- Home

- »

- Renewable Energy

- »

-

Waste To Energy Market Size, Share & Trends Report, 2030GVR Report cover

![Waste To Energy Market Size, Share & Trends Report]()

Waste To Energy Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Biological, Thermal (Incineration, Pyrolysis, Gasification)), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-319-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Waste To Energy Market Summary

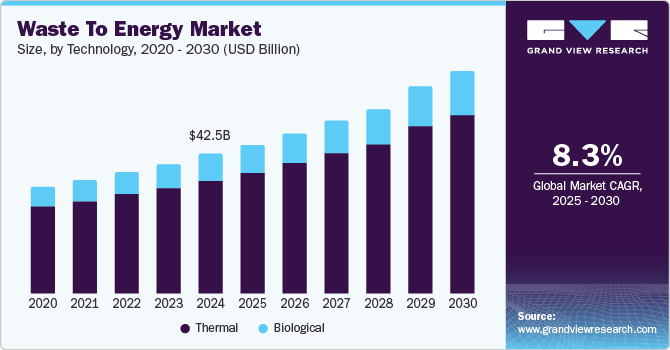

The global waste to energy market size was estimated at USD 42.5 billion in 2024 and is projected to reach USD 68.0 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2030. It focuses on converting municipal and industrial waste into energy through incineration and anaerobic digestion.

Key Market Trends & Insights

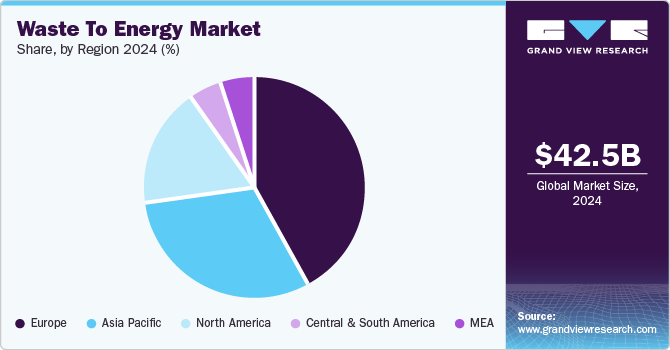

- Europe waste to energy market dominated the global market with a revenue share of 41.8% in 2024.

- The waste to energy market in Germany is expected to grow significantly in the forecast period

- By technology, the thermal segment dominated the market, with a revenue share of 81.7% in 2024

- By technology, The biological segment is projected to witness the fastest CAGR of 9.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 42.5 billion

- 2030 Projected Market Size: USD 68.0 Billion

- CAGR (2025-2030): 8.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is driven by rising energy demands, stringent environmental regulations, and the need for sustainable waste management solutions. In addition, technological advancements and increasing public awareness about renewable energy contribute to its growth.

The rising global population and economic expansion significantly increase energy demand, positioning waste to energy facilities as essential solutions. These facilities provide a reliable renewable energy source, reducing reliance on fossil fuels. In addition, strict government regulations aimed at minimizing landfill use and lowering greenhouse gas emissions support the growth of waste to energy. Therefore, converting waste into energy addresses energy needs and helps ensure compliance with environmental standards.

Recent innovations in gasification processes have significantly enhanced the efficiency of converting solid waste into syngas, a valuable energy source. New reactor designs optimize heat transfer and residence time, facilitating more effective waste breakdown. In addition, developing advanced catalysts accelerates chemical reactions, leading to higher syngas yields with lower energy consumption. These improvements increase the overall energy recovery from waste and reduce operational costs, making Waste to Energy systems more economically viable.

Technology Insights

The thermal segment dominated the market, with a revenue share of 81.7% in 2024, attributed to thermal technologies effectively reducing waste volume and converting it into ash and energy, which addresses the challenges municipalities face with landfill constraints. In addition to transforming non-recyclable waste into energy, these technologies manage waste effectively and support circular economy initiatives and sustainability goals. Moreover, research and development have led to advancements in efficiency and energy recovery, enhancing the viability of thermal solutions. As a result, these factors collectively increase the appeal of thermal technologies for waste management and energy production.

The biological segment is projected to witness the fastest CAGR of 9.3% over the forecast period, attributed to its environmental advantages, regulatory support, economic efficiency, versatility in feedstock usage, nutrient recovery potential, and strong public acceptance. These factors collectively position biological solutions as preferred for sustainable energy and waste management. Moreover, biological systems typically incur lower capital and operational costs due to simpler construction and reduced resource requirements, leading to quicker payback periods. Therefore, the economic attractiveness of biological technologies reinforces their role as a preferred solution for sustainable energy and waste management.

Regional Insights

North America waste to energy market held a substantial market share in 2024, fueled by growing energy demand, regulatory support, technological advancements, public awareness, circular economy initiatives, infrastructure readiness, economic benefits, and environmental regulations. Therefore, these factors collectively create a favorable environment for developing and expanding waste to energy technologies.

U.S. Waste To Energy Market Trends

U.S. waste to energy market dominated North America, with a significant revenue share in 2024, driven by the highest energy consumption rates in the world. As the population and economy grow, there is a strong demand for reliable and renewable energy sources. Waste to energy technologies provide an effective solution to meet this demand while addressing waste management issues. In addition, it has a well-established waste management infrastructure that can support the integration of waste to energy technologies. Further, many cities have existing facilities that can be upgraded or adapted for waste to energy processes, facilitating quicker implementation and reducing capital costs. This existing infrastructure provides a solid foundation for expanding waste to energy operations.

