- Home

- »

- Water & Sludge Treatment

- »

-

Water Desalination Plant Equipment Market Report, 2030GVR Report cover

![Water Desalination Plant Equipment Market Size, Share & Trends Report]()

Water Desalination Plant Equipment Market Size, Share & Trends Analysis Report By Equipment (Pretreatment System), By Source (Seawater), By Application (Municipal, Industrial), By Production Capacity (Below 10 m3/hr), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-463-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

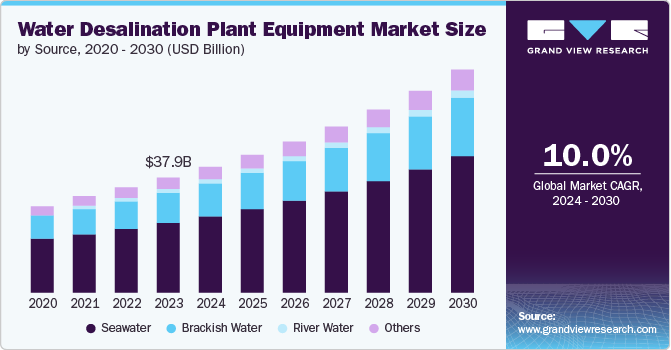

The global water desalination plant equipment market size was estimated at USD 37,968.2 million in 2023 and is anticipated to grow at a CAGR of 10.0% from 2024 to 2030. The scarcity of freshwater reserves, coupled with the rising demand for water in various arid regions, as these areas lack sources of surface water such as lakes and rivers, has resulted in augmenting the number of desalination plants globally.

Furthermore, according to the World Economic Forum, the global demand for freshwater is estimated to exceed supply by 40% by 2030. With increasing water scarcity, the demand for desalination plants is witnessing growth to close the demand-supply gap of water.

Water is an essential resource in daily life and is largely used to carry out industrial and construction processes. According to the U.S. Geological Survey (USGS), around 71% of the earth’s surface is covered with water, of which 96.5% is found in oceans, seas, and bays in the form of saline water. However, only the remaining 3.5% is freshwater, which is used for daily activities. Freshwater is obtained through various sources such as groundwater, rivers, streams, and lakes.

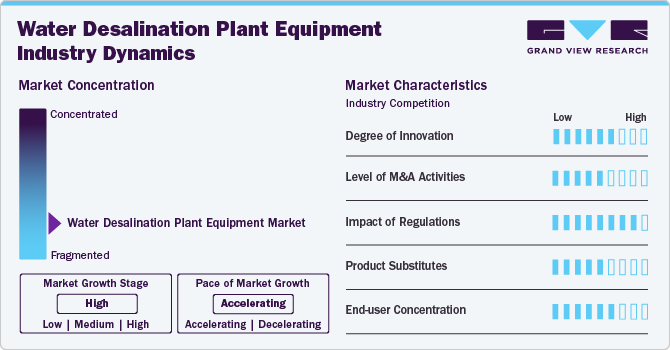

Market Concentration & Characteristics

Key trends include intelligent and automated systems, which use IoT-enabled sensors and devices to monitor and control various aspects of the desalination process, such as water quality, energy consumption, and equipment performance. This real-time data collection and analysis enables predictive maintenance, allowing operators to identify and address potential issues before they lead to breakdowns or disruptions. By minimizing downtime and optimizing operations, these systems contribute to increased plant efficiency and cost-effectiveness.

Regulations significantly impact the global water desalination plant equipment market by shaping both operational practices and market dynamics. As governments and regulatory bodies around the world enforce stringent standards to safeguard environmental and public health, these regulations play a critical role in influencing the design, operation, and expansion of desalination facilities.

Regulations such as those outlined in the Water Industry Competition Act 2006 mandate that desalination plants obtain a retailer supplier’s license and network operator’s license for their water desalination activities. Moreover, regulations regarding the prevention of contaminants, such as brine, can drive up operational costs as companies invest in advanced treatment technologies and systems to comply with these requirements. In regions with rigorous environmental regulations, the increased costs of compliance can slow down the pace of new desalination projects and impact market growth.

Drivers, Opportunities & Restraints

The rising population in urban areas across the globe is straining the existing natural water sources. Deteriorating environmental conditions such as altered weather patterns, increased pollution, and deforestation have resulted in water shortages and drought-like scenarios globally. The governments of various countries are investing in the development of desalination plants to counter this challenge, which, in turn, is projected to drive the water desalination equipment market.

