- Home

- »

- Water & Sludge Treatment

- »

-

Global Water Desalination Equipment Market Size Report 2030GVR Report cover

![Water Desalination Equipment Market Size, Share & Trends Report]()

Water Desalination Equipment Market Size, Share & Trends Analysis Report By Technology (Reverse Osmosis), By Source (Sea Water, River Water), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-489-5

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global water desalination equipment market size was estimated at USD 15.53 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. Factors including growing population, rapid urbanization and rising water scarcity in several parts of the world is expected to drive the demand for water desalination equipment over the forecast period. Various construction sites and manufacturing enterprises remained closed in 2020 due to COVID-19 pandemic, reducing the demand for water desalination equipment. However, when the world begun to return to normalcy in early 2021, the demand for water desalination technology grew as governments throughout the world seek to invest in water treatment solutions to address water scarcity issues. For instance, in India, the government programs such as the Atal Mission for Urban Rejuvenation and Transformation (AMRUT), which focuses on establishing infrastructure that ensures adequate water supply and sewage networks, are also expected to support the market growth.

The U.S. enacted a new Public-Private Partnership Act to stimulate domestic investments in the refurbishment and new construction of water purification and desalination plants. Furthermore, growing attempts to provide safe and reliable water supply to the people of the country during the COVID-19 outbreak have increased demand for water treatment, particularly desalination, in the country.

The primary source of freshwater on Earth is the natural desalination process, i.e., solar desalination evaporation (rains). The shortage of freshwater reserves coupled up with the increased demand for water in dry locations are anticipated to propel the market growth. In addition, due to a lack of surface water sources such as rivers and lakes, has resulted in an increase in the number of desalination plants worldwide

Globally, industrialization has put a strain on water resources. Water is used extensively in the creation of industrial-based processes for manufacturing and other tasks. Increasing need for water from industrial end-users such as oil & gas, paper & pulp, and food & beverage is expected to fuel demand for water desalination facilities, bolstering the growth of the water desalination equipment market.

The introduction of digital technology in desalination plants to improve monitoring, process control, and risk identification is expected to complement market growth. Desalination technology developments attempt to achieve a variety of aims, including reducing brine output along with disposal and increasing freshwater yield.

Source Insights

Seawater segment led the market and accounted for 60.1% of the global revenue share in 2022. The increasing scarcity of potable water is expected to drive increased demand for seawater desalination. The growing necessity of treating seawater to safeguard freshwater supplies is predicted to drive demand for seawater desalination technology.

Seawater is pumped into the desalination plant and processed, where suspended solids and other particles are separated by filtration. Following this stage, water is transferred for salinity removal through thermal distillation or reverse osmosis. Rapid population growth, combined with depletion of freshwater reserves, has increased global demand for water, consequently supporting market growth.

Brackish water segment is estimated to witness growth at a CAGR of 9.4% over the forecast period. The presence of abundant sources of brackish water that can be used to produce freshwater is predicted to drive demand for brackish water desalination technology throughout North America, South America, and Asia Pacific. The constantly growing population in these regions is predicted to increase demand for freshwater, boosting the industry.

The fundamental advantage of desalinating brackish groundwater over seawater is its high recovery rate. Seawater desalination produces around 50% freshwater, whereas brackish water produces about 90% freshwater. Furthermore, the amount of brine produced by brackish water treatment is less in volume and more concentrated than brine produced by seawater treatment, making the operation more environmentally friendly.

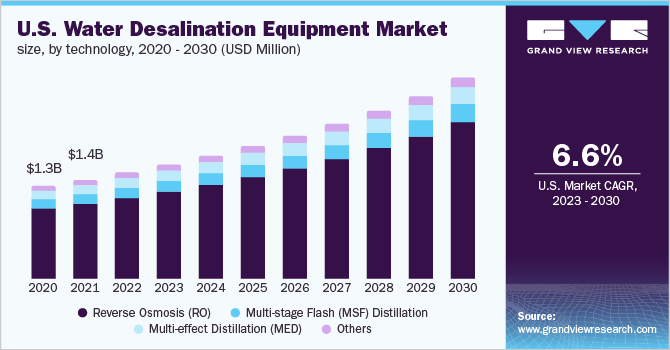

Technology Insights

Reverse Osmosis led the market and accounted for more than 55.4% of the global revenue share in 2022, owing to its properties such as easy processing, low installation cost, ability to treat different types of feed water, and minimal use of chemicals. The market growth largely supported by the increasing need for desalination plants in water-scarce regions globally.

