfort and productivity.

Regional Insights

The North America warm air furnace market held the largest revenue share of 54.38% in 2024, by accounting for a substantial market share owing to the massive investments by the governments of different countries in the region for the development of public infrastructure and the expansion of residential construction. Moreover, there is a growing awareness pertaining to energy saving across the region which is anticipated to fuel market demand.

U.S. Warm Air Furnace Market Trends

The warm air furnace market in the U.S. is expected to expand at a CAGR of 3.4% over the forecast period. The increasing focus on energy efficiency and sustainability among consumers and businesses in the country is driving the adoption of advanced heating solutions that reduce energy consumption and environmental impact. Government incentives and rebates for energy-efficient appliances further encourage consumers to invest in modern warm air furnaces.

Europe Warm Air Furnace Market Trends

The warm air furnace market in Europe the growth of driven by stringent energy efficiency regulations and a strong emphasis on reducing carbon emissions. The European Union’s initiatives to promote renewable energy and sustainable heating solutions are encouraging the adoption of modern heating technologies. Additionally, the retrofitting of older buildings with energy-efficient systems further boosts market demand.

The warm air furnace market in Germany dominated the market in terms of market share in Europe accounting for a share of 15.7% in 2023. In Germany, stringent regulations related to energy efficiency and a strong commitment to environmental sustainability drive the warm air furnace market. The government’s push for renewable energy and energy-efficient solutions encourages consumers to invest in modern heating systems. Furthermore, the popularity of smart home technologies facilitates the integration of advanced heating solutions in new and existing buildings.

The warm air furnace market in France held 13.8% of the region’s market share in 2023. In France, the growth of the warm air furnace market is fueled by rising awareness of energy conservation and the implementation of government incentives for energy-efficient heating systems. The country's focus on reducing greenhouse gas emissions and improving indoor air quality supports the adoption of modern warm air furnaces. Additionally, renovations and upgrades in residential and commercial properties drive demand for efficient heating solutions.

Asia Pacific Warm Air Furnace Market Trends

In the Asia Pacific region, rapid urbanization and increasing disposable incomes are significant drivers. As more people move to urban areas, there is a growing demand for reliable heating solutions in residential and commercial spaces. Furthermore, the expansion of the middle class and improvements in living standards are leading to increased investments in modern heating technologies.

The market in China held a 47.9% market share in 2023. In China, the growth of the warm air furnace market is driven by rapid urbanization and increasing investments in infrastructure. As cities expand, there is a rising demand for reliable heating solutions in both residential and commercial buildings. Additionally, government policies aimed at improving air quality and promoting energy-efficient technologies are encouraging the adoption of modern heating systems.

The market in Japan accounted for a 24.6% market share in 2023 driven by the country's commitment to energy efficiency and sustainability. With a focus on reducing energy consumption and carbon emissions, there is a growing demand for advanced heating technologies that offer better performance and lower environmental impact. The aging infrastructure and the need for upgrades in residential heating systems also contribute to market growth.

Central & South America Warm Air Furnace Market Trends

In Central & South America, the warm air furnace market is primarily driven by the rising demand for efficient heating solutions in response to fluctuating energy prices. Many countries in the region experience diverse climates, which creates a need for effective heating systems. Additionally, growing awareness of energy conservation and government initiatives aimed at promoting energy-efficient technologies are contributing to market growth.

Middle East & Africa Warm Air Furnace Market Trends

In the Middle East and Africa, the market is driven by increasing construction activities and the demand for efficient heating solutions in both residential and commercial sectors. The harsh climate conditions in many areas necessitate effective heating systems. Moreover, economic growth and urban development are leading to a higher demand for modern infrastructure, further propelling the adoption of warm air furnaces.

Key Warm Air Furnace Company Insights

Some of the key players operating in the global warm air furnace market include Ingersoll Rand and SLB.

-

Ingersoll Rand is headquartered in North Carolina, U.S. and has major four product lines namely, industrial technologies & services, precision & science technologies, specialty vehicle technologies, and high-pressure solutions. The company offers its products to various industries including, aerospace, Infrastructure Application (HDD)s, plastics & rubbers, consumer, electronics & semiconductors, environmental, food & beverage, general manufacturing, government & military, industrial gases, marine, oil & gas, power generation, PET bottle blowing, and water & wastewater treatment.