Europe Waste To Energy Market Trends

Europe waste to energy market dominated the global market with a revenue share of 41.8% in 2024 driven by established strict waste management and environmental regulations to minimize landfill usage and promote sustainability. According to the European Commission, the goal is to recycle 65% of municipal waste by 2035, which spurs investments in waste to energy technologies. Therefore, this regulatory framework encourages innovation and enhances solutions across Europe.

The waste to energy market in Germany is expected to grow significantly in the forecast period, attributed to the country's aim for a substantial transition to a low-carbon economy, according to the German Federal Ministry for Economic Affairs and Energy, 2021. The government has set a target of achieving 80% of its electricity from renewable sources by 2050. Waste to energy plays a crucial role in this transition, providing a reliable renewable energy source while reducing landfill waste. Therefore, integrating waste to energy into Germany's energy mix supports national climate goals.

Asia Pacific Waste To Energy Market Trends

Asia Pacific waste to energy anticipates registering the fastest CAGR of 13.2% over the forecast period, attributed to experiencing unprecedented urbanization and population growth, according to United Nations, 2021. By 2030, it's projected that 60% of the region's population will reside in urban areas, leading to increased waste generation, and cities such as Jakarta and Mumbai are grappling with waste management challenges, prompting investments in waste to energy technologies to convert waste into energy and address growing energy demands.

The increasing unprecedented urbanization and population growth in China drive the waste to energy market. The government has established a robust regulatory framework that directly supports waste growth in energy technologies. The Waste Management Law, revised in 2020, plays a critical role in this effort by mandating waste separation and encouraging recycling initiatives. This law aims to significantly reduce the waste sent to landfills and promote waste conversion into energy. Moreover, the Renewable Energy Law in China actively supports waste to energy projects by providing incentives for energy recovery from waste. Therefore, this law facilitates the integration of waste to energy plants into the national energy grid, ensuring that energy generated from waste is treated on par with other renewable sources.

Key Waste To Energy Company Insights

Some key companies operating in the market include Hitachi Zosen Inova AG, Suez, Covanta Holding Corporation, China Everbright International Limited, and Veolia. Companies are implementing strategic initiatives, including mergers, acquisitions, and product launches, to expand their market presence and address evolving healthcare demands through waste to energy.

-

Hitachi Zosen Inova AG offers advanced waste to energy solutions that convert municipal solid waste into electricity and heat through incineration and gasification technologies. It provides turnkey services, including project design, construction, and operational support for waste to energy facilities. The company emphasizes environmental sustainability and regulatory compliance to minimize emissions.

-

Suez offers comprehensive waste to energy solutions that convert waste into renewable energy, primarily through incineration and anaerobic digestion processes. Their services include designing, constructing, and operating waste to energy facilities, focusing on maximizing energy recovery while minimizing environmental impact. The company emphasizes sustainability and compliance with regulatory standards to enhance waste management efficiency.

Key Waste To Energy Companies:

The following are the leading companies in the waste to energy market. These companies collectively hold the largest market share and dictate industry trends.

- Hitachi Zosen Inova AG

- Suez

- Covanta Holding Corporation

- China Everbright International Limited

- Veolia

- Abu Dhabi National Energy Company PJSC

- Ramboll Group A/S

- Babcock & Wilcox Enterprises, Inc.

- Wheelabrator Technologies Inc.

- Xcel Energy Inc.

Recent Developments

-

In October 2024, SUEZ and CMA CGM Group signed a memorandum of understanding to collaborate on biomethane production in Europe. This partnership aims to support the low-carbon conversion of maritime transport, aligning with sustainability goals. By leveraging each other's expertise, they seek to enhance the use of renewable energy in shipping. Therefore, this initiative contributes to reducing the carbon footprint of maritime operations in the region.

-

In July 2024, Babcock & Wilcox Renewable Service A/S was acquired by Hitachi Zosen Inova AG from Babcock & Wilcox Enterprise, enhancing its capabilities in renewable energy solutions. This strategic acquisition expands service offerings in the biomass and waste-to-energy sectors, strengthening Hitachi Zosen Inova's position in the global renewable energy market. Furthermore, it fosters innovation and efficiency within its operational processes, positioning the company for future growth.

Waste To Energy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.6 billion

Revenue forecast in 2030

USD 68.0 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, China, India, Japan

Key companies profiled

Hitachi Zosen Inova AG; Suez; Covanta Holding Corporation; China Everbright International Limited; Veolia; Abu Dhabi National Energy Company PJSC; Ramboll Group A/S; Babcock & Wilcox Enterprises, Inc., Wheelabrator Technologies Inc; Xcel Energy Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Waste To Energy Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global waste to energy market report based on technology and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biological

-

Thermal

-

Incineration

-

Pyrolysis

-

Gasification

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global waste to energy market size was estimated at USD 31,005.3 million in 2019, and is expected to reach USD 33,053.8 million in 2020.

b. The global waste to energy market is expected to witness a compound annual growth rate of 7.4% from 2020 to 2027 to reach USD 54,813.3 million by 2027.

b. Thermal segment occupied the largest market revenue share in 2019, with incineration thermal technology being a major contributor to the revenue growth. A relatively simple process along with ease of operations is the growth factor for thermal conversion techniques.

b. Some key players operating in the waste to energy market include Hitachi Zosen Inova AG, Suez, Covanta Holding Corporation, Veolia, China Everbright International Limited, Abu Dhabi National Energy Company PJSC, Ramboll Group A/S, Babcock & Wilcox Enterprises, Inc., Wheelabrator Technologies Inc., Xcel Energy Inc.

b. Favorable regulatory policies encouraging proper waste disposal combined with energy production along with growing energy demands from the end-use sector are projected to play a vital role in the waste to energy market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.