RO involves passing saline water over a semipermeable membrane that filters salt molecules, removing salt from the water and producing clean water. The RO process is divided into four stages. The first is preparation of feed water to make it acceptable for membranes by removing any suspended particles, adding threshold inhibitors, and adjusting the pH.

Multi-stage Flash (MSF) distillation technology market is likely to grow at a CAGR of 9.4% over the forecast period. High gain output ratio (GOR), flexibility to cooperate with power production plants, ease of operation, and lower operating and maintenance costs are expected to increase technology acceptance in desalination applications, propelling the market.

Multi-effect distillation is a multi-effect process that evaporates and condenses feedwater numerous times at low pressure and temperature. The process's great efficiency, along with the use of low-temperature energy sources to deliver feed to the system, is predicted to drive technology acceptance in the desalination sector.

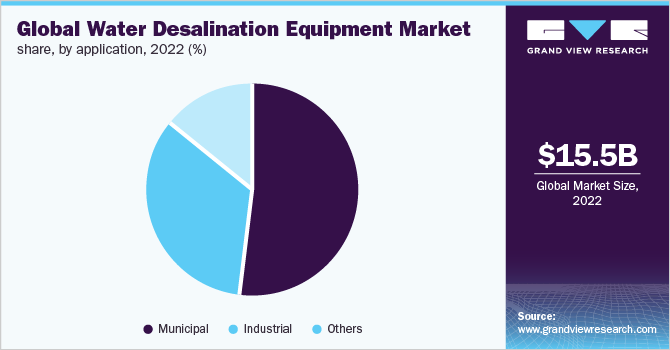

Application Insights

The municipal segment led the market and accounted for 52.1% of the global revenue share in 2022. The municipal sector is in charge of delivering drinkable water to the world's urban population. The growing urban population, combined with the expansion of megacities around the world, is expected to constrain municipal water supply capacity. As a result, this is likely to emerge as a critical industry for the expansion of water desalination equipment.

Increasing contamination of surface water and groundwater supplies has increased demand for safe drinking water. Furthermore, increased water scarcity in dry places is pushing worldwide clean water demand. The aforementioned factors are expected to boost demand for desalination equipment in the municipal sector over the forecast period.

Industrial application segment is likely to grow at a CAGR of 9.7% over the forecast period. Rapid industrialization in developing countries such as China, India, Malaysia, and Thailand is predicted to increase industrial demand for water desalination technology. Pharmaceutical, food and beverage, paper and pulp, and industrial industries are expected to rise in tandem with global population growth, complementing market growth.

Rising R&D investments in the desalination business have led in the utilization of waste generated by power plants and refineries to power desalination facilities. The utilization of renewable energy desalination facilities, such as solar and wind, is predicted to lower total plant operating costs and enhance market growth.

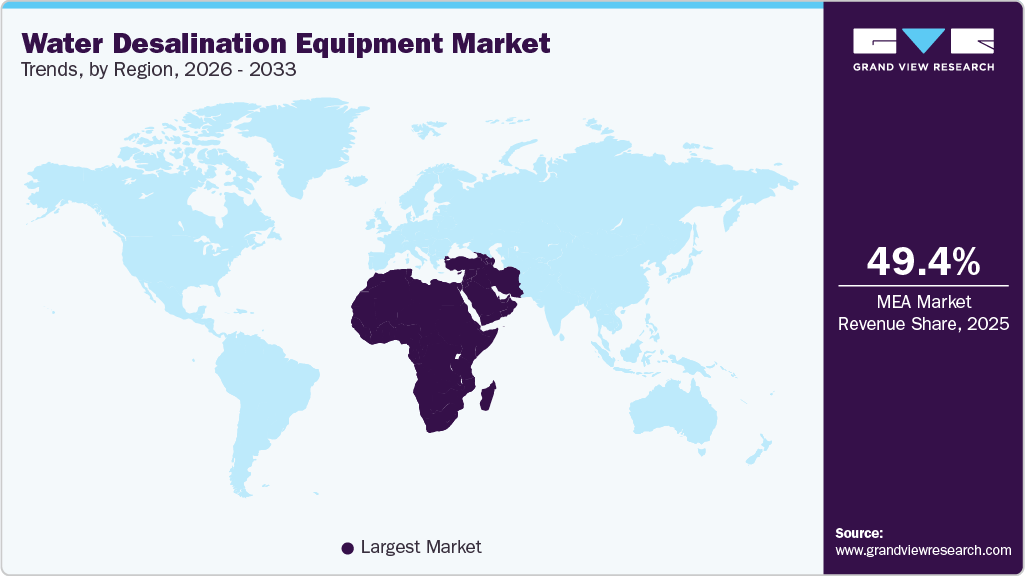

Regional Insights

Middle East & Africa led the market and accounted for 50.0% of the global revenue share in 2022 Growing per capita water use in the region, as well as rising immigration, are expected to drive demand for water desalination equipment over the forecast period.