-

SLB. is a manufacturer and provider of warm air furances, compressors, pumps, generators, power tools, and assembly systems. The company operates in the market through multiple brands such as ABAC, AGRE, AIRnet, ALUP, Balma, and American Pneumatic Tools (APT) among others. The company has a direct presence in over 70 countries and sales in more than 180 nations.

Key Warm Air Furnace Companies:

The following are the leading companies in the warm air furnace market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Ingersoll Rand

- Carrier Corporation

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Ingersoll-Rand Plc

- Daikin Industries, Ltd.

- Rheem Manufacturing

- Lennox International

- Johnson Controls, Inc.

- Robert Bosch GmbH

- Viessmann Group

- Goodman Manufacturing

- Fujitsu

View a comprehensive list of companies in the Warm Air Furnace Market

Recent Developments

-

In September 2023, Navien, Inc. held a virtual launch event where it introduced its first HVAC product, the NPF Hydro-furnace. The NPF Hydro-furnace is available in Upflow and Horizontal configurations with capacities of 60,000 BTU/h and 100,000 BTU/h. It boasts an impressive 97.0% Annual Fuel Utilization Efficiency (AFUE) and complies with stringent Ultra-Low NOx performance standards.

-

In February 2024, The U.S. Department of Energy (DOE) announced that it will not enforce the new Thermal Efficiency Two (TE2) metric for commercial warm air furnaces until the conclusion of ongoing legal proceedings related to the case AHRI v. U.S. Dept. of Energy. This decision allows manufacturers additional time to prepare their products and processes for the new standards without immediate regulatory pressure. Market players view this delay as a positive development, providing stability during a period of uncertainty and enabling companies to assess and innovate in response to potential changes in energy efficiency requirements. The DOE's ruling, established in the Energy Conservation Program on June 2, 2023, supports a more measured approach to compliance.

Warm Air Furnace Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,209.0 million

Revenue forecast in 2030

USD 10,900.7 million

Growth Rate

CAGR of 3.4% from 2025 to 2030

Base year for estimation

2024

Actual Data

2018 - 2023

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments Covered

Type and application

Regional Scope

North America; Europe; Asia Pacific; CSA; MEA

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Sweden; Norway; Spain; Finland; China; Japan; Australia; India; South Korea; Brazil; Argentina; Saudi Arabia; UAE

SLB; Ingersoll Rand; Carrier Corporation; Mitsubishi Electric Corporation; Emerson Electric Co.; Ingersoll-Rand Plc; Daikin Industries, Ltd.; Rheem Manufacturing; Lennox International; Johnson Controls, Inc.; Robert Bosch GmbH; Viessmann Group; Goodman Manufacturing; Fujitsu; Navien Inc.

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Warm Air Furnace Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global warm air furnace market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Gas Warm Air Furnaces

-

Oil Warm Air Furnaces

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Region Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Spain

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global warm air furnaces market size was estimated at USD 8,911.2 million in 2024 and is expected to be USD 10,900.7 million in 2030.

b. The global warm air furnaces market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.4% from 2025 to 2030 to reach USD 10,900.7 million by 2030.

b. The North American region dominated the market in 2024, accounting for a share of 54.4%, owing to the demand for energy-efficient heating solutions and the need for effective heating during harsh winters. Technological advancements, favorable government policies promoting energy efficiency, and the expansion of the construction sector further fuel the market's expansion. These factors collectively contribute to the increasing adoption of warm air furnaces in the region.

b. Some of the key players operating in the warm air furnaces market include SLB, Ingersoll Rand, Carrier Corporation, Mitsubishi Electric Corporation, Emerson Electric Co., Ingersoll-Rand Plc, Daikin Industries, Ltd., Rheem Manufacturing, Lennox International, Johnson Controls, Inc., Robert Bosch GmbH, Viessmann Group, Goodman Manufacturing, Fujitsu, and Navien Inc.

b. Key factors driving the warm air furnaces market include the demand for energy efficiency, technological advancements, favorable government policies, and the expansion of the construction sector. These elements contribute to the growing adoption of warm air furnaces.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."