Additionally, industrialization around the world has further strained water resources. The development of industrial-based processes requires a large amount of water for manufacturing and other functions. Sectors such as agriculture, oil & gas, paper & pulp, and food & beverage require water for various processes. Increasing demand for water by industrial end-users is anticipated to further drive the demand for water desalination plants, thereby augmenting the market growth.

The rise in demand for water is also evident in power plants wherein desalinated water is used for cooling them. As energy production increases globally to meet growing electricity demand, the requirement for desalinated water to support these facilities is on the rise. In essence, the growing industrial activities in arid regions highlight the crucial role of desalination technologies in ensuring a sustainable and reliable water supply. The requirement to support these activities while managing local water resources responsibly is driving advancements in water desalination plant equipment and expanding their market.

Equipment Insights

“The demand for post-processing system segment is expected to grow at a significant CAGR of 11.5% from 2024 to 2030 in terms of revenue”

The desalination device segment led the market and accounted for 44.3% of the global market revenue share in 2023. The increasing demand for desalinated water has significantly driven the water desalination plant equipment market growth globally. This surge is primarily due to the growing scarcity of freshwater resources and the escalating need for potable water across various sectors, including residential, industrial, and commercial services.

The demand for the post-processing system segment is expected to grow over the forecast period. The rising demand for post-processing systems in water desalination plants is increasingly becoming a pivotal factor in the growth of the water desalination plant equipment market. This surge in demand can primarily be attributed to the need for water that not only meets the safety standards for consumption but also matches the quality requirements of various industrial and agricultural applications.

Source Insights

“The demand for seawater source segment is expected to grow at a significant CAGR of 10.2% from 2024 to 2030 in terms of revenue”

The brackish water source segment held the second highest market share and accounted for 26.2% in 2023. One of the major advantages of desalinating brackish groundwater, compared to seawater, is its recovery rate. Seawater desalination yields around 50% of its volume in freshwater, whereas brackish water yields about 90% freshwater.

The seawater segment is likely to grow significantly over the forecast period owing to the use of water desalination plant equipment has seen a significant uptick, primarily due to the challenges posed by seawater pollution and the ever-increasing demand for potable water globally. Moreover, the demand for water desalination plant equipment is increasing owing to the rising concerns over water scarcity and the quality of available water resources, pushing nations toward adopting desalination technologies.

Application Insights

“The demand for industrial segment is expected to grow at a significant CAGR of 10.3% from 2024 to 2030 in terms of revenue”

The municipal application segment led the market and accounted for 50.7% of the global market revenue share in 2023. The municipal sector is responsible for providing potable water to the urban population around the world. Moreover, the growing urban population coupled with expanding megacities globally is anticipated to limit the capacity of municipal sectors to provide water. Thus, this sector is expected to emerge as a key segment that will aid the water desalination plant equipment market growth over the forecast period.

The industrial segment is expected to witness the highest growth over the forecast period with a CAGR of 10.3%. Rapid industrial development in growing economies, such as India, Thailand, and Malaysia, is projected to contribute to the rising demand for water desalination equipment in the industrial sector.

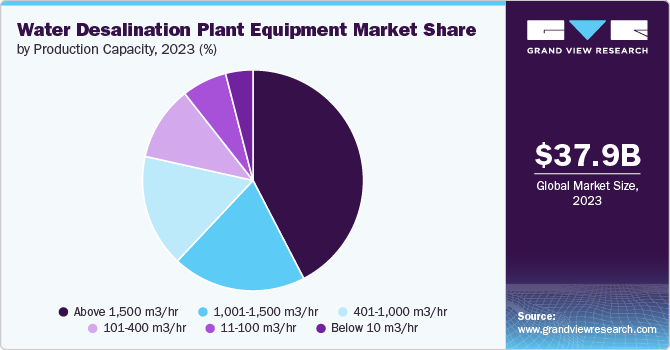

Production Capacity Insights

“The demand for 11-100 m3/hr segment is expected to grow at a significant CAGR of 11.2% from 2024 to 2030 in terms of revenue”

The above 1,500 m3/hr segment led the market and accounted for 42.4% of the global market revenue share in 2023. The growth of the segment is primarily fueled by the escalating need for freshwater in rapidly growing urban areas and industrial sectors worldwide. Mega projects such as the Ras Al-Khair Desalination Plant in Saudi Arabia, one of the world's largest facilities, exemplify how nations are investing in high-capacity desalination infrastructures to secure water for municipal supplies, agricultural irrigation, and industrial applications. Moreover, the desalination plant consists of 17 RO units and 8 MSF units.