With strong government support for infrastructure development, increased investments to improve logistical connections, and reconstruction efforts in conflict-affected areas, the Middle East construction sector is likely to grow significantly. This is expected to increase water consumption, helping the water desalination equipment market over the forecast period.

Asia Pacific market is likely to grow at a CAGR of 10.4% over the forecast period. Depleting groundwater levels, particularly in countries like as Bangladesh and India, are expected to further reduce water availability in the region, driving demand for water desalination technology in the coming year. Furthermore, the governments of China, India, and Australia have taken steps to build desalination plants.

In China, factors such as fast industrialization and urbanization, as well as a growing population, are predicted to be significant drivers of the country's water desalination equipment market expansion. Furthermore, rising water scarcity, particularly in the north, combined with increased demand for irrigation for agriculture has resulted in significant groundwater stress, which has complemented market expansion.

Key Companies & Market Share Insights

The global water desalination equipment market consists of several major as well as regional players that are engaged in the designing, manufacturing, and commissioning of water desalination equipment. These companies offer end-to-end services, which include design, construction, start-up, plant operation, and maintenance of desalination facilities.

Water desalination equipment manufacturers adopt several strategies including acquisition, collaboration, new product development, and geographical expansion to enhance their market penetration and meet the changing technological demand from various end-use industries such as municipal, industrial, and others. Some prominent players in the water desalination equipment market include:

-

Acciona S.A.

-

Doosan Heavy Industries & Construction

-

Veolia

-

SUEZ

-

IDE Technologies

-

Xylem

-

Aquatech International LLC

-

Biwater Holdings Limited

-

Genesis Water Technologies

-

Guangzhou KangYang Seawater Desalination Equipment Co., Ltd. (KYSEARO)

Water Desalination Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.87 billion

Revenue forecast in 2030

USD 31.70 billion

Growth rate

CAGR of 9.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Spain; Germany; Greece; Italy; India; China; Japan; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Acciona S.A.; Doosan Heavy Industries & Construction; Veolia; SUEZ; IDE Technologies; Xylem; Aquatech International LLC; Biwater Holdings Limited; Genesis Water Technologies; Guangzhou KangYang Seawater Desalination Equipment Co., Ltd. (KYSEARO)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Desalination Equipment Market Segmentation

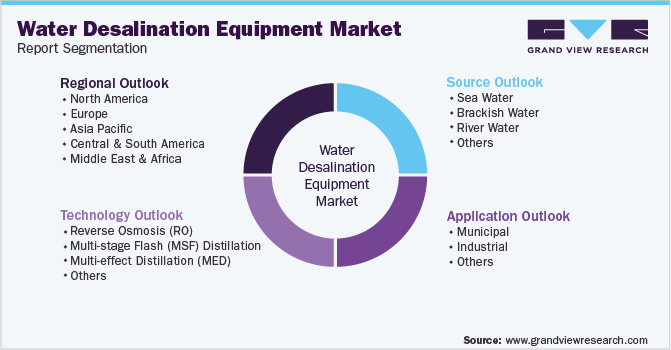

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global water desalination equipment market report based on source, technology, application and region:

-

Source Outlook (Revenue, USD Million; 2018 - 2030)

-

Sea water

-

Brackish water

-

River water

-

Others

-

-

Technology Outlook (Revenue, USD Million; 2018 - 2030)

-

Reverse Osmosis (RO)

-

Multi-stage Flash (MSF) distillation

-

Multi-effect Distillation (MED)

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Municipal

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Spain

-

Germany

-

Greece

-

Italy

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the water desalination equipment market include Genesis Water Technologies, Doosan Heavy Industries and Construction, GE Corporation, Koch Membrane Systems (KMS), IDE Technologies, Degremont SAS, Biwater, Hyflux Ltd., and Acciona, S.A.

b. Key factors that are driving the water desalination equipment market growth include increasing water concerns, usage of aqua resources by rising population, and abundance of saltwater.

b. The global water desalination equipment market size was estimated at USD 15.53 billion in 2022 and is expected to reach USD 16.87 billion in 2023.

b. The water desalination equipment market is expected to grow at a compound annual growth rate of 9.4% from 2023 to 2030 to reach USD 31.70 billion by 2030.

b. The Middle East & Africa dominated the water desalination equipment market with a share of 50.0% in 2022. This is attributable to the scarcity of clean water resources, affordable equipment, and increasing investments in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."