Water desalination plants with a production capacity of below 10 m³/hr play a pivotal role in delivering potable water to smaller communities, remote areas, and industries requiring high-purity water. These compact facilities are designed to treat seawater or brackish water, transforming it into water that is fit for agricultural irrigation and various industrial processes.

Regional Insights

“China to witness fastest market growth at 11.5% CAGR”

North America region expected to witness robust growth over the forecast period. Increasing investments in the chemical, pharmaceutical, food & beverage, and automotive industries of the U.S. and Canada are expected to trigger the demand for water services over the forecast period.

U.S. Water Desalination Plant Equipment Market Trends

The U.S. water desalination plant equipment market is expanding significantly, due to increasing concerns about water scarcity and the urgent need for reliable, sustainable water sources. The current desalination facilities in the country mostly treat brackish water. According to The World Bank, there are 413 water desalination plants in the nation as of 2024, a substantial proportion of which are brackish groundwater desalination plants.

Europe Water Desalination Plant Equipment Market Trends

The European water desalination industry is characterized by the various technological development aiding in the rising investments in the desalination plants and subsequently driving the market growth over the forecast period. Moreover, EU facilities have the capacity to produce up to 3.4 billion cubic meters of desalinated water annually, primarily from seawater and brackish sources. There are approximately 2,178 desalination plants across the EU, with Spain, Greece, Italy, Germany, and France being the primary contributors.

Spain water desalination plant equipment market held a 45.4% share in the European market.Spain has 892 large-scale desalination plants. The increase in government investments to ensure a steady water supply is anticipated to significantly boost the growth of the water desalination plant equipment market in the country.

Italy water desalination plant equipment market is likely to grow at a CAGR of 9.6% over the forecast period. In response to this ongoing challenge and the lack of immediate solutions, public authorities are starting to support the desalination sector.

Asia Pacific Water Desalination Plant Equipment Market Trends

The water desalination plant equipment market in Asia Pacific is experiencing robust growth, largely propelled by the growing population, rapid urbanization, extensive agriculture development, and intensified industrialization that have strained the existing water resources in the region. According to a 2020 report by the Asian Development Bank, 1.5 billion people in rural areas and an additional 600 million in urban areas across the region still lack adequate water supply and sanitation

China water desalination plant equipment market held over 39.5% share in the Asia Pacific market. Further, China is set to expand its desalination capabilities as per its five-year plan for 2021-2025. The National Development and Reform Commission announced that the country will boost its desalination capacity to 2.9 million tons per day.

India water desalination plant equipment market held 11.5% share in the Asia Pacific market in 2023. The issues related to uneven distribution of water resources across the country underscore the urgent need for innovative solutions to manage and augment the country’s water resources.In response to these critical challenges, India has embarked on ambitious initiatives to enhance its water supply. One of the most significant projects is the construction of the Perur desalination plant in Chennai, which is set to become one of Asia’s largest desalination facilities.

Middle East & Africa Water Desalination Plant Equipment Market Trends

Middle East & Africa region accounted for 49.8% of the global market share in 2023. The MEA region holds a substantial market share in the global water desalination plant equipment market, which is attributed to the scarcity of water resources in this region. This factor is likely to continue to create a strong demand for water desalination plant equipment over the forecast period.

UAE water desalination plant equipment market held 31.2% share in the Middle East & Africa market in 2023. The UAE market for water desalination plant equipment is expected to be driven by the high demand for potable water. The lack of freshwater sources in the country is also anticipated to fuel market growth over the forecast period.

Latin America Water Desalination Plant Equipment Market Trends

According to Desalination Latin America, a business platform that aims to boost desalination projects in Latin America, more than 25 desalination projects are underway in the region with an expected investment of USD 20 billion in the industry in the future.

Argentina water desalination plant equipment market is expected to grow with a CAGR of 11.0% over the forecast period. International collaboration and funding are also contributing to Argentina's interest in desalination. Partnerships with foreign governments and access to financial support are accelerating the development of desalination projects. For instance, the Saudi Fund for Development (SFD) has signed a USD 100 million loan agreement with the provinces of Córdoba and Santa Fe in Argentina to fund the Interprovincial Aqueduct Santa Fe - Córdoba Project.

Key Water Desalination Plant Equipment Company Insights

Some of the key players operating in the market include Xylem, Inc. Veolia, among others.

-

Xylem, Inc is a global water technology company engaged in the manufacturing, designing, and servicing of products that primarily cater to the water sector as well as the electric and gas sectors. The company owns numerous brands such as Aanderaa, AC Fire, Bell & Gossett, Bellingham + Stanley, CentriPro, ebro, Godwin,0 Flygt, Flojet, and Goulds Water Technolog.

-

Veolia is a multinational company engaged in the designing and distribution of water, waste, and energy management solutions. It operates through three business segments, namely water management, waste management, and energy management.

Biwater Holdings Limited and IDEare some of the emerging market participants in the water desalination plant equipment market.

-

Biwater Holdings Limited offers large-scale water and wastewater treatment solutions. The company offers solutions for various applications including water treatment, wastewater treatment, desalination, water reuse, membrane treatment, water asset management, project finance, and operation & maintenance.

-

IDE offers innovative water treatment solutions for the industrial and municipal sectors. It is fully owned by Alfa Water Partners. It primarily specializes in the design, construction, engineering, and operation of desalination & industrial water treatment plants.

Key Water Desalination Plant Equipment Companies:

The following are the leading companies in the water desalination plant equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Xylem, Inc.

- Veolia

- Aquatech

- DuPont

- TOYOBO CO., LTD.

- Pure Aqua, Inc.

- Doosan Corporation

- APPLIED MEMBRANES, INC.

- Ovivo

- Guangzhou KangYang Seawater Desalination Equipment Co., Ltd.

- Genesis Water Technologies

- Biwater Holdings Limited

- IDE

Recent Developments

-

In May 2023, Xylem Inc. announced the completion of its acquisition of Evoqua Water Technologies LLC, a company involved in manufacturing pretreatment systems for water desalination in addition to other essential water treatment solutions and services. The all-stock deal, valued at around USD 7.5 billion, merges the companies to form an advanced platform for tackling critical water challenges faced by customers and communities worldwide.

-

In November 2023, Aquatech, through its subsidiary QUA Group LLC, announced the launch of three new membrane technologies to expand its product portfolio. These newly launched technologies cater to a range of water treatment requirements.

Water Desalination Plant Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41,504.1 million

Revenue forecast in 2030

USD 73,616.8 million

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in units and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, source, application, production capacity, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; Greece; China; Japan; India; South Korea; Singapore; New Zealand; Australia; Brazil; Argentina; South Africa; Qatar; Saudi Arabia, Iran; UAE; Nigeria; Morocco

Key companies profiled

Xylem Inc.; Veolia; Aquatech; DuPont; TOYOBO CO., LTD.; Pure Aqua, Inc.; Doosan Corporation; APPLIED MEMBRANES; INC.; Ovivo; Guangzhou KangYang Seawater Desalination Equipment Co., Ltd.; Genesis Water Technologies; Biwater Holdings Limited; IDE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Water Desalination Plant Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global water desalination plant equipment market based on equipment, source, application, production capacity, and region:

-

Equipment Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Pretreatment System

-

Desalination Device

-

Reverse Osmosis

-

Multi-stage Flash (MSF) Distillation

-

Multi-effect Distillation (MED)

-

-

Post-Processing System

-

Cleaning System

-

Electrical Control System

-

-

Source Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Seawater

-

Brackish water

-

River water

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Municipal

-

Industrial

-

Others

-

-

Production Capacity Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Below 10 m3/hr

-

11-100 m3/hr

-

101-400 m3/hr

-

401-1,000 m3/hr

-

1,001-1,500 m3/hr

-

Above 1,500 m3/hr

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Spain

-

Greece

-

UK

-

France

-

Italy

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Qatar

-

Iran

-

UAE

-

Nigeria

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global water desalination plant equipment market size was estimated at USD 37,968.2 million in 2023 and is expected to reach USD 41,504.1 million in 2024.

b. The global water desalination plant equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.0% from 2024 to 2030 to reach USD 73,616.8 million by 2030.

b. The seawater water desalination plant equipment source segment led the market and accounted for 59.8% of the global market revenue share in 2023. The growing scarcity of water for domestic and industrial usage is projected to act as the key driver for the rising demand for seawater desalination.

b. Some of the key players operating in the water desalination plant equipment market include Xylem, Inc., Veolia, Aquatech, DuPont, TOYOBO CO., LTD., Pure Aqua, Inc., Doosan Corporation, APPLIED MEMBRANES, INC., Ovivo, Guangzhou KangYang Seawater Desalination Equipment Co., Ltd., Genesis Water Technologies, Biwater Holdings Limited, IDE.

b. The water desalination plant equipment market is driven by the scarcity of freshwater reserves, coupled with the rising demand for water in various arid regions, as these areas lack sources of surface water such as lakes and rivers, has resulted in augmenting the number of desalination plants globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."